Cheapest Auto Insurance In Nj

Finding the cheapest auto insurance in New Jersey can be a daunting task, especially with the state's notoriously high insurance rates. The Garden State has one of the most expensive insurance markets in the nation, making it crucial for residents to explore their options and understand the factors that influence premiums. This comprehensive guide aims to shed light on the best ways to secure affordable car insurance in New Jersey, providing valuable insights and strategies to help drivers save money without compromising on coverage.

Understanding the Cost of Auto Insurance in New Jersey

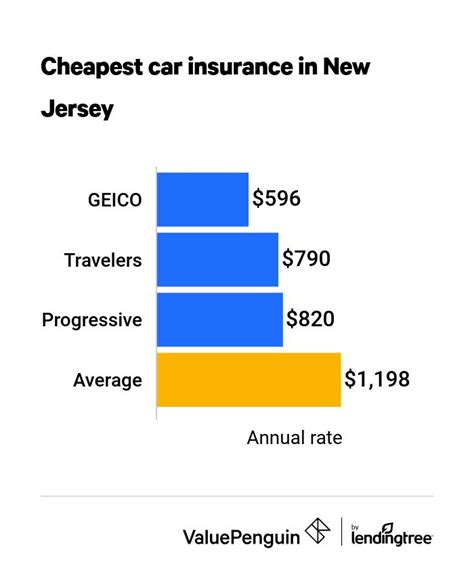

New Jersey is known for its high insurance costs, often ranking among the top states with the most expensive premiums. The average annual cost of car insurance in the state is significantly higher than the national average, with factors like high population density, a large number of uninsured drivers, and frequent claims contributing to these elevated rates. Understanding the unique insurance landscape in New Jersey is the first step towards finding more affordable coverage.

Exploring the Cheapest Insurance Carriers in New Jersey

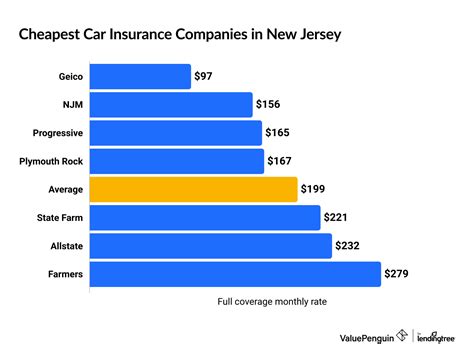

When it comes to finding the cheapest auto insurance in New Jersey, several carriers stand out for their competitive rates and comprehensive coverage options. These insurance companies have established a strong presence in the state, offering policies tailored to meet the diverse needs of New Jersey drivers.

NJM Insurance Company

NJM Insurance Company is a well-known and trusted provider in New Jersey. With a strong focus on customer satisfaction and competitive rates, NJM has earned a reputation for offering some of the most affordable insurance policies in the state. Their policies include a range of coverage options, from liability and collision to comprehensive and personal injury protection.

| Coverage Type | Average Annual Premium |

|---|---|

| Liability | $500 - $700 |

| Collision | $350 - $550 |

| Comprehensive | $250 - $400 |

Progressive

Progressive is a national insurance carrier with a strong presence in New Jersey. Known for its innovative approach to insurance, Progressive offers a range of coverage options and discounts to help drivers save money. Their policies are designed to cater to the diverse needs of New Jersey drivers, providing comprehensive protection at competitive rates.

| Coverage Type | Average Annual Premium |

|---|---|

| Liability | $600 - $800 |

| Collision | $400 - $600 |

| Comprehensive | $300 - $500 |

State Farm

State Farm is a leading insurance provider in New Jersey, offering a wide range of coverage options and competitive rates. Their policies are designed to meet the specific needs of New Jersey drivers, providing comprehensive protection and peace of mind. State Farm's commitment to customer service and its extensive network of local agents make it a popular choice among residents.

| Coverage Type | Average Annual Premium |

|---|---|

| Liability | $650 - $900 |

| Collision | $450 - $700 |

| Comprehensive | $350 - $600 |

Strategies to Find the Cheapest Auto Insurance in New Jersey

Finding the cheapest auto insurance in New Jersey requires a strategic approach. Here are some effective strategies to help drivers secure the most affordable coverage:

Compare Quotes from Multiple Carriers

Comparing quotes from different insurance carriers is essential to finding the best rates. New Jersey drivers should obtain quotes from at least three to five carriers to ensure they are getting the most competitive prices. Online quote comparison tools can be a convenient way to quickly gather multiple quotes and compare them side by side.

Understand Coverage Options

New Jersey requires drivers to carry minimum liability coverage, but it's important to understand the different coverage options available. Additional coverages like collision, comprehensive, and personal injury protection can provide extra protection in case of accidents or other incidents. Drivers should carefully review their coverage needs and select the options that best suit their requirements.

Utilize Discounts

Insurance carriers in New Jersey offer a variety of discounts that can help drivers save on their premiums. Some common discounts include good driver, safe vehicle, multi-policy, and loyalty discounts. Drivers should inquire about these discounts and ensure they are taking advantage of all the savings opportunities available to them.

Improve Driving Record

A clean driving record is crucial for securing affordable insurance. New Jersey drivers with a history of accidents or violations may face higher premiums. By maintaining a safe driving record, drivers can significantly reduce their insurance costs. Avoiding tickets, following traffic rules, and taking defensive driving courses can all contribute to a better driving record and lower insurance rates.

Consider Bundling Policies

Bundling multiple insurance policies, such as auto and home insurance, can often result in significant savings. Many insurance carriers in New Jersey offer multi-policy discounts, allowing drivers to reduce their overall insurance costs. By bundling their policies, New Jersey residents can take advantage of these discounts and enjoy more affordable coverage.

Shop Around Regularly

Insurance rates can fluctuate, and it's important for New Jersey drivers to regularly shop around for the best deals. Even if a driver has been with the same carrier for years, it's worth obtaining new quotes to ensure they are still getting the most competitive rates. Shopping around every few years, or whenever major life changes occur, can help drivers stay on top of the most affordable insurance options.

Frequently Asked Questions

What is the average cost of auto insurance in New Jersey?

+The average annual cost of auto insurance in New Jersey is around $1,500 to $2,000. However, rates can vary significantly based on individual factors such as driving record, age, and the type of vehicle insured.

Are there any low-cost insurance options for young drivers in New Jersey?

+Yes, several insurance carriers in New Jersey offer discounts specifically for young drivers. These discounts can include good student, safe driver, and multi-policy discounts. Young drivers should explore these options to reduce their insurance costs.

How can I lower my insurance premiums if I have a poor driving record in New Jersey?

+Improving your driving record is crucial to lowering insurance premiums. This can be achieved by taking defensive driving courses, avoiding violations, and maintaining a clean driving record. Additionally, shopping around for insurance quotes and comparing rates can help you find the most affordable coverage options.

By following these strategies and exploring the options offered by the cheapest auto insurance carriers in New Jersey, drivers can find affordable coverage that meets their needs. Remember to regularly review your insurance policy and shop around to ensure you are getting the best rates available.