Cats Insurance

Cats are beloved companions for many individuals and families worldwide, and just like humans, they can experience unexpected health issues and accidents. To safeguard these furry friends and ensure they receive the best veterinary care, cat insurance has become an increasingly popular option for pet owners. This comprehensive guide aims to delve into the world of cat insurance, exploring its benefits, coverage options, and how it can provide peace of mind to cat enthusiasts.

Understanding Cat Insurance

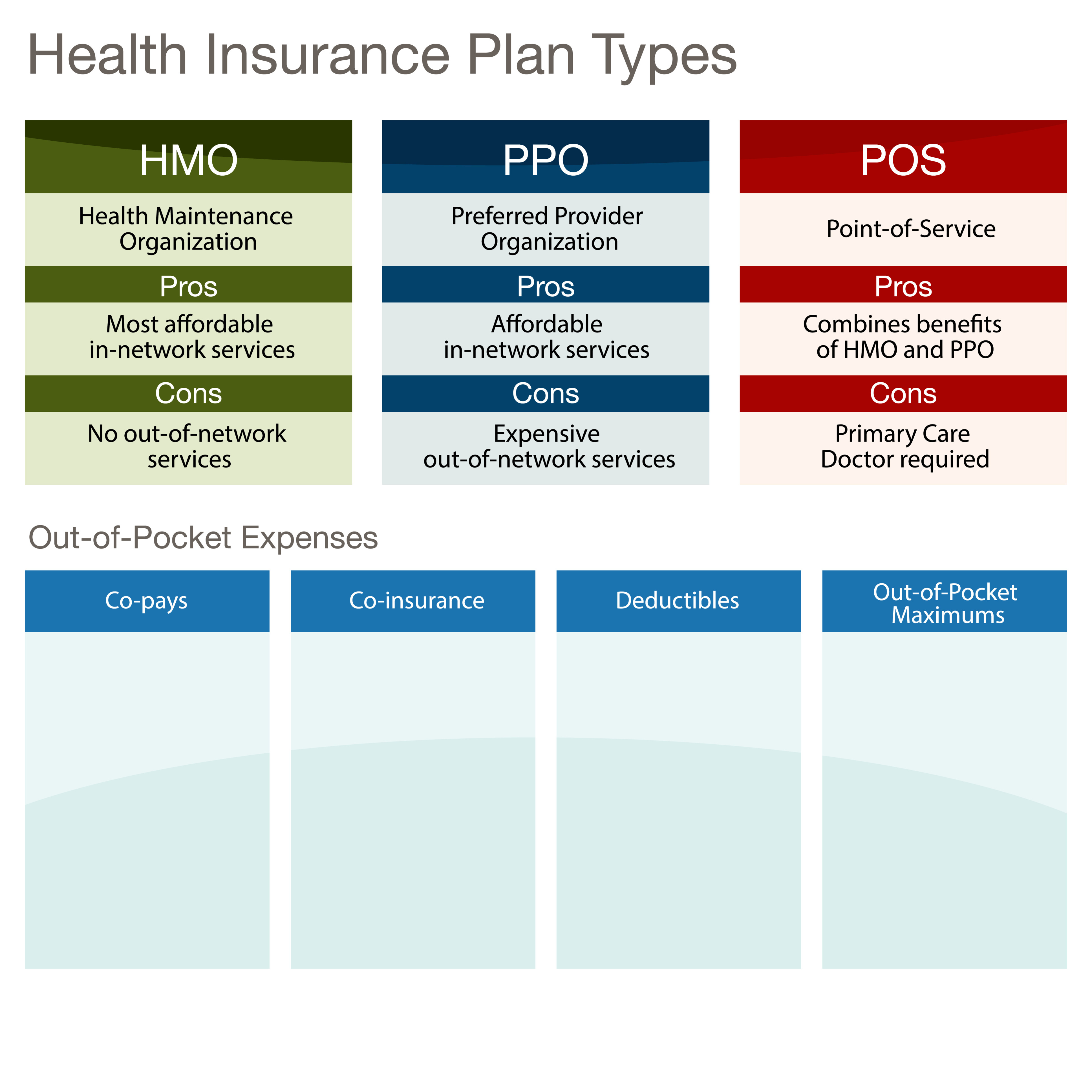

Cat insurance is a type of pet insurance specifically designed to cover the veterinary costs associated with cats. It functions similarly to human health insurance, providing financial protection against unexpected medical expenses. By paying a monthly premium, cat owners can access a range of benefits and ensure their feline companions receive the necessary care without incurring significant financial burdens.

