Car Insurance Full Coverage Quotes

Full coverage car insurance is an essential aspect of vehicle ownership, providing comprehensive protection for drivers and their vehicles. This type of insurance policy offers a wide range of coverage options, ensuring that policyholders are well-prepared for various unforeseen circumstances on the road. With the right full coverage plan, drivers can have peace of mind knowing they are protected against potential financial burdens resulting from accidents, theft, or natural disasters.

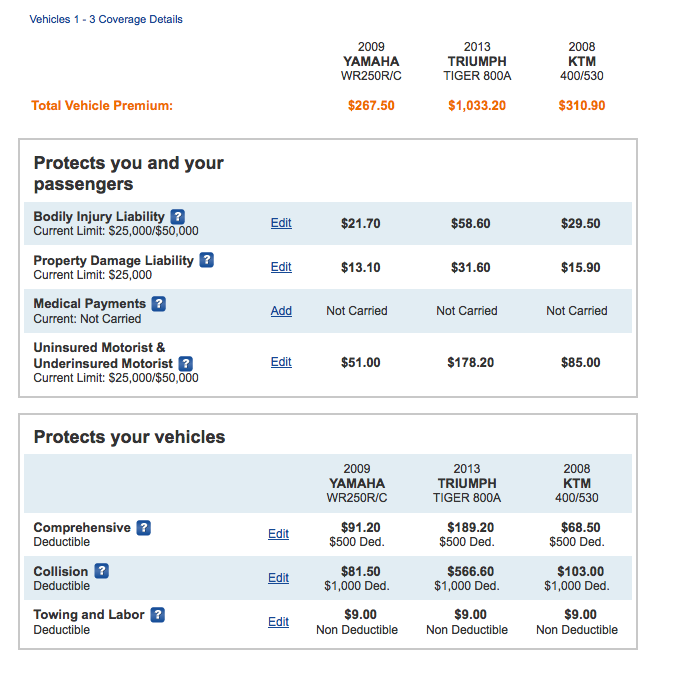

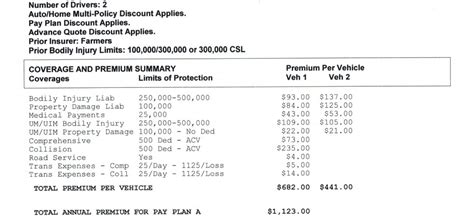

However, navigating the world of car insurance can be daunting, especially when it comes to understanding the nuances of full coverage quotes. From determining the appropriate levels of liability and collision coverage to deciding on additional add-ons like rental car reimbursement or roadside assistance, there are numerous factors to consider. Additionally, the cost of full coverage insurance varies significantly based on individual circumstances and the chosen provider.

In this comprehensive guide, we will delve into the intricacies of full coverage car insurance quotes, exploring the key components that influence policy costs and offering expert insights to help you make informed decisions. Whether you're a seasoned driver looking to optimize your existing coverage or a new car owner seeking guidance, this article will equip you with the knowledge and tools to secure the best full coverage quote for your specific needs.

Understanding Full Coverage Car Insurance

Full coverage car insurance is a term used to describe a policy that includes both liability and comprehensive coverage. It is designed to offer the broadest protection for vehicle owners, covering a wide range of potential risks and losses.

Liability Coverage

Liability coverage is a fundamental component of any car insurance policy. It protects policyholders against claims arising from bodily injury or property damage caused to others as a result of an accident for which the insured driver is at fault. Liability coverage typically consists of two main parts:

- Bodily Injury Liability: This covers medical expenses, lost wages, and pain and suffering for individuals injured in an accident caused by the insured driver.

- Property Damage Liability: This component provides coverage for damage to others’ property, such as vehicles, buildings, or personal belongings, caused by the insured driver.

The limits of liability coverage are typically expressed as three numbers, representing the maximum amount the insurance company will pay for each covered claim, per accident, and the total policy limit. For instance, a policy with limits of 100/300/100 means the insurer will pay up to 100,000 for bodily injury per person, up to 300,000 for bodily injury per accident, and up to $100,000 for property damage per accident.

Comprehensive Coverage

Comprehensive coverage, also known as “other than collision” coverage, provides protection for losses resulting from incidents other than collisions with other vehicles. This can include damages caused by theft, vandalism, natural disasters (such as hail, storms, or floods), falling objects, or collisions with animals.

Comprehensive coverage typically includes the following:

- Theft: Coverage for the cost of replacing or repairing your vehicle if it is stolen.

