Homeowner Insurance Online Quote

In today's digital age, obtaining a homeowner's insurance quote online has become a convenient and efficient process. With just a few clicks, homeowners can gain valuable insights into the cost and coverage options available to protect their biggest investment—their home. However, navigating the world of homeowner's insurance can be daunting, with numerous factors influencing the final quote. From understanding the basic components of a policy to exploring the various coverage options and add-ons, there is much to uncover. Additionally, the process of obtaining an online quote involves assessing one's specific needs and risks, and comparing quotes from multiple providers to ensure the best value and coverage. This article aims to provide a comprehensive guide to help homeowners navigate the online quote process, offering expert insights and practical tips to make informed decisions and secure the right coverage for their homes.

Understanding Homeowner’s Insurance: The Basics

Homeowner’s insurance is a fundamental protection for any property owner. It provides financial security in the event of unforeseen circumstances such as natural disasters, theft, or accidental damage. A typical homeowner’s insurance policy consists of several key components, each designed to address specific risks. These include:

- Dwelling Coverage: This covers the physical structure of the home, including the house itself, attached structures like garages, and often includes coverage for debris removal after a covered loss.

- Personal Property Coverage: Protects the belongings within the home, such as furniture, electronics, and clothing. It typically covers a wide range of perils, including fire, theft, and vandalism.

- Liability Coverage: Crucial for safeguarding homeowners against legal claims and lawsuits resulting from accidents or injuries that occur on the insured property. It provides coverage for medical expenses and legal defense costs.

- Additional Living Expenses: In the event of a covered loss that makes the home uninhabitable, this coverage reimburses the policyholder for additional living expenses incurred while the home is being repaired or rebuilt.

- Medical Payments Coverage: Offers coverage for medical expenses incurred by guests who are injured on the insured property, regardless of liability.

It’s essential to note that these basic components may vary depending on the insurance provider and the specific policy chosen. Some policies may offer more comprehensive coverage or include additional perks, such as identity theft protection or enhanced liability coverage.

Exploring Coverage Options and Add-Ons

While the basic components of a homeowner’s insurance policy provide essential coverage, there are often additional options and add-ons available to tailor the policy to specific needs. These can include:

- Personal Belongings Coverage: This provides additional coverage for high-value items such as jewelry, fine art, or collectibles. It ensures that these items are adequately insured and protected against loss or damage.

- Flood Insurance: Standard homeowner’s insurance policies typically do not cover flood damage. However, given the increasing frequency and severity of flooding events, it is crucial to consider adding flood insurance to one’s coverage. This add-on can provide financial protection in the event of a flood.

- Earthquake Insurance: Similar to flood insurance, earthquake insurance is often not included in standard policies. Depending on the seismic activity in the area, homeowners may want to consider adding this coverage to protect their home and belongings in the event of an earthquake.

- Umbrella Insurance: This add-on provides an extra layer of liability protection beyond the limits of the homeowner’s insurance policy. It offers coverage for lawsuits, legal defense costs, and other liability claims that exceed the limits of the primary policy.

- Home Systems Protection: This add-on covers the failure or breakdown of essential home systems, such as HVAC, electrical, or plumbing systems. It provides financial protection and peace of mind for unexpected repair or replacement costs.

When exploring coverage options and add-ons, it’s essential to assess one’s specific needs and risks. Factors such as the location of the home, the value of personal belongings, and the potential for natural disasters should be considered. Consulting with an insurance professional can help homeowners navigate these options and choose the coverage that best suits their circumstances.

