Advantage Insurance

Welcome to the world of Advantage Insurance, a leading name in the insurance industry. With a rich history spanning over three decades, this renowned company has established itself as a trusted provider of comprehensive insurance solutions. In today's complex and ever-evolving market, understanding the nuances of insurance and choosing the right coverage can be a daunting task. That's where Advantage Insurance steps in, offering expert guidance and tailored solutions to protect what matters most to its valued customers.

Headquartered in the heart of the insurance hub, Advantage Insurance boasts a team of seasoned professionals with an average industry experience of 15 years. Their deep-rooted expertise, coupled with a customer-centric approach, has positioned them as a preferred choice for individuals and businesses seeking peace of mind and financial security.

In this comprehensive guide, we will delve into the intricate world of Advantage Insurance, exploring its offerings, services, and the unique value it brings to its clientele. From personal insurance to commercial coverage, we will uncover the secrets to their success and discover why they are a top choice for those seeking reliable insurance solutions.

The Evolution of Advantage Insurance: A Journey of Excellence

Advantage Insurance was founded in 1992 by a visionary entrepreneur, Mr. John Miller, with a simple yet powerful mission: to revolutionize the insurance landscape by offering unparalleled customer service and innovative coverage options. Over the years, the company has grown exponentially, expanding its reach across multiple states and catering to a diverse range of clients.

The company's early days were marked by a strong focus on building a solid foundation. They invested heavily in research and development, studying market trends and customer needs to create tailored insurance products. This strategy paid off, and Advantage Insurance quickly gained recognition for its unique offerings and exceptional client satisfaction.

As the years progressed, Advantage Insurance continued to adapt and innovate. They embraced technological advancements, integrating digital tools into their operations to enhance efficiency and provide customers with seamless experiences. This commitment to staying ahead of the curve has allowed them to consistently deliver cutting-edge insurance solutions, solidifying their position as an industry leader.

Today, Advantage Insurance boasts an impressive portfolio of insurance products, catering to a wide array of needs. From auto and home insurance to specialized coverage for businesses and high-net-worth individuals, their offerings are designed to provide comprehensive protection. With a strong emphasis on customer education and transparent communication, they empower their clients to make informed decisions about their insurance needs.

Unveiling the Key Features of Advantage Insurance's Offerings

Advantage Insurance prides itself on offering a diverse range of insurance products, ensuring that its clients can find the perfect coverage to suit their unique circumstances. Let's explore some of the key features that set their offerings apart:

Comprehensive Personal Insurance Solutions

Advantage Insurance understands that personal insurance is not a one-size-fits-all proposition. That's why they offer a comprehensive suite of personal insurance products, including:

- Auto Insurance: Advantage Insurance provides coverage for a wide range of vehicles, from cars and motorcycles to recreational vehicles. Their policies offer protection against accidents, theft, and other unforeseen events, giving clients peace of mind on the road.

- Home Insurance: Whether you own a house, condo, or rental property, Advantage Insurance has you covered. Their home insurance policies protect against damage, theft, and liability claims, ensuring your residence and belongings are safeguarded.

- Life Insurance: Life insurance is an essential component of financial planning. Advantage Insurance offers a variety of life insurance policies, including term life, whole life, and universal life, to provide financial protection for your loved ones in the event of your untimely demise.

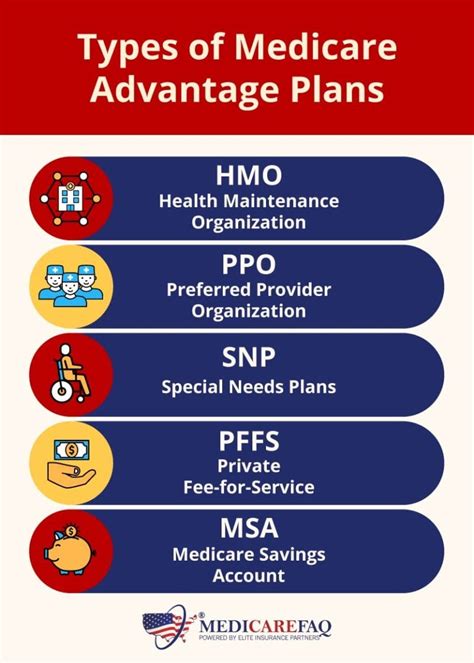

- Health Insurance: Access to quality healthcare is a priority for everyone. Advantage Insurance works with leading healthcare providers to offer comprehensive health insurance plans, covering medical expenses, hospitalization, and prescription drugs.

