Car Insurance Companies In Florida

Florida, known for its sunny beaches and vibrant culture, is also home to a diverse range of car insurance companies. With a large population and a unique set of regulations, the Sunshine State presents a complex market for auto insurance providers. This article aims to delve into the world of car insurance in Florida, providing an in-depth analysis of the companies operating within the state, their offerings, and the factors that influence the insurance landscape.

The Complex Landscape of Car Insurance in Florida

Florida’s car insurance market is characterized by a high level of competition and a diverse range of providers, from national giants to local, specialized companies. The state’s no-fault insurance system, unique to only a handful of other states, adds an extra layer of complexity to the insurance landscape. This system, known as the Personal Injury Protection (PIP) law, requires drivers to carry insurance that covers their own medical expenses, regardless of fault in an accident.

This arrangement has led to a market that is both innovative and contentious. Insurance companies in Florida must navigate a delicate balance between offering competitive rates and providing comprehensive coverage to meet the state's specific requirements. The result is a market that is constantly evolving, with companies adopting various strategies to stay ahead.

Leading Car Insurance Companies in Florida

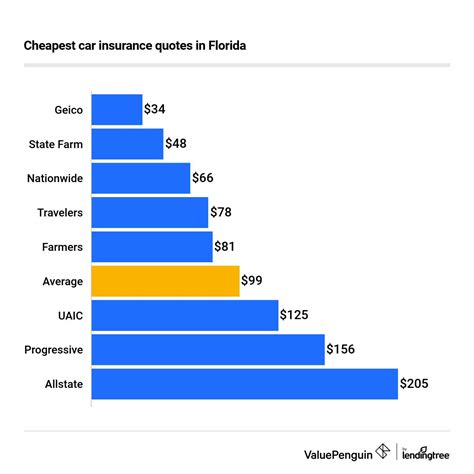

The car insurance market in Florida is dominated by a mix of well-known national brands and regional players. Here’s an overview of some of the top insurers in the state, along with their unique offerings and market strategies.

State Farm

Market Presence: State Farm is a stalwart in the Florida insurance market, known for its extensive network of agents and comprehensive coverage options. With a focus on personal service, State Farm has established itself as a go-to choice for many Florida residents.

Coverage Options: The company offers a range of auto insurance policies, including standard liability coverage, comprehensive and collision coverage, and optional add-ons like rental car reimbursement and roadside assistance. State Farm also provides PIP coverage, a mandatory requirement in Florida.

Unique Offerings: State Farm's Drive Safe & Save program utilizes telematics technology to reward safe drivers with discounts. Additionally, their Steer Clear program provides discounts for young drivers who complete an approved driver education course.

GEICO

Market Presence: GEICO, known for its catchy marketing campaigns, has made significant inroads into the Florida market. The company’s focus on digital convenience and competitive pricing has attracted a large customer base.

Coverage Options: GEICO offers a comprehensive range of auto insurance policies, including liability, collision, and comprehensive coverage. They also provide optional coverages like rental car reimbursement, emergency road service, and mechanical breakdown insurance.

Unique Offerings: GEICO's Digital Garage allows customers to manage their policies, file claims, and access insurance cards entirely online or via mobile apps. They also offer a unique discount for federal employees and military personnel.

Progressive

Market Presence: Progressive has established itself as a major player in the Florida insurance market, known for its innovative products and competitive rates. The company’s focus on customer service and customization has made it a popular choice.

Coverage Options: Progressive offers a range of auto insurance policies, including liability, collision, and comprehensive coverage. They also provide specialized coverage options like gap insurance, rental car reimbursement, and roadside assistance.

Unique Offerings: Progressive's Name Your Price tool allows customers to set their desired premium amount and then see the coverage options that fit within that budget. They also offer a Snapshot program, which uses telematics to monitor driving behavior and offer discounts to safe drivers.

Allstate

Market Presence: Allstate is a well-established brand in Florida, known for its extensive agent network and comprehensive coverage options. The company’s focus on customer service and financial strength has made it a trusted choice for many residents.

Coverage Options: Allstate offers a range of auto insurance policies, including liability, collision, and comprehensive coverage. They also provide optional coverages like rental car reimbursement, roadside assistance, and accident forgiveness.

Unique Offerings: Allstate's Drivewise program utilizes telematics to monitor driving behavior and offer discounts to safe drivers. They also offer a unique Safe Driving Bonus, which provides a discount for each year the insured driver avoids an accident.

USAA

Market Presence: USAA is a highly respected insurance provider, primarily serving military members, veterans, and their families. With a strong focus on customer service and competitive rates, USAA has established a loyal customer base in Florida.

Coverage Options: USAA offers a comprehensive range of auto insurance policies, including liability, collision, and comprehensive coverage. They also provide specialized coverages like rental car coverage, roadside assistance, and gap insurance.

Unique Offerings: USAA's unique membership eligibility requirements set it apart. They offer a range of discounts for safe driving, loyalty, and multi-policy bundles. Additionally, USAA provides a claims satisfaction guarantee, ensuring customers are happy with the claims process.

Factors Influencing Car Insurance Rates in Florida

Florida’s unique insurance landscape is influenced by a variety of factors, which can significantly impact the rates that drivers pay for their auto insurance policies.

