Insurance For Vehicle

Vehicle insurance, often referred to as auto insurance or car insurance, is an essential aspect of vehicle ownership and a crucial financial safeguard for drivers. It provides protection against financial losses resulting from vehicle-related incidents, ensuring peace of mind for vehicle owners. With the variety of coverage options available, understanding the nuances of vehicle insurance is paramount for making informed decisions and securing adequate protection.

This comprehensive guide aims to delve into the world of vehicle insurance, shedding light on its intricacies, benefits, and considerations. By exploring the key aspects of vehicle insurance, we aim to empower readers with the knowledge to navigate this complex yet vital landscape, ensuring their vehicles and finances are adequately protected.

The Essentials of Vehicle Insurance

Vehicle insurance serves as a vital safeguard, offering financial protection in the event of accidents, theft, or other unforeseen circumstances. It is a legal requirement in many regions, ensuring that drivers are accountable for potential damages caused while on the road. Understanding the fundamental components of vehicle insurance is essential for making informed choices and ensuring adequate coverage.

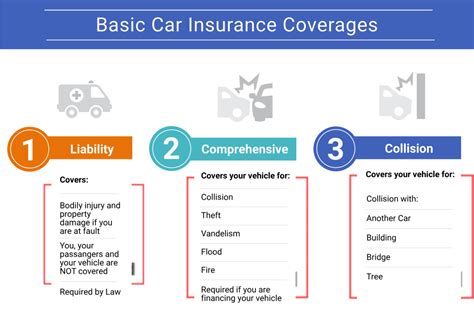

Liability Coverage

Liability coverage is a cornerstone of vehicle insurance, providing protection in the event that you are at fault for an accident. This coverage pays for damages or injuries sustained by others as a result of the accident, including medical expenses, property damage, and legal fees. It is crucial to have adequate liability coverage to protect your financial well-being in the event of an at-fault accident.

| Type of Liability Coverage | Description |

|---|---|

| Bodily Injury Liability | Covers medical expenses and lost wages for injured parties. |

| Property Damage Liability | Pays for repairs or replacements of damaged property, such as other vehicles or structures. |

| Uninsured/Underinsured Motorist Coverage | Provides protection if an at-fault driver lacks sufficient insurance coverage. |

Comprehensive and Collision Coverage

While liability coverage focuses on protecting others, comprehensive and collision coverage are designed to protect your vehicle. Comprehensive coverage provides protection against non-collision incidents, such as theft, vandalism, natural disasters, or collisions with animals. Collision coverage, on the other hand, covers damages to your vehicle resulting from collisions with other vehicles or objects.

These coverages are optional but highly recommended, especially if you have a loan or lease on your vehicle. They ensure that your vehicle is adequately protected and that you are not left with significant out-of-pocket expenses in the event of an accident or other covered incident.

Medical Payments and Personal Injury Protection

Medical payments coverage, also known as MedPay, provides coverage for medical expenses incurred by you or your passengers as a result of an accident, regardless of fault. This coverage is particularly beneficial as it offers quick access to funds for medical treatment, ensuring timely care without waiting for liability determinations.

Personal Injury Protection (PIP) is another type of coverage that provides broader medical coverage, including lost wages and funeral expenses. PIP is a no-fault coverage, meaning it covers expenses regardless of who is at fault in an accident. It is a mandatory coverage in some states and offers additional financial protection for policyholders.

Additional Coverages and Endorsements

Vehicle insurance policies often offer a range of additional coverages and endorsements to cater to specific needs. These can include:

- Roadside Assistance: Provides emergency services such as towing, flat tire changes, or battery jump-starts.

- Rental Car Reimbursement: Covers the cost of renting a vehicle while your car is being repaired.

- Gap Coverage: Bridges the gap between the actual cash value of your vehicle and the amount owed on a lease or loan.

- Custom Parts and Equipment Coverage: Protects modifications and custom additions to your vehicle.

- Accident Forgiveness: Prevents your rates from increasing after your first at-fault accident.

