Cheapest Car Insurance For Texas

When it comes to car insurance, Texans have a wide range of options to choose from, and finding the cheapest rates can be a challenging task. The good news is that with a bit of research and an understanding of the factors that influence insurance costs, you can secure affordable coverage for your vehicle. In this comprehensive guide, we'll delve into the world of car insurance in Texas, exploring the various factors that impact premiums, providing tips for obtaining the best rates, and highlighting the top insurance providers known for their affordability in the Lone Star State.

Understanding the Factors that Affect Car Insurance Rates in Texas

The cost of car insurance in Texas is influenced by several key factors. These include your personal details, such as age, gender, and driving history, as well as the type of vehicle you own, its make and model, and its usage. Additionally, the area in which you reside and park your car plays a significant role, as does the coverage level you opt for.

Insurance companies in Texas use these factors to assess the level of risk associated with insuring a particular driver. For instance, younger drivers, especially males under the age of 25, are often considered higher-risk and thus face higher premiums. Similarly, individuals with a history of accidents or traffic violations may be charged more for their insurance.

The type of vehicle you drive also matters. Sports cars and luxury vehicles, for example, tend to have higher insurance costs due to their increased risk of theft or higher repair costs. On the other hand, safer and more economical cars may attract more affordable rates.

The coverage level you choose is another crucial factor. While Texas requires all drivers to carry at least liability insurance, which covers damages to other people's property and injuries, you may opt for additional coverage types such as comprehensive and collision insurance. These provide protection for your own vehicle in the event of accidents, theft, or natural disasters, but they also come at a higher cost.

Top Affordable Car Insurance Providers in Texas

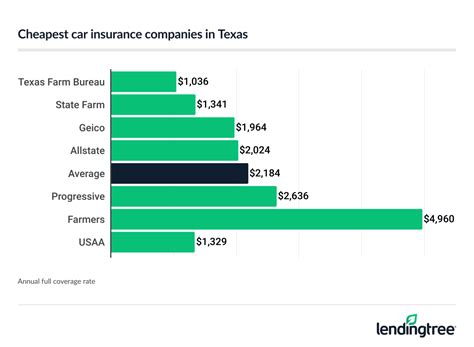

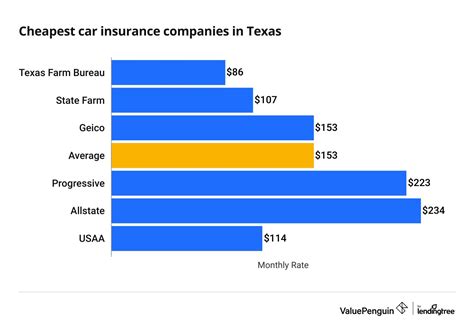

Texas is home to numerous insurance companies, each offering unique policies and rates. Here are some of the top providers known for their affordability:

Geico

Geico, one of the largest insurance companies in the United States, is renowned for its competitive rates. The company offers a wide range of coverage options and frequently provides discounts for good drivers, military personnel, and those who bundle their policies. Geico’s online platform also makes it easy to get a quote and manage your policy.

State Farm

State Farm is another major player in the insurance industry, known for its comprehensive coverage and competitive pricing. The company offers a variety of discounts, including those for students with good grades, safe drivers, and those who install anti-theft devices in their vehicles. State Farm also provides a range of additional services, such as roadside assistance and rental car reimbursement.

USAA

USAA specializes in providing insurance and financial services to military members, veterans, and their families. As such, they offer some of the most affordable rates in Texas for this specific demographic. USAA’s policies include a range of benefits and discounts, making them an excellent choice for those eligible for their services.

Progressive

Progressive is well-known for its innovative approach to insurance, offering a wide range of coverage options and discounts. The company’s Snapshot program, for instance, allows drivers to save on their premiums by installing a device that tracks their driving habits. Progressive also provides various other discounts, such as those for good students, safe drivers, and policy bundling.

Esurance

Esurance is an online insurance provider that offers a streamlined and convenient experience. They provide a range of coverage options and frequently offer discounts for policy bundling, good driving records, and safe vehicles. Esurance’s digital platform makes it easy to get a quote, manage your policy, and file claims.

| Insurance Provider | Average Annual Premium |

|---|---|

| Geico | $1,200 |

| State Farm | $1,350 |

| USAA | $950 |

| Progressive | $1,400 |

| Esurance | $1,150 |

Tips for Finding the Cheapest Car Insurance in Texas

Here are some strategies to help you secure the most affordable car insurance rates in Texas:

Shop Around

Compare quotes from multiple insurance providers to find the best deal. Each company uses different criteria to assess risk and set premiums, so getting quotes from several sources can help you identify the most affordable option.

Consider Bundling

If you have multiple vehicles or need other types of insurance, such as home or life insurance, consider bundling your policies with the same provider. Many insurance companies offer discounts when you purchase multiple policies from them.

Review Your Coverage

Regularly review your insurance policy to ensure you’re not overinsured or paying for coverage you don’t need. As your circumstances change, your insurance needs may also change. For instance, if you’ve paid off your car loan, you may no longer need comprehensive or collision coverage.

Maintain a Good Driving Record

A clean driving record can significantly impact your insurance rates. Avoid traffic violations and accidents to keep your premiums as low as possible. Some insurance companies even offer discounts for safe driving, so be sure to ask about these when getting quotes.

Increase Your Deductible

Consider increasing your deductible, which is the amount you pay out of pocket before your insurance kicks in. While this means you’ll pay more in the event of a claim, it can also lower your monthly premiums.

Take Advantage of Discounts

Insurance companies often offer a variety of discounts, such as those for good students, safe drivers, military personnel, and policy bundling. Be sure to ask about these discounts when getting quotes and consider how you can qualify for them.

Future Implications and Conclusion

The car insurance landscape in Texas is constantly evolving, with new providers entering the market and existing companies adjusting their rates and coverage options. As technology advances, we can expect to see more innovative approaches to insurance, such as usage-based insurance models and improved digital platforms for managing policies.

It's essential to stay informed about the latest trends and changes in the insurance industry to ensure you're getting the best value for your money. Regularly reviewing your insurance needs and comparing quotes can help you stay ahead of the curve and secure the most affordable coverage for your vehicle.

What is the average cost of car insurance in Texas?

+

The average cost of car insurance in Texas is around $1,500 per year. However, this can vary significantly depending on factors such as the driver’s age, driving history, vehicle type, and coverage level.

Do all car insurance providers offer the same coverage options in Texas?

+

No, each insurance provider offers a unique range of coverage options. It’s important to review these carefully to ensure you’re getting the level of protection you need at a price you can afford.

How often should I review my car insurance policy and rates?

+

It’s a good idea to review your car insurance policy and rates at least once a year, especially if your circumstances have changed. This way, you can ensure you’re still getting the best deal and have the coverage you need.