How To Apply For Insurance

Applying for insurance is an essential step towards safeguarding your financial well-being and protecting yourself and your loved ones from unforeseen circumstances. Whether it's health insurance, auto insurance, or property coverage, the process can seem daunting, but with the right information and preparation, it becomes much more manageable. In this comprehensive guide, we will walk you through the steps to navigate the insurance application process, providing valuable insights and tips to ensure a smooth and successful experience.

Understanding the Insurance Landscape

Before diving into the application process, it’s crucial to have a solid understanding of the insurance industry and the different types of coverage available. Insurance serves as a financial safety net, providing peace of mind and protection against potential risks. From health emergencies to accidental damages, insurance policies offer a range of benefits tailored to meet specific needs.

Types of Insurance

The insurance market offers a diverse range of policies, each designed to address unique situations. Here’s an overview of some common types of insurance:

- Health Insurance: This type of coverage is vital for accessing medical care and managing healthcare costs. It can include individual plans, family plans, and employer-sponsored options.

- Auto Insurance: Protecting your vehicle and yourself on the road is essential. Auto insurance policies cover damages, injuries, and liabilities arising from vehicle accidents.

- Homeowner’s Insurance: For homeowners, this policy provides financial protection against damages to your home and its contents, as well as liability coverage for accidents on your property.

- Renter’s Insurance: Similar to homeowner’s insurance, renter’s insurance protects your personal belongings and provides liability coverage for those renting a home or apartment.

- Life Insurance: Life insurance policies offer financial support to your loved ones in the event of your passing, ensuring their financial stability and future security.

- Travel Insurance: When planning a trip, travel insurance can provide coverage for trip cancellations, medical emergencies, and lost luggage, offering peace of mind while exploring new destinations.

- Business Insurance: Businesses require specialized insurance to protect against various risks, including property damage, liability, and employee-related issues.

Understanding the specific needs of your situation is crucial when choosing the right insurance coverage. Whether it's ensuring your health, protecting your assets, or safeguarding your business, the right policy can provide the necessary financial support when you need it most.

Preparing for the Insurance Application

Before initiating the insurance application process, it’s essential to gather relevant information and prepare the necessary documentation. This proactive approach ensures a smoother and more efficient experience.

Gathering Essential Documents

The insurance application process often requires a variety of documents to verify your identity, assess your risk profile, and determine the appropriate coverage. Here’s a checklist of common documents you may need:

- Personal Identification: Provide valid identification, such as a driver’s license, passport, or state-issued ID card.

- Proof of Address: Submit recent utility bills, bank statements, or rental agreements to verify your current residence.

- Financial Information: Gather details about your income, assets, and liabilities. This may include pay stubs, tax returns, or investment statements.

- Vehicle Details: For auto insurance, have your vehicle’s make, model, year, and Vehicle Identification Number (VIN) readily available.

- Medical Records: In the case of health insurance, be prepared to provide medical history and any relevant prescriptions or diagnoses.

- Business Documents: If applying for business insurance, collect business registration documents, financial statements, and employee records.

- Existing Policies: If you already have insurance coverage, gather details about your current policies, including coverage limits and expiration dates.

Having these documents organized and easily accessible will expedite the application process and help you provide accurate information to the insurance provider.

Assessing Your Insurance Needs

Understanding your specific insurance requirements is a critical step in the preparation process. Take time to evaluate your unique circumstances and identify the areas where insurance coverage can provide the most value.

- Health Insurance: Consider your current health status, pre-existing conditions, and the need for coverage for yourself and your family. Assess the level of coverage required, including deductibles and co-pays.

- Auto Insurance: Evaluate your driving history, the value of your vehicle, and the level of coverage needed for liability, collision, and comprehensive protection.

- Homeowner’s/Renter’s Insurance: Assess the value of your home or rental property, as well as the contents within. Determine the level of coverage required to protect against damages and liabilities.

- Life Insurance: Consider your financial obligations and the level of coverage needed to provide for your loved ones in the event of your passing. Calculate the amount needed to cover debts, education costs, and future expenses.

- Travel Insurance: Review your travel plans and assess the risks associated with your destination. Determine the coverage limits and benefits needed for trip cancellations, medical emergencies, and baggage loss.

