Buy Automobile Insurance

When it comes to safeguarding your vehicle and ensuring peace of mind on the road, purchasing automobile insurance is an essential step. With countless options available, it can be daunting to navigate the world of auto insurance. However, understanding the process and key factors involved can help you make an informed decision and secure the best coverage for your needs. This comprehensive guide will delve into the intricacies of buying automobile insurance, offering expert insights and practical tips to simplify the process and empower you to make the right choices.

Understanding Automobile Insurance Coverage

Automobile insurance, often referred to as car insurance, is a vital financial safeguard for vehicle owners. It provides protection against various risks and liabilities associated with owning and operating a motor vehicle. The primary purpose of car insurance is to offer financial compensation in the event of an accident, theft, or other unforeseen circumstances that could result in damage to your vehicle or cause bodily harm to yourself or others.

Automobile insurance policies typically consist of several coverage types, each designed to address specific risks. These coverage types can include:

- Liability Coverage: This coverage is mandatory in most states and protects you against claims arising from bodily injury or property damage caused by you to others.

- Collision Coverage: Collision insurance covers damage to your vehicle resulting from a collision with another vehicle or object, regardless of fault.

- Comprehensive Coverage: Comprehensive insurance provides protection against damage caused by events other than collisions, such as theft, vandalism, weather-related incidents, or collisions with animals.

- Personal Injury Protection (PIP) or Medical Payments Coverage: These coverages pay for medical expenses resulting from an accident, regardless of fault.

- Uninsured/Underinsured Motorist Coverage: This coverage protects you if you're involved in an accident with a driver who has no insurance or insufficient coverage.

Each of these coverage types has its own set of benefits and limitations, and understanding them is crucial for selecting the right automobile insurance policy for your needs. Additionally, some policies may offer optional add-ons, such as rental car coverage or roadside assistance, which can further enhance your protection and convenience.

Factors Influencing Automobile Insurance Premiums

The cost of automobile insurance, known as the premium, can vary significantly based on several factors. These factors are used by insurance companies to assess the risk associated with insuring a particular driver and vehicle. Understanding these factors can help you anticipate the cost of your insurance and potentially negotiate better rates.

Driver-Related Factors

- Driving Record: A clean driving record with no accidents or violations is often rewarded with lower premiums. Conversely, a history of accidents or traffic violations can lead to higher insurance costs.

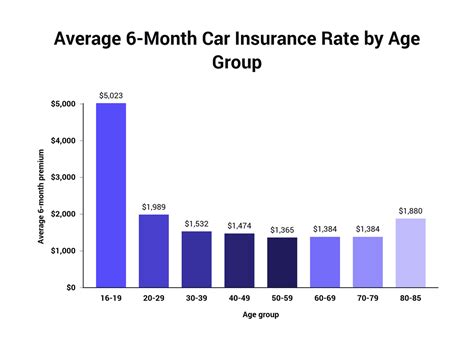

- Age and Gender: Younger drivers, especially males, are statistically more prone to accidents and tend to pay higher premiums. Older, more experienced drivers often benefit from lower rates.

- Marital Status: Married individuals are often considered lower-risk drivers, which can result in reduced insurance premiums.

- Credit History: In many states, insurance companies are permitted to use credit scores as a factor in determining premiums. A good credit score can lead to lower insurance costs.

Vehicle-Related Factors

- Make and Model: Some vehicles are more expensive to insure due to their repair costs, theft rates, or safety features.

- Vehicle Age and Value: Older vehicles with lower resale values may require less comprehensive coverage, resulting in lower premiums.

- Safety Features: Vehicles equipped with advanced safety features like anti-lock brakes, air bags, and crash avoidance systems may qualify for insurance discounts.

- Usage and Mileage: The primary use of the vehicle (e.g., commuting, pleasure, business) and the annual mileage can impact insurance rates.

Location and Usage Factors

- Geographic Location: Insurance rates can vary significantly by state, county, or even zip code, due to differences in traffic density, crime rates, and weather conditions.

- Garaging Location: Whether the vehicle is parked in a garage or on the street can affect insurance rates, as vehicles in garages are generally considered less at risk for theft or vandalism.

- Usage: The primary purpose of the vehicle (e.g., commuting, pleasure, business) can impact insurance rates, as different types of usage carry varying levels of risk.

It's important to note that insurance companies use these factors in combination to assess risk and determine premiums. Additionally, the weight given to each factor can vary between insurance providers, so it's beneficial to shop around for the best rates and coverage options.

Comparing Automobile Insurance Policies

With numerous insurance providers offering a wide array of policies, comparing automobile insurance options can be a complex task. However, taking a systematic approach can help you identify the best policy for your needs and budget.

