Homeowners Insurance

Homeowners insurance is a vital aspect of protecting one's most significant investment - their home. It provides financial security and peace of mind, ensuring homeowners are covered for various unforeseen events that could cause significant damage or loss. In this comprehensive guide, we will delve into the world of homeowners insurance, exploring its intricacies, benefits, and the key considerations every homeowner should make to secure the right coverage.

Understanding Homeowners Insurance: The Essential Coverage

Homeowners insurance, often referred to as home insurance, is a policy that safeguards a homeowner against a range of perils, including fire, theft, vandalism, and natural disasters like hurricanes, tornadoes, and earthquakes. It is a comprehensive protection plan designed to cover the cost of repairs or replacements for the insured property and its contents.

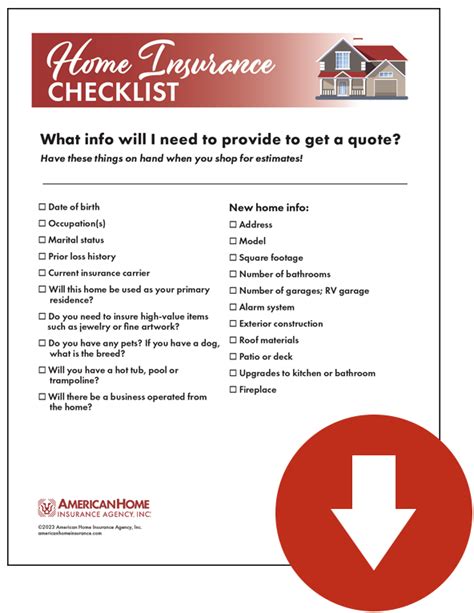

The primary components of a homeowners insurance policy typically include:

- Dwelling Coverage: This covers the physical structure of the home, including walls, roofs, and permanent fixtures.

- Personal Property Coverage: Protects the homeowner's belongings, such as furniture, electronics, and clothing.

- Liability Coverage: Provides financial protection in case a guest or passerby is injured on the insured property.

- Additional Living Expenses (ALE): Covers temporary living expenses if the home becomes uninhabitable due to a covered loss.

It's important to note that homeowners insurance policies can vary significantly, and the level of coverage depends on the specific policy and the provider. Understanding these variations is crucial to choosing the right policy for one's needs.

Key Factors Influencing Homeowners Insurance Premiums

The cost of homeowners insurance, known as the premium, can vary greatly depending on several factors. These factors are considered by insurance providers to assess the risk associated with insuring a particular home and its occupants. Some of the key considerations include:

Location and Climate

The geographic location of a home plays a significant role in determining insurance premiums. Areas prone to natural disasters like hurricanes, tornadoes, or earthquakes often carry higher premiums due to the increased risk of damage. Similarly, regions with a high crime rate may also result in higher insurance costs.

Home Construction and Age

The construction materials and age of a home can impact insurance rates. Homes built with modern, fire-resistant materials or those equipped with advanced security systems may qualify for lower premiums. Conversely, older homes or those constructed with outdated materials may face higher insurance costs.

Personal Factors

Individual factors, such as the homeowner’s age, occupation, and credit score, can also influence insurance premiums. Some insurance providers offer discounts for certain professions or for homeowners with excellent credit histories.

Coverage Limits and Deductibles

The amount of coverage chosen by the homeowner, known as the coverage limit, directly affects the premium. Higher coverage limits typically result in higher premiums. Additionally, the deductible, which is the amount the homeowner must pay out of pocket before the insurance coverage kicks in, can also impact the premium. Opting for a higher deductible may lower the premium, but it means the homeowner will have to pay more in the event of a claim.

Additional Coverage Options and Endorsements

Beyond the standard coverage offered by homeowners insurance policies, there are additional options and endorsements available to cater to specific needs. These include:

Flood Insurance

Standard homeowners insurance policies typically do not cover damage caused by floods. For homeowners in flood-prone areas, purchasing separate flood insurance is essential. This coverage can be obtained through the National Flood Insurance Program (NFIP) or private insurance providers.

