Rv Insurance Near Me

RV insurance is a crucial aspect of owning and operating a recreational vehicle. It provides the necessary protection and financial coverage for your RV, ensuring peace of mind during your travels. Whether you're a seasoned RVer or a first-time buyer, understanding the options available for RV insurance near you is essential. This comprehensive guide will delve into the world of RV insurance, covering everything from the basics to advanced topics, and providing you with the knowledge to make informed decisions.

Understanding RV Insurance: An Overview

RV insurance is designed to cover the unique needs and risks associated with recreational vehicles. It offers a range of coverage options tailored to different types of RVs, including motorhomes, travel trailers, and camper vans. By insuring your RV, you can protect yourself against various perils, such as accidents, theft, and damage, ensuring that you’re financially prepared for unexpected events.

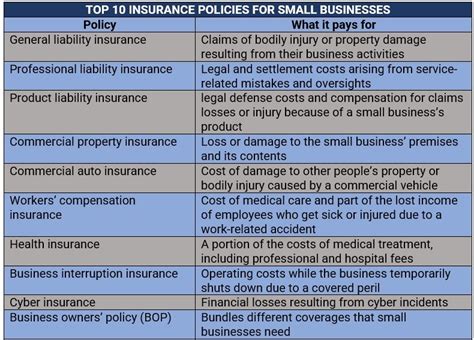

When it comes to RV insurance, there are several key aspects to consider. Firstly, you'll want to understand the different types of coverage available, such as liability insurance, comprehensive coverage, collision coverage, and personal property protection. Each of these coverage types plays a vital role in safeguarding your RV and providing the necessary financial support in case of an incident.

Secondly, it's important to explore the various factors that influence RV insurance rates. These factors can include the type and size of your RV, your driving record, the coverage limits you choose, and even the location where you store your vehicle. Understanding how these factors impact your insurance premiums can help you make more cost-effective decisions and potentially save money on your RV insurance.

Finding RV Insurance Near You

Locating the best RV insurance options near your area is a crucial step in the process. While there are numerous insurance providers that offer RV-specific policies, it’s essential to find a reputable and reliable company that understands the unique needs of RV owners.

Researching Local Insurance Providers

Start your search by researching local insurance agencies and companies that specialize in RV insurance. Look for providers with a strong track record in the industry and positive customer reviews. You can utilize online resources, such as insurance comparison websites and review platforms, to gather insights and narrow down your options.

Consider reaching out to these providers directly to inquire about their RV insurance offerings. Ask about the coverage options they provide, the claims process, and any additional services or benefits they offer to RV owners. This initial research will help you identify the most suitable insurance providers in your area.

Assessing Coverage Options

Once you’ve identified potential insurance providers, it’s time to assess the coverage options they offer. Evaluate the different types of coverage, such as liability, collision, comprehensive, and personal property protection. Ensure that the coverage limits provided align with your specific needs and the value of your RV.

Look for policies that offer flexible coverage options, allowing you to customize your insurance plan according to your preferences. Some providers may also offer additional endorsements or add-ons, such as roadside assistance or emergency expense coverage, which can further enhance your protection and provide added peace of mind during your travels.

Comparing Rates and Discounts

Insurance rates can vary significantly between providers, so it’s essential to compare quotes and assess the value you’re receiving for your money. Obtain quotes from multiple insurance companies to get a clear understanding of the market rates and the options available to you.

Look for providers that offer competitive rates while maintaining a strong reputation for customer service and claim handling. Additionally, explore the various discounts that may be available to you. Many insurance companies offer discounts for safe driving records, multi-policy discounts (if you bundle your RV insurance with other policies), and even loyalty discounts for long-term customers.

Key Considerations for RV Insurance

When selecting RV insurance, there are several key considerations to keep in mind to ensure you’re adequately protected.

Understanding Your RV’s Value

Accurately assessing the value of your RV is crucial when determining the appropriate level of insurance coverage. The value of your RV can impact the insurance premiums you pay and the limits of coverage you require. Consider the current market value of your RV, taking into account factors such as its age, condition, and any custom modifications or upgrades you’ve made.

Work with your insurance provider to ensure that the coverage limits you choose adequately reflect the value of your RV. This will ensure that you're not underinsured, which could lead to financial difficulties in the event of a total loss or extensive damage.

Tailoring Coverage to Your Needs

Every RVer has unique needs and circumstances. It’s important to tailor your RV insurance coverage to align with your specific requirements. Consider factors such as the frequency of your RV usage, the length of your trips, and any additional activities or hobbies you engage in while on the road.

For instance, if you frequently tow a boat or trailer behind your RV, you'll want to ensure that your policy includes coverage for these additional vehicles. Similarly, if you plan on storing your RV for extended periods, you may need to adjust your coverage to account for the potential risks associated with long-term storage.

Understanding Exclusions and Limitations

While RV insurance policies offer comprehensive coverage, it’s important to be aware of any exclusions or limitations that may apply. These can vary depending on the insurance provider and the specific policy you choose. Carefully review the policy documentation to understand what is and isn’t covered.

Common exclusions may include damage caused by wear and tear, mechanical breakdowns, or damage resulting from certain natural disasters. It's crucial to understand these limitations to ensure you're not caught off guard in the event of a claim. If there are specific exclusions or limitations that concern you, discuss them with your insurance provider to determine if additional coverage options are available.

