Do I Need Life Insurance

Securing the financial well-being of your loved ones is a paramount concern for most individuals, and life insurance emerges as a crucial tool in this pursuit. This comprehensive guide delves into the intricacies of life insurance, offering an in-depth analysis to help you make an informed decision about whether you need life insurance and how to choose the right policy for your unique circumstances.

Understanding Life Insurance: A Financial Safety Net

Life insurance is a financial instrument designed to provide a safety net for your dependents in the event of your untimely demise. It offers a lump-sum payment, known as a death benefit, to your beneficiaries, ensuring they can maintain their standard of living and meet their financial obligations without your income.

This protection is particularly vital for individuals with financial dependents, such as spouses, children, or elderly parents, as it can cover a wide range of expenses, including funeral costs, outstanding debts, daily living expenses, and even college tuition fees.

Key Factors to Consider Before Opting for Life Insurance

Determining whether life insurance is a necessity for you hinges on several crucial factors. These include your current financial situation, future financial goals, and the level of financial security you want to provide for your loved ones.

Assessing Your Financial Needs

The first step in deciding whether you need life insurance is to evaluate your current financial obligations and future financial goals. Consider the following:

- Debts and Loans: Do you have outstanding debts, such as a mortgage, student loans, or credit card balances? Life insurance can help repay these debts, preventing them from becoming a burden for your family.

- Living Expenses: Calculate your monthly and annual living expenses, including rent or mortgage payments, groceries, utilities, and other essentials. Life insurance can ensure these expenses are covered in your absence.

- Childcare and Education: If you have children, consider the cost of their upbringing, including childcare, extracurricular activities, and future education expenses. Life insurance can provide a financial cushion to ensure your children’s future is secure.

- Retirement Planning: If you’re the primary income earner, life insurance can help your spouse or partner maintain their retirement savings plan and ensure a comfortable retirement.

Financial Goals and Planning

Your financial goals also play a significant role in determining your need for life insurance. Consider if you have any short-term or long-term financial goals that life insurance could support, such as:

- Homeownership: If you’re planning to buy a home, life insurance can provide the necessary financial protection to ensure your family can remain in the home if something happens to you.

- Business Ownership: For business owners, life insurance can provide stability for your business partners or family members who may inherit the business.

- Estate Planning: Life insurance can be a vital component of your estate plan, ensuring your assets are distributed according to your wishes and minimizing estate taxes.

Determining the Right Amount of Coverage

If you decide that life insurance is a necessity, the next step is to determine the appropriate amount of coverage. This can be a complex process, as it involves considering various factors, including:

- Income Replacement: The primary goal of life insurance is often to replace your income. Calculate the amount of income your dependents would need to maintain their current standard of living.

- Outstanding Debts: Consider the total amount of your outstanding debts, including mortgages, loans, and credit card balances. Ensure your life insurance coverage can cover these debts.

- Future Expenses: Estimate future expenses, such as college tuition fees for your children or any planned major purchases or investments.

- Inflation: Don’t forget to account for the impact of inflation on future expenses. Ensure your coverage amount can keep pace with rising costs.

| Factor | Considerations |

|---|---|

| Debt Repayment | Mortgages, loans, credit cards |

| Living Expenses | Monthly and annual costs, including rent/mortgage, groceries, utilities |

| Childcare and Education | Current and future costs, including tuition and extracurricular activities |

| Retirement Planning | Spouse's or partner's retirement savings and income needs |

Types of Life Insurance: Choosing the Right Policy

Life insurance policies can be broadly categorized into two main types: term life insurance and permanent life insurance. Each type offers distinct advantages and is suited to different financial needs and goals.

Term Life Insurance

Term life insurance provides coverage for a specified period, typically ranging from 10 to 30 years. It is often the more affordable option and is ideal for individuals with short-term financial goals or those seeking coverage for a specific period, such as until their children become independent or their mortgage is paid off.

The key benefits of term life insurance include:

- Affordability: Term life insurance is generally more cost-effective than permanent life insurance, making it accessible to a wider range of individuals.

- Flexibility: You can choose the term length that aligns with your financial goals, ensuring coverage only for the period you need it.

- Focus on Specific Goals: Term life insurance is ideal for covering specific financial obligations, such as repaying a mortgage or funding your children's education.

Permanent Life Insurance

Permanent life insurance, as the name suggests, provides lifelong coverage. It offers a death benefit, but it also accumulates cash value over time, which can be borrowed against or withdrawn.

