Best California Home Insurance

When it comes to protecting your home and assets in the Golden State, choosing the right home insurance is crucial. With its diverse landscapes, ranging from coastal regions to mountainous areas, California presents unique challenges and risks. From wildfires to earthquakes, having comprehensive coverage is essential for peace of mind. This comprehensive guide will explore the best home insurance options tailored specifically for California residents.

Understanding the California Home Insurance Landscape

California’s insurance market offers a wide range of options, catering to the diverse needs of its residents. From traditional insurers to specialty providers, there are numerous companies vying for your business. However, not all policies are created equal, and it’s important to understand the specific challenges and risks faced by homeowners in this state.

California’s Unique Risks

California is renowned for its natural beauty, but this comes with its own set of challenges. Wildfires, earthquakes, mudslides, and even coastal erosion are just some of the natural disasters that homeowners in California must prepare for. Traditional insurance policies often exclude coverage for certain perils, such as earthquakes, leaving homeowners vulnerable. Understanding these risks and choosing a policy that provides adequate coverage is crucial.

The Importance of Customized Coverage

One size does not fit all when it comes to home insurance in California. The state’s diverse geography and unique risks mean that homeowners need tailored coverage. A policy that provides adequate protection in one region may fall short in another. It’s essential to work with insurance providers that offer customizable plans, allowing you to select the right coverage for your specific location and needs.

Top California Home Insurance Providers

With a myriad of options available, selecting the right home insurance provider can be daunting. To simplify the process, we’ve compiled a list of the top insurance companies catering specifically to California homeowners. These providers offer a combination of comprehensive coverage, competitive rates, and excellent customer service, ensuring you receive the best protection for your home and belongings.

State Farm

State Farm is a well-established insurance provider with a strong presence in California. They offer a range of home insurance policies tailored to the state’s unique risks. Their policies provide coverage for standard perils, such as fire, theft, and wind damage, as well as optional coverage for earthquakes and floods. State Farm also offers discounts for bundling home and auto insurance, making it a cost-effective option for many homeowners.

Farmers Insurance

Farmers Insurance is another leading provider in California, known for its comprehensive coverage options. They offer customizable home insurance policies that can be tailored to your specific needs. Farmers provides coverage for a wide range of perils, including fire, theft, and natural disasters. Additionally, they offer optional coverage for earthquakes, ensuring you have the protection you need in case of a seismic event.

Allstate

Allstate is a trusted name in the insurance industry, and their home insurance policies are designed to meet the unique challenges faced by California residents. Their policies provide coverage for a wide range of perils, including fire, theft, and weather-related damage. Allstate also offers optional coverage for earthquakes and flood insurance, ensuring you can customize your policy to your specific needs.

USAA

USAA is a highly regarded insurance provider, exclusively serving military members, veterans, and their families. With a strong focus on customer service and competitive rates, USAA offers comprehensive home insurance policies tailored to the needs of military personnel. Their policies provide coverage for standard perils and offer optional coverage for earthquakes and floods, making them a reliable choice for those stationed in California.

Esurance

Esurance is a modern insurance provider, offering a digital-first approach to home insurance. Their online platform makes it easy to compare policies, get quotes, and manage your insurance needs. Esurance provides coverage for a range of perils, including fire, theft, and natural disasters. They also offer optional coverage for earthquakes and flood insurance, ensuring you can tailor your policy to your specific risks.

| Insurance Provider | Coverage Highlights |

|---|---|

| State Farm | Customizable policies, optional earthquake coverage, and bundling discounts. |

| Farmers Insurance | Comprehensive coverage, customizable plans, and optional earthquake insurance. |

| Allstate | Wide range of coverage options, including earthquake and flood insurance. |

| USAA | Tailored policies for military personnel, with optional earthquake and flood coverage. |

| Esurance | Digital-first approach, customizable policies, and optional earthquake/flood insurance. |

Comparing Policies and Coverage Options

When selecting a home insurance policy in California, it’s crucial to compare coverage options and understand the specific needs of your home. Here are some key factors to consider when evaluating policies:

Coverage Limits and Deductibles

Ensure that the policy provides adequate coverage limits for your home’s structure, personal belongings, and liability. Consider your home’s replacement cost and the value of your belongings to determine the appropriate coverage limits. Additionally, evaluate the deductible options and choose one that aligns with your financial comfort level.

Optional Coverages

California’s unique risks often require additional coverage. Look for policies that offer optional coverages for earthquakes, floods, and other natural disasters. These optional coverages can provide an added layer of protection, ensuring you’re prepared for the unexpected.

Policy Exclusions

Carefully review the policy exclusions to understand what is not covered. Many standard policies exclude coverage for certain perils, such as earthquakes and floods. If you live in an area prone to these risks, consider purchasing additional coverage or seeking out policies that include these perils.

