Car Insurance Florida Quotes

Car insurance is a vital aspect of vehicle ownership, and in the Sunshine State of Florida, it's a necessity. Florida is unique in its car insurance regulations, and understanding the quotes and policies can be a complex task. This guide aims to demystify the process, providing an in-depth analysis of car insurance quotes in Florida, and offering expert insights to help you navigate this essential coverage.

Understanding Car Insurance in Florida

Florida’s car insurance landscape is distinct, primarily due to its no-fault system. This means that, in the event of an accident, each driver’s insurance company pays for their respective damages, regardless of who caused the accident. This system aims to expedite the claims process, but it also presents some unique challenges and considerations when it comes to insurance quotes.

In Florida, car insurance policies typically consist of several components, including:

- Personal Injury Protection (PIP): This coverage is mandatory in Florida and covers medical expenses and a portion of lost wages for the policyholder and their passengers after an accident, regardless of fault.

- Property Damage Liability (PDL): PDL covers damage caused by the policyholder to another person's property, including their vehicle.

- Bodily Injury Liability (BIL): BIL covers medical expenses and lost wages for other parties involved in an accident caused by the policyholder.

- Collision Coverage: This optional coverage pays for repairs to the policyholder's vehicle after an accident, regardless of fault.

- Comprehensive Coverage: Comprehensive coverage is also optional and pays for damages to the policyholder's vehicle caused by incidents other than collisions, such as theft, fire, or natural disasters.

Factors Affecting Car Insurance Quotes in Florida

When it comes to car insurance quotes in Florida, several factors come into play. These include:

- Vehicle Type and Usage: The make, model, and year of your vehicle, as well as how you use it (e.g., commuting, business, or pleasure) can impact your insurance rates.

- Driver Profile: Your driving record, credit score, and even your age and gender can influence your insurance rates. Younger drivers and those with a history of accidents or traffic violations may pay higher premiums.

- Location: The area where you live and where your vehicle is primarily garaged can affect your insurance rates. Urban areas with higher traffic volumes and crime rates often have higher insurance costs.

- Coverage and Deductibles: The level of coverage you choose and the deductibles you opt for can significantly impact your insurance premiums. Higher coverage limits and lower deductibles usually result in higher premiums.

- Discounts: Florida drivers can take advantage of various discounts, including multi-policy discounts (if you bundle your car insurance with other policies like home or life insurance), good student discounts, safe driver discounts, and loyalty discounts for long-term customers.

Comparing Car Insurance Quotes in Florida

Comparing car insurance quotes in Florida is essential to finding the best coverage at the most competitive rates. Here's a step-by-step guide to help you through the process:

Step 1: Gather Information

Before requesting quotes, ensure you have the following information readily available:

- Personal details: Your name, date of birth, driver’s license number, and Social Security number.

- Vehicle details: Make, model, year, VIN number, and odometer reading.

- Driving history: Any accidents, violations, or claims in the past 3-5 years.

- Current insurance: If you’re switching providers, have your current policy details handy.

Step 2: Choose Your Coverage

Decide on the level of coverage you need. While Florida law requires only PIP and PDL, most drivers opt for additional coverage, such as BIL, collision, and comprehensive. Consider your personal financial situation and the potential risks you want to protect against.

Step 3: Request Quotes

You can request quotes from insurance providers in several ways:

- Online Quote Tools: Many insurance companies offer online quote generators. Simply input your details and the coverage you want, and you’ll receive an instant quote.

- Phone Quotes: You can call insurance providers directly and speak to a representative to obtain a quote.

- Insurance Agents: Working with a local insurance agent can provide personalized advice and guidance. They can help you compare quotes from multiple providers.

Step 4: Compare Quotes

When comparing quotes, look beyond just the premium amount. Consider the coverage limits, deductibles, and any additional perks or benefits offered by each provider. Also, check for customer reviews and the financial stability of the insurance company.

Step 5: Choose Your Provider

Once you’ve thoroughly compared the quotes, choose the provider that offers the best combination of coverage, price, and customer service. Don’t forget to review your policy annually to ensure it still meets your needs and to take advantage of any potential discounts.

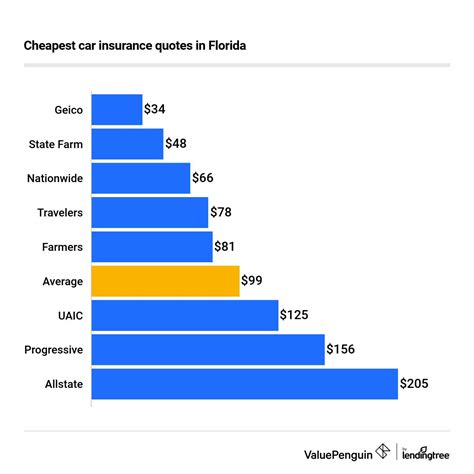

| Insurance Provider | Average Annual Premium |

|---|---|

| State Farm | $1,590 |

| Geico | $1,499 |

| Progressive | $1,650 |

| Allstate | $1,850 |

| USAA | $1,350 |

The Future of Car Insurance in Florida

The car insurance landscape in Florida is constantly evolving. With advancements in technology and changes in driving habits, the industry is likely to see significant shifts in the coming years. Here are some potential future developments:

Telematics and Usage-Based Insurance

Telematics devices and usage-based insurance programs are becoming increasingly popular. These technologies allow insurance companies to track driving behavior and offer discounts to safe drivers. In the future, we may see more insurers adopting these programs, providing incentives for safe driving and potentially reducing overall insurance costs.

Autonomous Vehicles and Car Insurance

The rise of autonomous vehicles could significantly impact car insurance. With fewer accidents caused by human error, insurance rates may decrease over time. However, the legal and regulatory frameworks surrounding autonomous vehicles are still evolving, and it may take some time before we see these changes reflected in insurance policies.

Digitalization and Online Insurance Platforms

The insurance industry is increasingly moving online, with many providers offering digital platforms for policy management and claims processing. This trend is likely to continue, providing customers with more convenience and efficiency when managing their insurance needs.

Insurtech Innovations

Insurtech startups are disrupting the traditional insurance industry with innovative technologies and business models. These companies are leveraging artificial intelligence, machine learning, and data analytics to offer personalized insurance products and more efficient claims processes. As these startups gain traction, we may see more traditional insurers adopting similar technologies to stay competitive.

Environmental and Social Considerations

With growing environmental concerns and a shift towards electric and hybrid vehicles, insurance providers may start offering specialized policies for these vehicles. Additionally, with the increasing focus on social responsibility, we may see insurance companies offering more sustainable and socially conscious products.

Conclusion

Navigating car insurance quotes in Florida can be a complex process, but with the right knowledge and tools, you can find the best coverage at a competitive price. Remember to regularly review your policy and stay informed about the evolving insurance landscape to ensure you’re always getting the best value for your money.

What is the average cost of car insurance in Florida?

+

The average cost of car insurance in Florida varies depending on several factors, including the driver’s profile, vehicle type, and coverage chosen. However, the average annual premium in Florida is around $1,600.

Are there any discounts available for Florida car insurance?

+

Yes, Florida drivers can take advantage of various discounts, including multi-policy discounts, good student discounts, safe driver discounts, and loyalty discounts. These discounts can significantly reduce your insurance premiums.

What is the minimum car insurance coverage required in Florida?

+

In Florida, the minimum required car insurance coverage is Personal Injury Protection (PIP) and Property Damage Liability (PDL). PIP covers medical expenses and a portion of lost wages, while PDL covers damage caused to another person’s property.