Pip Meaning Insurance

In the world of insurance, terminology can often be complex and confusing, especially for those who are new to the industry. One such term that frequently arises is "pip" in insurance, which is an acronym for Personal Injury Protection. This concept is an essential component of many insurance policies, particularly in the context of automobile insurance. It plays a vital role in providing coverage for medical expenses and lost wages resulting from an accident, regardless of who is at fault. Understanding the meaning and implications of PIP is crucial for anyone seeking to navigate the intricacies of insurance coverage effectively.

Unraveling the Concept of Personal Injury Protection (PIP)

Personal Injury Protection, or PIP, is a type of insurance coverage mandated in certain states, primarily in the no-fault insurance system. The purpose of PIP is to provide a swift and efficient mechanism for individuals to receive compensation for their injuries and other related costs after an accident. This coverage ensures that those involved in an accident can access the necessary medical treatment and financial support promptly, without having to wait for lengthy legal processes or determinations of fault.

PIP coverage typically includes:

- Medical Expenses: This covers a range of healthcare costs, including doctor visits, hospital stays, prescription medications, and even rehabilitation services.

- Lost Wages: If an individual is unable to work due to injuries sustained in the accident, PIP can provide compensation for the lost income during the recovery period.

- Funeral Expenses: In the unfortunate event of a fatality, PIP may assist with the costs associated with funeral arrangements.

- Essential Services: Some policies also offer coverage for necessary services that the injured person might require, such as child care or house cleaning during their recovery.

The exact scope of coverage under PIP can vary depending on the state and the specific policy. Some states have broader PIP coverage, while others may have more limited benefits. It's crucial for policyholders to understand the specifics of their PIP coverage to ensure they are adequately protected in the event of an accident.

How PIP Differs from Other Types of Insurance

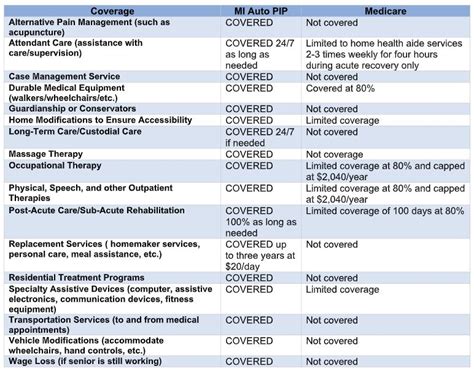

While PIP shares similarities with other types of insurance, such as health insurance and disability insurance, it has some distinct characteristics that set it apart.

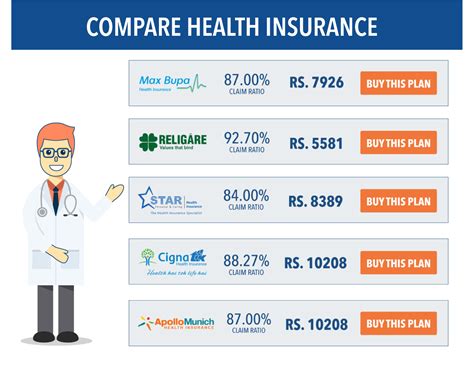

Comparison with Health Insurance

Health insurance typically covers a wide range of medical conditions and treatments, often with higher coverage limits. However, it may not provide the same level of immediate access to funds or the same breadth of coverage for non-medical expenses as PIP. Additionally, health insurance policies often have deductibles and co-pays, whereas PIP coverage is designed to be more accessible and comprehensive for accident-related injuries.

Distinction from Disability Insurance

Disability insurance, on the other hand, focuses primarily on providing income replacement if an individual becomes unable to work due to a disability. While it covers a similar scenario as PIP in terms of lost wages, disability insurance generally has longer waiting periods and stricter eligibility criteria. PIP is specifically designed to cover lost wages resulting from an accident, without the need to prove long-term disability.

The Importance of PIP in No-Fault States

In states with a no-fault insurance system, PIP coverage is a critical component of the overall insurance framework. These states, such as Florida, New York, and Michigan, have implemented no-fault laws to streamline the process of seeking compensation after an accident. Under this system, individuals typically turn to their own insurance provider for compensation, regardless of who caused the accident.

The no-fault system aims to reduce the number of personal injury lawsuits and expedite the process of receiving compensation. PIP coverage is a key element in achieving these goals, as it provides a predetermined set of benefits that are readily accessible to policyholders without the need for lengthy legal battles.

Understanding PIP Coverage Limits and Deductibles

As with any insurance policy, PIP coverage comes with its own set of limits and deductibles. The coverage limits refer to the maximum amount that the insurance company will pay out for a specific type of expense, such as medical bills or lost wages. These limits can vary significantly depending on the policy and the state's regulations.

