Edd State Disability Insurance

Edd State Disability Insurance, commonly known as SDI, is a crucial safety net for California's workers, providing essential financial support during periods of disability. As a comprehensive insurance program, SDI offers benefits to eligible individuals who are unable to work due to non-work-related injuries or illnesses. In this article, we will delve into the intricacies of Edd State Disability Insurance, exploring its benefits, eligibility criteria, and the steps involved in claiming this vital insurance.

Understanding Edd State Disability Insurance (SDI)

California’s SDI program is administered by the Employment Development Department (EDD), a government agency dedicated to supporting the state’s workforce. SDI is designed to offer financial stability to workers who find themselves temporarily unable to perform their jobs due to unforeseen circumstances.

The program ensures that individuals can access a portion of their regular income while they recover from their disability. This income protection is particularly valuable for self-employed individuals and small business owners, who may not have access to traditional employer-provided disability insurance.

Key Benefits of SDI

- Income Replacement: SDI provides a replacement income for eligible individuals, ensuring they can meet their financial obligations during their disability period.

- Peace of Mind: Knowing that you have access to a reliable income stream during a disability can provide significant peace of mind and reduce financial stress.

- Support for Medical Treatment: The insurance coverage allows individuals to focus on their recovery without worrying about the financial burden of medical expenses.

- Flexible Eligibility: SDI is accessible to a wide range of workers, including full-time, part-time, and self-employed individuals, ensuring that nearly all California workers are covered.

Eligibility Criteria for SDI

To be eligible for SDI benefits, certain criteria must be met. These criteria ensure that the program is accessible to those who genuinely require assistance while also preventing fraud and misuse.

- Work History: Applicants must have worked and paid SDI contributions for a minimum period. This ensures that the program is sustainable and that contributors have a vested interest in its success.

- Disability Duration: The disability must be expected to last at least eight days, excluding the day of injury or the start of the illness. This criterion prevents SDI from being used for minor, short-term illnesses or injuries.

- Medical Certification: A licensed medical professional must certify that the applicant is unable to perform their regular work due to a medical condition. This certification ensures that SDI benefits are provided only to those with genuine disabilities.

- Non-Work-Related Disability: SDI covers non-work-related disabilities only. Work-related injuries or illnesses are typically covered by workers' compensation, a separate insurance program.

Applying for SDI Benefits

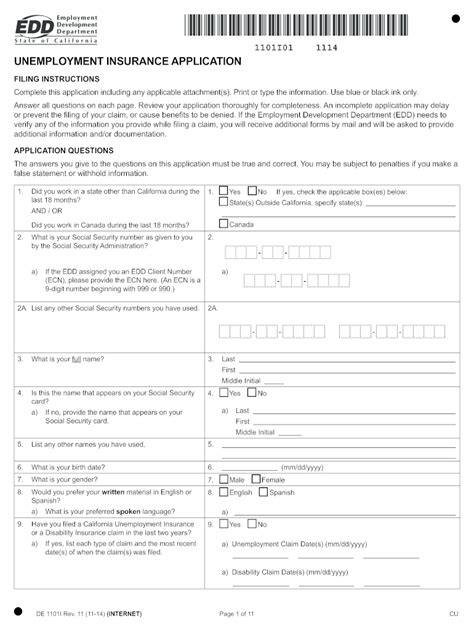

The application process for SDI benefits is straightforward and designed to be accessible to all eligible individuals. Here’s a step-by-step guide to applying for SDI:

- Online Application: The easiest and most efficient way to apply is through the EDD's online portal. This process allows applicants to provide all necessary information and documentation in a secure and convenient manner.

- Paper Application: For those who prefer a traditional approach, paper applications are available. These can be downloaded from the EDD website or requested by mail.

- Required Documentation: Applicants must provide proof of their identity, work history, and disability. This may include a driver's license, social security card, recent pay stubs, and a medical certification from a licensed healthcare provider.

