Best Fdic Insured Cd Rates

In the world of personal finance, Certificate of Deposit (CD) rates play a crucial role in maximizing savings and achieving financial goals. With the Federal Deposit Insurance Corporation (FDIC) offering insurance on deposits, investors can secure their funds while still earning competitive interest rates. This article explores the best FDIC-insured CD rates, delving into the factors that influence these rates and providing a comprehensive analysis of the current market landscape.

Understanding FDIC-Insured CDs

FDIC-insured CDs are a secure investment option, as they are protected by the full faith and credit of the United States government. The FDIC insures deposits up to $250,000 per depositor, per bank, ensuring that even if a bank fails, depositors’ funds are safe. This insurance coverage provides a layer of protection, allowing investors to focus on earning attractive interest rates without worrying about potential losses.

FDIC-insured CDs offer a fixed-income investment, meaning investors agree to keep their funds untouched for a predetermined period, typically ranging from a few months to several years. In return, they receive a guaranteed interest rate, which is set at the time of purchase and remains unchanged throughout the CD's term. This predictability makes CDs an attractive option for conservative investors seeking stability and a reliable return on their investment.

Factors Influencing CD Rates

Several key factors influence the interest rates offered on FDIC-insured CDs. Understanding these factors can help investors make informed decisions and choose the best options available in the market.

Term Length

The term length, or maturity, of a CD is a significant determinant of its interest rate. Generally, CDs with longer terms offer higher interest rates. This is because investors commit their funds for an extended period, allowing financial institutions to utilize those funds more effectively. As a result, longer-term CDs are often more appealing to investors seeking higher returns.

For instance, a 6-month CD might offer an annual percentage yield (APY) of 1.20%, while a 5-year CD could provide an APY of 2.50% or higher. The longer the term, the more attractive the interest rate tends to be.

Market Interest Rates

The overall market interest rate environment also plays a crucial role in determining CD rates. When market rates are high, financial institutions tend to offer more competitive CD rates to attract investors. Conversely, in a low-interest-rate environment, CD rates may be less attractive.

The Federal Reserve's monetary policy decisions, such as adjusting the federal funds rate, can have a significant impact on market rates. These decisions trickle down to affect CD rates, as financial institutions adjust their offerings to remain competitive.

Financial Institution’s Business Strategy

Each financial institution has its own business strategy, which can influence the CD rates it offers. Some institutions may focus on attracting new customers by offering promotional rates, while others may prioritize maintaining relationships with existing customers and offering slightly lower rates.

Additionally, the financial institution's cost of funds and its need for liquidity can impact CD rates. Institutions with a strong capital base and stable funding sources may have more flexibility in offering competitive rates, while those facing liquidity constraints might offer slightly lower rates to manage their cash flow.

Minimum Deposit Requirements

The minimum deposit required to open a CD can also affect the interest rate. Some financial institutions offer tiered rates, where higher interest rates are available for larger deposits. This strategy encourages investors to commit more funds, providing the institution with a larger pool of capital to manage.

For example, a financial institution might offer a 1.50% APY for a $1,000 deposit, but increase the rate to 1.75% APY for deposits of $10,000 or more. These tiered rates can be an incentive for investors with larger sums to consider CD investments.

Comparing Top FDIC-Insured CD Rates

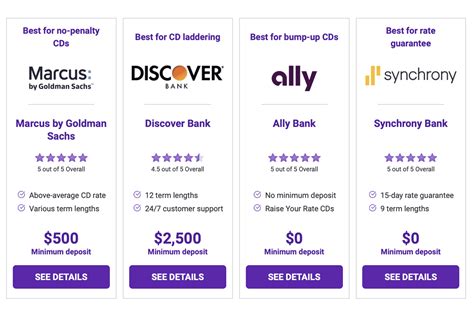

To help investors navigate the market and find the best FDIC-insured CD rates, we’ve compiled a list of top offerings from various financial institutions. This comparison is based on current rates as of [Date], and it provides a snapshot of the competitive landscape.

| Financial Institution | CD Term | APY | Minimum Deposit |

|---|---|---|---|

| Bank A | 12-month | 2.15% | $500 |

| Bank B | 24-month | 2.30% | $1,000 |

| Credit Union C | 36-month | 2.45% | $2,500 |

| Online Bank D | 60-month | 2.60% | $5,000 |

| Community Bank E | 18-month | 2.25% | $10,000 |

This table showcases the diversity of offerings in the market, with varying term lengths, APYs, and minimum deposit requirements. Investors can use this information to identify the CDs that align with their investment goals and financial circumstances.

