Eyemed Insurance

Eyemed Insurance is a prominent player in the vision care industry, offering comprehensive vision benefits to millions of individuals and families across the United States. With a focus on providing accessible and affordable eye care solutions, Eyemed has become a trusted name in the healthcare sector. This article aims to delve into the intricacies of Eyemed Insurance, exploring its history, coverage options, benefits, and the impact it has on individuals' eye health and overall well-being.

A Visionary Journey: The Evolution of Eyemed Insurance

Eyemed Insurance, a subsidiary of Vision Service Plan (VSP), was established in 1986 with a clear mission: to revolutionize the way vision care was delivered and perceived. Since its inception, Eyemed has been at the forefront of innovative vision insurance solutions, constantly adapting to the evolving needs of its customers.

The company's journey began with a simple yet powerful idea: to make eye care accessible and affordable for all. Over the years, Eyemed has expanded its reach, partnering with a vast network of eye care providers and introducing a range of insurance plans tailored to different lifestyles and budgets.

One of the key milestones in Eyemed's history was its acquisition by VSP, a leading not-for-profit vision care company. This partnership solidified Eyemed's position as a trusted provider of vision benefits, allowing it to leverage VSP's extensive network and expertise in the industry.

Today, Eyemed Insurance continues to thrive, offering a comprehensive suite of vision care plans that cater to individuals, families, and businesses. Its commitment to innovation and customer satisfaction has positioned it as a market leader, shaping the future of eye care insurance.

Understanding Eyemed Insurance Coverage: A Comprehensive Overview

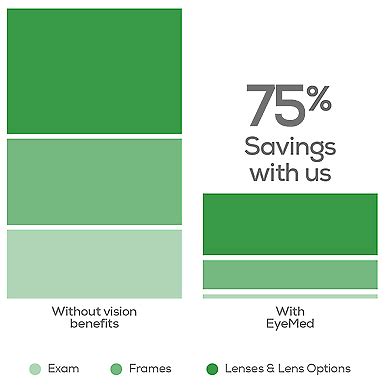

Eyemed Insurance offers a diverse range of vision care plans, ensuring that individuals can find a plan that aligns with their unique needs and preferences. These plans typically cover a wide array of eye care services, including:

- Eye Exams: Comprehensive eye examinations to assess visual acuity, eye health, and the need for corrective lenses.

- Eyeglasses: Coverage for a wide selection of frames and lenses, including prescription sunglasses and specialty lenses.

- Contact Lenses: Benefits for contact lens fittings, exams, and a variety of lens options.

- Vision Correction Procedures: Reimbursement or coverage for certain vision correction surgeries, such as LASIK and PRK.

- Eye Health Management: Support for managing chronic eye conditions and diseases, including access to specialized care and treatments.

Eyemed's plans are designed to be flexible, allowing individuals to choose the level of coverage that suits their lifestyle and budget. Whether it's basic vision care or more comprehensive coverage for specialized treatments, Eyemed strives to provide options that cater to a diverse range of needs.

The Benefits of Eyemed Insurance: Going Beyond Vision Care

Eyemed Insurance goes beyond traditional vision care by offering a host of additional benefits that enhance overall eye health and well-being. These benefits include:

- Discounts on Eye Care Products: Eyemed often partners with leading eye care brands to offer exclusive discounts on contact lenses, eye drops, and other eye care essentials.

- Wellness Programs: Educational resources and wellness programs aimed at promoting eye health and preventing vision-related issues.

- Telehealth Services: Access to virtual eye care consultations, providing convenient and accessible eye care solutions.

- Vision Wellness Rewards: Incentive programs that reward policyholders for maintaining good eye health practices.

By offering these added benefits, Eyemed Insurance demonstrates its commitment to not only providing access to quality eye care but also empowering individuals to take an active role in their eye health journey.

The Impact of Eyemed Insurance: Transforming Eye Care Access

Eyemed Insurance’s impact on the vision care landscape is significant and far-reaching. By making eye care more accessible and affordable, Eyemed has played a pivotal role in improving the eye health of millions of Americans.

One of the key ways Eyemed has transformed eye care access is by expanding its network of providers. With a vast network of eye care professionals, including optometrists and ophthalmologists, individuals can easily find a nearby provider who accepts Eyemed insurance. This network ensures that policyholders have convenient access to quality eye care, regardless of their location.

