Pet Insurance No Waiting Period

Pet insurance is an essential aspect of responsible pet ownership, providing financial protection and peace of mind for unexpected veterinary expenses. However, many pet owners are often concerned about waiting periods, which can delay coverage for pre-existing conditions or specific treatments. In this comprehensive guide, we will delve into the world of pet insurance, exploring the concept of no waiting period policies, their benefits, and how they can offer comprehensive coverage for your beloved furry friends.

Understanding Pet Insurance and Waiting Periods

Pet insurance policies typically come with waiting periods, which are predefined timeframes that must pass before certain conditions or treatments are covered. These waiting periods can vary between insurance providers and policy types, but they generally serve two main purposes:

- Pre-Existing Condition Exclusions: Waiting periods help insurance companies assess the risk of covering pre-existing conditions. If a pet has a known health issue before the policy starts, it may be excluded from coverage during the waiting period.

- Preventing Abuse and Fraud: Waiting periods also act as a deterrent for owners who might be tempted to enroll their pets solely to cover an existing medical condition.

The length of waiting periods can vary, often ranging from 14 to 30 days for illnesses and injuries. Some policies may also have separate waiting periods for specific conditions, such as cruciate ligament injuries or certain types of cancer.

The Rise of No Waiting Period Pet Insurance

Recognizing the drawbacks of traditional waiting periods, the pet insurance industry has evolved, introducing no waiting period policies. These innovative plans offer immediate coverage, eliminating the stress and uncertainty associated with traditional waiting periods.

Benefits of No Waiting Period Pet Insurance

No waiting period pet insurance policies provide several advantages that can significantly benefit pet owners:

- Immediate Coverage: As the name suggests, these policies offer instant coverage, meaning you can enroll your pet and have their medical expenses covered from day one. This is especially crucial for older pets or those with unknown health histories.

- Peace of Mind: By eliminating waiting periods, you can rest assured that your pet's health is protected from the moment you sign up. This peace of mind is invaluable, allowing you to focus on your pet's well-being without financial worries.

- No Exclusions: No waiting period policies often have fewer exclusions, providing broader coverage for a range of conditions and treatments. This can be a lifesaver for pets with pre-existing conditions or those prone to specific illnesses.

- Flexibility: These policies are highly flexible, allowing you to customize coverage to suit your pet's needs. Whether you have a young, healthy pet or an older companion with specific health concerns, you can tailor the policy accordingly.

- Comprehensive Benefits: No waiting period plans often include additional perks, such as routine care coverage, wellness exams, and even alternative therapies. These benefits can help you maintain your pet's overall health and prevent potential issues down the line.

How No Waiting Period Pet Insurance Works

No waiting period pet insurance policies operate similarly to traditional plans but with a crucial difference - immediate coverage activation. Here’s a simplified breakdown of how these policies work:

- Enrollment: You can enroll your pet in a no waiting period policy at any time, regardless of their age or health status. The process typically involves providing basic information about your pet, such as breed, age, and any pre-existing conditions.

- Coverage Activation: Once you've chosen a policy and made the initial payment, your pet's coverage becomes active immediately. This means that any eligible medical expenses incurred after the policy start date will be covered according to the terms of your plan.

- Claim Process: The claim process for no waiting period policies is generally the same as with traditional plans. You'll need to submit veterinary invoices and any required documentation to your insurance provider, who will then assess and reimburse you for covered expenses.

- Customizable Options: No waiting period policies often offer a wide range of coverage options, allowing you to choose the level of protection that best suits your budget and your pet's needs. You can select different levels of coverage for accidents, illnesses, and even routine care expenses.

| Pet Insurance Coverage Type | Description |

|---|---|

| Accident-Only | Covers injuries and accidents, but not illnesses. |

| Accident & Illness | Provides comprehensive coverage for both accidents and illnesses. |

| Routine Care | Includes coverage for wellness exams, vaccinations, and preventive care. |

| Specific Condition Coverage | Designed for pets with pre-existing conditions, offering coverage for specific illnesses or injuries. |

Choosing the Right No Waiting Period Policy

When selecting a no waiting period pet insurance policy, it’s essential to consider your pet’s unique needs and your financial situation. Here are some key factors to keep in mind:

- Coverage Limits: No waiting period policies may have different coverage limits for accidents, illnesses, and routine care. Ensure that the policy provides sufficient coverage for the types of expenses you anticipate.

- Deductibles and Co-pays: Like traditional insurance, no waiting period policies often have deductibles and co-pays. Choose a policy with deductibles and co-pays that align with your budget and financial comfort level.

- Pre-Existing Condition Coverage: If your pet has a known health issue, look for policies that offer coverage for pre-existing conditions. While these policies may be more expensive, they can provide essential protection for your pet's ongoing health needs.

- Reputation and Reviews: Research the insurance provider's reputation and read reviews from other pet owners. This can give you insights into the company's customer service, claim processing, and overall reliability.

- Additional Benefits: Some no waiting period policies offer extra perks, such as coverage for alternative therapies, prescription medications, or even travel expenses. Consider these additional benefits and choose a plan that aligns with your pet's lifestyle.

