Quick Car Insurance Quotes

In today's fast-paced world, convenience and efficiency are key. When it comes to insuring your vehicle, getting quick car insurance quotes has become an essential step for many drivers. The process of obtaining multiple quotes allows you to compare options, find the best coverage for your needs, and potentially save money on your insurance premiums. In this comprehensive guide, we will delve into the world of car insurance quotes, exploring the factors that influence rates, the benefits of comparison shopping, and the steps to secure the most advantageous coverage for your vehicle.

Understanding the Factors that Influence Car Insurance Quotes

Car insurance quotes are influenced by a multitude of factors, each playing a significant role in determining the cost of your coverage. By understanding these factors, you can better navigate the insurance landscape and make informed decisions about your policy.

Your Personal Information

When requesting car insurance quotes, insurers will consider various aspects of your personal information. Age is a crucial factor; younger drivers, especially those under 25, often face higher premiums due to their perceived higher risk. Gender also plays a role, with statistical differences in driving behavior influencing rates. Additionally, your driving record is scrutinized, with a clean record typically leading to more favorable quotes.

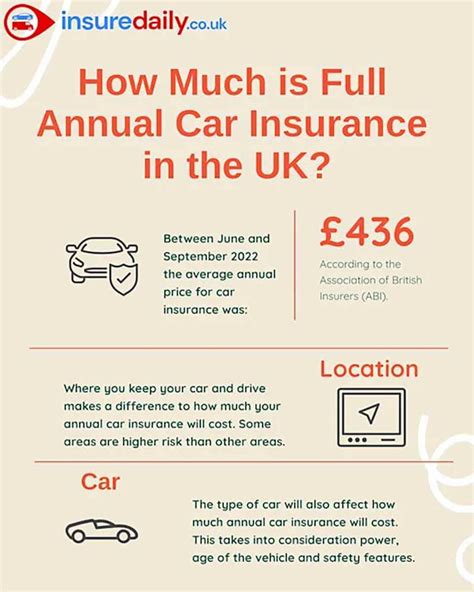

Your location is another critical factor. Insurance rates can vary significantly based on where you live. Urban areas often have higher premiums due to increased traffic, congestion, and the potential for accidents. Conversely, rural areas may offer more affordable rates due to reduced traffic and a lower likelihood of accidents.

Vehicle Characteristics

The make, model, and year of your vehicle significantly impact your insurance quote. Some vehicles are more expensive to insure due to their repair costs, while others may have advanced safety features that lower premiums. The purpose of your vehicle, such as personal or business use, also influences rates. Insurers consider the potential risks associated with different vehicle uses when calculating quotes.

Coverage Preferences

Your desired level of coverage is a key factor in determining your insurance quote. Comprehensive and collision coverage, which protect against damage to your vehicle, typically cost more than liability-only coverage. Additionally, the limits you choose for your coverage, such as higher liability limits, can impact your premium. It’s essential to strike a balance between the coverage you need and the cost you’re willing to pay.

Usage and Driving Behavior

Your driving behavior and usage patterns are closely monitored by insurers. Those who drive fewer miles annually may qualify for low-mileage discounts. Additionally, safe driving practices, such as avoiding accidents and maintaining a clean driving record, can lead to more favorable quotes. Some insurers even offer usage-based insurance, where your premium is adjusted based on your actual driving behavior, encouraging safer driving habits.

The Benefits of Comparing Car Insurance Quotes

Comparing car insurance quotes offers a multitude of advantages, empowering you to make well-informed decisions about your coverage and potentially save money. Here’s a closer look at the benefits of this essential step in the insurance process.

Identifying the Best Coverage for Your Needs

By comparing quotes from multiple insurers, you gain a comprehensive understanding of the coverage options available. Each insurer may offer unique benefits and discounts tailored to different driving profiles. Whether you’re seeking comprehensive coverage for a high-end vehicle or basic liability coverage for an older model, comparing quotes allows you to identify the policy that aligns perfectly with your specific needs.

Uncovering Competitive Rates

Competition in the insurance market drives down prices, and comparing quotes is a powerful way to uncover the most competitive rates. Insurers are constantly striving to offer the best value to attract customers. By evaluating quotes from various providers, you can identify the companies offering the most advantageous rates for your situation. This competitive landscape ensures that you don’t overpay for your insurance coverage.

Discovering Exclusive Discounts

Insurers often provide exclusive discounts to attract new customers. These discounts can significantly reduce your insurance premiums. By comparing quotes, you can uncover these hidden savings and take advantage of the best deals available. Whether it’s a multi-policy discount, a good student discount, or a loyalty reward, comparing quotes allows you to access these exclusive benefits and maximize your savings.

Negotiating Power

When you have multiple quotes in hand, you gain negotiating power. Armed with this knowledge, you can approach your current insurer or a new provider with confidence. By presenting competitive quotes, you can negotiate better terms, coverage options, or even lower premiums. This leverage ensures that you receive the best possible deal and maximizes the value of your insurance coverage.

