Who Has The Best Car Insurance Rates

When it comes to car insurance, one of the most common questions that arises is, "Who has the best rates?" Finding the most suitable car insurance policy at the most competitive price is a priority for many drivers. The insurance landscape is diverse, with numerous providers offering a range of policies tailored to different needs and budgets. This comprehensive guide aims to delve into the factors that influence car insurance rates and help you understand how to identify the best deals available in the market.

Understanding Car Insurance Rates

Car insurance rates are determined by a complex interplay of various factors, each contributing to the overall cost of your policy. These factors can be broadly categorized into two main groups: those that the insurance provider can control, and those that are beyond their influence.

Provider-Controlled Factors

Insurance companies have control over certain aspects that impact the rates they offer. These include:

- Claims Experience: Insurance providers carefully analyze their historical claims data to set rates. A higher number of claims in a specific area or for a particular type of vehicle can result in higher rates for that region or vehicle model.

- Competition: The level of competition in the insurance market can influence rates. Areas with a more competitive market often see lower rates as providers strive to offer the best deals to attract customers.

- Operating Costs: The operational costs of an insurance company, including overhead expenses and administrative costs, are factored into the rates they offer. Efficient companies with lower operating costs may pass on these savings to their customers.

- Risk Assessment: Insurance providers use sophisticated algorithms to assess the risk associated with insuring a particular driver or vehicle. Factors such as the driver’s age, gender, driving history, and the vehicle’s make and model are considered in this assessment.

Beyond Provider Control

There are several factors that are outside the direct control of insurance providers, but still play a significant role in determining rates. These include:

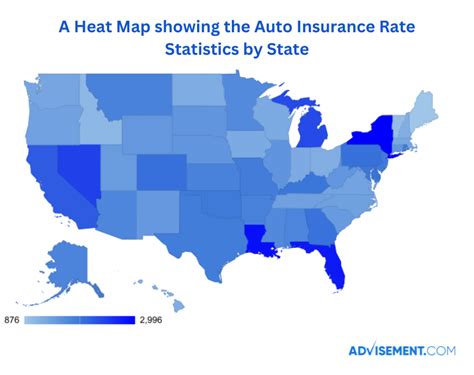

- State Laws and Regulations: Each state has its own set of laws and regulations governing car insurance. These laws can impact the minimum coverage requirements, no-fault vs. tort systems, and other aspects that influence the cost of insurance.

- Demographics: The demographics of the area you live in can affect your insurance rates. Areas with higher populations, particularly urban centers, often experience more traffic and accidents, leading to higher insurance rates.

- Vehicle Type: The make, model, and age of your vehicle are important considerations. Certain vehicles, especially those known for their safety features or low theft rates, may qualify for lower insurance rates.

- Personal Factors: Your personal characteristics and circumstances, such as your age, gender, marital status, and driving history, are taken into account when determining your insurance rates. Young drivers, for instance, are often considered higher risk and may face higher premiums.

Identifying the Best Car Insurance Rates

With a deeper understanding of the factors that influence car insurance rates, you can now explore strategies to identify the best deals available. Here are some key steps to consider:

Shop Around

Don’t settle for the first insurance quote you receive. Take the time to shop around and compare rates from multiple providers. Online comparison tools can be a great starting point to quickly get a sense of the market rates.

Understand Your Needs

Before you begin comparing rates, it’s essential to understand your specific insurance needs. Consider the type of coverage you require, the level of deductibles you’re comfortable with, and any additional services or perks you may need. This self-awareness will help you make more informed choices when comparing policies.

Explore Discounts

Insurance providers offer a variety of discounts to attract and retain customers. Common discounts include those for safe driving records, multi-policy purchases (e.g., bundling car and home insurance), and loyalty rewards for long-term customers. Ask about available discounts and ensure you’re taking advantage of all applicable options.

Consider Bundle Deals

Bundling your car insurance with other policies, such as home or renters insurance, can often lead to significant savings. Many providers offer discounts when you combine multiple policies, so it’s worth exploring these options to reduce your overall insurance costs.

Review Your Policy Regularly

Insurance rates can change over time, so it’s important to review your policy annually or whenever your circumstances change. This review process allows you to ensure you’re still getting the best deal and to make any necessary adjustments to your coverage.

Use Technology to Your Advantage

Leverage technology to your advantage when shopping for car insurance. Many insurance providers now offer apps or online tools that allow you to quickly get quotes, compare rates, and manage your policy. These tools can save you time and provide a more transparent view of the insurance landscape.