The Online Quote Process: A Step-by-Step Guide

Obtaining an online homeowner’s insurance quote is a straightforward process that typically involves the following steps:

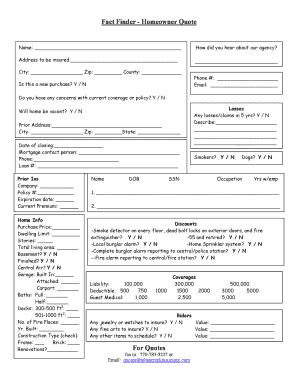

- Gather Information: Before starting the quote process, it’s beneficial to gather relevant information about the home and its contents. This includes details such as the home’s age, square footage, construction type, and the value of personal belongings. Having this information readily available can streamline the quote process.

- Choose an Insurance Provider: With numerous insurance providers available, selecting the right one can be overwhelming. It’s essential to research and compare providers based on their reputation, financial stability, and customer satisfaction ratings. Online reviews and recommendations from trusted sources can be valuable in making an informed decision.

- Provide Property Details: Once an insurance provider is chosen, the next step is to provide detailed information about the property. This includes the home’s address, construction type, age, and any recent renovations or improvements. Accurate information is crucial to ensure an accurate quote.

- Select Coverage Options: At this stage, homeowners can choose the coverage options and add-ons that best suit their needs. It’s important to carefully consider the basic components and additional coverage options discussed earlier to ensure comprehensive protection.

- Review and Compare Quotes: After providing the necessary information, multiple quotes will be generated. It’s essential to review these quotes carefully, comparing not only the cost but also the coverage limits, deductibles, and any exclusions. Homeowners should aim to strike a balance between affordability and adequate coverage.

- Assess Additional Benefits: Beyond the coverage limits and costs, homeowners should also evaluate the additional benefits and perks offered by each insurance provider. These can include discounts for safety features, loyalty programs, or claims-free incentives. Understanding these benefits can further enhance the value of the chosen policy.

- Make an Informed Decision: With all the necessary information and quotes at hand, homeowners can make an informed decision about their homeowner’s insurance. It’s crucial to choose a policy that provides the right balance of coverage and cost, taking into account one’s specific needs and risks.

By following this step-by-step guide, homeowners can navigate the online quote process with confidence, ensuring they obtain accurate and competitive quotes to protect their homes and belongings.

Comparing Quotes and Assessing Value

Comparing quotes from multiple insurance providers is a critical step in the homeowner’s insurance journey. It allows homeowners to evaluate the available options and make informed decisions about their coverage. When comparing quotes, several factors should be considered:

- Coverage Limits: Review the coverage limits for each policy, ensuring they align with the value of the home and its contents. Higher coverage limits often result in higher premiums, but they provide more comprehensive protection.

- Deductibles: Deductibles are the amount homeowners must pay out of pocket before the insurance coverage kicks in. Lower deductibles mean a smaller out-of-pocket expense in the event of a claim, but they typically result in higher premiums. Homeowners should choose a deductible that strikes a balance between affordability and risk tolerance.

- Exclusions: Carefully review the exclusions in each policy. Exclusions are specific situations or perils that are not covered by the policy. Understanding these exclusions is crucial to ensure the policy provides the desired level of protection.

- Additional Benefits and Perks: Beyond the basic coverage, some insurance providers offer additional benefits and perks. These can include discounts for safety features, loyalty programs, or bundle discounts for multiple policies. Evaluating these benefits can add value to the chosen policy.

- Financial Stability and Reputation: It’s essential to consider the financial stability and reputation of the insurance provider. A financially stable company is more likely to pay out claims promptly and fairly. Researching the provider’s financial ratings and customer satisfaction reviews can provide valuable insights.

- Customer Service and Claims Handling: The quality of customer service and claims handling is another critical factor. Homeowners should choose a provider known for its responsive and efficient claims process. Positive customer reviews and ratings can indicate a provider’s commitment to customer satisfaction.

By thoroughly comparing quotes and assessing these key factors, homeowners can make an informed decision about their homeowner’s insurance. It’s important to choose a policy that not only provides adequate coverage but also offers a positive overall experience, including efficient claims handling and exceptional customer service.

