Best Insurance Car Rates

Finding the best car insurance rates is a crucial aspect of financial planning, as it can significantly impact your monthly budget. With a vast array of insurance providers offering different coverage options and price points, navigating the car insurance market can be challenging. This comprehensive guide aims to demystify the process, offering insights into how to secure the most advantageous rates while ensuring adequate coverage.

Understanding Car Insurance Rates

Car insurance rates are influenced by a multitude of factors, including your personal details, driving history, and the type of vehicle you own. These rates are determined through a complex algorithm that assesses risk, with higher-risk drivers typically paying more for coverage. It’s essential to understand these factors to make informed decisions when choosing an insurance provider.

Key Factors Influencing Car Insurance Rates

- Age and Gender: Younger drivers, particularly males under the age of 25, are often considered high-risk and may face higher premiums. Conversely, mature drivers with a clean driving record can benefit from lower rates.

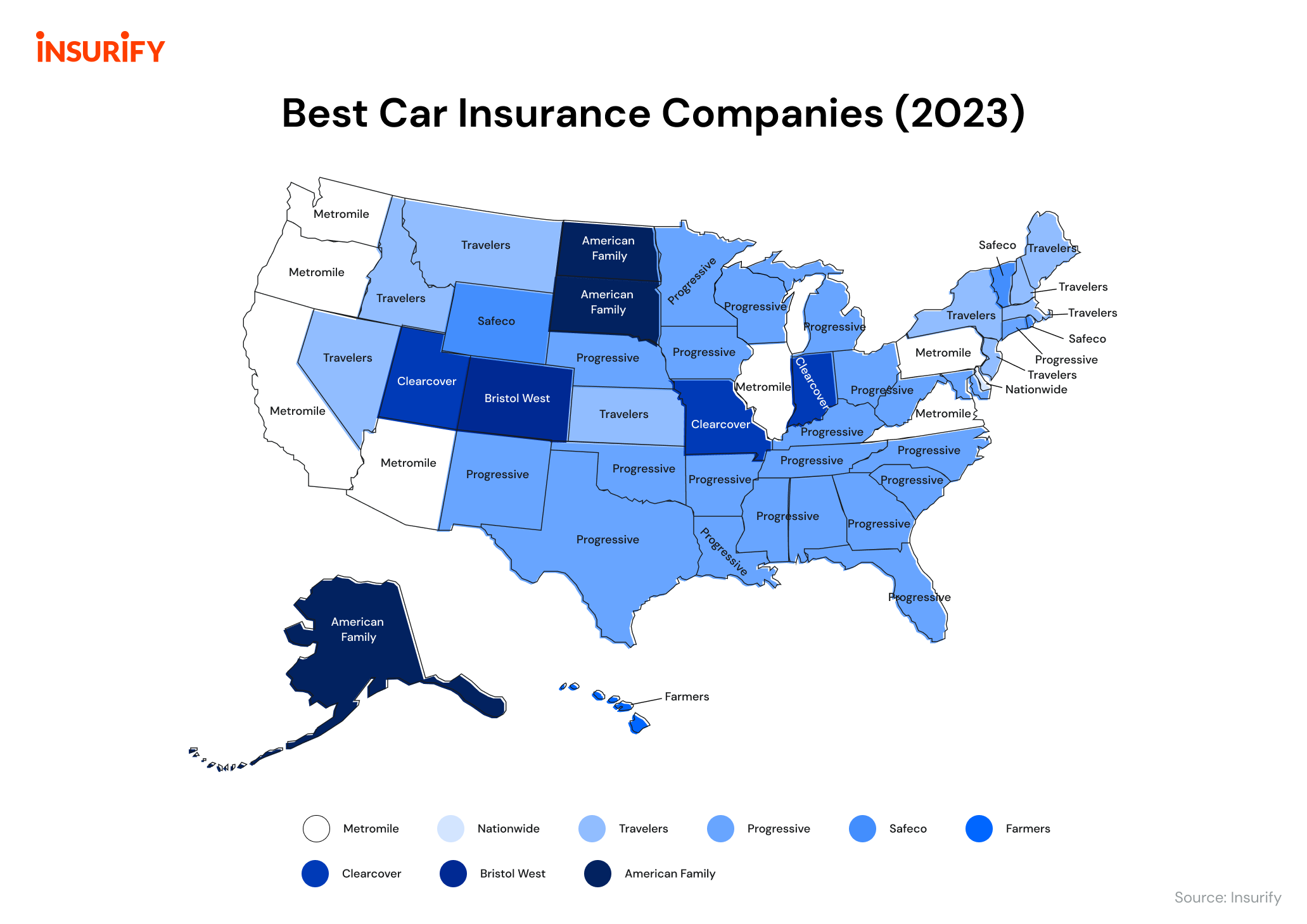

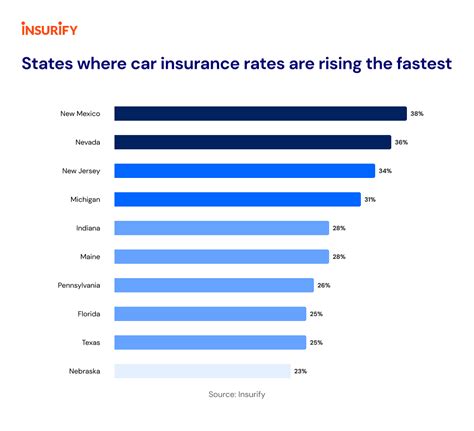

- Location: The area you reside in plays a significant role. Urban areas with higher populations and traffic tend to have more accidents, leading to increased insurance rates. Rural areas, on the other hand, often enjoy lower premiums.

