How Does A Universal Life Insurance Work

Understanding the Basics of Universal Life Insurance

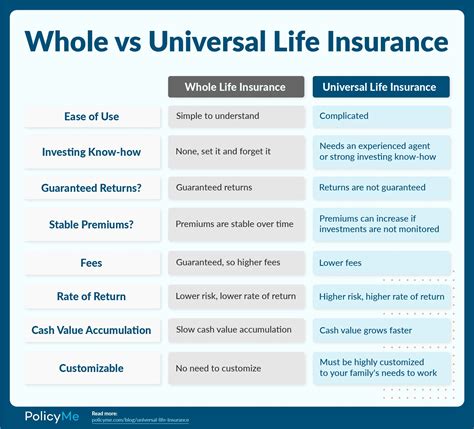

Universal life insurance is a versatile and flexible type of permanent life insurance policy that offers policyholders a range of benefits and options. Unlike term life insurance, which provides coverage for a specified period, universal life insurance is designed to offer lifelong protection, with the added advantage of customizable features. This type of insurance policy has gained popularity due to its ability to cater to individual needs and preferences, making it a valuable tool for long-term financial planning.

At its core, universal life insurance functions by combining life insurance coverage with a savings or investment component. This unique feature allows policyholders to not only secure financial protection for their loved ones but also to build a cash value within the policy. This cash value can be utilized in various ways, providing an added layer of financial flexibility.

One of the key attractions of universal life insurance is its adaptability. Policyholders have the freedom to adjust certain aspects of their policy, such as the death benefit amount and premium payments, to align with their changing financial circumstances and goals. This flexibility ensures that the policy remains relevant and beneficial over the long term.

Another notable feature of universal life insurance is the interest earnings on the policy's cash value. These earnings are typically tax-deferred, meaning they grow over time without being subject to immediate taxation. This aspect makes universal life insurance an attractive option for individuals seeking to build wealth while also securing life insurance coverage.

Furthermore, universal life insurance policies often offer a variety of investment options for the cash value. Policyholders can choose from a range of investment vehicles, such as mutual funds or separate accounts, allowing them to tailor their investment strategy to their risk tolerance and financial objectives. This level of customization ensures that the policy's cash value grows in a way that aligns with the policyholder's overall financial plan.

Key Components and Features of Universal Life Insurance

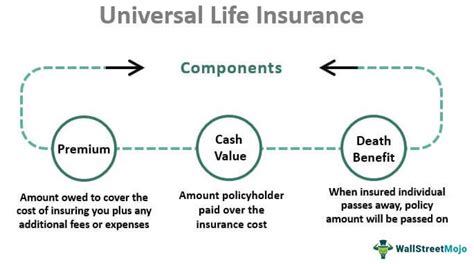

Universal life insurance policies are comprised of several key components, each serving a specific purpose and contributing to the overall flexibility and benefits of the policy.

Death Benefit

The death benefit is the core protection provided by a universal life insurance policy. It represents the amount that the policyholder's beneficiaries will receive upon the insured individual's death. This benefit is typically customizable, allowing policyholders to increase or decrease the death benefit amount based on their changing needs and financial circumstances.

| Death Benefit Types | Description |

|---|---|

| Level Death Benefit | The death benefit remains constant throughout the policy's term. |

| Increasing Death Benefit | The death benefit increases over time, providing additional protection as the policyholder ages. |

| Flexible Death Benefit | Policyholders can choose to adjust the death benefit amount as needed. |

Cash Value

The cash value is a unique feature of universal life insurance policies. It represents the policy's savings or investment component, where a portion of the premium payments is allocated. This cash value grows over time, earning interest and potentially providing investment returns. Policyholders can access this cash value through various means, such as loans, withdrawals, or using it to pay policy premiums.

Premium Payments

Premium payments are the contributions made by policyholders to maintain their universal life insurance policy. These payments are typically flexible, allowing policyholders to adjust the amount and frequency of payments to suit their financial situation. Some policies even offer the option of skipping premiums during certain periods, providing additional financial flexibility.

Interest Earnings

Interest earnings are a significant aspect of universal life insurance policies. The cash value within the policy earns interest, which is credited to the policy's account. The interest rate is typically guaranteed by the insurance company, providing policyholders with a stable and predictable growth rate for their savings. This interest component contributes to the overall value of the policy and can be used to fund future premium payments or increase the death benefit.

Flexibility and Customization in Universal Life Insurance

One of the standout features of universal life insurance is its flexibility, which allows policyholders to customize their policies to meet their specific needs and preferences. This level of customization is particularly valuable for individuals with evolving financial goals and circumstances.

Adjustable Death Benefit

Universal life insurance policies often offer the option to adjust the death benefit amount. Policyholders can increase the death benefit to provide additional protection for their beneficiaries, especially during life events such as marriage, the birth of a child, or the purchase of a new home. Conversely, they can also decrease the death benefit if their financial situation changes and they require more affordable premiums.