The main types of permanent life insurance include:

- Whole Life Insurance: This policy offers a guaranteed death benefit and cash value growth. The premiums are typically fixed and remain the same throughout the policy's duration.

- Universal Life Insurance: This policy offers more flexibility in terms of premium payments and death benefit amounts. It allows you to adjust your coverage and premiums based on your changing needs.

- Variable Life Insurance: This type of policy allows you to invest a portion of your premiums in different investment vehicles, offering the potential for higher cash value growth but also carrying higher risks.

Permanent life insurance is best suited for individuals seeking lifelong coverage and those who want to build cash value that can be accessed in the future. However, it's important to note that permanent life insurance policies are generally more expensive than term life insurance.

Other Considerations: Riders and Additional Benefits

When choosing a life insurance policy, it’s important to consider the additional benefits and riders that can enhance your coverage. These optional features can provide extra protection and peace of mind.

Common Riders and Benefits

- Waiver of Premium: This rider waives your premium payments if you become disabled and unable to work.

- Accelerated Death Benefit: This benefit allows you to receive a portion of your death benefit early if you’re diagnosed with a terminal illness.

- Children’s Term Rider: Provides term life insurance coverage for your children, ensuring they’re protected in the event of your death.

- Spouse Term Rider: Offers term life insurance coverage for your spouse, providing financial protection for both of you.

Comparing Quotes and Providers

Before making a decision, it’s crucial to compare quotes from multiple insurance providers. This will help you find the most competitive rates and the policy that best suits your needs. Consider the following when comparing quotes:

- Premiums: Compare the monthly or annual premiums for similar coverage amounts and policy types.

- Policy Features: Ensure the policies you’re comparing offer the same benefits and riders. Some providers may offer unique features that could be beneficial for your situation.

- Financial Strength: Research the financial stability and reputation of the insurance companies. You want to ensure they’ll be able to pay out your benefits when the time comes.

- Customer Service: Read reviews and ask for recommendations to gauge the provider’s customer service quality. You want a company that’s responsive and helpful.

The Bottom Line: Do You Need Life Insurance?

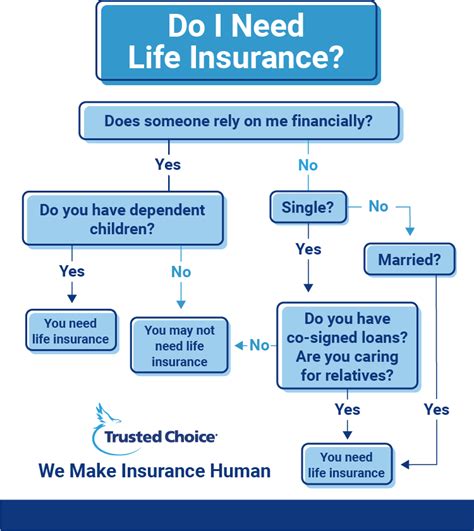

The decision to purchase life insurance is highly personal and depends on your unique financial situation and goals. If you have financial dependents, outstanding debts, or future financial goals that would be impacted by your untimely demise, life insurance is likely a necessity.

By assessing your financial needs, setting clear financial goals, and understanding the different types of life insurance policies available, you can make an informed decision about whether life insurance is right for you. Remember, life insurance provides a vital financial safety net for your loved ones, ensuring their financial well-being and security in your absence.

What is the average cost of life insurance?

+The cost of life insurance can vary significantly based on factors such as age, health, lifestyle, and the type and amount of coverage chosen. On average, a 30-year-old non-smoker can expect to pay around 20 to 30 per month for a $500,000 term life insurance policy. However, this is just an estimate, and actual costs can be higher or lower depending on individual circumstances.

Can I get life insurance if I have a pre-existing medical condition?

+Yes, individuals with pre-existing medical conditions can still obtain life insurance, although it may be more challenging and potentially more expensive. Some insurance companies specialize in providing coverage for individuals with specific health conditions. It’s important to be transparent about your health during the application process to avoid potential issues with your policy.

When is the best time to purchase life insurance?

+The best time to purchase life insurance is when you have financial dependents or outstanding debts that would create a financial burden for your loved ones in your absence. It’s generally advisable to buy life insurance when you’re young and healthy, as premiums tend to be more affordable at this stage.

Can I switch my life insurance policy later on?

+Yes, you can switch your life insurance policy at any time. However, it’s important to carefully consider the reasons for switching. If you’re looking to reduce costs, you may need to undergo a new medical exam, and your new policy may have different terms and conditions. It’s advisable to consult with a financial advisor or insurance broker to ensure you make an informed decision.