Factors Influencing Vehicle Insurance Premiums

Vehicle insurance premiums are determined by a multitude of factors, each playing a unique role in assessing the risk associated with insuring a particular vehicle and driver. Understanding these factors is essential for predicting and potentially mitigating the cost of vehicle insurance.

Driver Profile

Your driving record is a significant determinant of insurance premiums. A clean driving record with no accidents or moving violations typically results in lower premiums. On the other hand, a history of accidents, speeding tickets, or DUI convictions can lead to higher rates. Additionally, factors such as age, gender, and marital status can influence premiums, with younger drivers and males generally facing higher rates.

Vehicle Characteristics

The type of vehicle you drive and its characteristics play a role in determining insurance costs. Vehicles with higher repair costs, more powerful engines, or a higher likelihood of theft may result in higher premiums. Conversely, vehicles with advanced safety features or those that are less likely to be involved in accidents may be eligible for discounts.

Location and Usage

Where you live and how you use your vehicle can impact insurance rates. Areas with higher crime rates or a history of severe weather events may result in higher premiums. Additionally, the number of miles driven annually and the purpose of your vehicle’s usage (e.g., commuting, business, pleasure) can influence rates. Insurers may offer discounts for low-mileage drivers or those who use public transportation frequently.

Coverage Options and Deductibles

The coverage options you choose and the deductibles you select can significantly affect your insurance premiums. Higher coverage limits and lower deductibles generally result in higher premiums, while opting for lower coverage limits and higher deductibles can lead to cost savings. It’s essential to strike a balance between adequate coverage and affordable premiums.

Discounts and Bundling

Insurance providers often offer a variety of discounts to incentivize safe driving and loyalty. These can include discounts for safe driving records, multiple policy bundles (e.g., bundling auto and home insurance), loyalty discounts for long-term customers, and discounts for safety features or anti-theft devices installed in your vehicle.

Navigating the Vehicle Insurance Landscape

With the myriad of insurance providers and coverage options available, navigating the vehicle insurance landscape can be daunting. However, by following a systematic approach and considering key factors, you can make informed decisions and secure the best coverage for your needs.

Research and Compare Providers

Start by researching and comparing multiple insurance providers. Consider factors such as their financial stability, customer service ratings, and the range of coverage options they offer. Online comparison tools and customer reviews can be valuable resources for assessing providers’ reputations and services.

Understand Your Coverage Needs

Assess your unique coverage needs based on your vehicle, driving habits, and financial situation. Consider the level of liability coverage required to protect your assets, the value of your vehicle, and any additional coverages that may be beneficial. Understanding your needs will help you tailor your policy to your specific circumstances.

Obtain Multiple Quotes

Request quotes from multiple providers to compare prices and coverage options. Ensure that you’re comparing apples to apples by obtaining quotes with similar coverage limits and deductibles. This process will help you identify the most competitive rates and the best value for your insurance needs.

Review Policy Details and Exclusions

When reviewing insurance policies, pay close attention to the fine print. Understand the specific coverages, exclusions, and limitations outlined in the policy. Be mindful of any endorsements or additional coverages that may be beneficial to you. A thorough review will ensure that you fully comprehend the protections and limitations of the policy.

Consider Bundling and Loyalty Discounts

Bundling multiple insurance policies, such as auto and home insurance, can often result in significant savings. Additionally, many insurers offer loyalty discounts for long-term customers. By combining policies and maintaining a consistent relationship with your insurer, you may be eligible for reduced rates over time.

Maintain a Clean Driving Record

A clean driving record is a key factor in keeping insurance premiums low. Avoid accidents, moving violations, and DUI convictions. Safe driving habits not only reduce the risk of accidents but also demonstrate responsibility to insurance providers, potentially leading to lower rates.

Future Trends and Innovations in Vehicle Insurance

The vehicle insurance industry is continually evolving, driven by technological advancements and changing consumer needs. Several emerging trends and innovations are shaping the future of vehicle insurance, offering enhanced protection and personalized coverage options.

