Collision Vs Comprehensive Insurance

Unraveling the Differences: Collision and Comprehensive Insurance

In the realm of vehicle ownership, insurance is an essential aspect that provides peace of mind and financial protection. Two commonly encountered terms in the insurance landscape are collision and comprehensive coverage. These policies offer distinct benefits and coverages, catering to different scenarios and risks. Understanding the nuances between collision and comprehensive insurance is crucial for making informed decisions about your vehicle's protection.

This comprehensive guide aims to delve into the intricacies of collision and comprehensive insurance, shedding light on their unique features, coverage details, and real-world applications. By exploring these policies, we can empower vehicle owners to make strategic choices that align with their specific needs and circumstances.

Collision Insurance: Protecting Against Physical Damages

Collision insurance is a cornerstone of vehicle protection, specifically designed to address physical damages sustained by your vehicle in the event of a collision. This coverage extends to a wide range of scenarios, including accidents with other vehicles, collisions with stationary objects, and even rollovers.

Key Features of Collision Insurance

- Accident Coverage: Collision insurance primarily focuses on covering repairs or replacements required due to accidents. This includes damage to your vehicle's exterior, interior, and mechanical components.

- Two-Party Involvement: Collision coverage typically comes into play when you are involved in an accident with another vehicle, regardless of who is at fault. It ensures that your vehicle receives the necessary repairs, providing a sense of security during challenging times.

- Comprehensive Repair Options: With collision insurance, you have the flexibility to choose the repair shop that best suits your preferences and budget. This allows for personalized decisions regarding the restoration of your vehicle.

- Deductible Flexibility: Collision insurance policies often offer a range of deductible options. A higher deductible can lead to lower premiums, making it a strategic choice for those seeking cost-effective coverage.

Real-World Example: The Collision Coverage Story

Imagine a scenario where you're driving on a rainy day, and due to slippery road conditions, you lose control of your vehicle and collide with a tree. In this situation, collision insurance steps in to cover the repairs required to restore your vehicle to its pre-accident condition. From repairing the damaged body panels to replacing the broken windshield, collision coverage ensures that your vehicle is fully functional once again.

Comprehensive Insurance: Beyond Collisions

While collision insurance focuses on physical damages resulting from accidents, comprehensive insurance takes a broader approach, offering protection against a wide array of unforeseen events and circumstances.

Coverage Highlights of Comprehensive Insurance

- Vandalism and Theft: Comprehensive insurance covers damages or losses resulting from acts of vandalism, such as broken windows or scratched paint. Additionally, it provides coverage if your vehicle is stolen, ensuring you're not left bearing the financial burden.

- Natural Disasters: Whether it's a hailstorm damaging your vehicle's exterior or a flood submerging your car, comprehensive insurance has you covered. This coverage extends to various natural disasters, providing peace of mind in unpredictable situations.

- Animal Collisions: Encountering an animal on the road can lead to significant damage to your vehicle. Comprehensive insurance steps in to cover repairs needed when you collide with an animal, ensuring your vehicle's safety and functionality.

- Fire and Explosion: In the unfortunate event of a fire or explosion, comprehensive insurance provides coverage for the resulting damages. This includes repairs or replacements necessary to get your vehicle back on the road.

A Comprehensive Example

Let's consider a situation where you park your vehicle in a secure garage, only to discover the next morning that someone has smashed your window and stolen valuable items from the interior. In this scenario, comprehensive insurance proves invaluable. It covers the cost of repairing the broken window and, depending on your policy, may even reimburse you for the stolen items, ensuring you're not left financially strained.

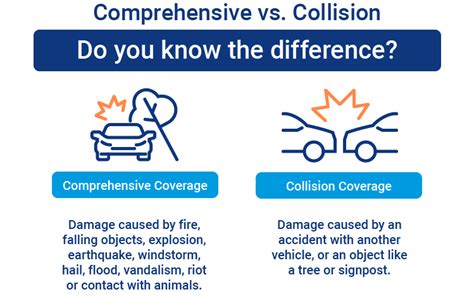

Comparative Analysis: Collision vs. Comprehensive

Now that we've explored the individual strengths of collision and comprehensive insurance, let's delve into a comparative analysis to help you make an informed decision about your vehicle's protection.