Discounts and Bundling Options

Insurance providers often offer discounts for various reasons, such as loyalty, bundling home and auto insurance, or having safety features in your home. Take advantage of these discounts to reduce your insurance premiums. Additionally, consider bundling your home and auto insurance policies with the same provider to save money and simplify your insurance needs.

The Importance of Customer Service and Claims Handling

In the event of a claim, having a responsive and efficient insurance provider can make a significant difference. When evaluating home insurance options, consider the provider’s reputation for customer service and claims handling. Look for providers with a strong track record of prompt claim processing, fair settlements, and excellent customer support.

How to Assess Customer Service

Research the insurance provider’s customer service reputation through online reviews and ratings. Look for providers with a history of positive customer experiences and timely claim resolutions. Additionally, consider the availability of customer support channels, such as phone, email, and online chat, to ensure you can easily reach out for assistance when needed.

Understanding the Claims Process

Familiarize yourself with the claims process and the steps involved in filing a claim. Look for providers that offer a seamless and straightforward claims process, with clear guidelines and timely responses. Ensure that the provider has a dedicated claims team and a reputation for fair and transparent claim settlements.

Additional Considerations for California Homeowners

Beyond the standard home insurance policy, there are additional considerations and coverages that California homeowners should be aware of. These optional coverages can provide an extra layer of protection and peace of mind.

Earthquake Insurance

Earthquakes are a significant risk in California, and standard home insurance policies often exclude coverage for seismic events. Consider purchasing earthquake insurance as a separate policy or as an add-on to your existing home insurance. This coverage can provide financial protection in the event of an earthquake, covering the cost of repairs or rebuilding your home.

Flood Insurance

California’s diverse geography means that certain areas are at higher risk of flooding. If your home is located in a flood-prone region, consider purchasing flood insurance. This coverage is typically provided through the National Flood Insurance Program (NFIP) and can help protect your home and belongings in the event of a flood.

Personal Property Coverage

Standard home insurance policies often provide coverage for personal belongings, but it’s important to ensure that your policy has adequate limits. Consider the value of your personal property and choose a policy with sufficient coverage. You may also want to consider purchasing additional coverage for high-value items, such as jewelry, artwork, or electronics.

Liability Coverage

Liability coverage is an essential aspect of home insurance, protecting you from financial losses in the event of an accident or injury on your property. Ensure that your policy provides sufficient liability coverage to protect your assets. Consider increasing your liability limits if you have significant assets or host frequent gatherings on your property.

FAQs

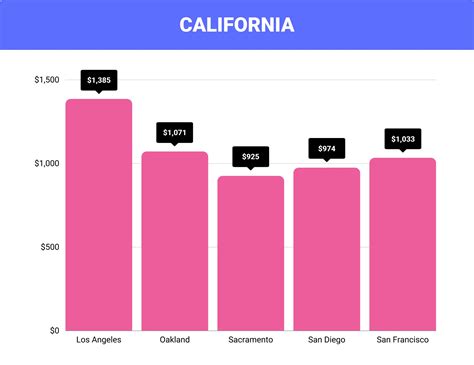

What are the average home insurance rates in California?

+Home insurance rates in California can vary significantly depending on factors such as location, the value of your home, and your chosen coverage limits. On average, homeowners in California can expect to pay between 1,000 and 2,000 per year for standard home insurance coverage. However, rates can be higher or lower based on individual circumstances.

Do I need earthquake insurance in California?

+While earthquake insurance is not legally required in California, it is highly recommended, especially if you live in an area with a high seismic risk. Standard home insurance policies typically exclude coverage for earthquakes, leaving homeowners vulnerable to financial losses. Consider purchasing earthquake insurance to protect your home and belongings in the event of a seismic event.

How can I lower my home insurance premiums in California?

+There are several ways to lower your home insurance premiums in California. Some strategies include increasing your deductible, bundling your home and auto insurance policies, installing security features in your home, and maintaining a good credit score. Additionally, shopping around and comparing quotes from different providers can help you find the most competitive rates.

What should I do if I’m not satisfied with my current home insurance provider in California?

+If you’re not satisfied with your current home insurance provider, it’s important to take action. Start by reviewing your policy and understanding the coverage limits and exclusions. Compare your policy with those offered by other providers to identify potential areas for improvement. Consider switching to a different provider that offers better coverage, more competitive rates, or superior customer service.

How often should I review and update my home insurance policy in California?

+It’s recommended to review your home insurance policy annually to ensure it aligns with your current needs and circumstances. Life changes, such as renovations, additions to your home, or acquiring high-value items, may require adjustments to your coverage limits. Additionally, reviewing your policy allows you to stay informed about any changes in coverage options, discounts, or available add-ons.