Online Quote For Homeowners Insurance

In today's digital age, obtaining an online quote for homeowners insurance has become a convenient and efficient process. With just a few clicks, homeowners can explore various insurance options, compare policies, and find the best coverage to protect their homes and assets. This article delves into the world of online homeowners insurance quotes, providing an in-depth analysis of the process, key considerations, and benefits to help you make an informed decision.

The Online Quote Process: A Step-by-Step Guide

Securing an online quote for homeowners insurance is a straightforward journey, typically consisting of the following steps:

Step 1: Research and Comparison

Begin by researching reputable insurance providers and their offerings. Compare different companies based on their financial stability, customer reviews, and the range of coverage options they provide. This initial research phase is crucial as it sets the foundation for your insurance journey.

Utilize online resources, such as insurance comparison websites and review platforms, to gather insights about various insurers. Look for providers with a strong track record of customer satisfaction and financial strength, ensuring your assets are protected by a reliable company.

Step 2: Gather Essential Information

Before requesting a quote, gather the necessary details about your home and personal circumstances. This information is vital for insurers to assess your risk profile accurately. Key details to have on hand include:

- Home Details: The location, size, and age of your home, along with any unique features or improvements.

- Personal Information: Your name, date of birth, and contact details. Additionally, provide information about any existing insurance policies you hold.

- Coverage Requirements: Determine the level of coverage you desire, considering factors like the replacement cost of your home, the value of your personal belongings, and any specific risks in your area (e.g., natural disasters, crime rates).

Step 3: Requesting a Quote Online

Once you’ve gathered the necessary information, visit the website of your chosen insurance provider and locate the “Get a Quote” or “Quote Request” section. Here, you’ll be guided through a series of questions to input the details you’ve prepared.

Most insurers offer an online form or a quick quote tool. Ensure you provide accurate and honest information to receive an accurate quote. Common questions may include:

- The year your home was built and any recent renovations.

- The type of construction (e.g., brick, wood frame) and the number of stories.

- The replacement cost estimate for your home.

- Any security features, such as alarm systems or fire prevention measures.

- The value of your personal belongings and any high-value items.

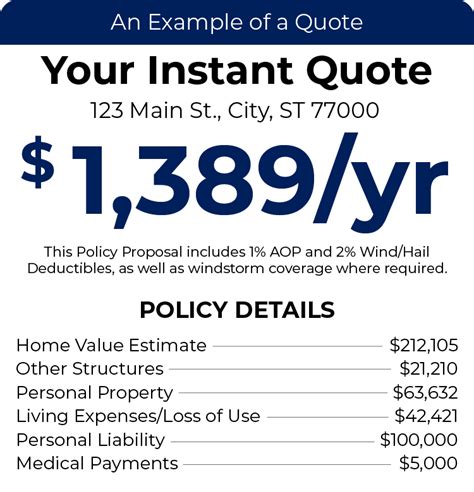

Step 4: Review and Customize Your Quote

After submitting your information, the insurance provider will generate a personalized quote based on your risk profile. Take the time to review the quote thoroughly, understanding the coverage limits, deductibles, and any optional add-ons or endorsements available.

Customizing your quote is a crucial step to ensure you receive the right coverage for your needs. Consider the following:

- Coverage Limits: Ensure the limits align with the replacement cost of your home and the value of your belongings. Higher limits provide more protection but may result in a higher premium.

- Deductibles: Choose a deductible that fits your financial comfort level. While a higher deductible can lower your premium, it means you'll pay more out of pocket in the event of a claim.

- Optional Coverages: Explore additional coverages like flood insurance, earthquake coverage, or personal liability protection. These can provide vital protection for specific risks unique to your area or lifestyle.

Step 5: Compare and Make an Informed Decision

Don’t stop at the first quote you receive. Continue researching and comparing quotes from multiple insurers to find the best value for your needs. Consider factors such as coverage options, premium costs, and the insurer’s reputation for claims handling.

Online comparison tools can be invaluable at this stage, allowing you to quickly view side-by-side comparisons of different policies. Take advantage of these resources to make an informed decision about your homeowners insurance coverage.

Benefits of Obtaining an Online Quote for Homeowners Insurance

The process of getting an online quote for homeowners insurance offers several advantages, making it a preferred choice for many homeowners.

Convenience and Accessibility

One of the biggest advantages of online quotes is the convenience and accessibility they provide. You can request quotes from the comfort of your home, at any time, without the need for face-to-face meetings or lengthy phone calls. This flexibility is particularly beneficial for busy individuals or those with limited mobility.

Transparency and Control

Online quote tools offer a high level of transparency. You can see the exact coverage limits, deductibles, and premiums associated with your policy. This transparency empowers you to make informed decisions about your coverage and allows for easy comparisons between different insurers.

