Are Safety Deposit Boxes Insured

Safety deposit boxes have long been a secure way for individuals and businesses to store valuable items, documents, and sensitive information. As these boxes are often used to protect irreplaceable assets, many people wonder about the insurance coverage associated with them. In this comprehensive article, we delve into the world of safety deposit boxes, exploring their insurance status, the potential risks involved, and the best practices to ensure the security of your valuables.

The Insurance Coverage Enigma

The question of whether safety deposit boxes are insured is not as straightforward as one might expect. While these boxes are considered a secure storage option, their insurance coverage can vary depending on several factors, including the bank or financial institution offering the service, the jurisdiction, and the specific terms and conditions of the agreement.

Bank-Provided Insurance

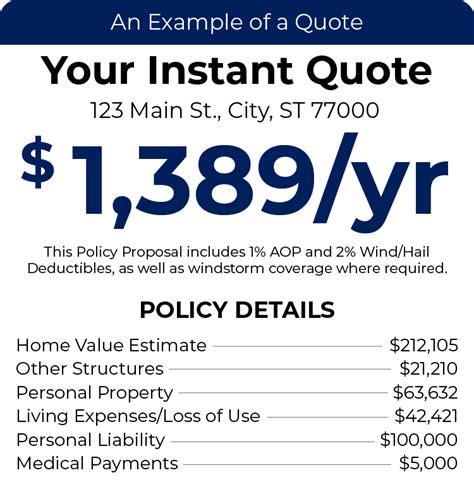

Some banks and financial institutions that offer safety deposit box services provide insurance coverage for the contents of the box. This insurance is often included as part of the rental agreement and is designed to protect customers against losses due to theft, natural disasters, or other unforeseen events. The insurance coverage typically extends to a certain monetary limit, and the bank may require an inventory of the items stored to ensure proper valuation and coverage.

| Bank | Insurance Coverage |

|---|---|

| Bank of America | Up to $250,000 in coverage, with a deductible of $1,000. Additional coverage can be purchased. |

| Wells Fargo | Insurance coverage is provided through a third-party insurer. Coverage limits vary and are based on the value of the items stored. |

| Chase | Offers optional insurance coverage through a third-party insurer. Coverage limits and deductibles vary based on the policy chosen. |

It's important to note that the insurance provided by banks often has specific exclusions and limitations. For instance, certain high-value items like precious gems, certain collectibles, or large sums of cash may not be fully covered, and there might be restrictions on the types of losses that are insured.

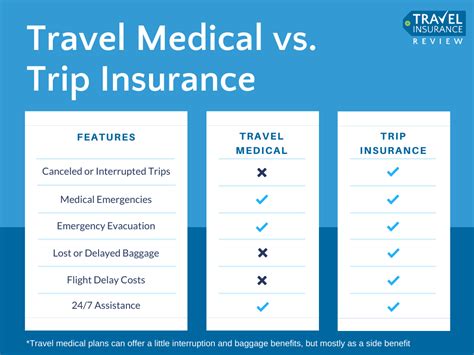

External Insurance Policies

In addition to the insurance offered by banks, individuals can also opt for external insurance policies to cover the contents of their safety deposit boxes. These policies are typically provided by insurance companies and can offer more comprehensive coverage, including higher limits and protection against a wider range of risks.

For example, a specialized insurance policy for valuable items might include coverage for theft, damage, and even mysterious disappearance, providing a higher level of protection for valuable assets. These policies often require a detailed inventory and appraisal of the items stored to ensure accurate coverage.

Assessing the Risks

While safety deposit boxes are designed to be secure, they are not entirely risk-free. Understanding the potential risks associated with these boxes is crucial for individuals and businesses looking to safeguard their valuables.

Theft and Robbery

Despite the security measures in place, safety deposit boxes are not immune to theft. While the likelihood of a robbery targeting a specific box is low, it is not impossible. Criminals may target banks or financial institutions to gain access to multiple boxes, and in such cases, insurance coverage can be vital.

Natural Disasters and Accidents

Natural disasters such as floods, fires, or earthquakes can pose a significant threat to the contents of safety deposit boxes. While banks often have robust security systems in place to protect against such events, accidents can still occur. In these cases, having adequate insurance coverage can help mitigate the financial losses.

