Term Life Vs Whole Life Insurance

In the realm of financial planning and security, life insurance stands as a cornerstone, offering individuals and families a crucial safety net. Among the myriad of options, two predominant categories emerge: term life insurance and whole life insurance. These distinct types of policies cater to different needs, financial goals, and life stages. Understanding the nuances between them is pivotal for making informed decisions about one's financial future.

This comprehensive exploration delves into the core aspects of term life and whole life insurance, dissecting their features, benefits, and implications. By the end, readers will possess the knowledge to navigate these intricate policies, empowering them to choose the most suitable coverage for their unique circumstances.

Unraveling Term Life Insurance

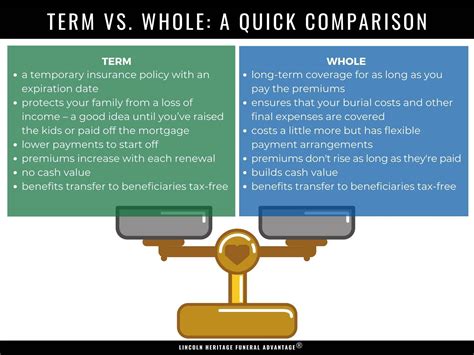

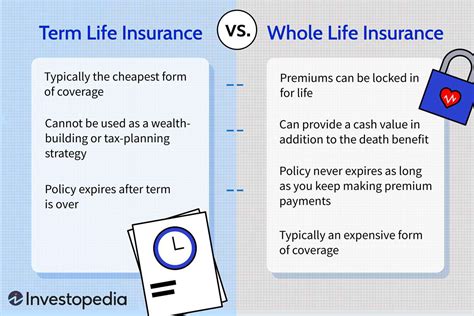

Term life insurance emerges as a straightforward and cost-effective solution for those seeking temporary coverage. At its core, this type of policy provides financial protection for a specified period, typically ranging from 10 to 30 years. During this term, the insured pays a fixed premium, ensuring their beneficiaries receive a predetermined sum upon their death.

Key Characteristics of Term Life Insurance

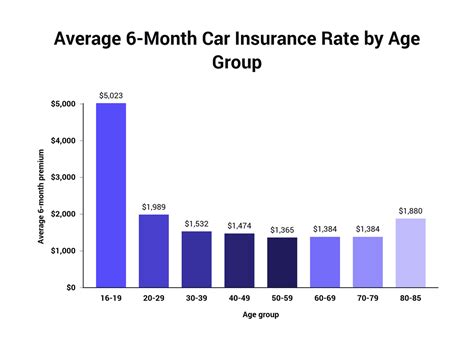

One of the standout features of term life insurance is its affordability. Premiums are often significantly lower compared to whole life policies, making it an attractive option for those on a budget or with specific, time-bound financial obligations. For instance, young families might opt for term life to secure their children’s future until they become financially independent.

Furthermore, term life insurance offers flexibility. Policyholders can choose the coverage amount and term length based on their needs and goals. This adaptability allows for precise financial planning, especially when coupled with the ability to convert term policies into permanent ones later on.

| Term Length | Premium Payment Period |

|---|---|

| 10, 15, 20, or 30 years | Equal to the chosen term length |

Despite its advantages, term life insurance comes with the risk of outliving the policy, leaving individuals without coverage in their later years when health concerns might arise. Additionally, premium rates can increase with age, making it less affordable for those seeking long-term protection.

Real-World Example: A 35-year-old with Term Life Insurance

Consider Sarah, a 35-year-old with a 20-year term life policy worth 500,000. Her annual premium is a manageable 300. This policy ensures her family’s financial stability if the unforeseen occurs during the next two decades, covering mortgages, education costs, and other expenses.

The Depth of Whole Life Insurance

In contrast to term life, whole life insurance, also known as permanent life insurance, offers lifelong coverage, providing a safety net that endures as long as the policy remains in force. This type of policy combines insurance coverage with a savings or investment component, often referred to as a cash value.

Key Features of Whole Life Insurance

Whole life insurance stands out for its enduring nature. Once purchased, the policy remains active for the insured’s entire life, barring any lapses in premium payments. This feature makes it an attractive option for those seeking lifelong peace of mind.

