Allstate Auto Insurance Quotes

Welcome to the comprehensive guide to understanding Allstate auto insurance quotes. In today's fast-paced world, having reliable car insurance is not just a necessity but a smart financial decision. Allstate, a trusted name in the insurance industry, offers a range of coverage options tailored to meet diverse needs. This article will delve into the intricacies of Allstate auto insurance quotes, providing you with valuable insights to make informed choices about your automotive coverage.

Understanding Allstate’s Auto Insurance Coverage

Allstate’s auto insurance policies are designed to offer comprehensive protection for vehicle owners. Their coverage options encompass a wide range of potential risks, ensuring that policyholders can drive with confidence. Let’s explore the key components of Allstate’s auto insurance:

Liability Coverage

Liability coverage is a fundamental aspect of any auto insurance policy. It protects policyholders from financial losses arising from accidents they cause. Allstate’s liability coverage includes both bodily injury and property damage liability, ensuring that policyholders are covered for a wide range of potential scenarios.

For instance, if an insured driver causes an accident resulting in injuries to other people and damage to their vehicles, Allstate’s liability coverage would step in to cover the associated costs. This coverage provides a safety net, helping policyholders avoid significant out-of-pocket expenses in the event of an accident.

Collision and Comprehensive Coverage

Allstate offers collision and comprehensive coverage options to provide additional protection for policyholders. Collision coverage pays for repairs or replacements when the insured vehicle is damaged in an accident, regardless of fault. This coverage is particularly beneficial for newer vehicles, as it can help cover the cost of repairs or replacements that may exceed the vehicle’s current value.

Comprehensive coverage, on the other hand, protects against damages caused by events other than collisions. This includes damage from theft, vandalism, natural disasters, or collisions with animals. With comprehensive coverage, policyholders can rest assured that their vehicles are protected from a wide range of potential hazards.

Uninsured/Underinsured Motorist Coverage

Uninsured/underinsured motorist coverage is an essential component of Allstate’s auto insurance policies. This coverage provides protection for policyholders who are involved in accidents with drivers who either have no insurance or insufficient insurance coverage. In such cases, Allstate’s uninsured/underinsured motorist coverage can step in to cover the costs of medical expenses, lost wages, and other damages.

By including this coverage in their policies, Allstate ensures that policyholders are not left financially vulnerable in the event of an accident with an uninsured or underinsured driver. This coverage provides an added layer of protection, giving policyholders peace of mind on the road.

Additional Coverages and Benefits

Allstate goes beyond the basics, offering a range of additional coverages and benefits to enhance their auto insurance policies. These include:

- Rental Car Reimbursement: This coverage helps policyholders cover the cost of renting a vehicle while their own car is being repaired or replaced after an accident.

- Roadside Assistance: Allstate provides 24⁄7 roadside assistance, offering services like towing, battery jump-starts, and tire changes to help policyholders in emergency situations.

- Accident Forgiveness: Allstate’s accident forgiveness option allows policyholders to maintain their good driver discount even after their first at-fault accident, helping to keep their insurance rates stable.

These additional coverages and benefits demonstrate Allstate’s commitment to providing comprehensive protection and peace of mind for their policyholders.

Obtaining an Allstate Auto Insurance Quote

Getting an Allstate auto insurance quote is a straightforward process. Policyholders can choose from several convenient options to obtain their quotes:

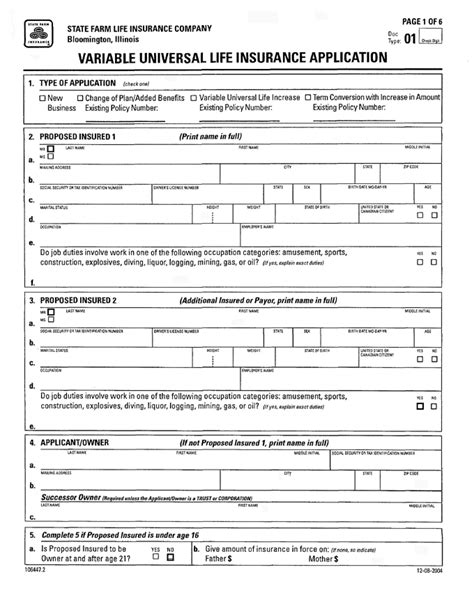

Online Quote

Allstate’s website offers a user-friendly online quoting tool. Policyholders can provide their basic information, including their vehicle details, driving history, and desired coverage levels, to receive an instant quote. This online process is quick, convenient, and provides an accurate estimate of their insurance costs.

Phone Quote

For those who prefer personal assistance, Allstate’s customer service representatives are available via phone to provide quotes. Policyholders can discuss their specific needs and coverage requirements with a knowledgeable agent, ensuring they receive a quote tailored to their situation.

In-Person Quote

Allstate’s local agents are available to meet with policyholders in person to discuss their auto insurance needs. This option allows for a more personalized experience, where agents can provide detailed explanations of coverage options and answer any questions policyholders may have.

Factors Affecting Allstate Auto Insurance Quotes

Allstate’s auto insurance quotes are influenced by various factors, each playing a role in determining the cost of coverage. Understanding these factors can help policyholders make informed decisions about their insurance choices.

Vehicle Type and Usage

The type of vehicle being insured and its intended usage are significant factors in determining insurance quotes. Allstate considers the make, model, and year of the vehicle, as well as its primary purpose (e.g., commuting, business use, or pleasure driving). Vehicles with higher safety ratings and lower accident risks may be eligible for more affordable insurance rates.

Driving History

Policyholders’ driving records are a critical factor in determining their insurance quotes. Allstate takes into account factors such as accident history, traffic violations, and claims made under previous policies. A clean driving record with no accidents or violations can lead to more favorable insurance rates.