Tailored Commercial Insurance Packages

For businesses, Advantage Insurance recognizes the unique risks and challenges they face. That's why they offer specialized commercial insurance packages designed to protect businesses of all sizes and industries.

- Business Owners' Policy (BOP): A BOP is a cost-effective solution for small to medium-sized businesses, combining property and liability coverage into one convenient package. Advantage Insurance's BOPs are customizable, ensuring businesses receive the coverage they need without paying for unnecessary add-ons.

- General Liability Insurance: This coverage is essential for businesses to protect against third-party claims, such as bodily injury or property damage. Advantage Insurance's general liability policies provide broad protection, covering a range of potential liabilities.

- Professional Liability Insurance: Also known as errors and omissions (E&O) insurance, this coverage is vital for professionals such as consultants, accountants, and lawyers. Advantage Insurance's professional liability policies provide financial protection against claims arising from negligent acts, errors, or omissions in the course of business.

- Workers' Compensation Insurance: This coverage is mandatory for most businesses with employees. Advantage Insurance's workers' comp policies provide benefits to employees who suffer work-related injuries or illnesses, covering medical expenses and lost wages.

Specialty Insurance: Protecting Unique Needs

In addition to personal and commercial insurance, Advantage Insurance offers a range of specialty insurance products to cater to unique needs. These include:

- Umbrella Insurance: Umbrella policies provide additional liability coverage beyond the limits of a primary policy. Advantage Insurance's umbrella insurance policies offer extra protection for high-net-worth individuals and businesses, ensuring they are fully shielded from catastrophic losses.

- Cyber Insurance: With the increasing prevalence of cyber threats, cyber insurance has become a critical component of risk management. Advantage Insurance's cyber insurance policies protect businesses and individuals against cyber attacks, data breaches, and other online risks.

- Travel Insurance: Whether you're traveling for business or pleasure, travel insurance provides peace of mind. Advantage Insurance's travel insurance policies cover a range of potential issues, including trip cancellations, medical emergencies, and lost luggage.

- Pet Insurance: Pets are beloved family members, and their health is a priority. Advantage Insurance's pet insurance policies provide coverage for veterinary expenses, helping pet owners manage the financial burden of unexpected illnesses or injuries.

The Advantage Insurance Advantage: Unparalleled Customer Experience

At Advantage Insurance, customer satisfaction is not just a goal, it's a way of life. The company is dedicated to providing an exceptional customer experience at every touchpoint, from initial consultation to ongoing policy management.

One of the key strengths of Advantage Insurance is its highly trained and dedicated team of insurance professionals. With an average industry experience of 15 years, these experts possess a wealth of knowledge and expertise. They take the time to understand each client's unique needs and circumstances, providing personalized recommendations and guidance.

Advantage Insurance believes in transparency and open communication. They provide clear and concise policy documents, ensuring clients fully understand their coverage. Additionally, their customer service team is always available to answer queries and address concerns promptly and efficiently.

To further enhance the customer experience, Advantage Insurance has invested in cutting-edge technology. Their online platform allows clients to easily manage their policies, make payments, and access important documents anytime, anywhere. Additionally, they offer mobile apps for convenient policy management on the go.

Claim Processing: A Seamless Experience

When it comes to claim processing, Advantage Insurance sets the bar high. Their streamlined process ensures a seamless and stress-free experience for policyholders. Upon receiving a claim, their dedicated claims team promptly assesses the situation and works diligently to process the claim efficiently.

