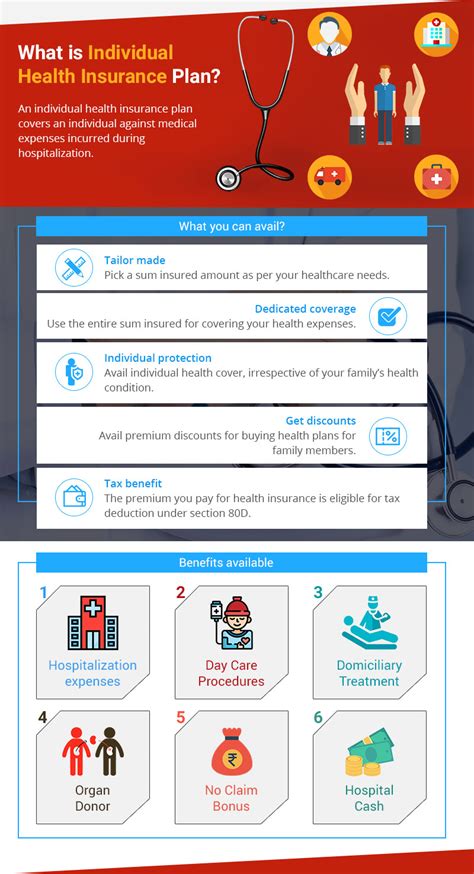

Medical Insurance Individual Plans

In the complex landscape of healthcare, understanding medical insurance is paramount. This guide delves into the intricacies of individual health plans, offering a comprehensive overview to help you make informed decisions about your coverage.

Unraveling the Complexity of Individual Health Plans

The healthcare industry is often fraught with intricate details and complexities, making it challenging for individuals to navigate. Individual health plans, designed for those who aren't covered by employer-sponsored insurance or government programs, are a crucial aspect of this landscape. These plans provide a safety net, ensuring access to essential healthcare services and financial protection in the event of unexpected medical needs.

With a myriad of options available, from major medical plans to short-term health insurance, the process of selecting the right coverage can be daunting. Each plan type comes with its own set of features, benefits, and limitations, making it essential to understand these nuances before making a decision.

Understanding Key Concepts

At the heart of individual health plans are several fundamental concepts that drive their design and functionality. Understanding these key terms is essential for evaluating and comparing different plans effectively.

Premiums

Premiums are the regular payments made by the policyholder to the insurance company to maintain coverage. These payments are typically made monthly, quarterly, or annually. The cost of premiums can vary significantly based on factors such as the individual's age, location, the type of plan, and the level of coverage desired.

Deductibles and Out-of-Pocket Costs

Deductibles are the amounts individuals must pay out of pocket before their insurance coverage kicks in. For instance, if you have a $1,500 deductible, you'll need to pay for medical services up to that amount before your insurance starts covering costs. Out-of-pocket costs also include co-pays (fixed amounts paid for each service) and co-insurance (a percentage of the service cost paid by the policyholder). These costs can quickly add up, especially for individuals with high deductibles or extensive medical needs.

Network Coverage

Most health insurance plans have a network of healthcare providers with whom they have negotiated rates. When individuals seek services from in-network providers, they typically benefit from reduced costs. However, services from out-of-network providers can be significantly more expensive, as these providers may not have agreed to the insurance company's negotiated rates.

Plan Types

Individual health plans come in various forms, each catering to different needs and preferences. Common plan types include:

- Major Medical Plans: These comprehensive plans offer coverage for a wide range of healthcare services, including doctor visits, hospital stays, prescription drugs, and more. They typically have higher premiums but also provide more extensive coverage.

- Short-Term Health Insurance: Designed for temporary coverage, these plans are ideal for individuals between jobs, recent graduates, or those facing a gap in coverage. They often have lower premiums but may have limited benefits and higher out-of-pocket costs.

- Catastrophic Plans: Geared towards younger, healthier individuals, these plans have low premiums but high deductibles. They provide coverage for essential health benefits but primarily aim to protect against unexpected, high-cost medical events.

Evaluating Individual Health Plans: A Comprehensive Guide

Selecting the right individual health plan involves a thoughtful evaluation of several key factors. Here's a step-by-step guide to help you navigate this process effectively.

Assess Your Healthcare Needs

Begin by understanding your current and potential future healthcare needs. Consider factors such as your age, health status, chronic conditions (if any), and the type of medical services you're likely to require. This self-assessment will help you determine the level of coverage you need.

Compare Plan Options

Research and compare various individual health plans offered by different insurance providers. Look for plans that align with your healthcare needs and budget. Consider the plan's network of providers, coverage limits, and any additional benefits or discounts it may offer.

Evaluate Premiums and Out-of-Pocket Costs

Premiums and out-of-pocket costs are critical factors in choosing an individual health plan. Evaluate the plan's premium structure, including whether it's a fixed amount or varies based on factors like age or location. Also, assess the deductible, co-pays, and co-insurance to understand the potential out-of-pocket costs you may incur.

Understand the Coverage Limits

Every health insurance plan has coverage limits, specifying the maximum amount the insurer will pay for a particular service or in a given year. These limits can vary significantly between plans. Ensure you understand the coverage limits for essential services like hospital stays, prescription drugs, and specialist visits to avoid unexpected costs.

Consider Additional Benefits and Discounts

Some individual health plans offer additional benefits or discounts that can enhance your coverage. These may include wellness programs, discounts on gym memberships or healthy lifestyle products, or coverage for alternative therapies. Evaluate these perks to determine if they add value to your overall healthcare plan.

