Typical Car Insurance

Car insurance is an essential aspect of vehicle ownership, providing financial protection and peace of mind for drivers worldwide. This comprehensive guide aims to delve into the intricacies of typical car insurance policies, exploring their coverage, costs, and the factors that influence them. By understanding the fundamentals of car insurance, drivers can make informed decisions to ensure they have adequate protection on the road.

Understanding Car Insurance Coverage

Car insurance policies are designed to offer protection against a range of risks and liabilities associated with driving. The coverage provided can vary significantly between policies and regions, but some fundamental types of coverage are common across the industry.

Liability Coverage

Liability coverage is a cornerstone of car insurance. It provides protection if you are found at fault in an accident, covering the costs of damage to other vehicles, property, and bodily injuries sustained by others involved. This coverage is typically divided into bodily injury liability and property damage liability.

| Coverage Type | Description |

|---|---|

| Bodily Injury Liability | Covers medical expenses, lost wages, and pain and suffering of the injured parties. |

| Property Damage Liability | Pays for repairs or replacements of damaged property, including other vehicles, fences, buildings, and more. |

Comprehensive and Collision Coverage

These coverages protect your own vehicle from damages that aren’t caused by collisions with other vehicles. Comprehensive coverage includes damage from theft, vandalism, natural disasters, and collisions with animals. Collision coverage, on the other hand, covers damages to your vehicle resulting from collisions with other vehicles or objects.

Personal Injury Protection (PIP)

PIP, also known as no-fault insurance, provides coverage for medical expenses and lost wages for the policyholder and their passengers, regardless of who is at fault in an accident. It is mandatory in some states and optional in others.

Uninsured/Underinsured Motorist Coverage

This coverage protects policyholders when involved in an accident with a driver who has no insurance or insufficient insurance. It covers bodily injury and property damage costs that the at-fault driver cannot pay.

Factors Influencing Car Insurance Costs

The cost of car insurance is influenced by a multitude of factors, each playing a unique role in determining the final premium. Understanding these factors can help drivers make informed choices to potentially reduce their insurance costs.

Vehicle Type and Usage

The type of vehicle you drive and how you use it significantly impacts your insurance costs. Sports cars and luxury vehicles generally have higher insurance premiums due to their expensive repair costs and higher likelihood of theft. Additionally, the vehicle’s primary usage (e.g., daily commute, leisure, or business) can affect the premium, as different usage scenarios carry varying levels of risk.

Driver’s Profile

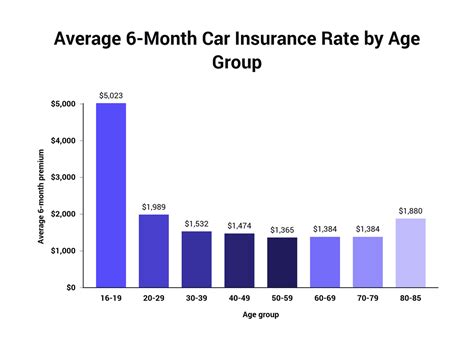

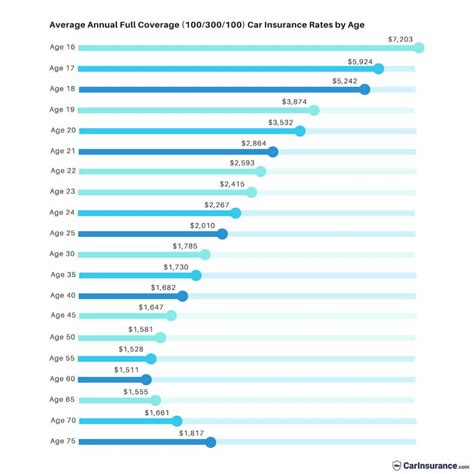

The driver’s profile is a critical factor in determining insurance costs. Insurers consider factors such as age, gender, driving history, and credit score when calculating premiums. Young drivers, especially males, often face higher premiums due to their statistically higher accident rates. A clean driving record with no accidents or traffic violations can lead to lower premiums, as can a good credit score.