Telematics and Usage-Based Insurance

Telematics technology, which involves tracking driving behavior through devices installed in vehicles or smartphone apps, is gaining traction in the insurance industry. Usage-based insurance, also known as pay-as-you-drive or pay-how-you-drive insurance, utilizes telematics data to offer personalized premiums based on an individual’s actual driving behavior. This innovative approach rewards safe drivers with lower premiums, providing a more accurate assessment of risk.

Connected Car Technology

The integration of connected car technology, such as advanced driver-assistance systems (ADAS) and vehicle-to-everything (V2X) communication, is transforming the way vehicles interact with their surroundings. This technology enhances safety and provides insurers with valuable data on driving behavior and vehicle performance. As connected car technology becomes more prevalent, insurers may leverage this data to offer more precise risk assessments and personalized coverage options.

Artificial Intelligence and Data Analytics

Artificial intelligence (AI) and data analytics are revolutionizing the insurance industry, enabling insurers to process vast amounts of data quickly and accurately. By analyzing historical and real-time data, insurers can identify patterns, assess risks more efficiently, and develop more accurate pricing models. AI-powered systems can also automate claims processing, improving efficiency and customer satisfaction.

Blockchain Technology

Blockchain technology, known for its secure and transparent nature, is being explored in the insurance industry to enhance data verification and streamline processes. By leveraging blockchain, insurers can verify policy information, track claims, and manage payments more efficiently. This technology has the potential to reduce administrative burdens and enhance trust between insurers and policyholders.

Personalized Coverage and Risk Assessment

The future of vehicle insurance lies in personalized coverage options tailored to individual needs and driving behavior. With the advancements in technology and data analytics, insurers can offer more precise risk assessments and customized coverage plans. This shift towards personalized insurance allows policyholders to pay for the coverage they truly need, ensuring adequate protection without unnecessary costs.

Conclusion

Vehicle insurance is a complex yet indispensable aspect of vehicle ownership, providing financial protection and peace of mind. By understanding the essential components of vehicle insurance, the factors influencing premiums, and the emerging trends in the industry, you can make informed decisions and navigate the insurance landscape effectively. With a comprehensive grasp of vehicle insurance, you can ensure that your vehicle and finances are adequately protected, allowing you to drive with confidence and security.

How much does vehicle insurance typically cost?

+The cost of vehicle insurance varies widely based on factors such as the driver’s profile, vehicle characteristics, location, and coverage options. On average, full coverage auto insurance can range from 1,000 to 2,000 annually, while minimum liability coverage may cost around 500 to 1,000 per year. However, these figures can vary significantly based on individual circumstances.

What are some ways to lower vehicle insurance premiums?

+There are several strategies to reduce vehicle insurance premiums. Maintaining a clean driving record, bundling policies, and taking advantage of loyalty discounts can lead to significant savings. Additionally, opting for higher deductibles and choosing lower coverage limits can reduce premiums. Comparing quotes from multiple providers is also essential to find the most competitive rates.

What is the difference between liability and comprehensive coverage?

+Liability coverage provides protection in the event that you are at fault for an accident, covering damages and injuries sustained by others. Comprehensive coverage, on the other hand, protects your vehicle against non-collision incidents such as theft, vandalism, or natural disasters. While liability coverage is mandatory in most states, comprehensive coverage is optional but highly recommended for adequate protection.

How does my driving record impact insurance rates?

+Your driving record is a critical factor in determining insurance rates. A clean driving record with no accidents or moving violations typically results in lower premiums. Conversely, a history of accidents, speeding tickets, or DUI convictions can lead to significantly higher rates. It’s essential to maintain a safe driving record to keep insurance costs manageable.

Can I get vehicle insurance if I have a poor credit score?

+Yes, you can still obtain vehicle insurance with a poor credit score. However, it’s important to note that credit-based insurance scores are used by many insurers to assess risk and determine premiums. A poor credit score may result in higher insurance rates. It’s advisable to shop around and compare quotes from multiple providers to find the best rates despite a poor credit score.