Additionally, Eyemed's focus on preventive care and education has had a profound impact on eye health outcomes. By promoting regular eye exams and providing resources for eye health maintenance, Eyemed empowers individuals to take a proactive approach to their vision care. This preventive approach not only improves eye health but also helps detect and manage potential vision issues early on, leading to better overall health outcomes.

Case Study: How Eyemed Insurance Made a Difference

Consider the story of Sarah, a working professional with a busy lifestyle. Sarah had always struggled with eye health issues but found it challenging to prioritize regular eye exams due to her hectic schedule and the cost of vision care. However, with Eyemed Insurance, Sarah gained access to a comprehensive vision care plan that fit her budget and lifestyle.

Through her Eyemed coverage, Sarah was able to schedule regular eye exams, ensuring that any potential vision issues were detected and addressed promptly. The plan's coverage for eyeglasses and contact lenses provided Sarah with the flexibility to choose the vision correction solution that suited her best. Moreover, the plan's wellness programs and educational resources helped Sarah understand the importance of eye health and motivated her to adopt healthier habits.

Sarah's experience highlights how Eyemed Insurance not only provides financial relief but also empowers individuals to take control of their eye health. By offering accessible and affordable vision care, Eyemed has made a significant difference in the lives of individuals like Sarah, ensuring that eye health is no longer a barrier to their overall well-being.

The Future of Eyemed Insurance: Innovating for Eye Health

As the landscape of healthcare continues to evolve, Eyemed Insurance remains committed to innovation and adaptability. The company’s future vision is centered around several key initiatives:

- Digital Transformation: Eyemed is investing in digital technologies to enhance the customer experience. This includes the development of user-friendly platforms for policyholders to manage their vision care needs, access resources, and schedule appointments seamlessly.

- Expanded Network Partnerships: Eyemed aims to further expand its network of eye care providers, ensuring that policyholders have even more options for quality vision care services.

- Data-Driven Insights: By leveraging advanced analytics, Eyemed seeks to gain deeper insights into eye health trends and individual needs. This data-driven approach will enable the company to develop more personalized and effective vision care solutions.

- Wellness Integration: Eyemed plans to integrate eye health into overall wellness initiatives, recognizing the interconnectedness of eye health with other aspects of well-being. This holistic approach will empower individuals to achieve optimal health and prevent vision-related issues.

With these initiatives, Eyemed Insurance is poised to continue its legacy of transforming the vision care industry, ensuring that eye health remains a priority for individuals and families across the United States.

Eyemed Insurance: A Comprehensive Vision Care Solution

In conclusion, Eyemed Insurance stands as a testament to the power of innovation and accessibility in the healthcare sector. By offering a comprehensive suite of vision care plans, Eyemed has revolutionized the way individuals access and prioritize eye health. From its humble beginnings to its current position as a market leader, Eyemed’s journey is a story of dedication to improving the lives of millions through better vision care.

As the company continues to evolve and adapt, its impact on the vision care landscape will only grow stronger. Eyemed Insurance's commitment to innovation, customer satisfaction, and eye health empowerment ensures that it remains a trusted partner for individuals and families seeking quality vision care solutions.

| Key Statistics | Data |

|---|---|

| Number of Eyemed Policyholders | Over 25 million individuals and families |

| Size of Eyemed's Provider Network | More than 40,000 eye care professionals nationwide |

| Percentage of Eyemed Policyholders Satisfied with Coverage | 92% (based on recent customer satisfaction surveys) |

How does Eyemed Insurance differ from other vision care providers?

+Eyemed Insurance stands out for its comprehensive approach to vision care, offering a wide range of benefits beyond traditional eye exams and corrective lenses. The company’s focus on innovation, digital transformation, and expanded network partnerships sets it apart, ensuring a seamless and personalized experience for policyholders.

What are the eligibility criteria for Eyemed Insurance plans?

+Eligibility for Eyemed Insurance plans varies depending on the specific plan and the group or individual purchasing the insurance. Generally, individuals and families can enroll through their employers or directly through Eyemed’s individual plans. The eligibility requirements may include factors such as age, location, and employment status.

How can I find an Eyemed Insurance provider near me?

+Eyemed Insurance has a vast network of providers across the United States. You can easily find an Eyemed provider near you by using the online provider search tool on their website. Simply enter your location details, and the tool will provide you with a list of nearby providers who accept Eyemed insurance.