The concept of pet insurance gained traction in the late 20th century, initially starting with dog insurance. However, as the understanding of the unique health needs of cats grew, cat-specific insurance policies became available. These policies are tailored to address the common ailments and injuries that cats may encounter throughout their lives.

Benefits of Cat Insurance

- Financial Security: Cat insurance offers a safety net for unexpected veterinary expenses. It can provide coverage for accidents, illnesses, and even routine procedures, ensuring that cat owners can make decisions based on their pet’s well-being rather than financial constraints.

- Access to Quality Care: With insurance, cat owners have the freedom to choose the best veterinary facilities and specialists for their pets. This ensures that cats receive timely and expert treatment, potentially leading to better health outcomes.

- Peace of Mind: Knowing that your cat is insured can alleviate stress and worry. Cat owners can focus on their pet’s recovery and well-being without the added pressure of financial concerns.

- Preventive Care: Many cat insurance policies cover routine vaccinations, check-ups, and preventive treatments, encouraging regular veterinary visits and early detection of potential health issues.

Coverage Options

Cat insurance policies offer a variety of coverage options to cater to different needs and budgets. The specific coverage can vary between insurance providers, but here are some common types of coverage:

| Coverage Type | Description |

|---|---|

| Accident-Only Coverage | Provides coverage for injuries resulting from accidents, such as falls, car collisions, or ingestion of foreign objects. This type of coverage is often more affordable but may not cover illnesses. |

| Accident and Illness Coverage | Offers comprehensive protection, covering both accidents and a wide range of illnesses. This is the most extensive type of coverage, ensuring peace of mind for pet owners. |

| Wellness Plans | These plans cover routine care, including vaccinations, flea and tick treatments, spaying/neutering, and annual check-ups. Wellness plans can be a cost-effective way to manage regular veterinary expenses. |

| Emergency Care | Some policies provide specific coverage for emergency situations, ensuring that urgent veterinary care is accessible without significant financial impact. |

| Prescription Medications | Certain policies cover the cost of prescription medications, which can be a significant expense for long-term treatments. |

Choosing the Right Policy

When selecting a cat insurance policy, it’s crucial to consider factors such as the cat’s age, breed, and pre-existing conditions. Older cats or those with known health issues may require more extensive coverage, while younger, healthier cats might benefit from more affordable options.

Additionally, pet owners should compare the annual deductible, reimbursement rates, and any exclusions listed in the policy. Some policies may have limitations on certain procedures or conditions, so it's essential to read the fine print and understand the coverage thoroughly.

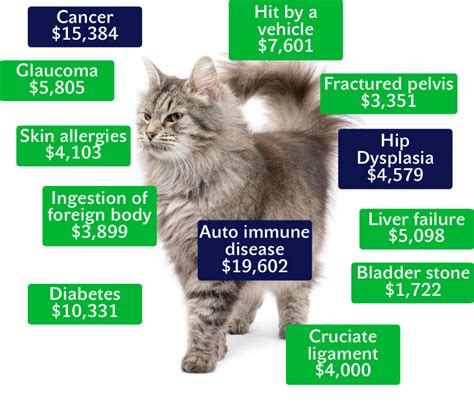

Real-Life Examples of Cat Insurance Claims

To illustrate the impact of cat insurance, let’s explore a few real-life scenarios where cat insurance proved to be a lifesaver:

Case Study 1: Feline Emergency

Meet Luna, a curious 3-year-old tabby cat who ventured too close to a hot stove, resulting in severe burns on her paws. Luna’s owners, who had purchased accident-only coverage, were relieved to discover that her insurance policy covered the emergency veterinary treatment she required. The insurance provider reimbursed them for the cost of the emergency room visit, surgery, and post-operative care, ensuring Luna received the best possible treatment without financial strain.

