Auto Progressive Insurance

In the dynamic landscape of the insurance industry, Auto Progressive Insurance stands out as a pioneering force, offering innovative coverage solutions tailored to the evolving needs of modern drivers. This comprehensive guide aims to delve into the intricacies of Auto Progressive Insurance, shedding light on its unique features, benefits, and impact on the industry. As we navigate the complex world of automotive insurance, understanding the nuances of Auto Progressive Insurance becomes crucial for both consumers and industry professionals alike.

The Evolution of Auto Insurance: Introducing Auto Progressive Insurance

The traditional auto insurance model has long been centered around static policies, where coverage remains unchanged over the policy period. However, with the rapid advancements in technology and the changing dynamics of vehicle ownership and usage, there emerged a need for a more dynamic and flexible insurance solution.

Enter Auto Progressive Insurance, a revolutionary concept designed to address the limitations of conventional auto insurance. This forward-thinking approach introduces a new era of insurance, one that adapts to the evolving nature of modern driving experiences.

The Core Principles of Auto Progressive Insurance

At its core, Auto Progressive Insurance operates on the principle of adaptability. It recognizes that driving behaviors, vehicle usage, and individual needs can vary significantly over time. By embracing this variability, Auto Progressive Insurance offers a more personalized and responsive insurance experience.

One of the key features of Auto Progressive Insurance is its ability to adjust coverage levels based on real-time data. This data-driven approach ensures that policyholders are not overinsured or underinsured, providing a more cost-effective and tailored insurance solution.

| Dynamic Coverage | Personalized Risk Assessment |

|---|---|

| Adjusts coverage based on driving behavior and vehicle usage. | Uses advanced analytics to assess individual risk profiles accurately. |

For instance, policyholders who drive less frequently or exhibit safer driving behaviors may benefit from reduced premiums, while those with higher-risk profiles can access more comprehensive coverage options.

Technology Integration: The Backbone of Auto Progressive Insurance

The success of Auto Progressive Insurance heavily relies on the integration of cutting-edge technology. Advanced telematics systems, connected car technologies, and data analytics play pivotal roles in shaping the insurance experience.

Telematics devices, for example, provide real-time data on driving behaviors, such as speed, acceleration, and braking patterns. This data is then analyzed to assess the policyholder’s risk profile and adjust coverage accordingly.

Additionally, connected car technologies enable direct communication between the vehicle and the insurance provider, facilitating a seamless exchange of data and real-time updates.

| Telematics Devices | Connected Car Technologies |

|---|---|

| Collects driving behavior data. | Enables vehicle-to-insurance communication. |

| Analyzes data for risk assessment. | Facilitates real-time data exchange. |

By leveraging these technological advancements, Auto Progressive Insurance not only enhances the accuracy of risk assessment but also empowers policyholders with a more transparent and interactive insurance experience.

The Benefits of Auto Progressive Insurance: A Comprehensive Overview

Auto Progressive Insurance offers a plethora of advantages that set it apart from traditional auto insurance models. These benefits extend beyond mere cost savings, providing a more holistic and tailored insurance solution.

Personalized Coverage: Meeting Individual Needs

One of the most significant advantages of Auto Progressive Insurance is its ability to provide personalized coverage. By analyzing individual driving behaviors and risk profiles, this insurance model ensures that policyholders receive coverage tailored to their specific needs.

For example, a driver who primarily uses their vehicle for short, urban commutes may require different coverage than someone who frequently embarks on long-distance road trips. Auto Progressive Insurance takes these nuances into account, offering customized coverage options that align with each policyholder’s unique driving patterns.

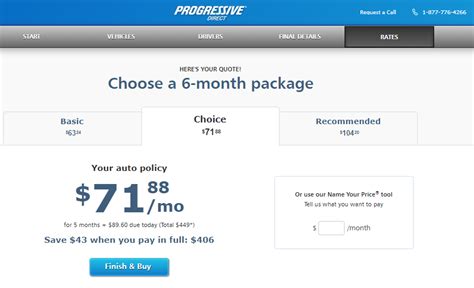

Cost Efficiency: Paying for What You Need

Traditional auto insurance often results in policyholders paying for coverage they may not fully utilize. Auto Progressive Insurance addresses this issue by dynamically adjusting coverage levels based on real-time data.

Policyholders who consistently exhibit safe driving behaviors and low-risk profiles may qualify for reduced premiums, while those with higher-risk profiles can opt for more comprehensive coverage without paying for unnecessary add-ons.

This cost-efficient approach ensures that policyholders are not overcharged for insurance, making Auto Progressive Insurance a more financially prudent choice.

Real-Time Updates: Staying Ahead of the Curve

The dynamic nature of Auto Progressive Insurance means that policyholders are not locked into static coverage for an entire policy period. Instead, coverage can be adjusted in real-time to reflect changes in driving behaviors or vehicle usage.

For instance, if a policyholder upgrades their vehicle or starts commuting longer distances, Auto Progressive Insurance can quickly adapt to these changes, ensuring that coverage remains adequate and up-to-date.

This real-time update feature provides policyholders with a sense of security, knowing that their insurance coverage is always aligned with their current driving circumstances.

