Lemonade Life Insurance

In the dynamic world of insurance, Lemonade stands out as a revolutionary force, challenging traditional models with a fresh approach to life insurance. This innovative company, born in the digital age, has crafted a unique business model that combines cutting-edge technology, a customer-centric philosophy, and a social mission, all while offering competitive life insurance policies. In this in-depth article, we'll explore the ins and outs of Lemonade Life Insurance, delving into its features, benefits, and the impact it's having on the insurance landscape.

The Lemonade Story: Disrupting the Insurance Industry

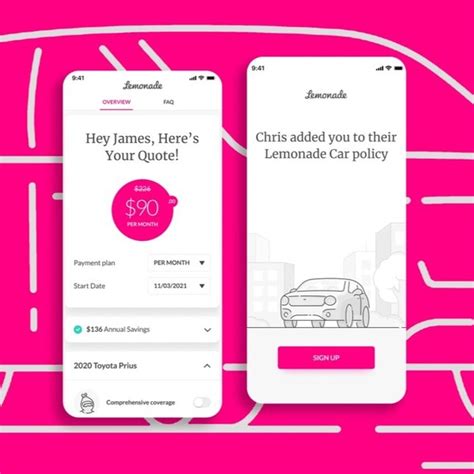

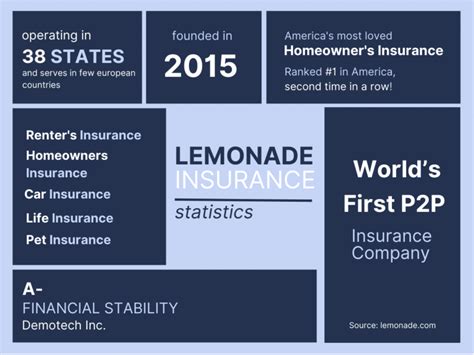

Lemonade, founded in 2015, is a tech-driven insurance company that has quickly gained recognition for its innovative business practices. With a mission to “make insurance simple, transparent, and fair,” Lemonade has disrupted the traditional insurance industry, attracting a new generation of policyholders with its digital-first approach.

At its core, Lemonade operates on a unique business model known as the Giveback Model. This model ensures that a significant portion of the premiums paid by customers are given back to charitable causes, fostering a sense of community and trust. By combining technology, transparency, and social responsibility, Lemonade has created a brand that resonates with today's socially conscious consumers.

The company's journey began with a simple idea: to create an insurance company that would do things differently. Lemonade's founders, Daniel Schreiber and Shai Wininger, aimed to challenge the status quo, addressing common pain points in the insurance industry, such as complex processes, lack of trust, and inefficient use of premiums.

Since its inception, Lemonade has expanded its offerings, and life insurance is a key component of its product suite. Let's delve deeper into Lemonade's life insurance policies, exploring how they work, the benefits they offer, and why they're a compelling choice for many individuals and families.

Understanding Lemonade’s Life Insurance Policies

Lemonade’s life insurance policies are designed with simplicity and transparency in mind. The company offers two primary types of life insurance: Term Life Insurance and Whole Life Insurance, each catering to different needs and financial goals.

Term Life Insurance

Term life insurance is a fundamental component of Lemonade’s offering. It provides coverage for a specified period, known as the term, during which the policyholder’s beneficiaries will receive a payout in the event of their death. Here’s a closer look at Lemonade’s Term Life Insurance:

- Coverage Options: Lemonade offers flexible term lengths, typically ranging from 10 to 30 years. This allows policyholders to choose a term that aligns with their specific financial goals and life stages.

- Affordable Premiums: Lemonade prides itself on offering competitive rates for term life insurance. The company's digital-first approach, with minimal overhead costs, enables it to pass on savings to its customers.

- Easy Application Process: Applying for Lemonade's Term Life Insurance is straightforward. The process is entirely digital, with no need for medical exams or extensive paperwork. Lemonade uses advanced underwriting algorithms to assess applicants quickly and efficiently.

- Renewal Options: As the term expires, policyholders have the option to renew their coverage. Lemonade provides clear and transparent renewal terms, ensuring policyholders can continue their coverage without hassle.

Whole Life Insurance

In addition to term life insurance, Lemonade offers Whole Life Insurance, a permanent insurance solution that provides coverage for the policyholder’s entire life. Here’s an overview of Lemonade’s Whole Life Insurance:

- Lifetime Coverage: Whole Life Insurance from Lemonade offers guaranteed coverage for the policyholder's entire life, ensuring peace of mind for their loved ones.

- Cash Value Accumulation: One of the key benefits of Whole Life Insurance is its cash value component. Over time, this cash value grows, providing policyholders with a financial asset they can borrow against or withdraw in certain circumstances.