No-Fault Insurance System

Florida’s no-fault insurance system, while providing benefits to policyholders, also adds complexity to insurance rates. The mandatory Personal Injury Protection (PIP) coverage can increase overall insurance costs, as it covers medical expenses and lost wages up to a certain limit, regardless of fault.

High Risk of Natural Disasters

Florida’s geographic location makes it prone to natural disasters like hurricanes and floods. These events can lead to widespread damage and increase insurance claims, which in turn can drive up insurance rates. Insurers must account for this risk when setting rates, leading to potentially higher premiums for Florida drivers.

Uninsured Motorist Rate

Florida has a relatively high rate of uninsured motorists, which can impact insurance rates for all drivers. When there are more uninsured drivers on the road, insured drivers face a higher risk of being involved in an accident with an uninsured motorist. Insurers often factor this risk into their rates, leading to potentially higher premiums.

Traffic Density and Accident Rates

Florida’s major cities, like Miami and Tampa, have high traffic densities and relatively high accident rates. This can lead to increased insurance claims, which in turn can drive up insurance rates. Insurers may set higher rates in these areas to account for the increased risk of accidents.

Future Implications and Market Trends

The car insurance market in Florida is poised for significant changes and growth in the coming years. Several trends and developments are likely to shape the market and influence the strategies of insurance companies operating in the state.

Rise of Telematics and Usage-Based Insurance

The increasing adoption of telematics technology and usage-based insurance models is likely to revolutionize the car insurance market in Florida. These technologies allow insurers to monitor driving behavior in real-time, offering discounts to safe drivers and potentially reducing insurance rates for those who demonstrate safe driving habits.

Expansion of Digital Insurance Platforms

The shift towards digital insurance platforms and online purchasing is expected to continue, offering customers more convenience and control over their insurance policies. Insurance companies will need to invest in digital infrastructure and enhance their online offerings to remain competitive in this evolving landscape.

Impact of Autonomous Vehicles

The advent of autonomous vehicles is likely to have a significant impact on the car insurance market in Florida. As self-driving cars become more prevalent, insurance companies will need to adapt their policies and pricing models to account for the reduced risk of human error. This could lead to a decrease in insurance rates for drivers of autonomous vehicles.

Focus on Customer Experience and Personalization

Insurance companies in Florida are increasingly focusing on enhancing the customer experience and offering personalized insurance solutions. This includes providing more options for policy customization, offering discounts for safe driving behaviors, and leveraging data analytics to better understand customer needs and preferences.

| Insurance Company | Unique Offering |

|---|---|

| State Farm | Drive Safe & Save program for safe drivers |

| GEICO | Digital Garage for online policy management |

| Progressive | Name Your Price tool for budget-conscious shoppers |

| Allstate | Drivewise program for safe driving discounts |

| USAA | Claims satisfaction guarantee for added peace of mind |

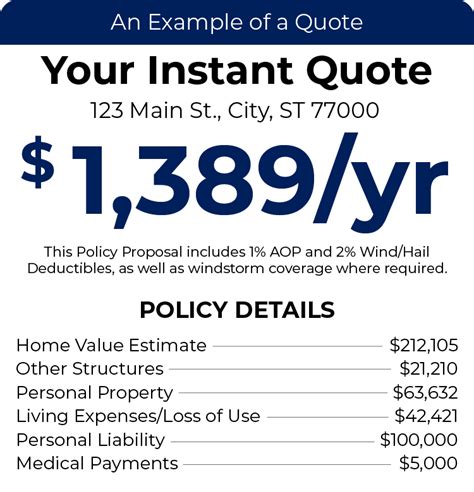

What is the average cost of car insurance in Florida?

+

The average cost of car insurance in Florida varies depending on several factors, including the driver’s age, location, driving record, and the type of coverage chosen. On average, drivers in Florida pay around 2,000 per year for auto insurance, although rates can range from as low as 1,000 to over $3,000 per year.

What factors influence car insurance rates in Florida?

+

Several factors influence car insurance rates in Florida, including the driver’s age, gender, marital status, driving record, and the type of vehicle insured. Additionally, the state’s no-fault insurance system, high risk of natural disasters, and relatively high rate of uninsured motorists can also impact insurance rates.

Are there any discounts available for car insurance in Florida?

+

Yes, several insurance companies in Florida offer a variety of discounts to their customers. These can include discounts for safe driving, loyalty, multi-policy bundles, and even unique discounts for specific professions or affiliations. It’s worth shopping around and comparing different insurance providers to find the best deal.

How can I choose the right car insurance company in Florida?

+

When choosing a car insurance company in Florida, it’s important to consider several factors, including the company’s financial strength, customer service reputation, coverage options, and pricing. Researching and comparing different providers can help you find the best fit for your needs. Additionally, consider the company’s unique offerings and discounts to ensure you’re getting the most value for your money.

What should I do if I’m involved in a car accident in Florida?

+

If you’re involved in a car accident in Florida, the first step is to ensure the safety of all involved parties. Then, contact the police to report the accident and exchange information with the other driver(s). Take photos of the scene and any damage to your vehicle. Finally, contact your insurance company to report the accident and initiate the claims process.