Data-Driven Insights: Empowering Policyholders

Auto Progressive Insurance leverages the power of data analytics to provide policyholders with valuable insights into their driving behaviors and risk profiles.

Through user-friendly interfaces and personalized reports, policyholders can access real-time data on their driving patterns, including speed, acceleration, braking, and even potential areas for improvement.

This data-driven approach not only enhances the transparency of the insurance process but also empowers policyholders to make informed decisions about their driving habits and insurance coverage.

The Impact of Auto Progressive Insurance: Shaping the Industry

The introduction of Auto Progressive Insurance has had a profound impact on the insurance industry, driving innovation and challenging traditional models.

Industry Disruption: Paving the Way for Change

Auto Progressive Insurance has disrupted the status quo of the insurance industry, forcing providers to reevaluate their approaches and embrace technological advancements.

The success of this innovative model has sparked a wave of competition, with traditional insurance providers racing to adopt similar dynamic insurance solutions to stay relevant in the market.

This disruption has led to a more dynamic and competitive insurance landscape, ultimately benefiting consumers with a wider range of insurance options and improved services.

Enhanced Risk Assessment: Precision and Accuracy

Auto Progressive Insurance’s reliance on real-time data and advanced analytics has revolutionized the way risk is assessed in the insurance industry.

By analyzing a wealth of data points, including driving behaviors, vehicle usage, and external factors, insurance providers can now assess risk with unprecedented precision.

This enhanced risk assessment capability not only improves the accuracy of insurance premiums but also enables more targeted risk management strategies, benefiting both policyholders and insurance providers.

Promoting Safe Driving: A Win-Win Scenario

Auto Progressive Insurance’s focus on personalized coverage and data-driven insights has inadvertently promoted safer driving behaviors among policyholders.

By providing real-time feedback and incentives for safe driving, this insurance model encourages policyholders to adopt more cautious driving habits, leading to reduced accident rates and improved road safety.

This win-win scenario not only benefits individual policyholders but also contributes to a safer driving culture overall, benefiting the broader community.

The Future of Auto Progressive Insurance: Trends and Predictions

As the insurance industry continues to evolve, Auto Progressive Insurance is poised to play a pivotal role in shaping the future of automotive insurance.

Expanding Coverage Options: Meeting Emerging Needs

With the rapid advancements in automotive technology, such as electric vehicles and autonomous driving, the insurance industry must adapt to meet the emerging needs of these new vehicle types.

Auto Progressive Insurance is well-positioned to expand its coverage options to include specialized policies for electric and autonomous vehicles, ensuring that policyholders have access to comprehensive coverage tailored to these innovative technologies.

Integrating AI and Machine Learning: Enhancing Precision

The integration of Artificial Intelligence (AI) and Machine Learning (ML) is set to revolutionize the precision and efficiency of Auto Progressive Insurance.

AI-powered analytics can further enhance risk assessment, predicting potential risks with even greater accuracy. ML algorithms can learn from vast datasets, identifying patterns and trends that traditional analytics may overlook.

By harnessing the power of AI and ML, Auto Progressive Insurance can continue to refine its coverage and pricing models, providing an even more tailored and cost-effective insurance experience.

Collaborative Insurance Models: A New Paradigm

The future of Auto Progressive Insurance may also involve collaborative models, where insurance providers work together to pool resources and share data.

By collaborating, insurance providers can leverage each other’s strengths and expertise, leading to more efficient risk management and improved coverage options for policyholders.

This collaborative approach could foster a more unified and innovative insurance ecosystem, benefiting both insurance providers and policyholders alike.

Embracing Sustainability: Greener Insurance Solutions

As sustainability becomes an increasingly important factor in consumer decision-making, Auto Progressive Insurance is well-placed to incorporate eco-friendly initiatives into its coverage.

For example, policyholders who drive electric or hybrid vehicles, or who adopt eco-conscious driving behaviors, may be rewarded with reduced premiums or additional coverage benefits.

By encouraging environmentally friendly practices, Auto Progressive Insurance can contribute to a greener and more sustainable future, aligning with the values of environmentally conscious consumers.

How does Auto Progressive Insurance determine my coverage and premiums?

+Auto Progressive Insurance uses a combination of real-time driving data, historical data, and advanced analytics to assess your individual risk profile. This data is then used to determine your coverage levels and premiums. The more accurate and comprehensive the data, the more precise your coverage and pricing will be.

What happens if my driving behavior changes over time with Auto Progressive Insurance?

+Auto Progressive Insurance is designed to adapt to changes in your driving behavior. If your driving habits become safer or if your vehicle usage patterns change, your coverage and premiums can be adjusted accordingly. This ensures that you always have the right level of coverage at the most competitive price.

Are there any disadvantages to Auto Progressive Insurance compared to traditional auto insurance?

+While Auto Progressive Insurance offers numerous advantages, it’s important to consider that it may not be suitable for all drivers. Some drivers may prefer the simplicity and stability of traditional auto insurance. Additionally, Auto Progressive Insurance may require a certain level of technological integration, which could be a drawback for those who prefer a more traditional insurance experience.