Case Study 2: Chronic Condition Management

Max, an 8-year-old Siamese cat, was diagnosed with chronic kidney disease. His owners had opted for accident and illness coverage with a wellness plan. This comprehensive policy covered Max’s regular check-ups, blood tests, and specialized diet. With the support of insurance, Max’s owners could provide him with the necessary ongoing care, ensuring his condition was well-managed and giving him a high quality of life.

Case Study 3: Unexpected Illness

Whiskers, a 5-year-old Persian cat, developed pancreatitis, a serious and costly condition. His owners, who had chosen a policy with high reimbursement rates, were grateful for the financial assistance. The insurance covered the majority of the expenses for Whiskers’ hospitalization, medication, and follow-up care, allowing him to recover fully.

Performance Analysis and Industry Insights

The cat insurance market has experienced significant growth over the past decade, with an increasing number of providers offering specialized policies. According to a recent industry report, the global pet insurance market, including cat insurance, is projected to reach $12.5 billion by 2026, reflecting the growing awareness and acceptance of pet insurance among pet owners.

Key trends in the cat insurance industry include:

- Increasing Focus on Preventive Care: Insurance providers are recognizing the importance of preventive measures in maintaining cat health. Many policies now offer incentives for routine check-ups and vaccinations.

- Personalized Coverage: Cat insurance policies are becoming more customizable, allowing pet owners to tailor coverage to their cat's specific needs and budget.

- Digital Innovations: Insurance companies are leveraging technology to enhance the customer experience. Online portals and mobile apps provide policyholders with easy access to their coverage details and claim status.

- Veterinary Collaboration: Some insurance providers are partnering with veterinary practices to offer discounted rates or specialized care packages, further benefiting pet owners.

Future Implications and Industry Developments

As the cat insurance industry continues to evolve, several trends and developments are worth noting:

Genetic Testing and Personalized Medicine

Advancements in genetic testing for cats are expected to play a significant role in the future of cat insurance. By identifying genetic predispositions to certain diseases, insurance providers may offer more tailored coverage options. Additionally, personalized medicine approaches could lead to more effective and targeted treatments, further improving the health outcomes for insured cats.

Telemedicine and Remote Care

The rise of telemedicine in the veterinary field has the potential to revolutionize cat insurance. With remote consultations and diagnostics, cat owners may have easier access to veterinary care, reducing the need for in-person visits and potentially lowering insurance costs.

Wellness Programs and Lifestyle Factors

Insurance providers are likely to place greater emphasis on cat wellness and lifestyle factors. Incentives for weight management, nutrition, and exercise could become more common, encouraging pet owners to adopt healthier lifestyles for their cats.

Data-Driven Insights

The collection and analysis of large-scale data from insured cats can provide valuable insights into feline health trends. This data-driven approach can inform insurance policies, leading to more accurate risk assessments and potentially reducing premiums for certain demographics.

Conclusion

Cat insurance offers a valuable solution for cat owners, providing financial protection and access to quality veterinary care. With a wide range of coverage options and the potential for significant savings, it’s an appealing choice for those who want to ensure the best possible care for their feline companions. As the industry continues to innovate and adapt, cat insurance is set to play an even more integral role in the lives of cat enthusiasts worldwide.

What is the average cost of cat insurance per month?

+

The cost of cat insurance can vary depending on factors such as the cat’s age, breed, and the level of coverage chosen. On average, basic accident-only coverage can start at around 10 per month, while comprehensive accident and illness coverage may range from 20 to $50 per month. It’s important to compare quotes from different providers to find the best fit for your budget and your cat’s needs.

Does cat insurance cover pre-existing conditions?

+

Most cat insurance policies do not cover pre-existing conditions, which are defined as health issues that were present or showing symptoms before the insurance policy was purchased. However, some providers offer policies that exclude pre-existing conditions for a waiting period, after which they may be covered. It’s crucial to review the policy terms and understand the coverage for pre-existing conditions before purchasing.

How do I choose the right cat insurance provider?

+

When selecting a cat insurance provider, consider factors such as their reputation, financial stability, customer reviews, and the level of coverage they offer. Look for providers with a track record of prompt claim processing and good customer service. Additionally, compare the coverage options, deductibles, and reimbursement rates to find the best fit for your cat’s needs and your budget.