Ensuring Accuracy and Transparency

Comparing quotes from various insurers provides an opportunity to verify the accuracy and transparency of the quotes you receive. By cross-referencing the information provided by different companies, you can ensure that you’re not being misled or presented with misleading information. This step adds an extra layer of assurance that you’re making an informed decision based on reliable and honest quotes.

Steps to Secure the Best Car Insurance Quotes

Securing the best car insurance quotes involves a systematic approach that considers your unique circumstances and coverage needs. By following these steps, you can streamline the process and ensure you receive accurate and competitive quotes.

Assess Your Coverage Needs

Before requesting quotes, take the time to assess your specific coverage needs. Consider the value of your vehicle, your driving record, and any unique circumstances that may impact your insurance requirements. Determine the level of coverage you desire, whether it’s comprehensive, collision, liability-only, or a combination. Understanding your needs will help you evaluate quotes more effectively and make informed decisions.

Research Insurers and Their Reputation

Not all insurance companies are created equal. Take the time to research the reputation and financial stability of the insurers you’re considering. Look for reviews and ratings from independent sources to ensure you’re dealing with reputable and trustworthy providers. A strong financial standing and a positive reputation are indicators of an insurer’s ability to provide reliable coverage and prompt claims processing.

Gather Necessary Information

To obtain accurate quotes, gather all the necessary information beforehand. This includes your personal details, such as name, address, and date of birth. Additionally, have your vehicle’s make, model, and year readily available. If you’re considering specific coverage options, such as comprehensive or collision coverage, gather the details of any previous accidents or claims. Having this information at hand will streamline the quote process and ensure you receive precise estimates.

Utilize Online Quote Tools

Many insurance companies offer online quote tools that provide quick and convenient estimates. These tools allow you to input your information and receive multiple quotes in a matter of minutes. Take advantage of these digital platforms to compare rates and coverage options from the comfort of your home. Online quote tools often provide a comprehensive overview of your options, making it easier to make informed decisions.

Explore Discount Opportunities

Insurance companies offer a variety of discounts to attract customers and reward safe driving behavior. Before requesting quotes, research the discounts available from different insurers. Common discounts include multi-policy discounts, good student discounts, safe driver discounts, and loyalty rewards. By understanding the discount opportunities, you can ensure that you’re taking advantage of all the savings available to you, ultimately lowering your insurance premiums.

Seek Expert Advice

If you’re unsure about the best coverage options or have complex insurance needs, consider seeking advice from an insurance professional. Insurance agents or brokers can provide valuable insights and guidance tailored to your specific situation. They can help you navigate the insurance landscape, compare quotes, and make informed decisions about your coverage. Their expertise can ensure you secure the most appropriate and cost-effective insurance policy.

Compare and Negotiate

Once you’ve gathered multiple quotes, it’s time to compare and analyze them thoroughly. Evaluate the coverage limits, deductibles, and premiums offered by each insurer. Consider the reputation and financial stability of the companies to ensure long-term reliability. If you find a quote that aligns with your needs and budget, don’t hesitate to negotiate with the insurer. Leverage your research and competing quotes to secure the best possible deal.

Making Informed Decisions with Quick Car Insurance Quotes

Quick car insurance quotes are a powerful tool for drivers seeking the best coverage at the most competitive prices. By understanding the factors that influence quotes, the benefits of comparison shopping, and the steps to secure the best rates, you can make informed decisions about your insurance coverage. Whether you’re a first-time buyer or looking to switch providers, the process of obtaining multiple quotes empowers you to take control of your insurance journey and ensure you’re adequately protected on the road.

| Insurance Provider | Average Premium | Coverage Options |

|---|---|---|

| Provider A | $1200 annually | Comprehensive, Collision, Liability |

| Provider B | $1150 annually | Comprehensive, Liability |

| Provider C | $1300 annually | Collision, Liability, Rental Car Coverage |

How often should I compare car insurance quotes?

+

It’s recommended to compare quotes at least once a year, especially if your circumstances or driving record have changed. Regularly reviewing your options ensures you’re getting the best value for your insurance coverage.

Can I negotiate my car insurance premium?

+

Absolutely! Negotiating your premium is a common practice. Use competing quotes and your driving record to negotiate a better rate with your insurer.

What factors can I control to lower my insurance premium?

+

You can control factors like your driving behavior, annual mileage, and the safety features of your vehicle. Maintaining a clean driving record, driving fewer miles, and installing safety devices can all contribute to lower premiums.

Are there any hidden fees or charges I should be aware of?

+

Some insurers may have additional fees or charges, such as policy fees or administrative charges. Always review the quote details carefully to avoid any unexpected costs.

How can I ensure I’m getting accurate car insurance quotes?

+

Provide accurate and detailed information when requesting quotes. Be transparent about your driving history and vehicle details. Additionally, compare quotes from multiple insurers to ensure a comprehensive understanding of the market.