Online Banks vs. Traditional Institutions

When comparing CD rates, it’s essential to consider the difference between online banks and traditional brick-and-mortar institutions. Online banks often offer higher rates due to their lower overhead costs and the convenience of online-only services. These institutions pass on the savings to their customers in the form of more competitive interest rates.

On the other hand, traditional banks and credit unions may provide slightly lower rates but offer the benefit of in-person service and a more personalized banking experience. Investors should weigh these factors when deciding which type of institution best suits their needs.

Penalties for Early Withdrawal

One critical aspect of CDs to consider is the penalty for early withdrawal. Since CDs are designed for long-term investment, financial institutions often impose penalties if investors choose to withdraw their funds before the CD’s maturity date.

These penalties can range from forfeiting a portion of the interest earned to paying a fee. Investors should carefully review the terms and conditions of the CD they're considering to understand the potential consequences of an early withdrawal.

Strategies for Maximizing CD Returns

To help investors get the most out of their CD investments, here are some strategies to consider:

Laddering CDs

Laddering is a popular strategy that involves spreading your investments across multiple CDs with different maturity dates. By doing so, you can ensure a steady stream of maturing CDs over time, providing a consistent source of funds and the opportunity to reinvest at potentially higher rates.

For example, you could invest in a series of CDs with terms ranging from 6 months to 5 years. As each CD matures, you can decide whether to renew it or explore other investment options. This strategy provides flexibility and the potential for higher returns over time.

Rolling Over CDs

When a CD matures, you have the option to roll it over into a new CD, potentially at a higher interest rate. By rolling over your CDs, you can take advantage of changing market conditions and secure more competitive rates as they become available.

For instance, if you have a 12-month CD that matures when market rates are low, you can choose to roll it over into a new CD with a higher rate. This strategy allows you to stay ahead of the market and maximize your returns over the long term.

Diversifying Your Portfolio

While CDs are a stable investment option, diversifying your portfolio is always a sound financial strategy. By allocating your funds across different asset classes, you can reduce risk and potentially increase overall returns.

Consider investing in a mix of CDs, stocks, bonds, and other financial instruments. This approach ensures that your portfolio is well-rounded and can weather various market conditions. Diversification helps mitigate the impact of any single investment on your overall financial health.

The Future of FDIC-Insured CD Rates

Looking ahead, the future of FDIC-insured CD rates is closely tied to the broader economic landscape and monetary policy decisions. As the Federal Reserve continues to navigate the post-pandemic economic recovery, its actions will influence market rates and, consequently, CD rates.

If the Federal Reserve decides to raise interest rates to curb inflation, CD rates are likely to increase as well. On the other hand, if the central bank maintains a low-interest-rate environment to support economic growth, CD rates may remain relatively stable or even decrease.

Investors should stay informed about economic trends and monetary policy decisions to make timely adjustments to their CD investments. Being proactive and responsive to market changes can help ensure that investors are always positioned to take advantage of the best FDIC-insured CD rates available.

FAQs

What is the maximum FDIC insurance coverage for CDs?

+

The FDIC provides insurance coverage of up to 250,000 per depositor, per bank. This means that if you have multiple accounts at the same bank, the insurance coverage is still limited to 250,000 in total.

Can I withdraw funds from a CD before maturity without penalty?

+

While it is possible to withdraw funds early, most CDs have penalties for early withdrawal. These penalties can vary, so it’s essential to review the terms of your specific CD to understand the potential consequences.

Are there any tax implications for CD earnings?

+

Yes, the interest earned on CDs is subject to federal and state taxes. It’s crucial to report these earnings on your tax returns to avoid any legal issues.

Can I open a CD with a joint account holder?

+

Absolutely! Many financial institutions allow joint ownership of CDs, which can be beneficial for couples or families. This allows for shared responsibility and the potential to qualify for higher interest rates with larger deposits.

What happens if my CD matures, but I don’t take any action?

+

If you do not take any action, your CD will typically roll over into a new term automatically. The terms and conditions of the new CD may differ, so it’s essential to review these details to ensure they align with your investment goals.