Texas Auto Insurance Quotes Online

Texas is known for its diverse landscape, vibrant cities, and, of course, its unique car culture. Whether you're cruising down the historic Route 66 or navigating the bustling streets of Houston or Dallas, having reliable auto insurance is essential. In this comprehensive guide, we'll explore the world of Texas auto insurance quotes online, uncovering the factors that influence rates, comparing top providers, and offering expert tips to help you secure the best coverage for your needs.

Understanding Texas Auto Insurance

Texas has its own set of regulations and requirements when it comes to auto insurance. Let’s delve into the key aspects to help you grasp the fundamentals.

Minimum Requirements

Texas law mandates that all drivers carry a minimum level of liability insurance. This includes 30,000</strong> in bodily injury liability coverage per person, <strong>60,000 per accident, and $25,000 in property damage liability coverage. While these are the minimums, it’s essential to consider your specific needs and potential risks to determine if additional coverage is necessary.

Factors Influencing Rates

The cost of auto insurance in Texas can vary significantly based on several factors. Here are some key influences:

- Location: Insurance rates can differ between cities and even neighborhoods. Urban areas with higher populations and traffic volumes often result in higher premiums.

- Driver Profile: Your age, driving record, and credit history play a significant role. Younger drivers and those with a history of accidents or traffic violations may face higher rates.

- Vehicle Type: The make, model, and year of your vehicle impact insurance costs. Sports cars and luxury vehicles tend to be more expensive to insure due to higher repair costs.

- Coverage Options: Beyond the mandatory liability coverage, you can choose additional options like collision, comprehensive, personal injury protection (PIP), and uninsured/underinsured motorist coverage.

- Discounts: Many insurance providers offer discounts for safe driving, multiple policies, good student status, and more. Exploring these discounts can help reduce your premiums.

Comparing Top Texas Auto Insurance Providers

Now, let’s take a closer look at some of the leading auto insurance providers in Texas and compare their offerings, customer satisfaction, and unique features.

State Farm

State Farm is a well-established insurance provider with a strong presence in Texas. They offer a range of coverage options, including liability, collision, comprehensive, and personal injury protection. State Farm is known for its personalized approach, providing agents who can guide you through the process and tailor a policy to your needs. They also offer various discounts, such as a good driving record discount and a multiple policy discount.

Geico

Geico, a widely recognized insurance company, provides auto insurance coverage across Texas. They are known for their competitive rates and efficient online quoting process. Geico offers a range of coverage options, including liability, medical payments, collision, and comprehensive coverage. Additionally, they provide discounts for safe driving, military personnel, and policy bundling.

Progressive

Progressive has gained popularity in Texas for its innovative approach to auto insurance. They offer a wide range of coverage options, from basic liability to more comprehensive plans. Progressive is particularly known for its Snapshot program, which uses a small device to monitor your driving habits and potentially offer discounts based on safe driving behaviors.

Allstate

Allstate is a trusted name in the insurance industry, offering a comprehensive range of auto insurance policies in Texas. They provide liability, collision, comprehensive, and personal injury protection coverage. Allstate is known for its commitment to customer service, with a network of agents across the state ready to assist with policy customization and claims.

Comparison Table: Texas Auto Insurance Providers

| Provider | Coverage Options | Discounts | Unique Features |

|---|---|---|---|

| State Farm | Liability, Collision, Comprehensive, PIP | Good Driving Record, Multiple Policy | Personalized Agent Support |

| Geico | Liability, Medical Payments, Collision, Comprehensive | Safe Driving, Military, Policy Bundling | Efficient Online Quoting |

| Progressive | Liability, Collision, Comprehensive, Personal Injury Protection | Safe Driving, Multi-Policy | Snapshot Program for Discounts |

| Allstate | Liability, Collision, Comprehensive, PIP | Safe Driving, Teen Driver, New Car | Excellent Customer Service, Agent Network |

Expert Tips for Securing the Best Auto Insurance Quotes

To ensure you’re getting the most competitive and suitable auto insurance quotes in Texas, consider these expert tips:

- Shop Around: Compare quotes from multiple providers to find the best rates. Online comparison tools can be a convenient way to start.

- Bundle Policies: If you have multiple insurance needs (e.g., home and auto), bundling them with the same provider can often result in significant discounts.

- Understand Your Coverage: Review your current coverage and ensure it aligns with your needs. Consider factors like your vehicle's value, potential risks, and your personal financial situation.

- Explore Discounts: Many providers offer a variety of discounts. Ask about safe driving, good student, and loyalty discounts to see if you're eligible.

- Maintain a Clean Driving Record: A clean driving history can lead to lower premiums. Focus on safe driving practices to keep your record clear.

- Consider Telematics: Programs like Progressive's Snapshot or similar offerings from other providers can reward safe driving behaviors with discounts.

- Review Regularly: Insurance needs can change over time. Regularly review your policy and shop around to ensure you're still getting the best rates and coverage.

FAQs

How can I get the best auto insurance rates in Texas?

+To get the best rates, compare quotes from multiple providers, bundle policies, and maintain a clean driving record. Explore discounts and consider telematics programs that reward safe driving.

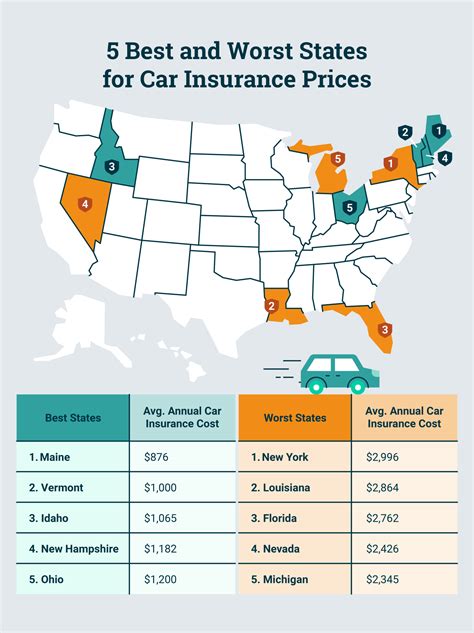

What is the average cost of auto insurance in Texas?

+The average cost of auto insurance in Texas can vary depending on factors like location, driving history, and coverage choices. However, the average annual premium is around $1,500.

Can I get auto insurance quotes online in Texas?

+Absolutely! Many insurance providers in Texas offer online quoting systems, making it convenient to get quotes and compare rates.

What are some common discounts available for auto insurance in Texas?

+Common discounts include safe driving, multiple policy, good student, loyalty, and telematics discounts. Each provider may offer unique discounts, so it’s worth exploring.

How can I ensure I’m getting adequate coverage for my needs in Texas?

+Review your coverage regularly and assess your needs. Consider factors like your vehicle’s value, potential risks, and personal financial situation. Consult with insurance agents or brokers for expert advice.