Personalized Coverage

Online quote processes often involve detailed questions about your home and personal circumstances. This allows insurers to provide tailored quotes based on your unique needs. Whether you require extensive coverage for high-value items or additional protection for specific risks, online quotes can accommodate these requirements.

Quick and Efficient Process

Obtaining an online quote is generally faster than traditional methods. Insurers often use advanced algorithms and data analytics to generate quotes quickly, providing you with a timely estimate of your insurance needs. This efficiency saves time and allows for a swift decision-making process.

Comparison Shopping Made Easy

With online quotes, you can easily compare multiple insurers’ offerings side by side. This feature enables you to find the best value for your money, ensuring you receive comprehensive coverage at a competitive price. Comparison shopping online is a powerful tool to secure the right homeowners insurance policy.

Key Considerations When Comparing Online Quotes

While online quotes offer numerous benefits, there are a few key considerations to keep in mind when comparing policies:

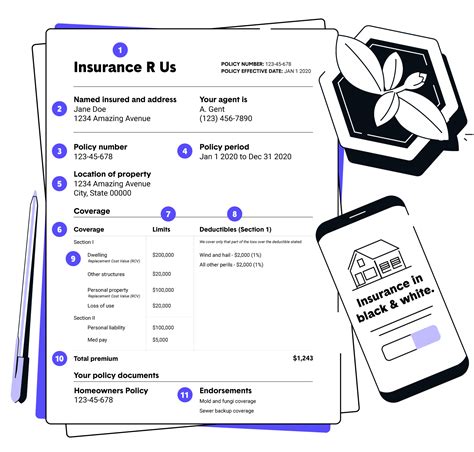

Coverage Limits and Deductibles

Pay close attention to the coverage limits and deductibles offered by each insurer. Ensure the limits align with your home’s replacement cost and the value of your belongings. A higher deductible can lower your premium, but it’s important to choose a deductible you can comfortably afford if you need to file a claim.

Optional Coverages and Endorsements

Review the optional coverages and endorsements available with each policy. Consider your specific needs and risks, such as flood or earthquake coverage, and select a policy that provides the protection you require. Don’t overlook these additional coverages, as they can be vital in certain situations.

Reputation and Financial Strength

Research the insurer’s reputation and financial stability. Choose a company with a strong track record of customer satisfaction and financial strength to ensure your claims will be handled efficiently and fairly. Independent rating agencies, such as AM Best or Standard & Poor’s, provide valuable insights into an insurer’s financial health.

Claims Handling and Customer Service

Consider the insurer’s claims handling process and customer service reputation. Look for reviews and testimonials from current or past customers to gauge their satisfaction with the insurer’s response to claims. Efficient and responsive claims handling is crucial when you need it most.

The Future of Online Homeowners Insurance Quotes

As technology continues to advance, the future of online homeowners insurance quotes looks promising. Insurers are investing in innovative tools and platforms to enhance the quote process, making it even more efficient and personalized.

One emerging trend is the use of artificial intelligence (AI) and machine learning algorithms to analyze vast amounts of data and provide highly accurate quotes. These technologies can consider a multitude of factors, from the home's construction materials to local crime rates, to generate precise risk assessments and quotes.

Additionally, insurers are exploring the potential of virtual reality (VR) and augmented reality (AR) technologies to offer more immersive and interactive quote experiences. VR and AR can provide virtual home assessments, allowing insurers to better understand the unique features and risks associated with each property.

The future of online homeowners insurance quotes is focused on delivering a seamless, personalized experience. Insurers are committed to leveraging technology to provide accurate quotes, efficient claims handling, and a high level of customer satisfaction.

Frequently Asked Questions

How accurate are online homeowners insurance quotes?

+Online quotes are designed to provide a personalized estimate based on the information you provide. While they offer a good starting point, it’s essential to understand that the final premium may vary slightly when your insurer conducts a thorough assessment of your home and personal circumstances.

Can I negotiate my homeowners insurance premium online?

+Negotiating your premium online may be possible, especially if you’re a loyal customer or have a strong claims history. Contact your insurer directly to discuss potential discounts or adjustments to your policy. They may offer bundle discounts, loyalty rewards, or other incentives to retain your business.

What happens if I find a better quote elsewhere after obtaining an online quote?

+It’s always a good idea to shop around for the best homeowners insurance deal. If you find a more competitive quote elsewhere, contact your current insurer and provide them with the details. They may be willing to match or beat the competing offer to retain your business.

Are there any disadvantages to obtaining an online quote for homeowners insurance?

+While online quotes offer numerous advantages, there may be some limitations. Complex situations or unique home features may require a more personalized assessment, which may not be fully captured in an online quote. In such cases, contacting an insurance agent or broker directly may be beneficial to discuss your specific needs.