Disability Insurance Law Firm

When faced with a disability, individuals often encounter numerous challenges, including the financial burden of medical expenses and the loss of income. In such situations, disability insurance becomes a crucial safety net, providing much-needed financial support. However, navigating the complex world of disability insurance claims can be overwhelming, especially when insurance companies may not always act in the best interests of their policyholders. This is where a specialized Disability Insurance Law Firm steps in, offering expert legal guidance and representation to ensure individuals receive the benefits they deserve.

The Role of a Disability Insurance Law Firm

A Disability Insurance Law Firm specializes in helping individuals who have been denied disability insurance benefits or are facing challenges in obtaining the coverage they are entitled to. These firms are equipped with a team of experienced attorneys and legal professionals who have an in-depth understanding of disability insurance policies, regulations, and the intricate legal processes involved.

The primary goal of a disability insurance law firm is to protect the rights of individuals with disabilities and ensure they receive the financial support they need to manage their condition and maintain their quality of life. Whether it's assisting with the initial claim process, appealing a denied claim, or litigating against an insurance company, these firms provide comprehensive legal services tailored to the unique needs of each client.

Services Offered by a Disability Insurance Law Firm

The services provided by a disability insurance law firm are diverse and tailored to address the specific challenges faced by individuals with disabilities. Here are some key services these firms typically offer:

- Claim Preparation and Filing: Disability insurance law firms assist clients in gathering the necessary medical documentation, employment records, and other supporting evidence to strengthen their claim. They ensure that all required forms are completed accurately and submitted within the specified timelines.

- Appeals and Reviews: If a disability insurance claim is initially denied, the law firm guides clients through the appeals process. They review the denial letter, identify the reasons for denial, and develop a comprehensive strategy to address these issues, increasing the chances of a successful appeal.

- Litigation and Legal Representation: In cases where an insurance company acts in bad faith or refuses to honor a valid claim, disability insurance law firms are prepared to take legal action. They represent clients in court, fighting for their rights and seeking the maximum compensation allowed by law.

- Policy Analysis and Interpretation: With their expertise in insurance law, these firms thoroughly analyze disability insurance policies to identify any loopholes or clauses that may impact a client's claim. They ensure that clients understand their policy and can make informed decisions about their claim strategy.

- Negotiation and Settlement: Disability insurance law firms often engage in negotiations with insurance companies to secure a fair settlement for their clients. Their experience and knowledge of disability insurance claims enable them to advocate effectively for their clients' interests.

By offering these specialized services, a disability insurance law firm becomes an invaluable ally for individuals navigating the complexities of disability insurance claims. They provide the legal expertise, strategic guidance, and unwavering support needed to secure the financial benefits that are essential for managing a disability.

The Impact of Disability Insurance on Individuals

Disability insurance plays a vital role in the lives of individuals with disabilities, offering a range of benefits that can significantly impact their financial well-being and overall quality of life. Here are some key ways in which disability insurance can make a difference:

Financial Stability and Peace of Mind

The primary purpose of disability insurance is to provide financial support when an individual is unable to work due to a disability. This support can come in the form of monthly benefit payments, which help cover living expenses, medical bills, and other financial obligations. Having a reliable source of income during a time of disability can bring immense peace of mind, allowing individuals to focus on their recovery without the added stress of financial worries.

| Metric | Impact |

|---|---|

| Monthly Benefit Payments | Cover living expenses and medical costs |

| Financial Stability | Reduce stress and provide security |

Maintaining Quality of Life

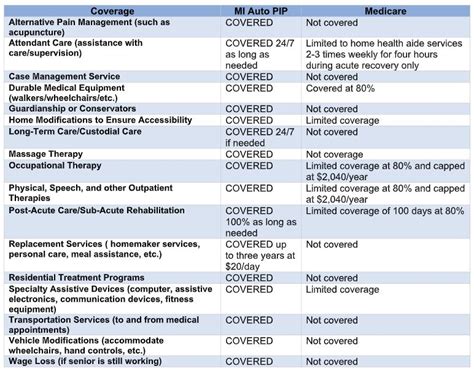

Disability insurance goes beyond just providing financial support; it also helps individuals maintain their quality of life. With the financial resources provided by disability insurance, individuals can access the medical care and treatments they need to manage their condition effectively. This includes specialized therapies, medications, and assistive devices that may not be covered by other insurance plans or government programs.