- Vehicle Type: The make, model, and year of your vehicle impact insurance rates. Sports cars and luxury vehicles generally attract higher premiums due to their increased repair costs and higher likelihood of theft.

- Driving Record: A clean driving record is a significant factor in determining insurance rates. Violations, accidents, and claims can lead to increased premiums or even policy cancellation.

- Credit Score: In many states, insurance companies use credit-based insurance scores to assess risk. A higher credit score can result in lower insurance rates, as it is seen as an indicator of financial responsibility.

| Factor | Impact on Rates |

|---|---|

| Age and Gender | Younger males often pay more |

| Location | Urban areas = higher rates; Rural areas = lower rates |

| Vehicle Type | Sports/luxury cars = higher rates; Standard vehicles = lower rates |

| Driving Record | Clean record = lower rates; Violations/accidents = higher rates |

| Credit Score | Higher credit score = lower rates |

Tips to Secure the Best Rates

Securing the best car insurance rates involves a combination of understanding the market, comparing providers, and making informed choices about coverage.

Comparing Providers

With numerous insurance providers in the market, it’s essential to compare rates and coverage options. Online comparison tools can be a great starting point, allowing you to quickly view rates from multiple providers. However, it’s important to note that these tools may not provide accurate quotes for your specific situation, and you should always verify the rates with the provider directly.

Bundling Policies

Bundling your car insurance with other policies, such as home or life insurance, can often lead to significant savings. Many insurance providers offer multi-policy discounts, which can lower your overall insurance costs.

Increasing Deductibles

Increasing your deductible, the amount you pay out of pocket before your insurance coverage kicks in, can lower your insurance premiums. This strategy works best for those with adequate savings to cover potential out-of-pocket expenses.

Maintaining a Clean Driving Record

A clean driving record is not only essential for your safety but also for keeping your insurance rates low. Avoid speeding, reckless driving, and other violations to maintain a positive driving record. Additionally, ensure you have adequate coverage to protect yourself in case of an accident, as underinsured drivers can face significant financial burdens.

Utilizing Telematics

Some insurance providers offer telematics programs, where your driving behavior is monitored through a device installed in your vehicle or an app on your smartphone. These programs can reward safe driving habits with lower insurance rates. However, it’s important to understand the potential privacy implications of these programs before enrolling.

Shopping Around Regularly

Insurance rates can fluctuate, and what was once a competitive rate may become outdated. Shopping around regularly, at least once a year, can help you stay on top of the market and ensure you’re getting the best rates available. Many providers offer introductory discounts to new customers, so don’t be afraid to switch providers if you can find a better deal.

Future Trends in Car Insurance Rates

The car insurance market is evolving, and several trends are expected to impact rates in the coming years.

Autonomous Vehicles

The rise of autonomous vehicles is expected to significantly impact car insurance rates. With the potential for reduced accidents, insurance providers may adjust their risk assessments, leading to lower premiums. However, the initial introduction of autonomous vehicles may increase rates as insurers gather data and adjust their models.

Usage-Based Insurance

Usage-based insurance, where rates are determined by actual driving behavior rather than estimates, is becoming more prevalent. This shift allows insurance providers to more accurately assess risk, which can benefit safe drivers with lower rates. However, those with more erratic driving habits may see increased premiums.

Data-Driven Pricing

With advancements in technology and data analytics, insurance providers are increasingly using data-driven pricing models. These models leverage vast amounts of data to more accurately assess risk, which can lead to more tailored insurance rates. While this may benefit some drivers, it also carries the potential for increased surveillance and data privacy concerns.

Environmental Factors

Environmental factors, such as natural disasters and extreme weather events, are becoming more frequent and severe due to climate change. These events can impact insurance rates, particularly in areas prone to such disasters. As a result, insurance providers may adjust their risk assessments and premiums to account for these increased risks.

Conclusion

Securing the best car insurance rates involves a combination of understanding the market, your personal risk factors, and making informed choices about coverage. By staying informed, comparing providers, and adopting safe driving habits, you can ensure you’re getting the best value for your insurance coverage. As the car insurance market evolves, staying ahead of emerging trends and technologies will be crucial to securing the most advantageous rates.

What is the average cost of car insurance in the United States?

+The average cost of car insurance in the U.S. varies widely depending on various factors, including the state you reside in, your driving record, and the type of coverage you choose. As of [most recent data available], the national average for annual car insurance premiums was around 1,674, according to the Insurance Information Institute. However, this figure can range from under 1,000 to over $3,000 depending on individual circumstances.

How often should I review my car insurance policy and rates?

+It’s generally recommended to review your car insurance policy and rates at least once a year. This allows you to stay informed about any changes in coverage, deductibles, or premiums. Additionally, reviewing your policy annually gives you the opportunity to compare rates with other providers and ensure you’re still getting the best deal.

Can I get car insurance if I have a poor credit score?

+Yes, you can still obtain car insurance with a poor credit score. However, it’s important to note that a low credit score is often considered a risk factor by insurance providers, which can lead to higher premiums. Some states prohibit the use of credit scores in determining insurance rates, but in states where it’s allowed, a poor credit score can significantly impact the cost of your insurance.