By thoroughly assessing your insurance needs, you can make informed decisions and choose policies that align with your specific circumstances, providing the right level of protection.

The Insurance Application Process

Once you’ve gathered the necessary documents and assessed your insurance needs, it’s time to embark on the application process. Here’s a step-by-step guide to help you navigate this journey.

Choosing the Right Insurance Provider

With numerous insurance providers in the market, selecting the right one can be a daunting task. Consider the following factors to make an informed decision:

- Reputation and Financial Stability: Research the insurance provider’s reputation and financial standing. Choose a company with a solid track record and financial stability to ensure they will be able to honor their commitments.

- Coverage Options: Review the range of coverage options offered by different providers. Ensure they align with your specific needs and provide the necessary protection.

- Customer Service: Assess the provider’s customer service reputation. Look for companies with responsive and knowledgeable representatives who can guide you through the application process and address any concerns.

- Pricing and Discounts: Compare insurance quotes from multiple providers to find the most competitive rates. Many providers offer discounts for multiple policies or loyalty programs, so be sure to inquire about available savings.

- Digital Services: In today’s digital age, consider providers that offer online or mobile applications for policy management and claims processing. These tools can streamline the insurance experience and provide added convenience.

Take the time to research and compare different insurance providers to find the one that best suits your needs and offers the most comprehensive coverage and services.

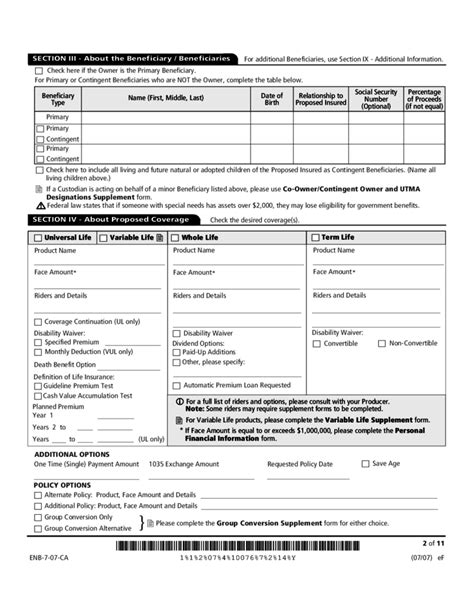

Completing the Application Form

The application form is a critical step in the insurance process, as it captures your personal and financial information. Here’s a guide to completing it accurately and efficiently:

- Read the Instructions: Carefully review the application instructions to understand the requirements and any specific guidelines provided by the insurance provider.

- Provide Accurate Information: Ensure that all the information you provide is truthful and accurate. Misrepresenting facts or omitting relevant details can lead to policy cancellation or claims denial.

- Complete All Required Fields: Make sure to fill in all the mandatory fields on the application form. If you’re unsure about a particular question, contact the insurance provider for clarification.

- Attach Supporting Documents: Include any supporting documents requested by the insurance provider. These may include proof of identification, financial statements, or medical records.

- Review and Verify: Before submitting the application, carefully review all the information you’ve provided. Double-check for any errors or omissions and make necessary corrections.

- Sign and Submit: Once you’re satisfied with the accuracy of the application, sign the necessary documents and submit them to the insurance provider. Follow their instructions for submitting the application, whether it’s via mail, email, or an online portal.

Completing the application form accurately and thoroughly is crucial to ensure a smooth insurance process and avoid any potential delays or complications.

Understanding Policy Terms and Conditions

Once you’ve submitted your insurance application, the provider will review your information and assess your eligibility. Upon approval, you’ll receive a policy document outlining the terms and conditions of your coverage.

It’s essential to thoroughly read and understand the policy document to ensure you’re aware of the coverage limits, exclusions, and any specific requirements. Here’s what to look for:

- Coverage Limits: Understand the maximum amount the insurance provider will pay for a covered claim. This information is typically outlined in the policy’s schedule of benefits or coverage limits section.

- Exclusions: Be aware of any specific situations or circumstances that are not covered by the policy. Exclusions can vary widely, so carefully review this section to avoid any surprises.