Preserving Employment Opportunities

For individuals with disabilities who are still able to work, disability insurance can be a valuable tool for maintaining employment. Short-term disability insurance, for instance, provides partial income replacement during temporary disabilities, allowing individuals to take the time they need to recover without risking their job security. Long-term disability insurance, on the other hand, offers ongoing support for individuals with more severe or permanent disabilities, ensuring they can continue working or pursue alternative career paths that accommodate their condition.

The Challenges of Navigating Disability Insurance Claims

While disability insurance is a crucial safety net for individuals with disabilities, the process of claiming benefits can be complex and fraught with challenges. Insurance companies often have strict guidelines and criteria for approving claims, and navigating these requirements without legal expertise can be overwhelming. Here are some common challenges individuals may face:

Strict Eligibility Criteria

Insurance companies have specific definitions of disability and eligibility criteria that must be met for a claim to be approved. These definitions can vary significantly between policies and may not always align with an individual’s unique circumstances. Understanding and meeting these criteria can be challenging, especially for individuals who are already dealing with the physical and emotional toll of their disability.

Denials and Appeals

Even if an individual believes they meet the eligibility criteria, insurance companies have a reputation for denying claims. Denials can be based on a variety of reasons, such as insufficient medical evidence, misinterpretation of policy terms, or even bad faith practices. Navigating the appeals process, which often involves strict timelines and complex paperwork, can be a daunting task without legal assistance.

Complex Legal and Regulatory Landscape

Disability insurance claims are governed by a complex web of laws and regulations, including state and federal statutes, as well as internal insurance company policies. Staying abreast of these legal requirements and ensuring compliance can be a full-time job in itself. Individuals who are already managing a disability may not have the capacity or expertise to navigate this complex landscape effectively.

The Benefits of Engaging a Disability Insurance Law Firm

Given the challenges inherent in the disability insurance claims process, engaging a specialized Disability Insurance Law Firm can provide numerous benefits to individuals seeking to secure their rightful benefits. Here’s how a law firm can make a difference:

Expert Legal Guidance

Disability insurance law firms are staffed with attorneys and legal professionals who have extensive experience in handling disability insurance claims. They possess in-depth knowledge of the legal and regulatory landscape, including the intricacies of disability insurance policies and the strategies insurance companies use to deny claims. This expertise ensures that clients receive the best possible legal guidance and representation throughout the claims process.

Increased Chances of Success

With their legal expertise and strategic approach, disability insurance law firms significantly increase the chances of a successful claim. They know how to present a compelling case, gathering and organizing the necessary medical evidence and other supporting documentation to meet the strict eligibility criteria set by insurance companies. Their experience in negotiating with insurance companies and, if necessary, taking legal action, further enhances the likelihood of a positive outcome.

Peace of Mind and Reduced Stress

Navigating the disability insurance claims process can be emotionally and mentally draining, especially for individuals who are already dealing with the challenges of a disability. By engaging a disability insurance law firm, individuals can offload the stress and complexity of the claims process onto experienced professionals. This allows them to focus on their health and well-being, knowing that their legal interests are being expertly represented.

Maximize Compensation

Disability insurance law firms work tirelessly to ensure their clients receive the maximum compensation they are entitled to. They carefully review insurance policies, identify potential areas for additional benefits, and negotiate with insurance companies to secure the highest possible settlement. By maximizing compensation, these firms help individuals secure the financial resources they need to manage their disability effectively.