Coverage Comparison

| Coverage Aspect | Collision Insurance | Comprehensive Insurance |

|---|---|---|

| Accident Coverage | Covers physical damages from collisions | Includes accident coverage, but also provides broader protection |

| Vandalism and Theft | Does not typically cover | Provides coverage for vandalism and theft |

| Natural Disasters | Does not cover natural disasters | Offers protection against various natural disasters |

| Animal Collisions | May cover animal collisions | Provides coverage for animal-related accidents |

| Fire and Explosion | Does not cover fire or explosion | Includes coverage for fire and explosion damages |

Cost Considerations

When deciding between collision and comprehensive insurance, it's essential to consider the cost implications. Generally, collision insurance tends to be more expensive due to the higher risk and potential for significant repairs. On the other hand, comprehensive insurance, while offering broader coverage, may be more affordable for certain vehicle owners.

The cost of insurance can vary based on factors such as the make and model of your vehicle, your driving history, and the level of coverage you choose. It's advisable to obtain quotes from multiple insurers to find the most suitable and cost-effective policy for your needs.

Making an Informed Choice: Tailoring Your Insurance Coverage

Selecting the right insurance coverage involves careful consideration of your unique circumstances and financial capabilities. Here are some key factors to ponder when deciding between collision and comprehensive insurance:

- Vehicle Value: Assess the current market value of your vehicle. If it's an older model with limited financial value, collision insurance may not be the most cost-effective choice. In such cases, comprehensive insurance might provide adequate protection at a lower cost.

- Risk Profile: Evaluate your personal driving habits and the environment in which you operate your vehicle. If you frequently drive in areas prone to natural disasters or have a history of accidents, comprehensive insurance can offer valuable peace of mind.

- Budgetary Constraints: Consider your financial capabilities and the potential impact of insurance premiums on your budget. Collision insurance may be more expensive, but comprehensive insurance could provide a suitable balance between coverage and affordability.

- Personal Preferences: Ultimately, your insurance choice should align with your preferences and peace of mind. If you prioritize comprehensive protection against a wide range of risks, comprehensive insurance is a logical choice. Conversely, if you seek specific coverage for accidents, collision insurance may be more suited to your needs.

Expert Insights and Tips

Navigating the world of insurance can be complex, but with the right guidance, you can make informed decisions. Here are some expert tips and insights to enhance your understanding of collision and comprehensive insurance:

Additionally, consider bundling your insurance policies. Many insurers offer discounts when you combine collision, comprehensive, and other coverages into a single policy. This not only simplifies your insurance management but also provides potential cost savings.

Regularly reviewing and updating your insurance coverage is essential. As your vehicle ages or your personal circumstances change, your insurance needs may evolve. Stay proactive by assessing your coverage annually to ensure it aligns with your current requirements.

Frequently Asked Questions

Does collision insurance cover accidents with uninsured drivers?

+Collision insurance typically covers damages to your vehicle regardless of the other driver's insurance status. However, it's important to review your specific policy terms to understand any exclusions or limitations.

What happens if I have both collision and comprehensive insurance, and my vehicle is totaled in an accident?

+In the event of a total loss, both collision and comprehensive insurance can provide coverage. Collision insurance covers the cost of repairs or the actual cash value of the vehicle, while comprehensive insurance may offer additional coverage for specific circumstances like theft or natural disasters.

Are there any situations where comprehensive insurance is not necessary?

+Comprehensive insurance is often recommended, but it may not be necessary for older vehicles with low market value. In such cases, the cost of the insurance premium might outweigh the potential benefits. Consult with an insurance expert to determine if comprehensive coverage is suitable for your specific vehicle.

Understanding the differences between collision and comprehensive insurance is a crucial step in safeguarding your vehicle and finances. By carefully considering your unique circumstances and the comprehensive information provided in this guide, you can make an informed decision that aligns with your needs and provides the peace of mind you deserve.