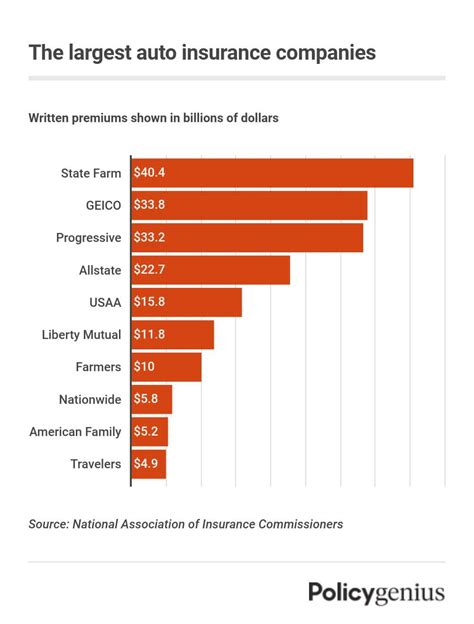

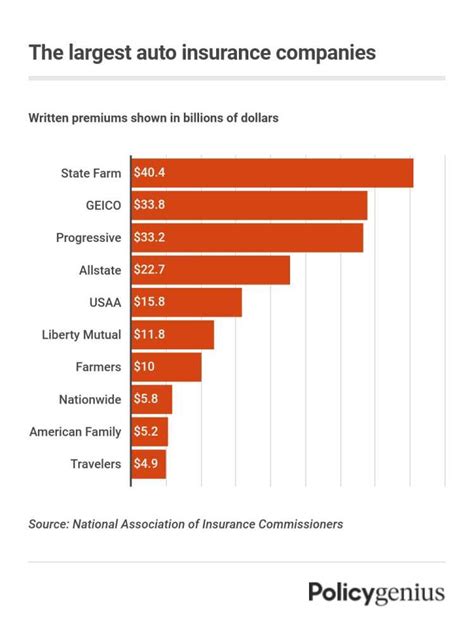

Largest Auto Insurance Companies In The Us

In the United States, the auto insurance industry is a highly competitive and complex landscape, with numerous companies vying for market share. The size and reach of these insurance providers vary significantly, ranging from national giants to regional players. This article delves into the realm of the largest auto insurance companies in the US, exploring their market presence, financial stability, and the services they offer to millions of American drivers.

Top Auto Insurance Companies by Market Share

The US auto insurance market is dominated by a handful of major players, each with its own unique business model and customer base. Here’s an overview of the top companies, based on their market share:

State Farm

State Farm is a household name in the insurance industry and holds the top spot in terms of market share. With a rich history dating back to 1922, State Farm has grown to become the largest auto insurer in the US. Their comprehensive range of insurance products, including auto, home, life, and health insurance, caters to a diverse customer base. State Farm’s strong focus on customer service and local agency presence has contributed to its success, with over 19,000 agents across the country.

Key Statistics:

- Market Share: 17.5% (as of 2022)

- Total Premiums Written: Over $40 billion (2021)

- Number of Customers: Approximately 44 million

Geico

Geico, an acronym for Government Employees Insurance Company, has risen to prominence as a major player in the auto insurance market. Founded in 1936, Geico has expanded its reach through direct-to-consumer sales and innovative marketing strategies. Their focus on digital platforms and user-friendly interfaces has attracted a large millennial and Gen Z customer base. Geico offers a wide range of insurance products and is known for its competitive pricing and discounts.

Key Statistics:

- Market Share: 13.3% (2022)

- Total Premiums Written: Approximately $30 billion (2021)

- Number of Customers: Over 26 million

Progressive

Progressive Insurance has established itself as a leader in the auto insurance market, known for its innovative approach and customer-centric strategies. Founded in 1937, Progressive has grown to become the third-largest auto insurer in the US. Their “Name Your Price” tool and customizable policies have made them a popular choice among drivers seeking tailored coverage. Progressive also offers a range of additional services, including usage-based insurance and roadside assistance.

Key Statistics:

- Market Share: 11.8% (2022)

- Total Premiums Written: Over $25 billion (2021)

- Number of Customers: Approximately 20 million

Allstate

Allstate Insurance is a well-known brand in the insurance industry, offering a comprehensive suite of products to its customers. Founded in 1931, Allstate has built a strong reputation for its financial stability and customer satisfaction. They provide auto insurance, home insurance, life insurance, and other financial services. Allstate’s “Good Hands” slogan reflects its commitment to customer support and protection.

Key Statistics:

- Market Share: 10.1% (2022)

- Total Premiums Written: Approximately $22 billion (2021)

- Number of Customers: Over 16 million

USAA

USAA (United Services Automobile Association) is a unique insurance provider, catering exclusively to military members, veterans, and their families. Founded in 1922, USAA has a strong reputation for its customer-centric approach and excellent service. While their focus is on military personnel, they have expanded their services to include auto, home, life, and health insurance, as well as financial products. USAA’s dedication to its target audience has earned it high customer loyalty and satisfaction.

