Brown Brown Insurance

Welcome to a comprehensive exploration of Brown Brown Insurance, a leading provider of insurance solutions with a rich history and a broad range of services. This expert-reviewed article aims to delve into the world of Brown Brown Insurance, offering an in-depth analysis of its offerings, impact, and future prospects. With a focus on specific details and industry insights, we'll navigate through the various aspects of this prominent insurance company.

A Legacy of Innovation: The Brown Brown Insurance Story

Brown Brown Insurance, often simply referred to as Brown & Brown, boasts an impressive journey that began in 1939. Founded by J. Powell Brown in Jacksonville, Florida, the company has since grown into a national force in the insurance industry. What started as a local insurance agency has transformed into a comprehensive risk management powerhouse, offering a diverse array of services to both businesses and individuals.

Over the decades, Brown & Brown has expanded its reach and expertise, acquiring numerous insurance agencies and specialty insurance companies. This strategic approach has allowed the company to diversify its portfolio, cater to a wide range of client needs, and establish itself as a trusted advisor in the industry. Today, Brown & Brown is a publicly traded company, listed on the New York Stock Exchange (NYSE) under the symbol BRO, further solidifying its position as a leading player in the insurance market.

Core Competencies and Specializations

Brown & Brown's success lies in its ability to provide tailored solutions across various sectors. The company offers a comprehensive suite of insurance products and services, including but not limited to:

- Property and Casualty Insurance: Covering a wide range of risks for businesses and individuals, from commercial property damage to personal auto accidents.

- Employee Benefits: Providing comprehensive employee benefit packages, including health, life, and disability insurance, as well as retirement planning services.

- Risk Management: Assisting clients in identifying, assessing, and managing risks through strategic planning and innovative solutions.

- Surety and Fidelity Bonds: Offering financial security and protection for businesses and individuals through various bond types.

- Specialty Insurance: Tailoring insurance solutions for unique and niche industries, such as aerospace, construction, and marine sectors.

With a vast network of experienced professionals, Brown & Brown ensures that its clients receive personalized attention and expert guidance. The company's dedication to client satisfaction and its commitment to staying ahead of industry trends have been key drivers of its success.

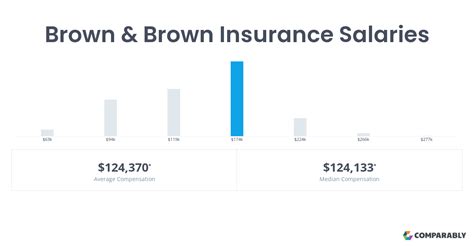

Performance and Market Standing

Brown & Brown's financial performance has been impressive, consistently delivering strong results. In the most recent fiscal year, the company reported a significant increase in revenue, surpassing the $5 billion mark. This growth can be attributed to its diverse client base, ranging from small businesses to Fortune 500 companies, and its ability to adapt to changing market dynamics.

The company's market share has expanded steadily over the years, with a particular focus on strategic acquisitions. By acquiring specialized insurance agencies, Brown & Brown has been able to enhance its expertise and offer a more comprehensive suite of services. This approach has not only strengthened its market position but also provided opportunities for organic growth.

| Metric | Value |

|---|---|

| Revenue (2022) | $5.2 billion |

| Market Share (US) | Top 5 Insurance Brokers |

| Employee Count | Over 13,000 |

Expanding Horizons: Global Presence and Initiatives

While Brown & Brown's roots are firmly planted in the United States, the company has actively sought opportunities to expand its reach internationally. Through strategic partnerships and acquisitions, Brown & Brown has established a presence in key global markets, including Europe and Asia. This global expansion allows the company to cater to multinational corporations and provide localized services in various regions.

In addition to its international ventures, Brown & Brown has been at the forefront of industry initiatives. The company actively participates in sustainability and social responsibility programs, recognizing the importance of environmental and social impact in today's business landscape. By embracing these initiatives, Brown & Brown aims to not only contribute to a more sustainable future but also to attract environmentally conscious clients.

The Future of Brown & Brown: Strategic Directions

As the insurance landscape continues to evolve, Brown & Brown remains dedicated to staying ahead of the curve. The company's future strategic directions are focused on several key areas:

- Digital Transformation: Embracing technology to enhance client experience and streamline processes. Brown & Brown is investing in digital tools and platforms to provide efficient and personalized services, especially in the realm of risk assessment and claim management.

- Data Analytics: Leveraging data to make informed decisions and provide tailored solutions. By analyzing client data and market trends, Brown & Brown aims to offer predictive analytics and risk modeling, further solidifying its position as a trusted advisor.

- Sustainable Business Practices: Continuing its commitment to environmental and social initiatives. Brown & Brown recognizes the importance of sustainability in attracting a new generation of clients and aims to integrate these practices across its operations and services.

- Mergers and Acquisitions: Strategic acquisitions will remain a key part of Brown & Brown's growth strategy. By acquiring specialized agencies, the company can expand its expertise and service offerings, catering to a broader range of clients.

With these strategic initiatives, Brown & Brown is well-positioned to navigate the evolving insurance landscape and maintain its status as a leading provider of insurance solutions.

Conclusion: A Legacy Continues

Brown & Brown Insurance's journey from a local agency to a national leader is a testament to its commitment to innovation, client service, and strategic vision. As the company looks to the future, its focus on digital transformation, data analytics, and sustainable practices ensures its continued relevance and success. With a strong foundation, a diverse range of services, and a dedicated team, Brown & Brown is poised to write the next chapter in its legacy.

Frequently Asked Questions

What is Brown & Brown’s unique selling proposition (USP)?

+

Brown & Brown’s USP lies in its ability to offer comprehensive, tailored insurance solutions. By combining a wide range of services with a client-centric approach, the company provides personalized risk management strategies, ensuring clients receive the right coverage for their unique needs.

How does Brown & Brown ensure client satisfaction?

+

Client satisfaction is a top priority for Brown & Brown. The company achieves this through its dedicated team of professionals who provide expert guidance and personalized attention. Additionally, Brown & Brown’s focus on staying updated with industry trends and providing innovative solutions ensures clients receive the best possible service.

What makes Brown & Brown a leader in the insurance industry?

+

Brown & Brown’s leadership in the insurance industry is a result of its diverse service offerings, strategic acquisitions, and commitment to innovation. By staying ahead of the curve and adapting to market changes, the company has established itself as a trusted advisor to businesses and individuals across various sectors.