- Review and Approval: Once the application is submitted, EDD reviews the provided information and documentation. If the application is approved, the applicant will receive regular benefit payments until they are able to return to work or their disability ends.

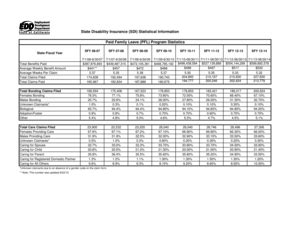

SDI Benefit Amounts and Payment Frequency

SDI benefit amounts are calculated based on an individual’s earnings during a specific period. The maximum weekly benefit amount is set annually, ensuring that benefits remain in line with the cost of living in California.

| Calendar Year | Maximum Weekly Benefit Amount |

|---|---|

| 2023 | $1,473 |

| 2022 | $1,393 |

| 2021 | $1,357 |

Benefit payments are typically made on a biweekly basis, with payments starting after a seven-day waiting period. This waiting period ensures that SDI is utilized for longer-term disabilities and reduces the potential for abuse.

Duration of SDI Benefits

The duration of SDI benefits depends on the nature and severity of the disability. For most disabilities, benefits are provided for up to 52 weeks within a 5-year period. However, for certain permanent disabilities, benefits may be extended indefinitely.

To continue receiving benefits beyond the initial 52 weeks, individuals must reapply and provide updated medical certifications demonstrating that their disability persists.

Filing an SDI Claim: A Step-by-Step Guide

Filing an SDI claim can be a straightforward process if you have the necessary information and documentation ready. Here’s a detailed guide to help you navigate the claim process:

- Assess Your Eligibility: Before filing a claim, ensure that you meet the basic eligibility criteria. This includes having sufficient work history, a non-work-related disability, and a medical certification from a licensed healthcare provider.

- Choose Your Application Method: Decide whether you prefer to apply online or through a paper application. The online application process is generally faster and more convenient, but some individuals may prefer the traditional paper route.

- Gather Required Documentation: Collect all necessary documents, including proof of identity, work history, and disability. Ensure that your medical certification is up-to-date and accurately reflects your current condition.

- Complete the Application: Whether online or on paper, ensure that you provide accurate and complete information. Double-check your application for any errors or omissions before submission.

- Submit Your Application: Once you've reviewed your application, submit it to the EDD. Online applications are typically processed more quickly, but paper applications are also accepted.

- Wait for a Decision: After submitting your application, you'll need to wait for EDD to review and process your claim. This process can take several weeks, so be patient and ensure that you have all the necessary documentation ready if further verification is required.

- Receive Your Benefit Payments: If your claim is approved, you'll start receiving biweekly benefit payments. Ensure that you understand the payment schedule and the amount you're entitled to receive.

- Maintain Regular Updates: Throughout your disability period, it's essential to keep EDD informed of any changes in your condition or circumstances. This includes providing updated medical certifications and notifying EDD if your disability ends or if you return to work.

SDI vs. Other Disability Insurance Programs

While SDI is a comprehensive disability insurance program, it’s important to understand how it differs from other disability insurance options.

Comparison with Private Disability Insurance

- Cost: SDI is funded through payroll deductions, making it a cost-effective option for many workers. Private disability insurance, on the other hand, requires individuals to pay premiums, which can be costly, especially for those with pre-existing conditions.

- Eligibility: SDI is accessible to a wide range of workers, including those who may not qualify for private insurance due to pre-existing conditions or self-employment status.

- Benefit Amounts: SDI benefit amounts are calculated based on an individual’s earnings, providing a reasonable income replacement. Private disability insurance often offers higher benefit amounts but may not be affordable for all individuals.

Workers’ Compensation vs. SDI

- Work-Related vs. Non-Work-Related: Workers’ compensation covers work-related injuries and illnesses, while SDI covers non-work-related disabilities. If your disability is work-related, you should apply for workers’ compensation benefits instead of SDI.

- Employer Responsibility: Workers’ compensation is typically paid by employers, while SDI is funded by workers through payroll deductions. This means that workers’ compensation benefits may be more comprehensive but are not accessible to self-employed individuals.