Comparing Pet Insurance Providers

The pet insurance market is highly competitive, with numerous providers offering no waiting period policies. To make an informed decision, compare multiple providers based on the following criteria:

- Coverage Options: Evaluate the range of coverage options each provider offers, including accident-only, accident & illness, and routine care coverage.

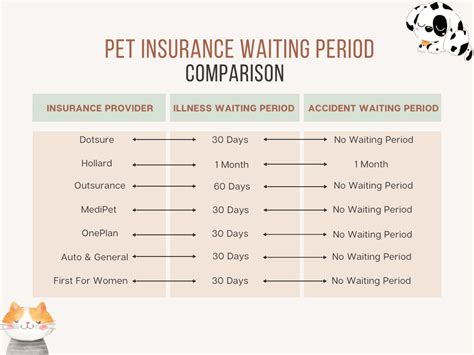

- Waiting Periods: While the focus is on no waiting period policies, it's still essential to understand any waiting periods that may apply to specific conditions or treatments.

- Pricing and Discounts: Compare the premiums and any available discounts or promotions. Some providers offer discounts for multiple pets or for enrolling early.

- Claim Process: Research the claim process and customer service reputation of each provider. A seamless and efficient claim process can make a significant difference during times of need.

- Additional Services: Look for providers that offer additional services, such as 24/7 vet helplines, online claim submission, and pet loss support.

Real-Life Examples and Success Stories

No waiting period pet insurance policies have proven to be a lifesaver for many pet owners. Here are a few real-life examples and success stories:

Case Study 1: Bella’s Cruciate Surgery

Bella, a 7-year-old Labrador Retriever, was diagnosed with a torn cruciate ligament. Her owners, aware of the high cost of surgery, decided to enroll her in a no waiting period pet insurance policy. The policy covered the entire surgery and post-operative care, allowing Bella to receive the necessary treatment without financial strain.

Case Study 2: Max’s Allergy Treatment

Max, a 4-year-old Golden Retriever, developed severe allergies, requiring ongoing medication and specialized diets. His owners enrolled him in a no waiting period policy that covered his allergy treatment, providing relief for both Max and his owners, who no longer had to worry about the financial burden of managing his condition.

Case Study 3: Lucy’s Emergency Surgery

Lucy, a 2-year-old cat, suffered a severe injury after being hit by a car. Her owners, who had recently enrolled her in a no waiting period policy, were able to get her the immediate surgery she needed. The policy covered the emergency procedure, saving Lucy’s life and giving her a second chance at a happy and healthy life.

The Future of Pet Insurance

The pet insurance industry is continuously evolving, and the introduction of no waiting period policies is a significant step forward. As more pet owners become aware of the benefits of immediate coverage, we can expect to see further innovations in the industry. Here are some potential future developments:

- Customizable Coverage: Pet insurance providers may offer even more personalized coverage options, allowing pet owners to tailor policies to their pets' unique needs and lifestyles.

- Enhanced Technology: Advances in technology may lead to more efficient claim processes, with digital platforms and mobile apps making it easier for pet owners to manage their policies and submit claims.

- Wellness Incentives: Some providers may introduce incentives for pet owners who focus on preventive care and wellness, encouraging responsible pet ownership and potentially reducing overall veterinary costs.

- Integration with Veterinary Care: Pet insurance companies may collaborate more closely with veterinary practices, offering integrated solutions that streamline the claim process and improve overall pet healthcare.

Frequently Asked Questions

Can I enroll my older pet in a no waiting period policy?

+

Yes, no waiting period policies are designed to accommodate pets of all ages, including older pets who may have pre-existing conditions. However, premiums for older pets may be higher due to increased health risks.

Are there any exclusions with no waiting period policies?

+

While no waiting period policies aim to provide comprehensive coverage, some exclusions may still apply. These can include pre-existing conditions diagnosed before the policy start date or specific exclusions listed in the policy terms.

Can I switch from a traditional policy to a no waiting period policy?

+

Yes, you can switch from a traditional policy to a no waiting period policy at any time. However, it’s essential to review the new policy’s terms and conditions to ensure seamless coverage and avoid any gaps in protection.

How do I choose the right coverage limits for my pet?

+

When selecting coverage limits, consider your pet’s age, breed, and health history. Higher limits provide more financial protection but may result in higher premiums. It’s a balance between your budget and your pet’s needs.

Are there any discounts available for no waiting period policies?

+

Yes, many pet insurance providers offer discounts for no waiting period policies. These can include multi-pet discounts, early enrollment discounts, or loyalty rewards. Be sure to inquire about available discounts when comparing policies.

No waiting period pet insurance policies offer a valuable solution for pet owners seeking immediate coverage and peace of mind. By eliminating traditional waiting periods, these policies provide comprehensive protection for your furry companions, ensuring their health and well-being are always a top priority. With a wide range of options and customizable coverage, pet owners can find the perfect policy to suit their pets’ unique needs and budgets.