- Vandalism: Compensation for damage caused by malicious acts, such as broken windows or graffiti.

- Natural Disasters: Protection against damages caused by weather-related events like hail, storms, floods, or earthquakes.

- Collision with Animals: Coverage for accidents involving your vehicle and an animal, such as deer or other wildlife.

- Fire and Explosion: Compensation for damages resulting from fire or explosions.

It’s important to note that comprehensive coverage usually comes with a deductible, which is the amount you pay out of pocket before your insurance kicks in. For instance, if you have a 500 deductible and your vehicle sustains 3,000 worth of damage in a covered incident, you would pay the first 500, and your insurance company would cover the remaining 2,500.

Factors Influencing Full Coverage Quotes

The cost of full coverage car insurance can vary significantly from one policyholder to another, depending on a variety of factors. These factors can be broadly categorized into personal, vehicle-related, and geographic considerations. Understanding these influences can help policyholders make more informed decisions when choosing their coverage and seeking the best quotes.

Personal Factors

Personal factors are characteristics specific to the policyholder that can significantly impact the cost of full coverage insurance. These factors include:

- Age and Gender: Younger drivers, particularly those under the age of 25, and male drivers tend to be associated with higher insurance rates due to their perceived risk of involvement in accidents.

- Driving History: Your past driving record is a key indicator of your future risk. Drivers with a history of accidents, moving violations, or DUI/DWI convictions may face higher insurance premiums.

- Credit Score: In many states, insurance companies use credit-based insurance scores to assess a driver’s risk. Individuals with lower credit scores may be considered higher-risk and charged higher premiums.

- Marital Status: Married individuals are often seen as lower-risk drivers and may qualify for better insurance rates compared to single individuals.

- Occupation and Education: Some insurance companies offer discounts to certain professions or educational backgrounds, recognizing that certain occupations or degrees may indicate lower-risk driving behavior.

Vehicle-Related Factors

The characteristics of the vehicle being insured can also influence the cost of full coverage insurance. These factors include:

- Make and Model: Some vehicles are more expensive to insure due to their higher replacement costs or increased risk of theft or accidents. Luxury and sports cars often fall into this category.

- Year of Manufacture: Older vehicles may have lower insurance premiums, as they are typically less expensive to replace or repair. However, classic or antique cars may require specialized coverage, which can be more costly.

- Vehicle Use: How you use your vehicle can impact your insurance rates. For instance, if you primarily use your car for commuting to work, you may be considered a higher-risk driver compared to someone who uses their vehicle only for occasional pleasure trips.

- Safety Features: Vehicles equipped with advanced safety features, such as anti-lock brakes, air bags, or collision avoidance systems, may qualify for insurance discounts, as they are less likely to be involved in accidents.

Geographic Factors

The geographic location where the vehicle is primarily garaged can significantly influence insurance rates. This is due to a variety of reasons, including:

- Population Density: Areas with higher population densities often experience more accidents and car-related crimes, leading to higher insurance rates.

- Weather Conditions: Regions prone to severe weather events, such as hurricanes, floods, or hailstorms, may have higher insurance costs due to the increased risk of weather-related damage.

- Crime Rates: Areas with higher crime rates may experience more vehicle-related theft or vandalism, leading to increased insurance premiums.

- Traffic Patterns: Areas with heavy traffic or high-speed roads may have a higher incidence of accidents, influencing insurance rates.

Obtaining Full Coverage Quotes

When it comes to obtaining full coverage car insurance quotes, there are several avenues you can explore to find the best options for your needs and budget. Here are some strategies to consider:

Online Comparison Tools

Utilizing online comparison tools is an efficient way to gather multiple full coverage quotes from different insurance providers. These tools allow you to input your personal and vehicle information, and they’ll provide a list of quotes from various insurers. Some popular online comparison platforms include:

These platforms often have user-friendly interfaces, making it easy to compare quotes and coverage options side by side.

Directly from Insurance Companies

You can also obtain full coverage quotes directly from insurance companies. Most major insurers, such as those mentioned above, have online quote tools on their websites. Additionally, you can contact their customer service representatives or local agents to discuss your specific needs and receive personalized quotes.

Independent Insurance Agents

Working with an independent insurance agent can be beneficial, as they represent multiple insurance companies and can shop around for the best full coverage quote on your behalf. They have access to a wide range of insurers and can provide tailored recommendations based on your unique circumstances.

Bundling Policies

If you have multiple insurance needs, such as home, auto, and life insurance, consider bundling your policies with the same insurer. Many insurance companies offer discounts when you combine multiple policies, which can result in significant savings on your full coverage car insurance.