Deductibles, on the other hand, are the amount that the policyholder must pay out of pocket before the insurance coverage kicks in. For example, if an individual has a $500 deductible on their PIP coverage, they would need to pay the first $500 of their medical expenses before the insurance company starts providing compensation.

It's important for policyholders to carefully review their PIP coverage limits and deductibles to ensure they have adequate protection. In some cases, it may be beneficial to increase coverage limits or reduce deductibles, especially for those with higher-risk occupations or those who frequently drive in areas with a higher incidence of accidents.

Real-Life Scenarios: How PIP Coverage Can Help

To better understand the practical implications of PIP coverage, let's explore a few real-life scenarios.

Scenario 1: Minor Accident with No Visible Injuries

Imagine a driver, John, is involved in a minor fender bender. At the time of the accident, he feels fine and doesn't notice any immediate injuries. However, a few days later, he starts experiencing severe neck pain and headaches. In this scenario, PIP coverage could be invaluable. John can use his PIP benefits to cover the cost of medical appointments, diagnostic tests, and any necessary treatment, even though the injuries didn't manifest immediately.

Scenario 2: Severe Accident with Long-Term Impairment

In a more severe accident, an individual might sustain injuries that result in long-term impairment or disability. PIP coverage can provide critical financial support during the recovery period, covering medical expenses, rehabilitation services, and lost wages. It can also assist with the transition back to work, ensuring that the individual has the necessary resources to adapt to any new physical limitations.

Scenario 3: Fatal Accident and Funeral Costs

Unfortunately, some accidents result in fatalities. In such tragic circumstances, PIP coverage can be a source of financial relief for the bereaved family. It can assist with funeral and burial expenses, helping to alleviate some of the financial burden during an already difficult time.

Maximizing the Benefits of Your PIP Coverage

To ensure you're making the most of your PIP coverage, here are some tips and strategies to consider:

- Review Your Policy Regularly: Stay informed about the specifics of your PIP coverage, including limits, deductibles, and any exclusions. Regularly reviewing your policy can help you identify areas where you might need to adjust your coverage to better meet your needs.

- Keep Records: Maintain a detailed record of all accident-related expenses, including medical bills, receipts for essential services, and documentation of lost wages. These records will be essential when filing a PIP claim.

- Understand Exclusions: Be aware of any exclusions or limitations in your PIP coverage. For example, some policies may have specific restrictions on pre-existing conditions or certain types of injuries. Understanding these exclusions can help you plan for any potential gaps in coverage.

- Seek Professional Advice: If you're unsure about the scope of your PIP coverage or have questions about specific scenarios, consider consulting an insurance professional or legal expert who specializes in personal injury protection.

The Future of PIP Coverage

As the insurance industry continues to evolve, so too will the landscape of Personal Injury Protection. With advancements in technology and changing consumer needs, we can expect to see innovations in PIP coverage that better meet the diverse needs of policyholders. Some potential future developments include:

- Enhanced Telemedicine Integration: As telemedicine becomes more prevalent, PIP coverage could evolve to incorporate this technology, allowing for more accessible and convenient medical care for policyholders.

- Expanded Coverage for Mental Health: With growing awareness of the importance of mental health, future PIP policies may include broader coverage for mental health treatment and support services following an accident.

- Increased Flexibility in Coverage Limits: Insurers may explore more flexible coverage limits, allowing policyholders to customize their PIP coverage based on their individual needs and risk profiles.

- Improved Claims Processing: Advances in technology could lead to more efficient and streamlined claims processing, reducing the time and effort required for policyholders to receive the benefits they're entitled to.

As the insurance industry adapts to meet the changing needs of consumers, it's important for policyholders to stay informed and proactive about their coverage. By understanding the intricacies of PIP coverage and keeping up with industry developments, individuals can ensure they have the protection they need to navigate the challenges that may arise after an accident.

Frequently Asked Questions (FAQ)

What is the purpose of Personal Injury Protection (PIP) in insurance policies?

+PIP is designed to provide coverage for medical expenses, lost wages, and other related costs after an accident, ensuring swift access to financial support for policyholders.

How does PIP coverage differ from health insurance and disability insurance?

+PIP focuses specifically on accident-related injuries and provides immediate access to funds without the need for lengthy legal processes. Health insurance covers a broader range of medical conditions, while disability insurance primarily covers long-term disability and has longer waiting periods.

What are some real-life scenarios where PIP coverage can be beneficial?

+PIP can assist in various situations, from minor accidents with delayed injury onset to severe accidents resulting in long-term impairment. It can also provide financial support for funeral expenses in the event of a fatality.

How can I maximize the benefits of my PIP coverage?

+Regularly review your policy, keep detailed records of accident-related expenses, understand any exclusions, and consider seeking professional advice to ensure you’re fully utilizing your PIP coverage.