Read the Fine Print

While comparing rates is important, it’s equally crucial to read the fine print of the insurance policies you’re considering. Understand the coverage limits, exclusions, and any additional fees or charges that may apply. This step ensures you’re not only getting a good rate but also a policy that meets your needs.

Seek Professional Advice

If you’re unsure about your insurance needs or have complex circumstances, consider seeking advice from an insurance broker or agent. These professionals can provide personalized recommendations and help you navigate the insurance market to find the best policy for your situation.

Real-World Examples

Let’s look at some real-world scenarios to better understand how these factors influence car insurance rates:

| Scenario | Influencing Factors | Impact on Rates |

|---|---|---|

| Urban vs. Rural Areas | Demographics, State Laws | Insurance rates are often higher in urban areas due to higher traffic density and accident rates. Rural areas may have lower rates, but may also have fewer coverage options and higher minimum coverage requirements. |

| Young Drivers | Personal Factors | Young drivers, particularly those under 25, are considered high-risk due to their lack of driving experience. This often results in higher insurance rates. However, some providers offer discounts for young drivers who maintain good grades or complete defensive driving courses. |

| Safe Driving Record | Claims Experience | A clean driving record with no accidents or violations can lead to significant savings on insurance rates. Insurance providers reward safe drivers with lower premiums, recognizing their reduced risk of making claims. |

| High-Risk Vehicles | Vehicle Type | Certain vehicle types, such as sports cars or luxury SUVs, are considered high-risk due to their performance capabilities or theft rates. Insuring these vehicles often comes with higher premiums to account for the increased risk. |

Future Implications and Industry Trends

The car insurance industry is constantly evolving, and several trends are shaping the future of insurance rates. Here are some key developments to watch:

Telematics and Usage-Based Insurance

Telematics technology, which uses sensors and GPS to track driving behavior, is gaining popularity. Usage-based insurance policies that utilize telematics can offer real-time feedback on driving habits and provide discounts to drivers who exhibit safe behaviors. This trend is expected to grow, offering more personalized insurance rates based on actual driving habits.

Data-Driven Risk Assessment

Insurance providers are increasingly leveraging advanced data analytics to assess risk more accurately. This includes using machine learning algorithms to analyze vast amounts of data, including driver behavior, weather patterns, and traffic conditions. This enhanced risk assessment can lead to more precise insurance rates and better-tailored policies.

Autonomous Vehicles and Safety Features

The rise of autonomous vehicles and advanced safety features is expected to significantly impact insurance rates. As these technologies become more prevalent, insurance providers may offer discounts for vehicles equipped with advanced safety systems. Additionally, as autonomous vehicles reduce the risk of accidents, insurance rates for these vehicles may become more competitive.

Regulatory Changes

State and federal regulations play a critical role in shaping the car insurance landscape. Changes in minimum coverage requirements, no-fault laws, or other regulatory shifts can have a significant impact on insurance rates. It’s important to stay informed about these changes to understand how they may affect your insurance costs.

The Role of Technology in Claims Processing

Advancements in technology are also streamlining the claims process, making it faster and more efficient. This includes the use of mobile apps for quick claim submissions, real-time damage assessments using AI, and digital documentation. Improved claims processing can lead to reduced administrative costs for insurance providers, potentially resulting in lower insurance rates for customers.

How do I find the best car insurance rates for my specific needs?

+To find the best rates for your specific needs, start by understanding your insurance requirements. Consider factors like the type of coverage you need, your budget, and any additional services you may require. Then, compare rates from multiple providers, using online tools or seeking advice from insurance professionals. Don’t forget to explore discounts and bundle deals to further reduce your insurance costs.

Are there any hidden costs associated with car insurance policies?

+Some car insurance policies may have hidden costs or fees, such as administrative charges, policy cancellation fees, or additional fees for certain services. It’s important to carefully review the policy documents and ask the insurance provider about any potential hidden costs before finalizing your policy.

Can I negotiate car insurance rates with providers?

+While car insurance rates are largely determined by various factors, some providers may offer flexibility in pricing, especially for loyal customers or those with a long-term relationship. It’s worth discussing your specific circumstances with the provider to see if they can offer any discounts or rate adjustments.

What are some common mistakes to avoid when shopping for car insurance?

+Some common mistakes to avoid include settling for the first quote you receive, not reading the fine print of the policy, and neglecting to review your policy annually. Additionally, be cautious of policies that seem too good to be true, as they may have hidden limitations or exclusions.

How can I improve my chances of getting lower car insurance rates in the future?

+To improve your chances of getting lower rates in the future, maintain a clean driving record, explore discounts and bundle deals, and regularly review your policy to ensure you’re getting the best value. Additionally, consider investing in safety features for your vehicle, as these can often lead to insurance discounts.