Flexible Premium Payments

Premium payments for universal life insurance policies are typically flexible. Policyholders can choose the amount and frequency of their premium payments, providing them with control over their financial commitments. This flexibility is particularly beneficial for individuals with fluctuating income or those who prefer to make larger payments during certain periods to take advantage of investment opportunities or to build their cash value more rapidly.

Investment Options

Universal life insurance policies often provide a range of investment options for the cash value component. Policyholders can choose from various investment vehicles, such as mutual funds, bonds, or separate accounts, allowing them to align their investment strategy with their risk tolerance and financial goals. This feature adds an element of financial planning to the insurance policy, enabling policyholders to grow their cash value while also securing life insurance coverage.

Utilizing the Cash Value Component

The cash value component of a universal life insurance policy is a valuable asset that can be utilized in various ways to meet the policyholder's financial needs and objectives.

Policy Loans

Policyholders can borrow against the cash value of their universal life insurance policy. This allows them to access funds without having to surrender the policy or incur additional debt. Policy loans are typically interest-free, with the interest accumulating within the policy's cash value. This feature can be particularly beneficial for individuals seeking short-term financial assistance without disrupting their long-term financial plans.

Withdrawing Cash

Policyholders can withdraw a portion of their cash value without surrendering the policy. This provides a flexible source of funds that can be used for various purposes, such as funding a child's education, making a down payment on a home, or covering unexpected expenses. Withdrawals reduce the policy's cash value and may impact the death benefit and future premiums, so it's essential to consider the long-term implications.

Paying Premiums with Cash Value

The cash value within a universal life insurance policy can be used to pay for future premiums. This feature is particularly advantageous for individuals who wish to maintain their policy coverage but may face financial challenges in the future. By using the cash value to fund premiums, policyholders can ensure their policy remains active, providing continuous protection for their beneficiaries.

Tax Considerations and Benefits

Universal life insurance policies offer several tax advantages that can enhance their overall value and attractiveness as a financial planning tool.

Tax-Deferred Growth

The cash value within a universal life insurance policy grows on a tax-deferred basis. This means that the earnings and interest credited to the policy's cash value are not subject to immediate taxation. The tax-deferred growth allows the cash value to accumulate more rapidly, providing policyholders with a more significant financial asset over time.

Tax-Free Death Benefit

The death benefit received by beneficiaries upon the insured individual's death is typically tax-free. This means that the full amount of the death benefit can be used to cover the policyholder's final expenses, provide financial support for their loved ones, or fund any other financial obligations without incurring additional tax liability.

Tax-Advantaged Policy Loans

Policy loans taken against the cash value of a universal life insurance policy are generally tax-advantaged. The interest earned on the policy loan is not taxable, and the loan proceeds are also not subject to immediate taxation. This feature makes policy loans a valuable tool for accessing funds without incurring additional tax obligations.

Potential Risks and Considerations

While universal life insurance policies offer numerous benefits and advantages, it's essential to consider potential risks and factors that may impact the policy's performance and value.

Interest Rate Risk

The interest rate on the cash value within a universal life insurance policy is typically guaranteed by the insurance company. However, these rates can vary over time, and if the guaranteed rate is lower than the prevailing market rates, the policy's cash value may grow more slowly than expected. Policyholders should carefully consider the potential impact of interest rate fluctuations on their policy's performance.

Investment Risk

If the policyholder chooses to invest the cash value in variable investment options, such as mutual funds, there is an inherent investment risk. The value of these investments can fluctuate, and in some cases, the policy's cash value may decrease. Policyholders should assess their risk tolerance and financial goals before selecting investment options to ensure they align with their overall financial plan.

Surrender Charges

Universal life insurance policies may have surrender charges if the policyholder decides to surrender or cancel the policy before a certain period. These charges can significantly impact the policy's cash value, reducing the amount received by the policyholder. It's essential to understand the surrender charges and the potential impact on the policy's value before making any decisions to surrender the policy.

Conclusion

Universal life insurance is a powerful financial tool that offers a combination of life insurance coverage and savings or investment opportunities. Its flexibility, customization options, and tax advantages make it an attractive option for individuals seeking long-term financial protection and wealth accumulation. By understanding the key components, features, and potential risks, policyholders can make informed decisions to maximize the benefits of their universal life insurance policy.

Can I access the cash value of my universal life insurance policy at any time?

+Yes, you can access the cash value of your universal life insurance policy through loans, withdrawals, or using it to pay premiums. However, it’s important to consider the potential impact on your policy’s performance and future benefits.

Are there any age limits for purchasing universal life insurance?

+Age limits for purchasing universal life insurance can vary between insurance companies. Generally, individuals can purchase universal life insurance up to a certain age, typically around 75-80 years old. It’s best to consult with an insurance agent to understand the specific age limits and options available.

How does the death benefit of a universal life insurance policy work?

+The death benefit of a universal life insurance policy is the amount paid to the policyholder’s beneficiaries upon their death. It can be customized and adjusted over time to meet changing needs. The death benefit is typically tax-free and provides financial protection for loved ones.