Insurance For Liability

In today's complex and dynamic world, the importance of insurance coverage, particularly liability insurance, cannot be overstated. Liability insurance serves as a vital safeguard, protecting individuals and businesses from the financial fallout of unexpected events and legal claims. It plays a pivotal role in ensuring stability and peace of mind in an uncertain environment. This comprehensive guide aims to delve into the intricacies of liability insurance, shedding light on its diverse forms, benefits, and the critical role it plays in risk management.

Understanding Liability Insurance

Liability insurance is a specialized form of coverage designed to protect policyholders from financial losses arising from claims of negligence or harm caused to others. It serves as a financial safety net, providing coverage for legal defense costs, settlements, and damages awarded in lawsuits. The fundamental purpose of liability insurance is to mitigate the financial risks associated with potential legal liabilities, ensuring that policyholders can navigate unexpected legal challenges with minimal financial strain.

The Importance of Tailored Liability Coverage

The significance of liability insurance extends beyond a mere legal requirement; it is a strategic tool for risk management. Every individual and business faces unique risks, and a tailored liability insurance plan is essential to address these specific concerns. For instance, a professional in the medical field might require medical malpractice insurance, while a business owner might prioritize product liability insurance. This personalized approach ensures that the coverage aligns perfectly with the potential risks and exposures of the policyholder.

Types of Liability Insurance

Liability insurance is a diverse category, offering a range of specialized policies to address different risks. Here’s an overview of some common types of liability insurance:

General Liability Insurance

General liability insurance is a cornerstone for many businesses and professionals. It provides broad coverage for a range of common risks, including bodily injury, property damage, and advertising injuries. This policy is particularly valuable for businesses that interact with the public, as it protects against slips and falls, product defects, and other common hazards.

Professional Liability Insurance (E&O)

Professional liability insurance, also known as Errors and Omissions (E&O) insurance, is designed to protect professionals from claims of negligence, errors, or omissions in their work. This policy is crucial for professionals in fields like medicine, law, accounting, and consulting, where mistakes can lead to significant financial liabilities.

Product Liability Insurance

Product liability insurance is essential for manufacturers, distributors, and sellers of goods. It provides coverage for bodily injury or property damage caused by a defective product. This policy is a critical safeguard against the potential financial consequences of product recalls, lawsuits, and other product-related incidents.

Cyber Liability Insurance

In an era of increasing cyber threats, cyber liability insurance has become a necessity. This policy protects businesses and individuals from the financial fallout of cyber attacks, data breaches, and other online security incidents. It covers legal fees, data recovery costs, and potential damages arising from such events.

Umbrella Liability Insurance

Umbrella liability insurance is an additional layer of protection that sits on top of existing liability policies. It provides excess liability coverage, kicking in when the limits of other policies are reached. This policy is particularly beneficial for individuals and businesses with significant assets to protect.

The Benefits of Liability Insurance

The advantages of liability insurance are multifaceted and extend beyond the obvious financial protection. Here are some key benefits that liability insurance offers:

- Financial Protection: Liability insurance safeguards policyholders from potentially devastating financial losses resulting from legal claims.

- Peace of Mind: With liability insurance in place, individuals and businesses can operate with confidence, knowing they are protected from unexpected liabilities.

- Legal Defense: Liability insurance often covers the cost of legal defense, ensuring policyholders have access to expert legal representation.

- Damage and Settlement Coverage: In the event of a claim, liability insurance provides coverage for damages awarded or settlements reached.

- Risk Management: By identifying and addressing potential risks, liability insurance serves as a proactive tool for risk management.

How Liability Insurance Works

Liability insurance operates through a claims process that is designed to be straightforward and efficient. When a claim is made against a policyholder, the insurance company steps in to handle the legal and financial aspects of the claim. This process typically involves the following steps:

- Notification: The policyholder promptly notifies the insurance company of the claim.

- Investigation: The insurance company investigates the claim to assess its validity and potential financial impact.

- Legal Defense: If necessary, the insurance company provides legal defense services to protect the policyholder's interests.

- Negotiation and Settlement: The insurance company negotiates with the claimant to reach a fair settlement, ensuring the policyholder's interests are protected.

- Coverage and Payment: If the claim is valid and covered by the policy, the insurance company provides the necessary financial coverage to the policyholder.

