Get Health Insurance Quotes

Welcome to a comprehensive guide on navigating the world of health insurance quotes. Obtaining the right health insurance coverage is a crucial step towards safeguarding your well-being and financial security. With a vast array of options available, it's essential to make an informed decision that aligns with your specific needs and circumstances. This guide will walk you through the process of securing health insurance quotes, offering valuable insights and practical tips to help you find the perfect coverage.

Understanding Health Insurance Quotes

Health insurance quotes provide an estimate of the cost of health insurance coverage based on your personal details and preferences. These quotes serve as a starting point for evaluating different plans and making an informed choice. It’s important to note that quotes can vary significantly depending on various factors, including your age, location, pre-existing conditions, and the level of coverage you require.

When seeking health insurance quotes, you'll encounter different types of plans, each with its own set of features and benefits. The most common types include:

- Individual Plans: Tailored to cover one person, these plans offer flexibility and are ideal for those who are self-employed, between jobs, or not eligible for group insurance.

- Family Plans: Designed to provide comprehensive coverage for the entire family, including spouses and dependent children.

- Group Plans: Often offered through employers, group plans typically provide more affordable coverage due to the larger pool of participants.

- Medicare and Medicaid: Government-sponsored programs that offer health insurance to eligible individuals based on age, disability, or financial need.

Steps to Obtain Health Insurance Quotes

To embark on your journey towards securing health insurance coverage, follow these systematic steps:

Step 1: Assess Your Needs

Before seeking quotes, take the time to understand your unique healthcare requirements. Consider factors such as your age, current health status, any pre-existing conditions, and the type of medical services you anticipate needing. This self-assessment will help you determine the level of coverage you require and the features that are most important to you.

Step 2: Explore Your Options

Health insurance is offered by a variety of providers, including insurance companies, government agencies, and employer-sponsored plans. Research and compare different options to identify the ones that align with your needs and budget. Look for providers that offer a range of plans with varying levels of coverage and benefits.

Step 3: Gather Essential Information

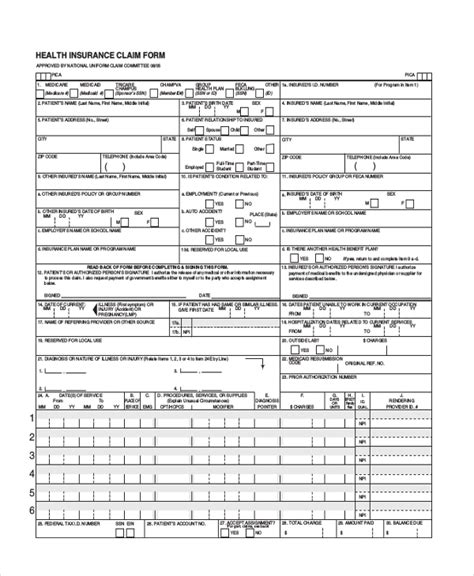

To obtain accurate quotes, you’ll need to provide certain personal details. This typically includes your date of birth, gender, zip code, and information about any pre-existing conditions. Having this information readily available will streamline the quoting process and ensure you receive relevant and precise estimates.

Step 4: Utilize Online Quote Tools

Many insurance providers offer user-friendly online tools that allow you to input your information and receive instant quotes. These tools provide a convenient way to compare plans and premiums from the comfort of your own home. Ensure you use reputable websites and verify the legitimacy of the providers before submitting your details.

Step 5: Compare Quotes

Once you have a selection of quotes, it’s time to analyze and compare them. Consider factors such as monthly premiums, deductibles, co-pays, and the scope of coverage. Assess the out-of-pocket costs and the network of healthcare providers associated with each plan. Remember, the cheapest plan may not always be the best option, so carefully evaluate the benefits and limitations of each quote.

Step 6: Seek Professional Advice

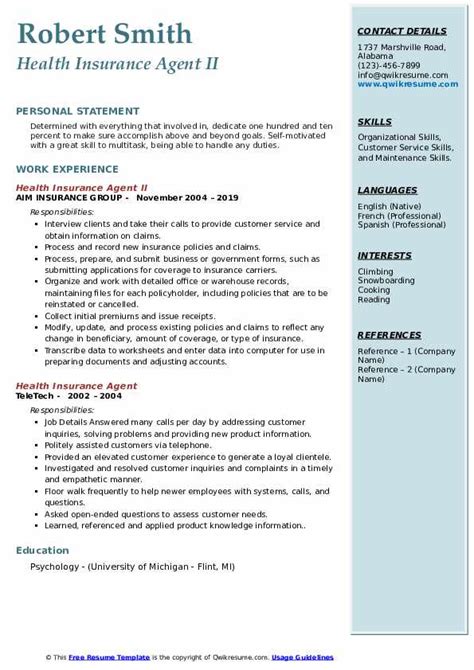

If you find the process overwhelming or need expert guidance, consider consulting with a licensed insurance agent or a healthcare advocate. These professionals can provide personalized advice based on your specific needs and help you navigate the complexities of health insurance. Their expertise can be invaluable in making an informed decision.

