Geico Insurance Claim Phone Number

Navigating the intricacies of insurance claims can be a daunting task, but with the right guidance and resources, it becomes more manageable. This comprehensive guide aims to shed light on the process of contacting GEICO, one of the leading insurance providers in the United States, for insurance claim-related inquiries. We will delve into the various avenues available for reaching out to GEICO, with a specific focus on their insurance claim phone number.

The GEICO Insurance Claim Process

GEICO, or Government Employees Insurance Company, is renowned for its efficient and customer-centric approach to insurance claims. Their commitment to providing prompt and accurate assistance is evident in the various channels they offer for policyholders to initiate and manage their claims.

Understanding GEICO’s Insurance Claim Channels

GEICO recognizes that different individuals have diverse preferences and needs when it comes to communication. As such, they provide a multitude of options for policyholders to report and manage their insurance claims.

- Online Claims Reporting: Policyholders can initiate a claim online through the GEICO website or mobile app. This method offers convenience and efficiency, allowing individuals to report claims at their own pace and from the comfort of their homes.

- Mobile App: GEICO’s mobile app, available for both iOS and Android devices, provides a seamless and user-friendly experience for managing insurance claims on the go. Policyholders can report claims, upload necessary documentation, and track the progress of their claim all from their smartphones.

- Email and Mail: For those who prefer more traditional methods, GEICO accepts insurance claims via email or regular mail. This ensures that individuals who may not have immediate access to the internet or a smartphone can still effectively report and manage their claims.

- In-Person Claims Reporting: GEICO has a network of local offices across the United States where policyholders can personally visit to report and discuss their insurance claims. This option provides a face-to-face interaction, allowing for a more personalized experience.

The Role of the Insurance Claim Phone Number

While GEICO offers a plethora of options for policyholders to initiate and manage their insurance claims, the insurance claim phone number remains a vital and widely-used channel.

GEICO’s insurance claim phone number provides a direct line of communication between policyholders and their claims representatives. This dedicated phone line ensures that individuals can quickly and easily connect with a knowledgeable professional who can guide them through the claims process, answer any questions, and provide the necessary support to ensure a smooth and efficient claims experience.

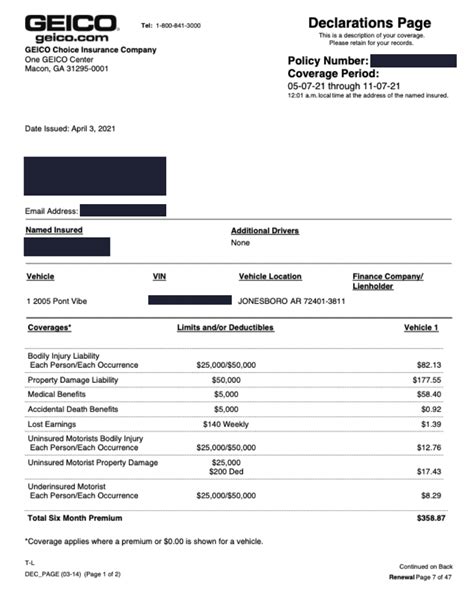

| Insurance Type | GEICO Insurance Claim Phone Number |

|---|---|

| Auto Insurance | 1-800-841-3000 |

| Home and Property Insurance | 1-888-806-3633 |

| Motorcycle Insurance | 1-888-806-3633 |

| Boat and RV Insurance | 1-888-806-3633 |

| Travel Insurance | 1-888-230-8735 |

Navigating the GEICO Insurance Claim Phone Number

Calling the GEICO insurance claim phone number is a straightforward process, designed to provide a seamless experience for policyholders.

Step-by-Step Guide to Calling GEICO

- Gather Necessary Information: Before making the call, ensure you have your policy number, the details of the incident or claim, and any relevant documentation readily available. This will help expedite the process and provide a more efficient experience.

- Dial the Correct Phone Number: Refer to your policy documents or the GEICO website to identify the appropriate insurance claim phone number for your specific policy. Ensure you are dialing the correct number to reach the right department and avoid any unnecessary delays.

- Follow the Automated Prompt: Upon calling, you will likely be greeted by an automated system. Follow the prompts to navigate to the appropriate department or representative. This system is designed to efficiently direct your call to the right person, ensuring a more streamlined experience.

- Connect with a Claims Representative: After navigating through the automated prompts, you will be connected to a live claims representative. Provide them with your policy details and a brief description of your claim. They will guide you through the next steps and provide the necessary assistance to ensure a smooth claims process.

- Document the Conversation: It’s a good practice to take notes during your conversation with the claims representative. Note down important details, such as the representative’s name, the steps you need to take, and any deadlines or follow-up actions. This ensures that you have a clear record of the conversation and can refer back to it as needed.

Benefits of Calling the Insurance Claim Phone Number

Calling the GEICO insurance claim phone number offers several advantages, making it a preferred method for many policyholders.

- Real-Time Assistance: Speaking directly with a claims representative allows for immediate clarification and guidance. You can ask questions, seek advice, and receive personalized support, ensuring a more tailored and efficient claims experience.

- Human Connection: A phone call provides a more personal and empathetic experience. Claims representatives can offer a human touch, understanding the unique circumstances of your claim, and providing support and guidance accordingly.

- Efficiency and Speed: While other channels like email or mail may take longer to process, a phone call allows for immediate action. Claims representatives can quickly assess your situation, provide necessary instructions, and ensure that your claim progresses without unnecessary delays.

Conclusion: A Multifaceted Approach to Insurance Claims

GEICO’s commitment to providing exceptional customer service is evident in the diverse range of channels they offer for policyholders to manage their insurance claims. While the insurance claim phone number remains a popular and effective method, GEICO’s online, mobile, and in-person options provide a well-rounded approach to cater to the diverse needs of their policyholders.

By understanding the various avenues available and utilizing them effectively, policyholders can navigate the insurance claims process with confidence and ease. Remember, GEICO’s team of dedicated professionals is always ready to assist, ensuring a seamless and stress-free claims experience.

What if I am unsure about the insurance claim phone number for my specific policy?

+If you are unsure about the correct insurance claim phone number for your policy, you can refer to your policy documents or the GEICO website. These resources will provide you with the necessary contact information. Additionally, you can always call GEICO’s main customer service number, where a representative can guide you to the appropriate department.

Can I call the insurance claim phone number for non-claim-related inquiries?

+While the insurance claim phone number is primarily for claims-related inquiries, GEICO also provides a separate customer service phone number for general inquiries. You can call this number for questions or concerns unrelated to insurance claims. However, it’s always a good idea to refer to the specific contact information provided in your policy documents for the most accurate guidance.

Are there any additional fees for calling the insurance claim phone number?

+No, there are no additional fees for calling the GEICO insurance claim phone number. GEICO aims to provide convenient and accessible support to its policyholders, ensuring that they can reach out for assistance without incurring extra charges.