Location and Mileage

The location where the vehicle is primarily garaged and the annual mileage can also impact insurance costs. Urban areas with higher traffic volumes and theft rates may result in higher premiums. Additionally, the number of miles driven annually can influence the premium, as it is associated with a higher risk of accidents.

Insurance Company and Policy Features

Different insurance companies offer varying rates and policy features. Some companies may specialize in certain types of vehicles or driver profiles, offering more competitive rates. Additionally, the policy features you choose, such as deductibles, coverage limits, and add-ons, can significantly impact the overall cost of your insurance.

Analyzing Performance and Benefits

A typical car insurance policy’s performance and benefits are best evaluated by examining real-world scenarios and data. This section will delve into some practical aspects of car insurance to help drivers understand its true value and potential.

Claim Settlement Process

The claim settlement process is a critical aspect of car insurance. It involves the steps taken by the insurance company to assess, validate, and pay out claims. A smooth and efficient claim process can make a significant difference in the overall satisfaction of policyholders. Some key factors to consider include the average time taken to settle claims, the ease of the claims process, and the reputation of the insurance company for fair and prompt settlements.

Real-World Coverage Examples

Examining real-world scenarios can help illustrate the benefits of car insurance coverage. For instance, consider a scenario where a driver, insured with comprehensive coverage, hits a deer on a rural road. Comprehensive coverage would cover the repairs to the vehicle, potentially saving the policyholder thousands of dollars in repair costs. Similarly, liability coverage can protect a driver financially if they cause an accident resulting in significant property damage or bodily injuries.

Cost-Benefit Analysis

A cost-benefit analysis can help drivers understand the value of car insurance. While the cost of insurance may seem like a significant expense, it provides protection against potentially devastating financial losses. For example, the average cost of a liability-only policy is often far less than the cost of repairing or replacing a vehicle after an at-fault accident. Additionally, the peace of mind that comes with knowing you’re financially protected can be invaluable.

Future Implications and Trends

The car insurance industry is continually evolving, influenced by technological advancements, changing driving habits, and shifts in consumer expectations. Understanding these trends can provide insights into the future of car insurance and potential opportunities for drivers.

Technological Advancements

The rise of telematics and usage-based insurance (UBI) is a significant trend in the car insurance industry. UBI policies use telematics devices to track driving behavior, offering personalized premiums based on real-time data. This technology has the potential to revolutionize car insurance, rewarding safe drivers with lower premiums.

Changing Driving Habits

With the increasing popularity of ride-sharing services and the potential for autonomous vehicles, driving habits are evolving. These changes could significantly impact car insurance. For example, if autonomous vehicles become widespread, the number of accidents could decrease, potentially leading to lower insurance premiums. Conversely, the introduction of new technologies like electric scooters and bikes could introduce new risks and insurance needs.

Consumer Expectations

Consumers today expect convenience, speed, and personalized services. Insurance companies are adapting to meet these expectations, offering digital platforms for policy management, claim filing, and payment. Additionally, the increasing demand for eco-friendly and sustainable practices is influencing the development of green insurance policies that offer incentives for environmentally friendly vehicles.

What is the average cost of car insurance per year?

+

The average cost of car insurance per year can vary significantly depending on several factors, including the driver’s profile, vehicle type, location, and coverage chosen. According to recent data, the national average for car insurance premiums is approximately 1,674 per year, or around 140 per month. However, this figure can range from under 1,000 to over 3,000 annually, depending on individual circumstances.

How can I reduce my car insurance costs?

+

There are several strategies you can employ to potentially reduce your car insurance costs. These include maintaining a clean driving record, shopping around for quotes from multiple insurers, increasing your deductible, and considering bundling your car insurance with other policies, such as home or renters insurance. Additionally, safe driving habits and the use of safety features in your vehicle can lead to discounts.

What should I do if I’m involved in an accident?

+

If you’re involved in an accident, it’s important to remain calm and prioritize the safety of all involved parties. Exchange information with the other driver(s), including names, contact details, insurance information, and license plate numbers. Take photos of the accident scene and any damage to the vehicles. Report the accident to your insurance company as soon as possible, providing all the relevant details. Follow the claim process outlined by your insurer, and remember to keep records of all communications and documents related to the accident.