Liability Insurance Online

In today's digital age, navigating the intricacies of insurance has evolved, with liability insurance being no exception. This guide aims to demystify the online realm of liability coverage, offering an in-depth exploration of its critical aspects, benefits, and potential pitfalls.

As businesses and individuals increasingly embrace digital platforms, understanding how to secure appropriate liability insurance online becomes paramount. This article provides an expert-level analysis, delving into the specific details and real-world examples to ensure you make informed decisions about your liability coverage.

The Evolution of Liability Insurance in the Digital Era

The landscape of insurance has transformed significantly, especially with the advent of online services. This evolution has brought forth a range of opportunities and considerations for those seeking liability protection.

Liability insurance, traditionally associated with physical assets and operations, has expanded its reach to encompass the digital realm. As more businesses operate online and individuals engage in various digital activities, the need for comprehensive liability coverage has become increasingly vital.

One of the key drivers of this evolution is the growing awareness of cyber risks. With the rise of cyberattacks, data breaches, and online disputes, the potential for legal liabilities has expanded. As a result, liability insurance providers have adapted, offering specialized policies to address these unique digital challenges.

Understanding Online Liability Risks

Online liability risks encompass a wide range of potential issues. For businesses, this includes everything from website content and online advertising to e-commerce transactions and data privacy. Individuals, too, face risks such as online defamation, privacy breaches, and cyberbullying.

Consider the case of a small e-commerce startup. While they may not have a physical storefront, their online presence carries inherent risks. A product defect or a faulty transaction could lead to legal action, and without adequate liability insurance, the financial burden could be devastating.

Similarly, individuals active on social media platforms may find themselves embroiled in legal disputes over copyright infringement, defamation, or privacy violations. Having liability insurance in place can provide crucial protection against such unforeseen events.

The Benefits of Obtaining Liability Insurance Online

The digital realm offers a host of advantages when it comes to acquiring liability insurance.

Convenience and Accessibility

One of the most significant benefits is the convenience and accessibility that online platforms provide. Individuals and businesses can compare policies, obtain quotes, and purchase coverage without the need for physical meetings or lengthy paperwork.

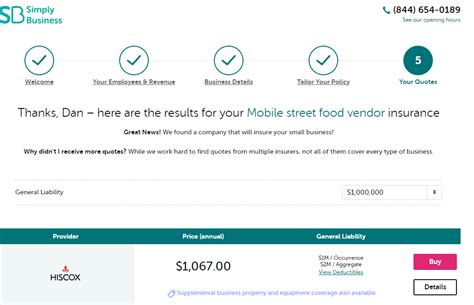

For instance, a busy entrepreneur can access multiple insurance provider websites, review their offerings, and obtain quotes during their lunch break. This level of convenience allows for efficient decision-making and simplifies the often-daunting task of selecting the right liability insurance.

Enhanced Comparison and Customization

Online platforms enable a more comprehensive comparison of liability insurance policies. With a few clicks, individuals can assess various providers, coverage limits, and policy terms, ensuring they choose the option that best fits their needs.

Furthermore, online platforms often offer a high degree of customization. Whether it's tailoring coverage limits, adding specific endorsements, or selecting optional riders, the digital space provides a flexible approach to liability insurance that may not be as readily available through traditional channels.

Real-Time Updates and Flexibility

Liability insurance policies are not static; they often require updates as circumstances change. Online platforms facilitate real-time updates, allowing policyholders to make necessary adjustments promptly.

For example, a business expanding its online operations may need to increase its liability coverage limits. With an online policy, they can log in, make the necessary changes, and have the updated coverage in place within minutes, ensuring continuous protection.

Navigating the Online Liability Insurance Landscape

While the benefits are substantial, navigating the online liability insurance landscape requires a thoughtful approach.

Researching Reputable Providers

With the abundance of online insurance providers, it’s crucial to research and select reputable companies. This involves assessing their financial stability, customer reviews, and industry reputation.

For instance, checking an insurance provider's financial strength rating from independent agencies like A.M. Best or Standard & Poor's can provide valuable insights into their financial health and ability to pay claims.

Understanding Policy Terms and Conditions

Online liability insurance policies can be complex, and it’s essential to understand the fine print. This includes grasping the specific coverage limits, deductibles, and exclusions.

Consider a policy that offers coverage for product liability but excludes certain high-risk products. Without a thorough understanding of such exclusions, a policyholder could be left unprotected in the event of a claim.

Seeking Professional Guidance

While the convenience of online insurance is appealing, complex liability scenarios may require professional advice. Engaging with insurance brokers or agents can provide valuable insights tailored to your specific needs.

A seasoned insurance professional can assess your unique circumstances, recommend suitable coverage, and explain the nuances of different policies. This personalized guidance can be especially beneficial for businesses with complex operations or individuals facing unique liability risks.

The Future of Liability Insurance Online

As technology continues to advance, the future of liability insurance online holds exciting possibilities.

Artificial Intelligence and Data Analytics

The integration of artificial intelligence (AI) and data analytics is set to revolutionize the insurance industry. These technologies can enhance risk assessment, personalize coverage, and improve claims processing.

For example, AI-powered risk assessment tools can analyze vast amounts of data to provide more accurate and tailored liability insurance quotes. This could lead to more affordable coverage for low-risk policyholders and better-informed decisions for insurers.

Blockchain and Smart Contracts

Blockchain technology and smart contracts have the potential to transform the insurance landscape. These innovative tools can streamline policy administration, automate claims processing, and enhance transparency.

Imagine a scenario where a smart contract automatically triggers the payment of a claim once certain conditions are met, eliminating the need for manual intervention and reducing the risk of delays or errors.

Increased Personalization and Customization

The future of liability insurance online is likely to see an even greater emphasis on personalization and customization. With advanced data analytics, insurers will be able to offer tailored policies that align perfectly with an individual’s or business’s unique needs.

This could mean dynamic coverage limits that adjust based on real-time risk assessments or customizable endorsements that allow policyholders to select specific coverage options, ensuring they pay only for the protection they truly require.

| Key Takeaways |

|---|

| The digital era has expanded liability insurance coverage to address online risks. |

| Online platforms offer convenience, customization, and real-time updates. |

| Research reputable providers and understand policy terms. |

| AI, blockchain, and data analytics will shape the future of online liability insurance. |

What are the primary risks covered by liability insurance online?

+Liability insurance online typically covers a range of risks, including product liability, professional liability (for errors and omissions), property damage, and personal injury. These policies are designed to protect businesses and individuals from legal liabilities arising from their online activities.

How can I determine the right coverage limits for my online liability insurance policy?

+Determining coverage limits involves assessing your unique risks and potential liabilities. Consider factors such as the value of your assets, the nature of your business or activities, and the likelihood of claims. Consulting with an insurance professional can help you arrive at suitable coverage limits.

Are there any drawbacks to obtaining liability insurance online?

+While online liability insurance offers many advantages, it’s important to be cautious. Some potential drawbacks include the risk of overlooking important policy details, missing out on personalized advice, and the possibility of encountering less reputable providers. Thorough research and due diligence are essential.