The policy's cash value, which accumulates over time, acts as a savings account. Policyholders can borrow against this value, use it to pay premiums, or withdraw it as needed. This flexibility makes whole life insurance a potential tool for wealth building and estate planning.

| Policy Type | Cash Value Growth |

|---|---|

| Whole Life | Guaranteed, tax-deferred growth |

However, whole life insurance is typically more expensive than term life due to its comprehensive nature and guaranteed cash value growth. The premium payments are also fixed, offering predictability but potentially limiting the policyholder's financial flexibility.

A Case Study: John’s Whole Life Policy

John, aged 45, purchased a whole life insurance policy with a 1 million death benefit and a 2,000 annual premium. Over time, his policy’s cash value has grown steadily, providing him with a substantial sum for retirement planning or unexpected financial needs. This policy ensures his family’s financial security throughout his life.

Comparative Analysis: Term Life vs. Whole Life

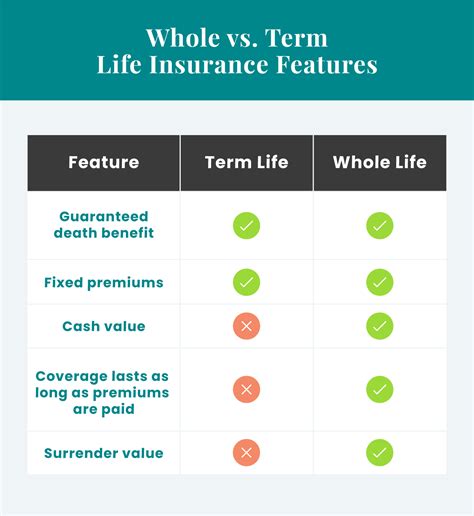

When comparing term life and whole life insurance, several key factors come into play. The decision largely hinges on an individual’s financial goals, life stage, and risk tolerance.

Cost and Affordability

Term life insurance is generally more affordable, making it accessible to a broader range of individuals. The premium payments are often lower and fixed for the term’s duration. In contrast, whole life insurance comes with higher premiums due to its lifelong coverage and guaranteed cash value growth.

Flexibility and Customization

Term life policies offer flexibility in terms of coverage amounts and term lengths. Policyholders can adjust their coverage to align with their changing financial needs and obligations. Whole life insurance, while providing lifelong coverage, offers less flexibility in terms of policy adjustments.

Savings and Investment Potential

Whole life insurance stands out for its cash value accumulation, which can serve as a savings or investment tool. Policyholders can leverage this value for various financial goals, including retirement planning or emergency funds. Term life insurance, on the other hand, does not offer this savings component.

Risk and Longevity

Term life insurance carries the risk of outliving the policy, leaving individuals without coverage in their later years. Whole life insurance mitigates this risk by providing lifelong coverage. However, whole life insurance’s higher premiums and fixed nature might limit financial flexibility for some individuals.

| Comparison Factor | Term Life | Whole Life |

|---|---|---|

| Cost | Lower premiums, fixed for the term | Higher premiums, fixed for life |

| Flexibility | Adjustable coverage, term lengths | Limited policy adjustments |

| Savings Potential | None | Cash value accumulation |

| Risk | Risk of outliving policy | Lifelong coverage |

Choosing the Right Fit

The decision between term life and whole life insurance is deeply personal and dependent on an individual’s financial situation and goals. For those with short-term financial obligations or budget constraints, term life insurance offers a cost-effective solution. On the other hand, whole life insurance provides lifelong coverage and a potential savings vehicle for those with long-term financial security in mind.

It's essential to thoroughly assess one's financial situation, consult with financial advisors, and consider personal goals when choosing between these two types of life insurance. The right policy can provide invaluable peace of mind and financial security for individuals and their loved ones.

Can I switch from term life to whole life insurance?

+Yes, many term life policies offer a conversion option, allowing policyholders to convert their term policy into a whole life policy. This is often done without the need for a medical exam, making it an attractive option for those seeking permanent coverage.

What happens if I outlive my term life policy?

+If you outlive your term life policy, the coverage simply expires, and you no longer have insurance protection. However, some policies offer a renewable option, allowing you to extend the term for a new period.

How does the cash value in whole life insurance work?

+The cash value in a whole life insurance policy grows over time, typically at a guaranteed rate. This value can be used for various purposes, such as borrowing against it, paying premiums, or withdrawing funds for financial needs.