Choosing the Right Liability Insurance

Selecting the appropriate liability insurance policy is a critical decision that requires careful consideration. Here are some key factors to keep in mind when choosing liability insurance:

- Risk Assessment: Conduct a thorough risk assessment to identify the specific liabilities and exposures unique to your situation.

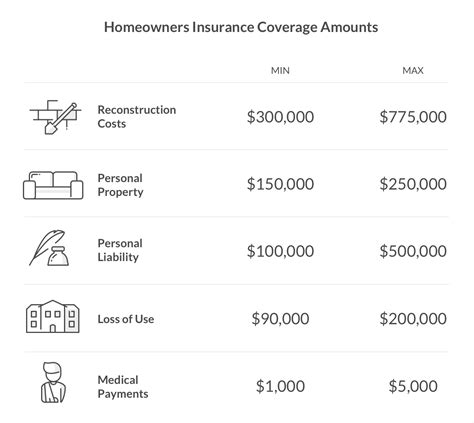

- Coverage Limits: Ensure that the policy's coverage limits are sufficient to protect your assets and financial interests.

- Policy Exclusions: Carefully review the policy's exclusions to understand what is not covered.

- Claims Process: Familiarize yourself with the insurance company's claims process to ensure it aligns with your expectations.

- Cost and Premiums: Evaluate the policy's cost and premiums, ensuring they are affordable and provide adequate coverage.

Real-World Examples of Liability Claims

Liability claims can arise from a multitude of situations, impacting individuals and businesses alike. Here are some real-world examples to illustrate the importance of liability insurance:

Medical Malpractice

A medical professional faces a malpractice claim after a patient experiences complications following a routine procedure. The patient seeks significant financial compensation, and the medical professional relies on their liability insurance to cover legal fees and potential damages.

Product Recall

A manufacturing company discovers a defect in one of its products, leading to a widespread recall. The company’s product liability insurance steps in to cover the costs of the recall, including legal fees and potential damages to consumers.

Slip and Fall

A customer slips and falls in a retail store, sustaining injuries. The store’s general liability insurance provides coverage for the customer’s medical expenses and potential legal costs.

Data Breach

A small business experiences a data breach, exposing sensitive customer information. The business’s cyber liability insurance covers the cost of data recovery, legal fees, and potential damages to affected individuals.

The Future of Liability Insurance

The landscape of liability insurance is evolving, driven by changing risks and emerging technologies. As the world becomes increasingly interconnected, the potential for new liabilities continues to grow. Here are some key trends and considerations for the future of liability insurance:

- Cybersecurity Risks: With the rise of digital technologies, cyber liability insurance is expected to play an increasingly prominent role in risk management.

- Environmental Concerns: As environmental regulations become more stringent, liability insurance will need to address the risks associated with environmental damage and pollution.

- Product Liability: The complexity of product design and manufacturing processes will continue to drive the need for robust product liability insurance.

- Professional Services: The growth of the gig economy and the increasing demand for professional services will lead to a greater emphasis on professional liability insurance.

- Risk Assessment Tools: Advanced risk assessment tools and data analytics will play a crucial role in tailoring liability insurance policies to specific risks.

Conclusion

Liability insurance is a vital component of risk management, providing financial protection and peace of mind in an uncertain world. By understanding the diverse types of liability insurance and the benefits they offer, individuals and businesses can make informed decisions to safeguard their interests. As risks evolve, staying abreast of emerging trends and adapting insurance strategies will be key to effective risk management.

What is the average cost of liability insurance?

+The cost of liability insurance varies widely depending on factors such as the type of coverage, the level of risk, and the policyholder’s specific needs. On average, general liability insurance for small businesses can range from 500 to 1,000 per year, while professional liability insurance can cost between 500 and 2,000 annually. However, these are just estimates, and the actual cost can be higher or lower based on individual circumstances.

Can liability insurance cover intentional acts or criminal activities?

+Liability insurance typically excludes coverage for intentional acts or criminal activities. These types of actions are generally not covered as they are considered to be outside the scope of standard liability insurance policies. However, there may be exceptions or specific endorsements available to provide limited coverage for certain intentional acts.

How long does it take to process a liability insurance claim?

+The time it takes to process a liability insurance claim can vary depending on several factors, including the complexity of the claim, the cooperation of all parties involved, and the insurance company’s internal processes. On average, it can take anywhere from a few weeks to several months for a liability claim to be resolved. It’s important to promptly notify your insurance company of the claim and provide all necessary information to expedite the process.