Understanding the Quote

When you receive a full coverage quote, it’s important to understand its components. Here’s a breakdown of what you’ll typically find:

| Coverage Type | Description |

|---|---|

| Liability Coverage | Protection against bodily injury and property damage claims caused by you to others. |

| Collision Coverage | Covers damages to your vehicle resulting from collisions with other vehicles or objects. |

| Comprehensive Coverage | Provides protection for damages not related to collisions, such as theft, vandalism, or natural disasters. |

| Uninsured/Underinsured Motorist Coverage | Protects you if you’re involved in an accident with a driver who has no insurance or insufficient coverage. |

| Medical Payments Coverage | Covers medical expenses for you and your passengers, regardless of fault, after an accident. |

| Rental Car Reimbursement | Provides coverage for rental car expenses if your vehicle is in the shop for repairs covered by your policy. |

| Roadside Assistance | Offers emergency services such as towing, flat tire changes, or battery jumps. |

Tips for Lowering Full Coverage Insurance Costs

While full coverage car insurance provides essential protection, it can be costly. Here are some strategies to help you lower your insurance premiums:

Increase Your Deductible

Opting for a higher deductible can significantly reduce your insurance premiums. A deductible is the amount you pay out of pocket before your insurance coverage kicks in. By choosing a higher deductible, you’re essentially sharing more of the financial risk with your insurance company, which can lead to lower premiums.

Maintain a Clean Driving Record

Insurance companies reward safe drivers with lower premiums. To qualify for these discounts, you must maintain a clean driving record by avoiding accidents, moving violations, and DUI/DWI convictions. Additionally, some insurers offer safe driver discounts if you complete a defensive driving course.

Bundle Policies

Bundling your insurance policies, such as combining your auto, home, and life insurance with the same insurer, can lead to substantial savings. Many insurance companies offer multi-policy discounts, which can significantly reduce your overall insurance costs.

Take Advantage of Discounts

Insurance companies often offer a variety of discounts to policyholders. These can include:

- Good Student Discount: If you’re a student with a good academic record, you may qualify for this discount.

- Loyalty Discount: Some insurers reward long-term policyholders with loyalty discounts.

- Safe Vehicle Discount: Vehicles equipped with advanced safety features may qualify for this discount.

- Low Mileage Discount: If you drive fewer miles annually, you may be eligible for this discount.

- Occupational Discounts: Certain professions, such as teachers or military personnel, may qualify for occupational discounts.

Shop Around Regularly

Insurance rates can vary significantly between providers. It’s a good idea to shop around for quotes regularly, especially when your policy is up for renewal. By comparing quotes, you can ensure you’re getting the best possible rate for your specific circumstances.

Consider Usage-Based Insurance

Usage-based insurance, also known as pay-as-you-drive or telematics insurance, is an innovative approach to car insurance. It uses a small device or an app on your smartphone to track your driving habits, such as miles driven, braking patterns, and times of day you drive. Based on this data, insurance companies can offer personalized premiums. If you’re a safe and cautious driver, you may qualify for lower rates with usage-based insurance.

FAQs

What is the difference between full coverage and liability-only car insurance?

+Full coverage car insurance provides broader protection, including liability coverage, collision coverage, and comprehensive coverage. Liability-only insurance, on the other hand, only covers bodily injury and property damage claims caused by the insured driver to others. It does not cover damages to the insured vehicle.

How much does full coverage car insurance cost on average?

+The average cost of full coverage car insurance varies widely based on individual circumstances and the chosen provider. As of 2023, the average annual cost of full coverage insurance in the United States is approximately $1,674. However, your specific rate may be higher or lower depending on factors such as your driving record, the value of your vehicle, and your location.

Are there any ways to get full coverage car insurance without a down payment?

+While most insurance companies require a down payment when you first purchase a policy, some insurers offer payment plans that allow you to spread out the cost of your insurance over several months. This can help make full coverage insurance more affordable and accessible.

Can I get full coverage car insurance with a bad driving record?

+Yes, it is possible to obtain full coverage car insurance even with a bad driving record. However, you may face higher premiums or have limited options for providers. It’s important to shop around and compare quotes to find the best coverage at a reasonable rate.

What should I do if I’m not satisfied with my full coverage car insurance quote?

+If you’re not satisfied with your full coverage car insurance quote, consider exploring other options. Shop around and compare quotes from multiple insurers to find the best coverage at the most competitive price. Additionally, review your current policy to ensure you’re not paying for unnecessary coverage or add-ons.