Factors Influencing Health Insurance Quotes

Health insurance quotes are influenced by a multitude of factors, each playing a significant role in determining the cost of coverage. Understanding these factors can help you anticipate potential variations in quotes and make more accurate comparisons.

Age

Age is a primary factor in health insurance quotes. Generally, younger individuals tend to pay lower premiums, as they are less likely to require extensive medical care. As you age, your premiums may increase, reflecting the higher likelihood of health issues.

| Age Group | Average Premium |

|---|---|

| Under 30 | $300/month |

| 30-40 | $350/month |

| 40-50 | $400/month |

| 50-65 | $450/month |

Location

The cost of health insurance can vary significantly based on your geographical location. Urban areas with higher costs of living and access to specialized healthcare services may result in higher premiums. Conversely, rural areas with limited healthcare options might offer more affordable coverage.

Pre-existing Conditions

Pre-existing conditions, such as chronic illnesses or previous medical procedures, can impact your health insurance quotes. Some providers may offer specialized plans for individuals with pre-existing conditions, while others may exclude certain conditions from coverage. It’s crucial to disclose all pre-existing conditions to ensure accurate quotes and avoid surprises later.

Level of Coverage

The level of coverage you choose will directly affect your insurance quotes. Higher coverage plans, offering a broader range of benefits and lower out-of-pocket costs, typically come with higher premiums. On the other hand, lower coverage plans may have lower premiums but may leave you vulnerable to higher costs if you require extensive medical care.

Maximizing Your Health Insurance Coverage

Now that you have a better understanding of health insurance quotes, it’s time to delve into strategies to maximize your coverage and get the most value for your money.

Understand Your Plan’s Benefits

Take the time to thoroughly read and comprehend the benefits outlined in your chosen health insurance plan. Familiarize yourself with the coverage limits, deductibles, co-pays, and any exclusions. This knowledge will empower you to make informed decisions about your healthcare and help you avoid unexpected expenses.

Utilize Preventive Care

Many health insurance plans offer preventive care services at little to no cost. These services, such as annual check-ups, vaccinations, and screenings, are designed to catch potential health issues early on, preventing more serious and costly medical problems down the line. Make sure to take advantage of these preventive care benefits to maintain your health and well-being.

Choose In-Network Providers

Health insurance plans typically have a network of preferred providers, including doctors, hospitals, and pharmacies. Utilizing these in-network providers can result in significant cost savings, as they have negotiated rates with the insurance company. Check your plan’s network directory and choose providers within the network to ensure maximum coverage and minimize out-of-pocket expenses.

Negotiate Your Premiums

If you’re faced with high premiums, don’t be afraid to negotiate. Contact your insurance provider and explain your circumstances. Many providers are open to negotiating premiums, especially if you’re a loyal customer or have a good payment history. It’s worth exploring this option to find a more affordable plan that suits your needs.

Future Trends in Health Insurance

The world of health insurance is constantly evolving, with new trends and innovations shaping the industry. As technology advances and healthcare needs change, here are some insights into the future of health insurance:

Telehealth and Virtual Care

The rise of telehealth and virtual care services has transformed the way healthcare is delivered. With the convenience of video consultations and remote monitoring, patients can access medical advice and treatment without leaving their homes. This trend is expected to continue, offering increased accessibility and cost-effectiveness for both patients and providers.

Value-Based Care Models

Traditional fee-for-service models are gradually being replaced by value-based care models. These models focus on providing high-quality, cost-effective care, with payments tied to patient outcomes and satisfaction. This shift towards value-based care is aimed at improving patient health and reducing overall healthcare costs.

Artificial Intelligence and Data Analytics

Artificial intelligence (AI) and data analytics are revolutionizing the healthcare industry. These technologies enable insurance providers to analyze vast amounts of data, identify trends, and predict potential health issues. By leveraging AI, insurers can develop more personalized and targeted coverage plans, improving overall patient care and reducing unnecessary costs.

Conclusion

Obtaining health insurance quotes is a crucial step towards securing the right coverage for your needs. By following the systematic steps outlined in this guide, you can navigate the complex world of health insurance with confidence. Remember to assess your needs, explore your options, and compare quotes to find the perfect plan. With the right coverage in place, you can focus on maintaining your health and well-being without financial worry.

What is the difference between a health insurance quote and a plan?

+A health insurance quote is an estimate of the cost of coverage based on your personal details. It serves as a starting point for comparison and decision-making. A health insurance plan, on the other hand, is the actual coverage you purchase, outlining the benefits, limitations, and costs associated with your healthcare.

Can I change my health insurance plan after purchasing it?

+In most cases, you can change your health insurance plan during the annual open enrollment period or if you experience a qualifying life event, such as marriage, divorce, or a change in employment status. However, it’s important to check with your insurance provider for specific guidelines and restrictions.

How can I reduce my health insurance premiums?

+There are several strategies to reduce your health insurance premiums. These include opting for a higher deductible, enrolling in a health savings account (HSA), taking advantage of employer-sponsored wellness programs, and negotiating with your insurance provider. It’s essential to explore these options to find the most cost-effective plan for your needs.