Check Auto Insurance Rates

In the vast landscape of financial planning and personal protection, auto insurance stands as a critical pillar, offering a safety net for drivers and their vehicles. The process of securing the right coverage involves a meticulous exploration of various factors, from individual driving records to the unique features of different vehicles. This article delves into the intricate world of auto insurance rates, shedding light on the key determinants and strategies to navigate this essential financial decision.

Understanding Auto Insurance Rates: A Comprehensive Guide

Auto insurance rates are more than just a financial commitment; they are a reflection of an individual’s driving history, the vehicle’s characteristics, and the specific coverage needs. Delving into this realm, we uncover the intricate factors that influence these rates, providing a comprehensive roadmap for informed decision-making.

The Influence of Driving History

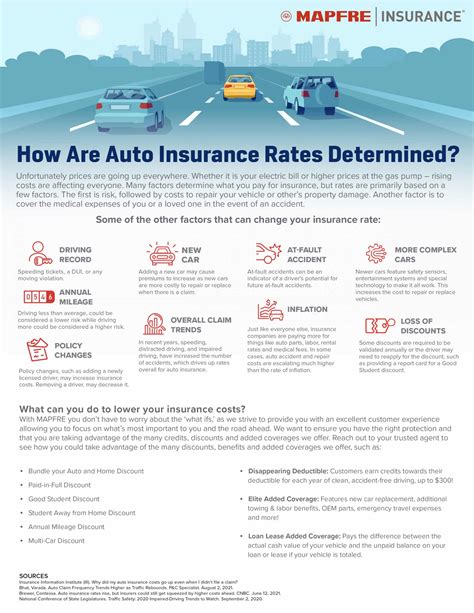

One of the primary determinants of auto insurance rates is an individual’s driving history. Insurance companies meticulously examine this record, taking into account factors such as accident claims, traffic violations, and even the frequency of claims. For instance, a driver with a clean record, free from accidents and traffic infractions, can expect more favorable rates compared to those with a history of accidents or frequent claims. This emphasis on driving history underscores the importance of responsible driving, not just for safety reasons but also for financial considerations.

| Driving Record | Rate Impact |

|---|---|

| Clean Record | Lower Rates |

| Minor Violations | Moderate Increase |

| Major Accidents | Significant Increase |

Vehicle Characteristics and Coverage Needs

The vehicle itself plays a pivotal role in determining insurance rates. Insurance providers assess the vehicle’s make, model, and year, considering factors like its safety features, repair costs, and the likelihood of theft. Additionally, the coverage chosen by the policyholder influences the rate. Comprehensive and collision coverage, for example, provide broader protection but come at a higher cost compared to basic liability coverage.

| Vehicle Type | Average Insurance Rate |

|---|---|

| Economy Car | $800 - $1200 annually |

| Sports Car | $1500 - $2500 annually |

| Luxury SUV | $1800 - $3000 annually |

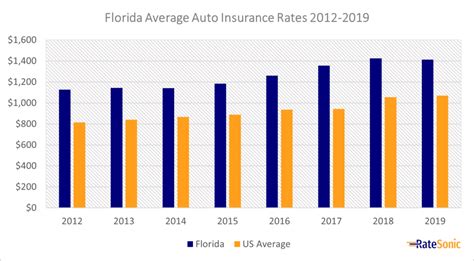

Geographic Location and Demographic Factors

The geographic location of the driver is another crucial factor. Insurance rates can vary significantly depending on the state, city, or even neighborhood. This variation is influenced by a range of factors, including the frequency of accidents, theft rates, and even the cost of living in the area. Demographic factors such as age, gender, and marital status also play a role, with younger drivers and males often facing higher rates due to statistical risk profiles.

| Demographic Factor | Rate Impact |

|---|---|

| Age | Younger drivers pay more |

| Gender | Males may pay higher rates |

| Marital Status | Married individuals may get discounts |

The Impact of Credit Score

A often-overlooked factor in auto insurance rates is an individual’s credit score. Many insurance companies use credit-based insurance scores to assess an individual’s risk profile. A higher credit score can lead to more favorable rates, as it is seen as an indicator of financial responsibility and stability. Conversely, a lower credit score may result in higher insurance premiums, as insurance companies view this as a potential indicator of increased risk.

| Credit Score Range | Rate Impact |

|---|---|

| Excellent (720+) | Lower Rates |

| Good (660-719) | Moderate Rates |

| Fair (620-659) | Higher Rates |

Comparative Analysis: Different Insurance Providers

The landscape of auto insurance is populated by numerous providers, each with its own pricing structure and coverage offerings. Conducting a comparative analysis is crucial to ensure you are getting the best value for your money. This process involves obtaining quotes from multiple insurers, comparing their rates, coverage options, and any additional benefits or discounts they offer. It’s important to note that the cheapest option may not always provide the best coverage, so a balanced approach is key.

| Insurance Provider | Average Rate | Discounts Offered |

|---|---|---|

| Provider A | $1200 annually | Multi-policy, safe driver |

| Provider B | $1350 annually | Good student, loyalty |

| Provider C | $1100 annually | Pay-per-mile, new customer |

Strategies for Obtaining Competitive Rates

Securing competitive auto insurance rates requires a proactive approach. Here are some strategies to consider:

- Shop Around: Obtain quotes from multiple insurers to compare rates and coverage options.

- Bundle Policies: Combining auto insurance with other policies, such as home or life insurance, can lead to significant discounts.

- Improve Your Credit Score: A higher credit score can lead to lower insurance rates.

- Choose a Higher Deductible: Opting for a higher deductible can reduce your premium, but ensure it's an amount you can comfortably afford in the event of a claim.

- Utilize Discounts: Insurance companies often offer discounts for various reasons, such as safe driving, good student status, or even certain professional affiliations.

Conclusion: Navigating the Auto Insurance Landscape

Understanding the factors that influence auto insurance rates is the first step towards making an informed decision. From driving history and vehicle characteristics to geographic location and credit score, each element plays a crucial role in determining the cost of your coverage. By conducting thorough research, comparing providers, and implementing strategic cost-saving measures, you can navigate the auto insurance landscape with confidence, securing the coverage you need at a competitive rate.

How often should I review my auto insurance policy?

+It’s recommended to review your policy annually or whenever your circumstances change, such as a move to a new state, a change in marital status, or the purchase of a new vehicle. Regular reviews ensure your coverage remains adequate and allow you to take advantage of any new discounts or benefits offered by your insurer.

Can I get auto insurance if I have a poor driving record?

+Yes, you can still obtain auto insurance with a poor driving record, but it may come at a higher cost. Some insurance companies specialize in providing coverage for high-risk drivers. It’s advisable to shop around and compare rates to find the most competitive option.

What are some common discounts offered by auto insurance providers?

+Common discounts include multi-policy discounts (for bundling multiple policies with the same insurer), safe driver discounts, good student discounts, loyalty discounts, and discounts for certain professions or affiliations. Some insurers also offer usage-based insurance, where rates are adjusted based on your actual driving habits.