Internal Errors and Negligence

In rare instances, internal errors or negligence by bank employees can lead to the loss or damage of items stored in safety deposit boxes. While banks have protocols to minimize these risks, human error cannot be entirely eliminated. Insurance coverage can provide a safety net in such situations.

Maximizing Security and Protection

To ensure the safety and protection of your valuables, it is essential to take a proactive approach. Here are some best practices to consider when utilizing safety deposit boxes:

Conduct Due Diligence

Before renting a safety deposit box, thoroughly research the bank or financial institution. Look into their security measures, reputation, and insurance offerings. Ensure that the institution has a robust security system, including surveillance cameras, alarm systems, and controlled access to the vault.

Choose the Right Size and Location

Select a safety deposit box size that aligns with your needs. Consider the number and size of the items you wish to store, and choose a box that provides adequate space. Additionally, opt for a location that is convenient for you, but also one that is less susceptible to potential risks. Avoid choosing a box that is easily accessible to unauthorized individuals.

Maintain Accurate Records

Keep a detailed and up-to-date inventory of the items stored in your safety deposit box. This inventory should include descriptions, valuations, and, if applicable, photographs or appraisals. Regularly review and update this inventory to ensure accuracy. Accurate records are essential for insurance claims and can help streamline the process in the event of a loss.

Consider Additional Security Measures

While safety deposit boxes are inherently secure, you can further enhance the protection of your valuables by implementing additional security measures. This could include purchasing external insurance coverage, installing security seals on your box, or utilizing specialized storage solutions designed to resist tampering.

Regularly Review and Update

Safety deposit boxes are not a “set it and forget it” solution. Regularly review the contents of your box and ensure that the items stored are still relevant and necessary. As your circumstances change, you may need to update the items or adjust your insurance coverage accordingly.

The Future of Safety Deposit Boxes

As technology advances, the world of safety deposit boxes is also evolving. Here are some insights into the future of this secure storage method:

Biometric Access and Smart Vaults

Traditional key-based access to safety deposit boxes is being replaced by more advanced biometric systems. These systems use fingerprint, facial recognition, or even iris scanning to provide secure and personalized access. Additionally, smart vaults are being developed with advanced security features and remote monitoring capabilities, further enhancing the security of stored items.

Digital Storage Solutions

With the increasing reliance on digital assets and information, safety deposit boxes are also adapting to store digital data securely. Banks and financial institutions are exploring ways to offer digital storage solutions, allowing individuals to protect their sensitive digital information, such as passwords, encryption keys, and digital assets like cryptocurrency.

Enhanced Insurance Options

As the demand for safety deposit boxes continues to grow, insurance providers are developing more specialized and comprehensive policies to cater to this market. These policies may offer higher coverage limits, more flexible terms, and enhanced protection against a wider range of risks, providing individuals with greater peace of mind.

Collaborative Security Measures

The future of safety deposit boxes may also involve collaborative security measures between banks and external security providers. By leveraging the expertise of specialized security companies, banks can further enhance the protection of their vaults and safety deposit boxes, ensuring a higher level of security for their customers.

Can I store any type of item in a safety deposit box?

+While safety deposit boxes offer a secure storage solution, there may be restrictions on the types of items you can store. Banks often have guidelines that prohibit the storage of certain items, such as illegal substances, hazardous materials, or live ammunition. Additionally, high-value items like jewelry or collectibles may require additional insurance coverage.

What happens if I lose the key to my safety deposit box?

+If you lose the key to your safety deposit box, you should contact the bank immediately. They will have procedures in place to assist you in accessing your box. This may involve providing identification, signing a waiver, or even drilling the box open as a last resort. It is crucial to keep track of your key and maintain a secure storage location for it.

How often should I access my safety deposit box?

+The frequency of accessing your safety deposit box depends on your individual needs. Some individuals may only need to access their box annually or bi-annually to update or review their stored items. Others may require more frequent access, especially if they are using the box for business purposes or to store frequently used documents. It is recommended to establish a regular review schedule to ensure the box’s contents remain relevant and secure.