Coverage Levels and Deductibles

The level of coverage and deductibles chosen by policyholders also impact their insurance quotes. Higher coverage limits and lower deductibles typically result in higher insurance premiums, while lower coverage limits and higher deductibles can lead to more affordable rates. Policyholders should carefully consider their coverage needs and financial situation when selecting their coverage levels and deductibles.

Location and Demographics

Allstate considers policyholders’ location and demographic factors when calculating insurance quotes. Areas with higher crime rates or a history of frequent accidents may result in higher insurance rates. Additionally, demographic factors such as age, gender, and marital status can also influence insurance quotes, as these factors are statistically linked to driving behavior and accident risks.

Comparing Allstate’s Auto Insurance Quotes

When comparing Allstate’s auto insurance quotes with those of other insurance providers, it’s essential to consider several key factors to ensure an accurate and fair comparison.

Coverage Levels and Benefits

Policyholders should compare the coverage levels and benefits offered by different insurance providers. Allstate’s comprehensive range of coverage options and additional benefits should be weighed against those of other providers to ensure a fair comparison. This includes evaluating liability limits, collision and comprehensive coverage, and any optional coverages that may be of interest.

Discounts and Savings Opportunities

Allstate offers a variety of discounts and savings opportunities to its policyholders. These may include multi-policy discounts, good student discounts, safe driver discounts, and loyalty rewards. Policyholders should compare these savings opportunities with those offered by other insurance providers to determine the most cost-effective option.

Customer Service and Claims Handling

The quality of customer service and claims handling is an important consideration when choosing an insurance provider. Allstate prides itself on its dedicated customer service and claims teams, ensuring policyholders receive prompt and professional assistance when they need it most. Comparing Allstate’s customer service reputation with that of other providers can help policyholders make an informed decision.

Tips for Obtaining the Best Allstate Auto Insurance Quote

To ensure you get the best auto insurance quote from Allstate, consider the following tips:

Shop Around

Don’t settle for the first quote you receive. Compare quotes from multiple insurance providers, including Allstate, to ensure you’re getting the best value for your money. Shopping around allows you to see the range of coverage options and pricing available in the market.

Bundle Your Policies

Allstate offers multi-policy discounts when policyholders bundle their auto insurance with other insurance products, such as homeowners or renters insurance. By bundling your policies, you can save money and streamline your insurance management.

Maintain a Clean Driving Record

A clean driving record is essential for obtaining the best insurance rates. Avoid accidents and traffic violations to keep your insurance premiums as low as possible. Allstate rewards safe driving with discounts, so maintaining a clean record can lead to significant savings over time.

Consider Higher Deductibles

Opting for higher deductibles can result in lower insurance premiums. While this means you’ll pay more out of pocket if you need to file a claim, it can be a cost-effective strategy for policyholders who are confident in their ability to handle smaller repairs or incidents without making a claim.

The Future of Allstate Auto Insurance

Allstate is continuously innovating and adapting to the changing landscape of the insurance industry. As technology advances, Allstate is exploring new ways to enhance its auto insurance offerings and improve the overall customer experience.

Telematics and Usage-Based Insurance

Allstate is exploring the use of telematics and usage-based insurance models. These innovative approaches allow policyholders to provide real-time driving data, such as miles driven, driving behavior, and accident avoidance, which can be used to personalize their insurance rates. This technology has the potential to reward safe drivers with more affordable insurance premiums.

Digital Transformation and Convenience

Allstate is investing in digital transformation to enhance its online and mobile platforms. Policyholders can expect increased convenience and accessibility, with the ability to manage their policies, file claims, and obtain quotes entirely online or through mobile apps. This digital shift aims to provide a seamless and efficient customer experience.

Data-Driven Insights and Personalization

Allstate is leveraging data analytics to gain deeper insights into customer needs and preferences. By analyzing vast amounts of data, Allstate can personalize its insurance offerings, providing policyholders with coverage options that are tailored to their unique circumstances. This data-driven approach ensures that policyholders receive the right coverage at the right price.

Conclusion

Allstate’s auto insurance quotes offer a comprehensive and customizable coverage experience. By understanding the factors that influence their quotes and exploring the various coverage options, policyholders can make informed decisions about their automotive insurance. With a commitment to innovation and customer satisfaction, Allstate continues to lead the way in providing reliable and affordable auto insurance solutions.

What factors influence Allstate’s auto insurance rates?

+Allstate’s auto insurance rates are influenced by a variety of factors, including the make and model of your vehicle, your driving record, the coverage levels you choose, and your location. Allstate also considers demographic factors like age, gender, and marital status when calculating rates.

How can I get a more accurate Allstate auto insurance quote?

+To obtain a more accurate quote, provide Allstate with detailed information about your vehicle, your driving history, and the coverage levels you desire. Being transparent and providing accurate information will help ensure you receive a quote that aligns with your specific needs.

Are there any discounts available with Allstate auto insurance?

+Yes, Allstate offers a range of discounts to help policyholders save on their auto insurance premiums. These discounts include multi-policy discounts, good student discounts, safe driver discounts, and loyalty rewards. By taking advantage of these discounts, you can reduce your insurance costs significantly.

What should I do if I need to file a claim with Allstate auto insurance?

+If you need to file a claim, contact Allstate’s dedicated customer service team. They will guide you through the claims process, providing prompt and professional assistance. Allstate aims to make the claims process as seamless and stress-free as possible for its policyholders.

How can I manage my Allstate auto insurance policy online?

+Allstate offers an online platform where policyholders can manage their policies, make payments, update their information, and even obtain quotes for additional insurance products. By utilizing the online platform, you can conveniently manage your auto insurance and access your policy details whenever needed.