Earthquake Insurance

Similarly, earthquake insurance is often not included in standard homeowners policies. For homeowners in earthquake-prone regions, this additional coverage can provide vital protection against the devastating effects of seismic activity.

Personal Property Endorsements

Homeowners may opt for personal property endorsements to increase the coverage limits for specific valuable items, such as jewelry, artwork, or collectibles. These endorsements provide extra protection for items that may exceed the standard coverage limits.

Water Backup Coverage

Water backup coverage protects against damage caused by water backup through sewers or drains. This coverage is particularly important for homes with basements or those in areas prone to heavy rainfall or flooding.

Filing a Homeowners Insurance Claim: The Process

In the event of a covered loss, homeowners can file an insurance claim to seek financial assistance for repairs or replacements. The claims process typically involves the following steps:

- Assess the Damage: Conduct a thorough assessment of the damage and document it with photos or videos.

- Contact the Insurance Provider: Notify your insurance company about the loss as soon as possible. Provide them with the necessary details and any relevant documentation.

- Wait for the Claims Adjuster: An insurance claims adjuster will be assigned to evaluate the extent of the damage and determine the value of the claim.

- Provide Additional Information: Cooperate with the adjuster and provide any additional information or documentation they may require.

- Receive the Claim Settlement: Once the claim is approved, the insurance provider will issue a settlement, either as a direct payment or through a repair contractor.

It's important to note that the claims process can vary depending on the insurance provider and the nature of the loss. Homeowners should review their policy and understand the specific claims process outlined by their insurer.

The Future of Homeowners Insurance: Trends and Innovations

The homeowners insurance industry is continuously evolving, driven by technological advancements and changing consumer needs. Some key trends and innovations shaping the future of homeowners insurance include:

Digitalization and Telematics

Insurance providers are increasingly leveraging technology to streamline the insurance process. This includes the use of telematics devices to monitor and analyze home conditions, such as water usage, temperature, and humidity levels. These devices can help identify potential risks and provide real-time alerts, allowing homeowners to take preventive measures.

Artificial Intelligence and Machine Learning

AI and machine learning algorithms are being utilized to analyze vast amounts of data, enabling insurance providers to make more accurate risk assessments and pricing decisions. These technologies can also enhance the claims process by automating certain tasks and improving overall efficiency.

Personalized Coverage Options

The traditional one-size-fits-all approach to homeowners insurance is giving way to more personalized coverage options. Insurance providers are offering tailored policies that consider individual homeowner needs and preferences, allowing for greater flexibility and customization.

Sustainable and Green Initiatives

With growing environmental awareness, insurance providers are increasingly offering incentives for homeowners who adopt sustainable practices. This includes discounts for homes equipped with energy-efficient systems or for those who implement eco-friendly renovations.

What is the difference between homeowners insurance and home warranty coverage?

+Homeowners insurance covers damage caused by unforeseen events, such as fires, storms, or theft. It provides financial protection for the home’s structure and its contents. On the other hand, a home warranty covers the repair or replacement of specific home systems and appliances. While homeowners insurance is essential for protecting against unforeseen damages, a home warranty can provide additional peace of mind by covering the cost of repairs for everyday wear and tear.

Can I customize my homeowners insurance policy to suit my specific needs?

+Absolutely! Homeowners insurance policies can be tailored to meet individual needs. You can choose the coverage limits for your home’s structure, personal belongings, and liability. Additionally, you can opt for specific endorsements to enhance your coverage, such as flood insurance or coverage for valuable items like jewelry or artwork.

How often should I review my homeowners insurance policy?

+It is recommended to review your homeowners insurance policy annually. This ensures that your coverage remains up-to-date and aligned with your current needs. Life changes, such as renovations, additions to your home, or acquiring valuable possessions, may require adjustments to your policy. Regular reviews also provide an opportunity to explore potential discounts or new coverage options offered by your insurance provider.