Advantage Insurance understands that claims can be stressful, so they strive to make the process as smooth as possible. They provide regular updates to policyholders, keeping them informed throughout the claims process. Their network of trusted repair and restoration partners ensures that any necessary repairs are completed to the highest standards.

In addition to their efficient claims handling, Advantage Insurance offers additional support to policyholders during challenging times. They provide resources and guidance to help policyholders navigate the aftermath of a claim, ensuring they receive the necessary assistance to get back on their feet.

Community Engagement and Giving Back

At Advantage Insurance, giving back to the community is a core value. The company believes in using its success to make a positive impact and contribute to the well-being of the communities it serves.

Through various initiatives and partnerships, Advantage Insurance actively supports local charities, non-profit organizations, and community projects. Their commitment to corporate social responsibility goes beyond financial donations. They encourage employee involvement, providing volunteer opportunities and encouraging active participation in community events.

One of Advantage Insurance's notable community initiatives is its annual charity drive, where they partner with local organizations to raise funds and awareness for important causes. This initiative not only benefits the community but also fosters a sense of camaraderie and purpose among their employees.

Sustainable Practices: A Commitment to the Environment

In addition to community engagement, Advantage Insurance is dedicated to sustainable practices and environmental responsibility. They recognize the impact of their operations on the planet and strive to minimize their carbon footprint.

The company has implemented several eco-friendly initiatives, such as adopting energy-efficient technologies, promoting paperless processes, and encouraging waste reduction. They also actively support environmental conservation efforts and advocate for sustainable practices within the insurance industry.

By embracing sustainable practices, Advantage Insurance sets an example for other businesses and demonstrates its commitment to creating a better future for generations to come.

The Future of Advantage Insurance: Innovation and Growth

As Advantage Insurance looks to the future, it remains committed to innovation and growth. The company understands that the insurance landscape is constantly evolving, and staying ahead of the curve is essential to providing the best possible service to its clients.

To achieve this, Advantage Insurance continues to invest in research and development, exploring new technologies and insurance products. They collaborate with industry experts and thought leaders to stay at the forefront of insurance innovation, ensuring they can offer cutting-edge solutions to their clients.

Additionally, Advantage Insurance is focused on expanding its reach and accessibility. They aim to make insurance more accessible to a wider range of individuals and businesses, breaking down barriers and providing comprehensive coverage to those who may have previously been underserved.

Through strategic partnerships and acquisitions, Advantage Insurance is expanding its geographic footprint and diversifying its product offerings. This allows them to cater to a broader spectrum of insurance needs, ensuring that more people can access the protection they require.

As Advantage Insurance continues to evolve and grow, it remains dedicated to its core values of excellence, customer satisfaction, and community impact. By embracing innovation, expanding its reach, and staying true to its principles, Advantage Insurance is well-positioned to thrive in the dynamic insurance industry.

Frequently Asked Questions

How long has Advantage Insurance been in business?

+Advantage Insurance has been providing insurance solutions since 1992, making it a trusted name with over 30 years of industry experience.

What makes Advantage Insurance unique compared to other insurance companies?

+Advantage Insurance stands out with its comprehensive range of insurance products, highly experienced professionals, and unwavering commitment to customer satisfaction. They offer personalized guidance and innovative solutions tailored to each client's unique needs.

How can I get a quote for insurance coverage from Advantage Insurance?

+Getting a quote from Advantage Insurance is easy. You can visit their website and use the online quote tool, or you can contact their friendly customer service team who will guide you through the process and provide a personalized quote based on your specific needs.

Does Advantage Insurance offer discounts on insurance policies?

+Absolutely! Advantage Insurance understands the importance of affordability, which is why they offer a range of discounts on their insurance policies. These discounts may include multi-policy discounts, safe driver discounts, loyalty discounts, and more. Contact them to explore the available options and potentially save on your insurance premiums.

What happens if I need to file a claim with Advantage Insurance?

+In the event of a claim, Advantage Insurance has a dedicated claims team ready to assist you. They provide a streamlined and efficient claims process, ensuring a stress-free experience. Simply contact their claims department, and they will guide you through the necessary steps to file and process your claim promptly.