The Impact of Location and Risk Factors

The location of a home plays a significant role in determining the cost and coverage of homeowner’s insurance. Insurance providers assess various risk factors associated with a specific area to calculate premiums and tailor coverage. These risk factors can include:

- Natural Disasters: Areas prone to natural disasters such as hurricanes, tornadoes, earthquakes, or wildfires often face higher insurance premiums. Insurance providers assess the historical data and likelihood of these events to determine the level of risk.

- Crime Rates: High crime rates in a particular area can increase the risk of theft, vandalism, or other property-related crimes. Insurance providers take into account the local crime statistics when calculating premiums.

- Distance from Fire Stations: The proximity of a home to fire stations can impact insurance rates. Homes located farther away from fire stations may face higher premiums due to the increased response time in the event of a fire.

- Weather Conditions: The local weather patterns and climate can influence insurance rates. Areas with severe weather conditions, such as frequent storms or extreme temperatures, may pose higher risks and result in higher premiums.

- Age and Condition of the Home: Older homes or those in need of significant repairs may face higher insurance costs. Insurance providers assess the age and condition of the home to determine the potential risks and costs associated with maintaining and repairing the property.

- Construction Type: The construction type of the home can also impact insurance rates. Homes built with more durable materials or designed to withstand specific weather conditions may be eligible for lower premiums.

When obtaining an online quote, insurance providers will consider these location-specific risk factors to determine the premium and coverage options. Homeowners should be aware of these factors and understand how they influence their insurance costs. Additionally, taking proactive measures to mitigate these risks, such as installing security systems or making structural improvements, can potentially lower insurance premiums and enhance overall coverage.

Tips for Lowering Homeowner’s Insurance Costs

While homeowner’s insurance provides essential protection, it’s natural for homeowners to seek ways to lower their insurance costs without compromising coverage. Here are some expert tips to help homeowners reduce their insurance premiums:

- Increase Deductibles: Choosing a higher deductible can result in lower premiums. By increasing the deductible, homeowners take on a larger portion of the financial responsibility in the event of a claim. However, it’s important to ensure the chosen deductible is affordable and aligns with one’s financial capabilities.

- Bundle Policies: Many insurance providers offer bundle discounts when homeowners combine multiple policies, such as homeowner’s insurance with auto insurance or life insurance. Bundling policies can result in significant savings, so it’s worth exploring this option with the chosen insurance provider.

- Improve Home Security: Investing in home security measures, such as installing a monitored alarm system, motion sensors, or security cameras, can reduce the risk of theft and vandalism. Insurance providers often offer discounts for homes with enhanced security features, making it a win-win situation for homeowners.

- Maintain a Claims-Free Record: Maintaining a claims-free record over an extended period can lead to insurance discounts. Insurance providers reward policyholders who have not filed claims by offering loyalty discounts or reduced premiums. This incentive encourages responsible behavior and discourages unnecessary claims.

- Review Coverage Regularly: It’s essential to review one’s homeowner’s insurance coverage regularly, especially after significant life changes or renovations. By reassessing coverage needs and making necessary adjustments, homeowners can ensure they are not overpaying for unnecessary coverage or underinsured for their current circumstances.

- Shop Around and Compare: The insurance market is competitive, and prices can vary significantly between providers. Homeowners should regularly shop around and compare quotes from multiple providers to ensure they are getting the best value for their insurance needs. Online comparison tools and insurance brokers can be valuable resources in this process.

- Understand Discounts and Perks: Insurance providers often offer a range of discounts and perks, such as loyalty discounts, safety feature discounts, or multi-policy discounts. Understanding these incentives and taking advantage of them can help homeowners lower their insurance costs without sacrificing coverage.

By implementing these tips and staying proactive in managing their homeowner’s insurance, homeowners can potentially reduce their insurance costs while maintaining adequate coverage for their homes and belongings.

