How To Lower Home Insurance

Lowering your home insurance premiums is a common goal for many homeowners. The good news is that there are several strategies and considerations you can explore to potentially reduce your insurance costs without compromising the coverage you need. This comprehensive guide will walk you through the factors that influence home insurance rates, practical steps to optimize your policy, and expert tips to help you save money on your home insurance.

Understanding Home Insurance Premiums

Home insurance premiums are calculated based on a variety of factors, each playing a unique role in determining the overall cost of your policy. Here’s a breakdown of these key factors and how they impact your insurance rates.

Risk Assessment

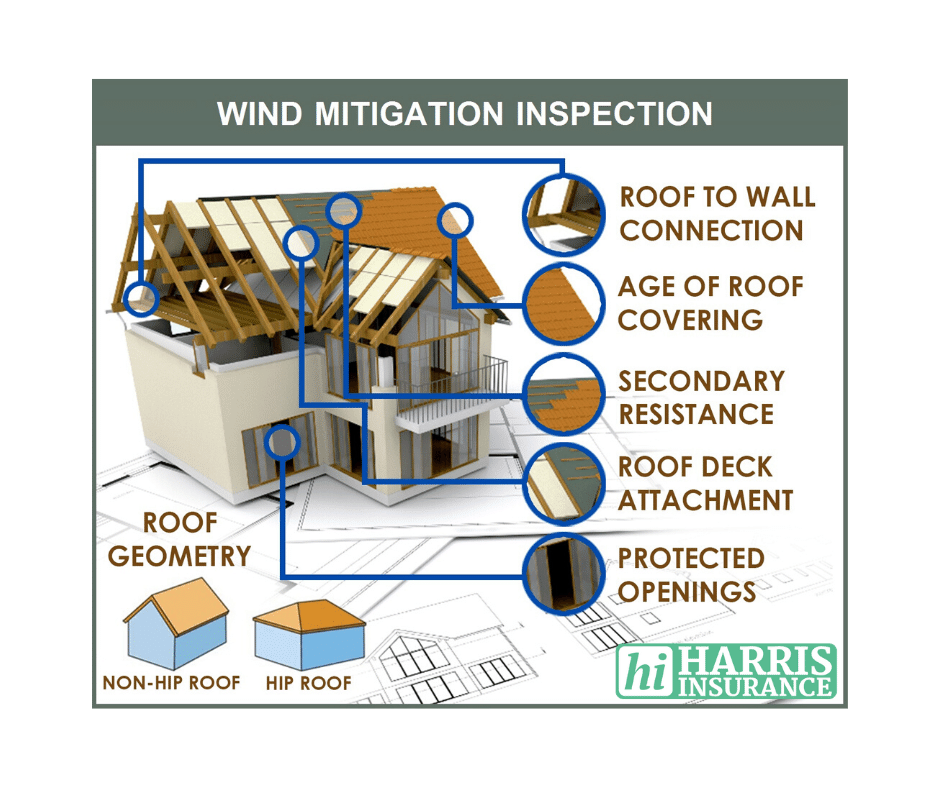

Insurance companies assess the potential risks associated with insuring your home. Factors such as the location of your property, its age, and the construction materials used can influence the perceived risk. High-risk areas prone to natural disasters or crimes may result in higher premiums.

Consider implementing risk-mitigating measures like installing security systems, reinforcing your home against natural hazards, or opting for fire-resistant materials. These steps can significantly reduce the perceived risk and lead to lower premiums.

Coverage Options

The coverage you choose for your home plays a crucial role in determining your insurance premiums. Different types of coverage, such as property coverage, liability coverage, and additional living expenses, can impact your overall policy cost. Understanding your coverage needs and selecting the right options can help you strike a balance between protection and affordability.

Deductible and Policy Limits

Your deductible is the amount you agree to pay out of pocket before your insurance coverage kicks in. Higher deductibles often result in lower premiums, as you’re taking on more financial responsibility. However, it’s important to choose a deductible that aligns with your financial capabilities.

Similarly, the policy limits you select for different types of coverage impact your premiums. Higher limits generally mean higher premiums, so finding the right balance between coverage and cost is essential.

Claims History

Your insurance claims history is a significant factor in premium calculations. Frequent claims can lead to higher premiums or even policy cancellations. On the other hand, a clean claims record may result in discounts or lower rates.

Discounts and Bundling

Many insurance providers offer discounts to encourage certain behaviors or to reward loyalty. Common discounts include multi-policy discounts (bundling home and auto insurance), safety discounts for installing security systems or smoke detectors, and loyalty discounts for long-term customers.

Additionally, bundling multiple insurance policies with the same provider can often result in significant savings. This approach simplifies your insurance management and potentially reduces administrative costs for the insurer.

Market Competition

The insurance market is competitive, and insurers may adjust their rates to remain competitive or attract new customers. Shopping around and comparing quotes from different providers can help you identify the most cost-effective options for your home insurance needs.

Strategies to Lower Your Home Insurance Premiums

Now that we’ve explored the factors influencing home insurance premiums, let’s delve into practical strategies to optimize your policy and potentially reduce your costs.

Shop Around and Compare Quotes

Obtaining multiple quotes from different insurance providers is a fundamental step in finding the most competitive rates. Each insurer has its own risk assessment methodology and pricing structure, so comparing quotes can reveal significant variations in premiums.

Use online comparison tools or work with an insurance broker to gather quotes from a range of reputable insurers. Ensure that you're comparing policies with similar coverage options and deductibles to make an accurate assessment.

Increase Your Deductible

As mentioned earlier, increasing your deductible can lead to lower premiums. However, this strategy requires careful consideration of your financial situation. While a higher deductible reduces your insurance costs, it also means you’ll have to pay more out of pocket in the event of a claim.