Case Studies: Real-World Success Stories

To illustrate the impact and value of engaging a disability insurance law firm, let’s explore a few real-world case studies:

Case Study 1: Complex Medical Condition and Denied Claim

Mr. Johnson, a 45-year-old sales manager, was diagnosed with a rare autoimmune disorder that rendered him unable to work. His disability insurance claim was initially denied by the insurance company, citing a lack of medical evidence to support his condition. With the help of a disability insurance law firm, Mr. Johnson was able to gather additional medical records and expert testimony to demonstrate the severity of his condition. The law firm successfully appealed the denial, and Mr. Johnson received the disability benefits he needed to manage his health and maintain his financial stability.

Case Study 2: Long-Term Disability and Bad Faith Practices

Ms. Smith, a 38-year-old teacher, suffered a severe back injury that left her unable to perform her job duties. After initially approving her long-term disability claim, the insurance company abruptly terminated her benefits, claiming she was capable of returning to work. Ms. Smith, with the support of a disability insurance law firm, gathered extensive medical evidence and legal arguments to demonstrate the ongoing nature of her disability. The law firm successfully litigated against the insurance company, securing a substantial settlement that provided Ms. Smith with the financial support she needed to continue her treatment and maintain her quality of life.

Case Study 3: Navigating Policy Loopholes

Mr. Davis, a 55-year-old software engineer, was diagnosed with a serious mental health condition that impacted his ability to work. His disability insurance policy contained a complex provision that could have limited his benefits if he did not seek treatment within a specific timeframe. With the guidance of a disability insurance law firm, Mr. Davis was able to understand the nuances of his policy and take the necessary steps to ensure he met the treatment criteria. The law firm’s expertise helped Mr. Davis navigate the policy loophole and secure the full extent of his disability benefits, providing him with the financial support he needed to manage his condition.

Conclusion: Empowering Individuals with Disabilities

In conclusion, a Disability Insurance Law Firm plays a critical role in empowering individuals with disabilities to navigate the complex world of disability insurance claims. With their expert legal guidance, strategic approach, and unwavering support, these firms help individuals secure the financial benefits they deserve, ensuring they can focus on their health and well-being without the added stress of financial worries. By providing peace of mind, increasing the chances of a successful claim, and maximizing compensation, disability insurance law firms are essential allies in the fight for disability rights and financial security.

How do I choose the right disability insurance law firm for my needs?

+When selecting a disability insurance law firm, it’s essential to consider their experience, expertise, and track record in handling disability insurance claims. Look for firms with a proven history of successful outcomes and positive client testimonials. Schedule consultations with multiple firms to discuss your specific case and assess their level of dedication and understanding. Ensure the firm has a comprehensive understanding of your policy and the challenges you face, and choose a firm that aligns with your goals and provides personalized attention.

What should I expect during the initial consultation with a disability insurance law firm?

+During the initial consultation, the disability insurance law firm will gather information about your disability, your insurance policy, and the challenges you’ve faced with your claim. They will assess the strength of your case, discuss potential strategies, and provide an honest evaluation of your chances of success. It’s an opportunity for you to ask questions, understand the legal process, and decide if the firm is the right fit for your needs.

How long does the disability insurance claims process typically take, and what factors can impact the timeline?

+The duration of the disability insurance claims process can vary widely depending on several factors, including the complexity of your case, the responsiveness of the insurance company, and whether an appeal or litigation is required. On average, the process can take several months to a year or more. It’s important to maintain open communication with your law firm throughout the process to stay informed about any developments and potential delays.

What are some common reasons for disability insurance claim denials, and how can a law firm help overcome them?

+Insurance companies may deny disability insurance claims for various reasons, including insufficient medical evidence, failure to meet policy definitions of disability, or issues with claim forms and paperwork. A disability insurance law firm can help overcome these denials by gathering additional medical records, expert opinions, and legal arguments to strengthen your case. They can also negotiate with the insurance company or take legal action if necessary to secure the benefits you deserve.