- Flexible Premiums: Lemonade's Whole Life Insurance policies offer flexible premium payment options. Policyholders can choose to pay premiums annually, semi-annually, quarterly, or monthly, depending on their financial preferences.

- Guaranteed Benefits: Whole Life Insurance policies from Lemonade come with guaranteed benefits, including a death benefit payout to beneficiaries and the potential for dividends, depending on the company's financial performance.

The Benefits of Lemonade Life Insurance

Lemonade’s life insurance policies offer a range of benefits that set them apart from traditional insurance providers. These benefits appeal to a wide range of consumers, from those seeking affordable coverage to individuals prioritizing social impact.

Affordable Coverage

One of the most appealing aspects of Lemonade’s life insurance is its affordability. By leveraging technology and streamlining processes, Lemonade is able to offer competitive rates, making life insurance accessible to a broader audience.

The company's digital-first approach eliminates the need for extensive paperwork and physical offices, reducing overhead costs. These savings are passed on to customers in the form of lower premiums, making it easier for individuals and families to secure the financial protection they need.

Simplicity and Transparency

Lemonade is renowned for its commitment to simplicity and transparency. The company’s online platform is user-friendly, making it easy for policyholders to understand their coverage, manage their policies, and make changes as needed.

The application process is straightforward, with clear explanations of coverage options and benefits. Policyholders can access their policies and make updates at any time, ensuring they remain informed and in control of their insurance journey.

Social Impact

Perhaps one of the most unique aspects of Lemonade’s life insurance is its focus on social impact. The company’s Giveback Model sets it apart from traditional insurers. Here’s how it works:

- Surplus Giveback: At the end of each year, Lemonade calculates any surplus (remaining premiums after paying out claims and operational costs). This surplus is then given back to charitable causes chosen by policyholders.

- Community Engagement: Lemonade encourages its policyholders to participate in the selection of charitable causes. This fosters a sense of community and empowers individuals to make a positive impact through their insurance choices.

- Transparent Giving: Lemonade provides transparent reporting on the charitable causes it supports, ensuring policyholders can see the impact of their premiums.

Performance and Customer Experience

Lemonade’s life insurance policies have garnered positive reviews from customers and industry experts alike. The company’s commitment to innovation, transparency, and social responsibility has earned it a reputation for excellence.

Customers praise Lemonade for its easy-to-use platform, quick claim processes, and competitive rates. The company's focus on customer experience is evident in its approach to insurance, making it a top choice for those seeking a modern and ethical insurance provider.

In terms of performance, Lemonade has demonstrated strong growth and financial stability. The company's innovative business model, combined with its commitment to social impact, has attracted a loyal customer base and positive industry recognition.

Future Outlook and Industry Impact

Lemonade’s disruptive approach to life insurance has the potential to shape the future of the industry. As more consumers seek out digital-first, socially conscious companies, Lemonade is well-positioned to continue its growth and expand its market share.

The company's focus on technology and customer experience sets a new standard for the industry. By offering affordable, transparent, and socially responsible life insurance, Lemonade is paving the way for a more inclusive and sustainable insurance landscape.

Looking ahead, Lemonade's ongoing commitment to innovation and social impact is likely to drive further advancements in the life insurance space. The company's success serves as a testament to the power of combining technology, transparency, and a social mission in the insurance industry.

Conclusion

Lemonade Life Insurance offers a compelling alternative to traditional insurance providers. With its innovative business model, focus on affordability and transparency, and commitment to social impact, Lemonade is transforming the way people think about life insurance.

As the company continues to grow and innovate, it will undoubtedly play a significant role in shaping the future of the insurance industry. For consumers seeking a modern, ethical, and customer-centric insurance provider, Lemonade is a top choice, offering peace of mind and the opportunity to make a positive impact through their insurance decisions.

How does Lemonade determine life insurance premiums?

+Lemonade uses advanced underwriting algorithms to assess applicants’ risk profiles. Factors such as age, health status, and lifestyle choices are considered to determine the premium amount. The company’s digital-first approach allows for efficient risk assessment, leading to competitive premiums.

What happens to my policy if I miss a premium payment with Lemonade Life Insurance?

+If you miss a premium payment, Lemonade will typically send a reminder notice. If the payment remains overdue, the policy may enter a grace period, allowing you to make the payment without losing coverage. However, repeated missed payments can result in policy cancellation.

Can I add additional beneficiaries to my Lemonade life insurance policy?

+Yes, Lemonade allows policyholders to add or change beneficiaries at any time. This can be done through their online platform, ensuring flexibility and ease of management for policyholders.