Evaluate your financial stability and determine the highest deductible you're comfortable with. A good rule of thumb is to choose a deductible that you can afford to pay without straining your finances.

Review and Optimize Your Coverage

Regularly reviewing your home insurance coverage is essential to ensure it aligns with your current needs. Over time, your circumstances may change, and your coverage requirements may evolve.

Consider the following when optimizing your coverage:

- Property Value: Ensure your home's value is accurately reflected in your policy. Underinsuring your home can lead to inadequate coverage in the event of a claim.

- Personal Belongings: Review your coverage for personal property to ensure it adequately covers the value of your belongings. Consider any significant acquisitions or losses since your last policy update.

- Liability Protection: Assess your liability coverage to ensure it's sufficient for your needs. This coverage protects you from lawsuits related to injuries or damages on your property.

- Additional Living Expenses: If your policy includes coverage for additional living expenses in the event of a covered loss, ensure the limits are appropriate for your situation.

Improve Your Home's Security

Insurance companies often reward homeowners who take proactive measures to secure their properties. Investing in security systems, such as burglar alarms, surveillance cameras, or smart home security solutions, can lead to significant premium discounts.

Additionally, consider reinforcing your home against natural hazards like hurricanes, earthquakes, or floods. This may involve installing impact-resistant windows, reinforcing your roof, or elevating your property in flood-prone areas.

Maintain a Clean Claims History

A clean claims history is a powerful tool for lowering your insurance premiums. Avoid making small claims that may not significantly impact your financial situation. Instead, consider paying for minor repairs out of pocket to maintain a claims-free record.

However, it's important to remember that major, catastrophic losses should always be reported to your insurer. These claims are expected and won't necessarily lead to higher premiums if they're legitimate and covered by your policy.

Take Advantage of Discounts

Insurance providers offer a variety of discounts to encourage certain behaviors and reward loyalty. Common discounts include:

- Multi-Policy Discounts: Bundling your home and auto insurance policies with the same provider can result in significant savings.

- Safety Discounts: Installing security systems, smoke detectors, or fire sprinklers may qualify you for safety discounts.

- Loyalty Discounts: Many insurers reward long-term customers with loyalty discounts.

- Senior or Retirement Discounts: Some insurers offer discounts to seniors or retirees, recognizing their lower risk profiles.

- New Homeowner Discounts: First-time homeowners may be eligible for discounts as they’re perceived as lower risk.

Explore Alternative Policies

Traditional home insurance policies aren’t the only option. Consider exploring alternative policies such as:

- High-Value Home Insurance: If your home is considered high-value due to its location, size, or unique features, a specialized high-value home insurance policy may offer more tailored coverage at a competitive rate.

- Condo Insurance: If you own a condo, a condo insurance policy can provide the coverage you need while potentially offering more cost-effective options.

- Renters Insurance: For renters, a renters insurance policy covers your personal belongings and provides liability protection, often at a lower cost than traditional home insurance.

Consider a Home Warranty

A home warranty can provide coverage for your home’s systems and appliances, offering protection against unexpected repair or replacement costs. While a home warranty isn’t a substitute for home insurance, it can help reduce the financial burden of homeownership and potentially lower your insurance premiums by reducing the risk of major claims.

Work with an Insurance Broker

Insurance brokers are professionals who work with multiple insurance providers to find the best coverage options for their clients. They can provide valuable insights, negotiate on your behalf, and help you secure the most competitive rates.

Brokers have access to a wide range of insurance products and can offer personalized advice based on your specific needs and circumstances. They can also assist in reviewing your coverage regularly to ensure it remains optimal and cost-effective.

Performance Analysis and Future Implications

By implementing the strategies outlined in this guide, you can potentially reduce your home insurance premiums while maintaining adequate coverage. However, it’s important to regularly review and assess your insurance needs to ensure you’re always protected.

Stay informed about changes in the insurance market, such as new coverage options or discount programs, and be proactive in adjusting your policy as your circumstances evolve. Regularly comparing quotes and exploring alternative policies can help you identify cost-saving opportunities and ensure you're getting the best value for your insurance dollar.

Remember, home insurance is a critical aspect of financial protection, and while saving money is important, it should never come at the expense of adequate coverage. Work with reputable insurers and seek professional advice when needed to strike the right balance between affordability and protection.

FAQ

How often should I review my home insurance policy?

+It’s recommended to review your home insurance policy annually or whenever your circumstances change significantly. Regular reviews ensure your coverage remains up-to-date and aligned with your needs.

Can I negotiate my home insurance premiums?

+While insurance premiums are largely determined by risk assessment and market factors, you can negotiate with your insurer by highlighting your low-risk profile, clean claims history, or loyalty. An insurance broker can assist in negotiating on your behalf.

What factors can cause my home insurance premiums to increase unexpectedly?

+Unexpected premium increases can occur due to changes in your risk profile, such as a move to a high-risk area or an increase in claims frequency. Additionally, insurers may adjust their rates periodically to reflect changes in the market or to maintain profitability.

Are there any common misconceptions about home insurance that can impact my premiums?

+One common misconception is that home insurance covers all types of damage. It’s important to understand the specific perils covered by your policy and any exclusions. Misunderstanding your coverage can lead to unexpected out-of-pocket expenses.

Can I lower my home insurance premiums by increasing my home’s energy efficiency?

+Increasing your home’s energy efficiency can lead to lower utility costs, but it may not directly impact your insurance premiums. However, energy-efficient upgrades can reduce your home’s environmental impact and potentially make it more resilient against certain natural hazards, which could indirectly lower your insurance costs.