Future Trends and Innovations in Homeowner’s Insurance

The homeowner’s insurance industry is continually evolving, driven by technological advancements and changing consumer needs. Several trends and innovations are shaping the future of homeowner’s insurance, offering enhanced protection and improved customer experiences. Here are some key developments to watch out for:

- Telematics and Usage-Based Insurance: Telematics technology, which collects and analyzes data from sensors and devices, is being utilized to offer usage-based insurance policies. These policies can provide personalized premiums based on an individual’s actual usage and behavior, rewarding responsible homeowners with lower rates.

- AI and Machine Learning: Artificial Intelligence (AI) and machine learning algorithms are being employed to streamline the insurance process, from risk assessment to claims handling. These technologies can analyze vast amounts of data to identify patterns and trends, enabling more accurate risk profiling and efficient claims processing.

- Smart Home Integration: The integration of smart home technology with homeowner’s insurance is gaining traction. Smart home devices, such as smart locks, smoke detectors, and water sensors, can provide real-time data and insights, allowing insurance providers to offer tailored coverage and potentially lower premiums for homes with enhanced safety features.

- Blockchain Technology: Blockchain technology is being explored to enhance the security and efficiency of insurance processes. It can facilitate secure and transparent transactions, streamline claims handling, and improve overall data management, leading to a more seamless and trustworthy insurance experience.

- Parametric Insurance: Parametric insurance is an innovative approach that provides coverage based on specific parameters or triggers, such as wind speed or rainfall intensity. This type of insurance offers rapid payouts in the event of a covered loss, providing homeowners with swift financial relief during times of need.

- Digital Onboarding and Claims Processing: Insurance providers are investing in digital technologies to streamline the onboarding process and claims handling. Digital platforms and mobile apps enable homeowners to easily obtain quotes, manage policies, and file claims, providing a more convenient and efficient experience.

- Collaborative Risk Assessment: Insurance providers are increasingly collaborating with homeowners and other stakeholders to assess and mitigate risks. By sharing data and insights, they can develop more accurate risk models and offer personalized coverage options, ensuring that homeowners receive the right protection for their specific needs.

As these trends and innovations continue to shape the homeowner’s insurance industry, homeowners can expect enhanced coverage, improved customer experiences, and more efficient processes. Staying informed about these developments can help homeowners make the most of the evolving insurance landscape and secure the best protection for their homes.

Conclusion: Empowering Homeowners with Knowledge

Navigating the world of homeowner’s insurance can be complex, but with the right knowledge and tools, homeowners can make informed decisions to protect their homes and belongings. This comprehensive guide has provided an in-depth understanding of homeowner’s insurance, from the basic components to the latest trends and innovations. By exploring coverage options, comparing quotes, and implementing cost-saving tips, homeowners can secure the right insurance coverage at a competitive price.

The online quote process, while convenient, requires careful consideration of various factors, including location-specific risks, coverage needs, and additional benefits. By assessing these aspects and leveraging the power of technology, homeowners can obtain accurate quotes and make confident choices about their insurance coverage.

As the homeowner’s insurance industry continues to evolve, staying informed about the latest trends and innovations is crucial. Embracing new technologies and collaborative approaches can lead to more personalized and efficient insurance solutions. Homeowners should actively engage with their insurance providers, stay updated on industry developments, and leverage the available resources to ensure they are well-protected against unforeseen circumstances.

In conclusion, obtaining a homeowner’s insurance online quote is just the beginning of a journey towards financial security and peace of mind. By arming themselves with knowledge and staying proactive, homeowners can make the most of their insurance coverage, ensuring their homes and belongings are adequately protected for years to come.

How often should I review my homeowner’s insurance policy?

+It is recommended to review your homeowner’s insurance policy annually or whenever there are significant changes in your life or home. Life events such as marriage, divorce, the birth of a child, or major home renovations can impact your insurance needs. Regularly reviewing your policy ensures that your coverage remains up-to-date and aligns with your current circumstances.