- Deductibles and Co-Pays: Familiarize yourself with the financial obligations you may have to meet before the insurance coverage kicks in. Deductibles are the amount you pay out of pocket before the insurance provider covers the remaining expenses, while co-pays are the fixed amounts you pay for specific services.

- Renewal and Cancellation Policies: Understand the terms and conditions surrounding policy renewals and cancellations. This includes the renewal process, any changes to coverage, and the circumstances under which the insurance provider may cancel your policy.

- Claims Process: Review the steps you need to take to file a claim, including any necessary documentation and timelines. Understanding the claims process ensures a smoother experience when you need to make a claim.

By thoroughly understanding the policy terms and conditions, you can make informed decisions and take advantage of the coverage provided by your insurance policy.

Tips for a Successful Insurance Application

Navigating the insurance application process can be challenging, but with the right approach and attention to detail, you can increase your chances of a successful outcome. Here are some valuable tips to keep in mind:

Be Transparent and Honest

Transparency and honesty are crucial when applying for insurance. Provide accurate and complete information to the insurance provider. Misrepresenting facts or withholding relevant details can lead to policy cancellation or claims denial. Be upfront about your health conditions, driving history, or any other factors that may impact your insurance eligibility.

Compare Quotes and Shop Around

Insurance rates can vary significantly between providers, so it’s essential to shop around and compare quotes. Obtain multiple quotes from different insurance companies to find the most competitive rates and coverage options. Consider factors such as coverage limits, deductibles, and additional benefits when comparing quotes.

Seek Professional Advice

If you’re unsure about the insurance application process or have specific concerns, consider seeking professional advice from an insurance broker or financial advisor. These experts can provide valuable guidance, help you understand your options, and ensure you choose the right coverage for your needs.

Understand Your Rights and Responsibilities

Familiarize yourself with your rights and responsibilities as an insurance policyholder. Understand the terms and conditions of your policy, including any obligations you need to fulfill to maintain coverage. Be aware of your rights in the event of a claim, such as the right to appeal a denied claim or receive timely payments.

Stay Organized and Manage Your Policy

Once you’ve obtained your insurance policy, stay organized and manage your coverage effectively. Keep track of important documents, such as policy certificates, renewals, and any changes made to your policy. Set reminders for policy renewals and review your coverage periodically to ensure it still meets your needs.

By following these tips and staying proactive, you can navigate the insurance application process with confidence and secure the coverage that best protects your financial well-being.

Conclusion

Applying for insurance is a crucial step towards securing your financial future and protecting yourself and your loved ones. By understanding the insurance landscape, preparing adequately, and following the application process diligently, you can obtain the coverage you need to face life’s uncertainties with confidence. Remember to choose the right insurance provider, provide accurate information, and thoroughly review your policy terms and conditions. With these steps and a proactive approach, you can ensure a successful insurance application experience.

How long does the insurance application process typically take?

+The duration of the insurance application process can vary depending on the type of insurance and the complexity of your circumstances. In general, it can take anywhere from a few days to several weeks. Factors such as the availability of supporting documents, the thoroughness of your application, and the insurance provider’s processing time can influence the overall timeline.

What happens if I provide inaccurate or incomplete information on my insurance application?

+Providing inaccurate or incomplete information on your insurance application can have serious consequences. Insurance providers rely on truthful and complete disclosures to assess risk and determine eligibility. If they discover that you’ve misrepresented facts or withheld relevant details, they may deny your application, cancel your policy, or refuse to pay claims. It’s crucial to be honest and provide accurate information to ensure a smooth and successful insurance experience.

Can I apply for multiple types of insurance with the same provider?

+Yes, many insurance providers offer a wide range of coverage options, allowing you to bundle multiple types of insurance under one provider. Bundling your insurance policies can often lead to significant savings and streamlined policy management. Contact your preferred insurance provider to explore their available coverage options and the benefits of bundling your policies.

What should I do if I have questions or concerns during the insurance application process?

+If you have questions or concerns during the insurance application process, don’t hesitate to reach out to the insurance provider. Most providers have dedicated customer service representatives who can provide guidance and clarification. You can contact them via phone, email, or live chat to address your queries and ensure a smooth application experience.