Social Security Disability Insurance (SSDI)

SSDI is a federal program that provides benefits to individuals with long-term disabilities. Here’s how it compares to SDI:

- Eligibility: SSDI has stricter eligibility criteria, requiring individuals to have worked and paid Social Security taxes for a certain period. SDI, on the other hand, has more flexible eligibility criteria, making it accessible to a wider range of workers.

- Benefit Amounts: SSDI benefit amounts are based on an individual's average lifetime earnings, while SDI benefit amounts are calculated based on recent earnings. This means that SSDI benefits may be higher but are also subject to more stringent eligibility requirements.

- Application Process: The SSDI application process can be complex and time-consuming, often requiring multiple appeals. SDI, in comparison, has a simpler and more efficient application process.

Future Outlook and Implications of SDI

SDI plays a vital role in supporting California’s workforce during times of disability. As the program continues to evolve, it is essential to consider its future implications and potential areas for improvement.

Potential Enhancements to SDI

- Benefit Amount Adjustments: With the cost of living in California continuously rising, adjusting the maximum weekly benefit amount to keep pace with inflation could ensure that SDI benefits remain sufficient to meet the needs of beneficiaries.

- Improved Accessibility: Enhancing the online application process and providing more resources for individuals with disabilities to navigate the system could make SDI more accessible to all eligible workers.

- Expanded Coverage: Exploring options to cover a broader range of disabilities, including those related to mental health, could ensure that more individuals have access to the support they need.

The Role of SDI in California’s Economy

SDI is not only a vital safety net for individuals but also plays a significant role in supporting California’s economy. By providing financial stability to workers during their disabilities, SDI ensures that individuals can continue to contribute to the state’s economy once they recover.

Additionally, SDI helps reduce the burden on other social safety nets, such as unemployment insurance and welfare programs, by providing a targeted support system for workers with disabilities.

Addressing Long-Term Disability Challenges

While SDI is designed to provide short-term disability coverage, addressing the challenges faced by individuals with long-term disabilities is crucial. Exploring partnerships with organizations specializing in long-term disability support and rehabilitation could enhance the overall effectiveness of SDI.

Furthermore, educating the public about the importance of long-term disability planning and the availability of resources could empower individuals to make informed decisions about their financial security in the face of long-term disabilities.

Frequently Asked Questions (FAQ)

How long does it take to receive my first SDI benefit payment after my claim is approved?

+

After your claim is approved, you can expect to receive your first benefit payment within 14 days. However, it’s important to note that the first payment covers a two-week period, so you may receive a slightly larger payment to account for this initial period.

Can I work while receiving SDI benefits?

+

Yes, you can work while receiving SDI benefits. However, your benefit amount may be reduced based on your earnings. If you earn more than a certain threshold, your SDI benefits may be suspended. It’s essential to notify EDD if you return to work or experience a change in your earnings.

What happens if my disability ends before the 52-week benefit period is over?

+

If your disability ends before the 52-week benefit period, you must notify EDD immediately. Your benefit payments will stop, and you may be required to repay any overpayments received after your disability ended. It’s crucial to keep EDD informed of any changes in your disability status.

Can I appeal an SDI claim denial?

+

Yes, if your SDI claim is denied, you have the right to appeal the decision. The appeals process involves a review by an administrative law judge, who will consider your case and make a final determination. It’s important to carefully review the reasons for denial and gather any additional evidence to support your appeal.

How does SDI benefit my employer?

+

SDI benefits not only individuals but also employers. By ensuring that workers have access to financial support during disabilities, SDI helps maintain a stable and productive workforce. It also reduces the burden on employers to provide extended leave or additional benefits for disabled employees.

Edd State Disability Insurance is a critical component of California’s social safety net, offering essential financial support to workers during times of disability. By understanding the eligibility criteria, application process, and benefits provided by SDI, individuals can access this vital insurance when they need it most. As SDI continues to evolve, it will play an increasingly vital role in supporting California’s workforce and economy.