Key Statistics:

- Market Share: 5.6% (2022)

- Total Premiums Written: Over $11 billion (2021)

- Number of Customers: Approximately 12 million

Services and Innovations Offered by Top Insurers

The largest auto insurance companies in the US are not only leaders in terms of market share but also innovators in the industry. They continuously strive to enhance their services and stay ahead of the curve. Here’s a glimpse at some of the innovative offerings and services provided by these top insurers:

State Farm: Personalized Customer Experience

State Farm emphasizes a personalized approach to insurance, offering tailored policies to meet individual customer needs. They provide a wide range of coverage options, including comprehensive, collision, liability, and personal injury protection. Additionally, State Farm offers various discounts, such as good driver discounts, student discounts, and loyalty rewards.

Geico: Digital Convenience and Discounts

Geico’s focus on digital platforms and online services provides customers with convenient access to their insurance policies. They offer a user-friendly website and mobile app for policy management and claims filing. Geico also provides a variety of discounts, including multi-policy discounts, good student discounts, and military discounts.

Progressive: Usage-Based Insurance and Customization

Progressive’s innovative approach to insurance includes its usage-based insurance program, Snapshot. This program allows drivers to customize their insurance rates based on their driving behavior. Progressive also offers a range of customizable policies, giving customers the flexibility to choose the coverage that best suits their needs.

Allstate: Financial Strength and Customer Support

Allstate’s financial stability and strong customer support have made it a trusted choice for many drivers. They offer a comprehensive suite of insurance products, including auto, home, and life insurance. Allstate’s “Good Hands” promise extends to its customer service, with a focus on providing prompt and efficient support during claims processing.

USAA: Exclusive Benefits for Military Families

USAA’s unique position as an insurer for military families allows it to offer exclusive benefits and services. They provide specialized coverage for military personnel, including deployment coverage and discounts for active-duty service members. USAA also offers financial planning and investment services tailored to the needs of military families.

Future Outlook and Trends in the Auto Insurance Industry

The auto insurance industry is evolving rapidly, driven by technological advancements and changing consumer preferences. Here are some key trends and future prospects for the largest auto insurance companies in the US:

Embracing Digital Transformation

All major auto insurers are investing in digital transformation to enhance customer experience and streamline operations. This includes the development of mobile apps, online policy management tools, and digital claims processing. By embracing digital technologies, insurers aim to improve efficiency and provide customers with convenient and accessible services.

Focus on Data Analytics and Personalization

The use of data analytics is becoming increasingly important in the auto insurance industry. Insurers are leveraging advanced analytics to personalize insurance offerings, identify high-risk drivers, and optimize pricing. By analyzing vast amounts of data, insurers can offer more accurate and tailored policies, leading to improved customer satisfaction and risk management.

Expansion of Usage-Based Insurance

Usage-based insurance, also known as pay-as-you-drive or telematics insurance, is gaining traction among auto insurers. This approach allows insurers to track and analyze driver behavior, rewarding safe driving habits with lower premiums. With the increasing adoption of connected car technologies, usage-based insurance is expected to become more prevalent, providing insurers with valuable insights into driver behavior.

Emphasis on Customer Experience and Satisfaction

In a highly competitive market, customer experience and satisfaction are critical factors for insurers. The largest auto insurance companies are investing in customer-centric strategies, including 24⁄7 customer support, expedited claims processing, and personalized policy recommendations. By prioritizing customer needs and providing exceptional service, insurers aim to build long-term relationships and loyalty.

Adoption of Artificial Intelligence and Machine Learning

Artificial intelligence (AI) and machine learning (ML) are revolutionizing the insurance industry. These technologies are being used to automate processes, improve fraud detection, and enhance risk assessment. Insurers are leveraging AI and ML to streamline claims handling, optimize pricing, and provide more accurate risk predictions. The adoption of these technologies is expected to continue, driving efficiency and innovation in the auto insurance sector.

What are the key factors that contribute to an insurance company’s success in the US market?

+Several factors contribute to an insurance company’s success in the US market. These include a strong focus on customer service, financial stability, a comprehensive range of insurance products, innovative marketing strategies, and a commitment to technological advancements. Additionally, building a robust agent network and providing excellent claims handling services are crucial for customer satisfaction and retention.

How do these top insurers ensure financial stability and customer trust?

+Financial stability is vital for insurance companies to maintain customer trust and ensure long-term sustainability. Top insurers achieve this through rigorous risk management practices, strong capital reserves, and prudent investment strategies. They also maintain high standards of customer service and transparency, regularly communicating with customers and providing clear policy terms and conditions.

What are the benefits of choosing a large auto insurance company over a smaller provider?

+Large auto insurance companies often offer a wider range of coverage options, specialized services, and enhanced customer support. They have the financial resources to provide stability and handle complex claims efficiently. Additionally, larger insurers may have a broader network of agents and claims adjusters, making it easier for customers to access services and receive prompt assistance.

How do these insurers handle claims and provide customer support?

+Top auto insurers prioritize prompt and efficient claims handling. They have dedicated claims departments and trained professionals to assess and process claims quickly. Many insurers also offer 24⁄7 customer support, providing assistance and guidance throughout the claims process. Additionally, they leverage technology to streamline claims handling, such as online claim filing and digital documentation.