Insurance Individual Health

The landscape of individual health insurance has undergone significant transformations, especially in the wake of recent global health crises. As we navigate an era defined by changing healthcare needs and evolving insurance policies, understanding the intricacies of individual health insurance plans becomes more crucial than ever. This comprehensive guide aims to shed light on the key aspects, benefits, and considerations surrounding individual health insurance, empowering individuals to make informed decisions about their healthcare coverage.

Understanding Individual Health Insurance

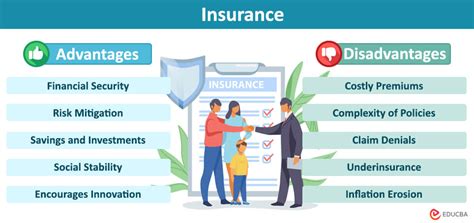

Individual health insurance, often referred to as private health insurance, is a type of coverage that individuals purchase for themselves and their families. It offers a range of benefits and protections, providing financial security and access to healthcare services when needed. Unlike group health insurance plans offered by employers, individual health insurance is tailored to meet the specific needs of individuals and their dependents.

Key Features and Benefits

Individual health insurance plans offer a variety of features and benefits that cater to different healthcare requirements. Here's an overview of some key aspects:

- Coverage Options: These plans typically provide coverage for a wide range of medical services, including doctor visits, hospital stays, prescription medications, preventive care, and more. Some plans may also offer additional benefits such as dental, vision, or mental health coverage.

- Personalized Plans: One of the advantages of individual health insurance is the ability to customize coverage to suit individual needs. Whether you require comprehensive coverage for a large family or more targeted protection for specific health concerns, there are options available.

- Premium Flexibility: Premium payments for individual health insurance plans can be adjusted based on factors such as age, location, and the level of coverage desired. This flexibility allows individuals to find a balance between their healthcare needs and their budget.

- Pre-existing Condition Coverage: In many countries, individual health insurance plans are required to cover pre-existing conditions. This ensures that individuals with existing health issues can obtain coverage and receive the necessary medical treatment without being penalized.

- Portability: Unlike group health insurance, individual plans are portable, meaning you can keep your coverage even if you change jobs or experience other life changes. This portability provides stability and peace of mind during transitions.

Comparative Analysis: Individual vs. Group Health Insurance

While individual health insurance offers many advantages, it's essential to understand how it differs from group health insurance plans offered by employers.

| Individual Health Insurance | Group Health Insurance |

|---|---|

| Personalized coverage tailored to individual needs | Standardized coverage provided by employers |

| Flexible premium options based on individual circumstances | Premiums are typically shared between employer and employee |

| Often more expensive than group plans | May be more affordable due to employer contributions |

| Portability allows coverage to continue even with job changes | Coverage is tied to employment, may end upon leaving the job |

| No age or health restrictions for coverage | May have age or health-related restrictions for certain plans |

The choice between individual and group health insurance depends on individual circumstances and preferences. While group plans may offer cost advantages, individual plans provide flexibility and personalized coverage.

Performance Analysis: A Real-World Example

To illustrate the benefits and performance of individual health insurance, let's consider a case study. Meet Sarah, a 35-year-old professional with no major health concerns. She recently decided to purchase an individual health insurance plan to ensure she has adequate coverage in case of unexpected medical needs.

Sarah's Experience with Individual Health Insurance

Sarah opted for a comprehensive individual health insurance plan that offered coverage for a wide range of medical services, including hospitalization, outpatient care, and prescription medications. Here's how her experience unfolded:

- Choosing the Right Plan: Sarah carefully reviewed various insurance providers and plans, considering factors such as coverage limits, co-pays, and deductibles. She selected a plan with a higher premium but lower out-of-pocket costs, knowing that her health was generally good but wanting peace of mind for unexpected emergencies.

- Claim Process: Within a few months of enrolling, Sarah had to undergo a minor surgical procedure. The hospital and doctors were covered under her insurance network, and the claim process was straightforward. She received the necessary treatment without any financial strain, as the insurance company covered the majority of the costs.

- Peace of Mind: Throughout the year, Sarah benefited from preventive care services such as annual check-ups and screenings, which were covered by her insurance plan. Knowing that she had comprehensive coverage gave her peace of mind, allowing her to focus on her career and personal goals without worrying about potential medical expenses.

Sarah's experience highlights the effectiveness of individual health insurance in providing financial protection and access to necessary healthcare services. By choosing a plan that suited her needs, she was able to navigate unexpected medical situations with confidence and minimal financial burden.

Future Implications and Industry Insights

The future of individual health insurance is shaped by ongoing advancements in healthcare technology, changing demographics, and evolving regulatory landscapes. Here are some key trends and considerations:

Digital Health and Telemedicine

The integration of digital health technologies and telemedicine services is transforming the way healthcare is delivered and accessed. Individual health insurance plans are increasingly incorporating these innovations, offering coverage for virtual consultations, remote monitoring, and digital health platforms. This trend enhances accessibility and convenience for policyholders, especially in remote areas or during public health emergencies.

Wellness and Prevention

There is a growing emphasis on preventive care and wellness programs within the individual health insurance industry. Insurers are recognizing the value of promoting healthy lifestyles and early detection of health issues. Many plans now offer incentives and rewards for policyholders who engage in preventive measures, such as annual check-ups, fitness programs, or smoking cessation initiatives. This shift towards prevention not only improves overall health outcomes but also helps control long-term healthcare costs.

Personalized Medicine and Precision Health

The field of personalized medicine, which tailors medical treatment to an individual's unique genetic makeup and health profile, is gaining momentum. Individual health insurance plans are starting to explore ways to incorporate personalized medicine approaches, offering coverage for genetic testing and targeted therapies. This shift towards precision health has the potential to revolutionize healthcare, improving treatment outcomes and reducing unnecessary procedures.

Regulatory and Policy Changes

The regulatory environment surrounding individual health insurance is subject to change, influenced by political and social factors. Insurers and policyholders must stay informed about potential reforms and updates to healthcare policies. Keeping abreast of these changes is crucial for understanding the evolving landscape of coverage options and benefits.

Frequently Asked Questions

Can I purchase individual health insurance if I have a pre-existing condition?

+Yes, many countries have regulations in place that require individual health insurance plans to cover pre-existing conditions. This ensures that individuals with existing health issues can obtain coverage and receive necessary medical treatment. However, it’s important to carefully review the policy details and understand any specific exclusions or limitations that may apply.

How do I choose the right individual health insurance plan for my needs?

+Choosing the right plan involves considering factors such as your age, health status, family size, and budget. Review the coverage options, including the types of medical services covered, co-pays, deductibles, and out-of-pocket maximums. Assess your healthcare needs and preferences, and compare plans to find one that aligns with your priorities. It’s also beneficial to consult with insurance brokers or agents who can provide expert guidance.

Are there any tax benefits associated with individual health insurance plans?

+The tax benefits associated with individual health insurance plans may vary depending on your country’s tax regulations. In some cases, you may be eligible for tax deductions or credits for the premiums you pay. It’s advisable to consult with a tax professional or refer to your country’s tax guidelines to understand the specific tax advantages available to you.