Coverage Comparison

Start by evaluating the coverage options offered by different insurers. Ensure that the policies you’re comparing provide the necessary coverage types, such as liability, collision, and comprehensive coverage, as well as any additional coverages you may require (e.g., rental car coverage, roadside assistance, etc.). Compare the limits and deductibles associated with each coverage type to ensure they align with your risk tolerance and budget.

Premium Comparison

While coverage is paramount, it’s also essential to compare premiums to ensure you’re getting a competitive rate. Obtain quotes from multiple insurers to get a clear picture of the market rates. When comparing premiums, consider not only the cost of the policy but also any discounts that may be available, such as multi-policy discounts, safe driver discounts, or discounts for bundling home and auto insurance.

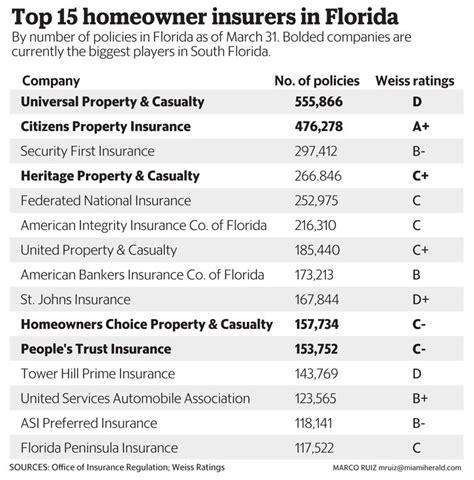

Reputation and Financial Stability

The financial stability and reputation of an insurance provider are critical considerations. Choose insurers with a strong financial standing, as this ensures they will be able to pay out claims in the event of an accident. Research the insurer’s reputation, customer satisfaction ratings, and claims handling process to ensure they provide excellent service and prompt payouts.

Customer Service and Claims Handling

The quality of customer service and claims handling can significantly impact your experience with an insurance provider. Look for insurers with a reputation for prompt and efficient claims handling, as this can make a significant difference in the aftermath of an accident. Consider factors such as the availability of online or phone support, the ease of filing claims, and the insurer’s track record in settling claims fairly and promptly.

Tips for Purchasing Automobile Insurance

Navigating the world of automobile insurance can be simplified with the right approach and knowledge. Here are some expert tips to guide you through the process of buying car insurance:

Know Your Coverage Needs

Before shopping for insurance, assess your coverage needs. Consider factors such as the value of your vehicle, your personal financial situation, and any specific risks associated with your driving habits or location. This assessment will help you determine the appropriate levels of coverage for your policy.

Shop Around and Compare

Don’t settle for the first insurance quote you receive. Shop around and compare policies from multiple insurers. Online comparison tools can be a great starting point, but also consider seeking recommendations from friends, family, or local insurance agents who can provide personalized advice.

Understand Policy Terms and Conditions

Read the fine print of any policy you’re considering. Understand the coverage limits, deductibles, and any exclusions or limitations that may apply. This knowledge will help you make an informed decision and ensure you’re not caught off guard in the event of a claim.

Consider Bundling Policies

If you’re in the market for other types of insurance, such as home or renters insurance, consider bundling your policies with the same insurer. Bundling policies can often lead to significant discounts and simplify your insurance management.

Review and Adjust Your Policy Regularly

Your insurance needs may change over time, so it’s important to review your policy annually and make adjustments as necessary. This could include updating your coverage limits, adding or removing vehicles, or adjusting your deductibles to align with your current financial situation.

Frequently Asked Questions

What is the average cost of automobile insurance?

+The average cost of automobile insurance varies significantly depending on factors such as location, driving record, and vehicle type. As of 2022, the national average for car insurance premiums is approximately 1,674 per year, or about 140 per month. However, rates can range from a few hundred dollars to several thousand dollars annually.

How can I reduce my automobile insurance premiums?

+There are several strategies to potentially reduce your automobile insurance premiums. These include maintaining a clean driving record, shopping around for the best rates, bundling policies with the same insurer, taking advantage of discounts (such as safe driver discounts or student discounts), and increasing your deductibles (though this may increase your out-of-pocket costs in the event of a claim).

What should I do if I’m involved in an accident?

+If you’re involved in an accident, the first step is to ensure your safety and the safety of others involved. Contact the police to file a report and obtain a copy for your records. Exchange contact and insurance information with the other driver(s). Notify your insurance company as soon as possible, and provide them with all relevant details. Take photos of the accident scene and any damage to your vehicle. Cooperate with your insurance company during the claims process, and seek legal advice if necessary.

Can I cancel my automobile insurance policy at any time?

+In most cases, you can cancel your automobile insurance policy at any time. However, there may be cancellation fees or other penalties associated with early cancellation, and you may not receive a refund for the remaining portion of your policy term. It’s important to review your policy terms and conditions and consult with your insurance provider to understand the cancellation process and any potential costs.