Review the Fine Print

Before finalizing your choice, carefully review the plan's policy document. This will provide detailed information about the plan's coverage, exclusions, and any limitations. Pay close attention to the exclusions, as these are services or conditions that aren't covered by the plan.

Performance Analysis: Real-World Examples

Understanding how individual health plans perform in real-world scenarios can provide valuable insights. Here, we analyze two case studies to illustrate the impact of different plan choices.

Case Study 1: Major Medical Plan for Chronic Condition Management

Consider the case of Sarah, a 35-year-old individual with a chronic condition requiring regular medical care and prescription medications. Sarah opted for a major medical plan with a slightly higher premium but a lower deductible. This plan provided comprehensive coverage for her condition, including specialist visits, laboratory tests, and prescription drugs.

Over the year, Sarah incurred significant medical expenses due to her condition. However, her major medical plan covered a substantial portion of these costs, leaving her with manageable out-of-pocket expenses. The plan's network of providers also ensured that Sarah had access to high-quality healthcare services without incurring additional costs.

| Plan Type | Premium | Deductible | Out-of-Pocket Costs |

|---|---|---|---|

| Major Medical Plan | $500/month | $1,000 | $3,000 |

Case Study 2: Short-Term Health Insurance for Transitional Periods

Now, let's examine the scenario of Michael, a 26-year-old recent graduate who is between jobs. Michael chose a short-term health insurance plan due to its affordability and flexibility. This plan had a lower premium but a higher deductible and limited benefits.

During the coverage period, Michael experienced a minor accident that required emergency room treatment and follow-up care. While the short-term plan covered these expenses, Michael faced higher out-of-pocket costs due to the plan's higher deductible and limited coverage. Additionally, he had to carefully select providers within the plan's network to avoid incurring additional expenses.

| Plan Type | Premium | Deductible | Out-of-Pocket Costs |

|---|---|---|---|

| Short-Term Health Insurance | $250/month | $3,000 | $4,500 |

Future Implications and Industry Insights

The landscape of individual health plans is dynamic, influenced by evolving healthcare needs, technological advancements, and regulatory changes. Here, we explore some key trends and their potential impact on the future of individual health insurance.

Digital Health Solutions

The integration of digital health solutions, such as telemedicine and health apps, is revolutionizing the healthcare industry. These technologies offer convenient access to healthcare services, particularly for individuals in remote areas or with limited mobility. Insurance providers are increasingly incorporating these digital tools into their plans, offering enhanced convenience and potentially reducing costs.

Value-Based Care

Value-based care models are gaining traction, focusing on providing high-quality healthcare while controlling costs. These models aim to improve patient outcomes and reduce unnecessary expenses. As these models evolve, individual health plans may increasingly incorporate value-based incentives, such as reward programs for maintaining good health or penalties for avoidable hospital readmissions.

Regulatory Changes

Regulatory changes, such as the Affordable Care Act (ACA) and potential future reforms, significantly impact individual health plans. The ACA, for instance, introduced essential health benefits and prohibited insurers from denying coverage based on pre-existing conditions. Future regulatory changes could further expand coverage options or introduce new requirements for individual health plans.

Consumer-Driven Health Plans

Consumer-driven health plans, such as Health Savings Accounts (HSAs) and Health Reimbursement Arrangements (HRAs), are gaining popularity. These plans give individuals more control over their healthcare spending, allowing them to save pre-tax dollars for medical expenses. As these plans become more prevalent, they may offer a cost-effective alternative to traditional individual health plans, particularly for those with lower healthcare needs.

Global Healthcare Trends

The global healthcare landscape is also influencing individual health plans. Advances in medical technology, particularly in areas like genetic testing and precision medicine, are shaping the future of healthcare. Insurance providers are beginning to incorporate these advancements into their plans, offering coverage for genetic testing and personalized treatment options.

Conclusion

Navigating individual health plans requires a thoughtful approach, considering various factors such as healthcare needs, financial constraints, and plan benefits. By understanding the key concepts, evaluating plan options, and considering real-world examples, individuals can make informed decisions about their health coverage. As the healthcare industry continues to evolve, staying informed about emerging trends and industry insights will be crucial for selecting the right individual health plan.

How do I know if an individual health plan is right for me?

+Evaluating an individual health plan involves assessing your healthcare needs, budget, and preferences. Consider factors like your age, health status, and the type of medical services you’re likely to require. Compare different plan options, evaluating premiums, deductibles, and coverage limits. If you have specific healthcare needs, ensure the plan provides adequate coverage. For transitional periods, short-term plans can be cost-effective, while major medical plans offer comprehensive coverage for ongoing healthcare needs.

What are the key differences between major medical plans and short-term health insurance?

+Major medical plans offer comprehensive coverage, including a wide range of healthcare services like doctor visits, hospital stays, and prescription drugs. They typically have higher premiums but lower deductibles, providing more financial protection. Short-term health insurance, on the other hand, is designed for temporary coverage and has lower premiums but higher deductibles and limited benefits. It’s ideal for individuals between jobs or for transitional periods.

Are there any tax benefits associated with individual health plans?

+Yes, there are tax benefits associated with certain individual health plans. For instance, Health Savings Accounts (HSAs) and Health Reimbursement Arrangements (HRAs) allow individuals to save pre-tax dollars for medical expenses, reducing their taxable income. Additionally, depending on your income and family size, you may qualify for premium tax credits to lower the cost of your individual health plan.