RV Insurance Claims: A Step-by-Step Guide

In the unfortunate event of an accident or incident involving your RV, understanding the claims process is essential. Here’s a step-by-step guide to help you navigate the RV insurance claims process.

Reporting the Incident

As soon as an accident or incident occurs, it’s crucial to report it to your insurance provider promptly. Most insurance companies have dedicated claim hotlines or online portals where you can initiate the claims process. Provide accurate and detailed information about the incident, including the date, time, location, and any relevant details.

It's important to gather as much evidence as possible at the scene. Take photographs of any damage to your RV, as well as the surrounding area. If there are any witnesses, obtain their contact information and a brief statement regarding what they observed. This documentation will be invaluable when it comes to processing your claim.

Assessing the Damage

Once you’ve reported the incident, your insurance provider will assign a claims adjuster to assess the damage. The adjuster will evaluate the extent of the damage, determine the cause, and provide an estimate for the repairs or replacement costs. This assessment is a critical step in the claims process, as it will determine the final settlement amount.

It's important to cooperate fully with the claims adjuster and provide any additional information or documentation they may request. This could include maintenance records, repair receipts, or any other relevant documents that support your claim.

Repairing or Replacing Your RV

After the claims adjuster has assessed the damage, you’ll receive a settlement offer from your insurance provider. This offer will outline the repairs or replacement costs that will be covered under your policy. It’s important to carefully review the settlement offer to ensure it aligns with the actual costs of repairing or replacing your RV.

If you agree with the settlement offer, you can proceed with the necessary repairs or replacement. Work with a reputable RV repair shop or dealership to ensure that the work is carried out to the highest standards. Keep all receipts and documentation related to the repairs for future reference.

Advanced Topics in RV Insurance

Beyond the basics, there are several advanced topics in RV insurance that are worth exploring to ensure you’re fully protected.

Full-Time RV Living

If you plan on living full-time in your RV, it’s crucial to understand the unique insurance considerations associated with this lifestyle. Full-time RV living often requires additional coverage beyond the standard RV insurance policy. This may include personal liability coverage, medical payments coverage, and even specialized coverage for your personal belongings.

Work closely with your insurance provider to tailor your policy to meet the specific needs of full-time RV living. Discuss any concerns or requirements you may have, such as coverage for extended stays in one location or the need for additional liability protection.

RV Rental Insurance

If you’re considering renting out your RV, it’s important to understand the insurance implications. Renting your RV can expose you to additional risks and liabilities, so it’s essential to have the right insurance coverage in place.

Many insurance providers offer specialized RV rental insurance policies that provide coverage for both the owner and the renter. These policies typically include liability coverage, collision and comprehensive coverage, and even additional coverage for personal property inside the RV. Work with your insurance provider to understand the specific requirements and coverage options available for RV rentals.

Travel Trailer Insurance vs. Motorhome Insurance

The type of RV you own can impact the insurance coverage you require. Travel trailers and motorhomes have different characteristics and potential risks, which can influence the insurance policies and premiums you pay.

Travel trailers, which are towed behind a vehicle, may have lower insurance premiums compared to motorhomes. However, they may require additional coverage for the towing vehicle and the potential risks associated with towing. Motorhomes, on the other hand, may have higher insurance premiums due to their size and the increased risk of accidents.

When comparing insurance options, it's important to understand the specific coverage needs for your type of RV and ensure that your policy adequately addresses these risks.

Conclusion

RV insurance is an essential aspect of responsible RV ownership. By understanding the various coverage options, researching local insurance providers, and tailoring your policy to your specific needs, you can ensure that you’re adequately protected during your RV adventures. Remember to review your insurance policy regularly and stay informed about any changes or updates that may impact your coverage.

As you hit the open road, have peace of mind knowing that you've taken the necessary steps to safeguard your RV and your travels. With the right RV insurance coverage, you can focus on creating unforgettable memories and exploring the beauty of the world around you.

What is the average cost of RV insurance per year?

+The average cost of RV insurance per year can vary significantly depending on factors such as the type of RV, coverage limits, and the owner’s location and driving record. On average, RV insurance premiums can range from 500 to 2,000 per year. However, it’s important to note that these are rough estimates, and the actual cost can be higher or lower based on individual circumstances.

Can I get RV insurance even if I only use my RV occasionally?

+Absolutely! RV insurance policies are designed to accommodate a range of usage frequencies. Whether you’re a full-time RVer or only use your RV for occasional trips, there are insurance options available to suit your needs. It’s important to discuss your specific usage patterns with your insurance provider to ensure you’re getting the right coverage.

What should I do if I’m involved in an accident while using my RV?

+In the event of an accident, it’s crucial to remain calm and follow these steps: First, ensure the safety of all involved parties. Then, contact the appropriate emergency services if needed. Next, gather as much information as possible, including contact details of any other parties involved, and take photographs of the accident scene. Finally, report the incident to your insurance provider promptly, providing them with all the relevant details.

Are there any discounts available for RV insurance?

+Yes, many insurance providers offer discounts for RV insurance policies. These discounts can vary depending on the provider, but common examples include safe driving discounts, multi-policy discounts (if you bundle your RV insurance with other policies), loyalty discounts for long-term customers, and even discounts for taking RV safety courses.