Buy Insurance For Car

The Comprehensive Guide to Buying Car Insurance: Navigating Coverage and Costs

Purchasing car insurance is a crucial step for any vehicle owner, offering financial protection and peace of mind. This guide aims to demystify the process, empowering you to make informed decisions and secure the right coverage for your needs. From understanding the types of insurance to comparing costs and navigating the fine print, we'll cover it all. Join us as we delve into the world of car insurance, ensuring you're equipped with the knowledge to navigate this essential aspect of vehicle ownership.

Understanding the Fundamentals of Car Insurance

At its core, car insurance provides financial protection in the event of an accident, theft, or other unforeseen incidents involving your vehicle. It's a contract between you and the insurance company, where you pay a premium, and in return, they agree to cover specific costs as outlined in your policy.

Types of Car Insurance

Car insurance comes in various forms, each catering to different needs and offering distinct levels of coverage. Here's a breakdown of the primary types:

- Liability Insurance: This is the most basic form, covering damages you cause to others' property or injuries you cause to others in an accident. It's mandatory in most states and is essential for protecting your assets.

- Collision Insurance: This covers damages to your own vehicle in the event of a collision, regardless of fault. It's particularly beneficial if you own a newer or more valuable car.

- Comprehensive Insurance: This policy covers damages from incidents other than collisions, such as theft, vandalism, natural disasters, or hitting an animal. It provides broad coverage but typically comes with a higher premium.

- Personal Injury Protection (PIP): PIP covers medical expenses for you and your passengers, regardless of fault. It's a crucial aspect of insurance, ensuring you're protected even in no-fault states.

- Uninsured/Underinsured Motorist Coverage: This provides protection if you're involved in an accident with a driver who has no insurance or insufficient coverage to pay for the damages they caused.

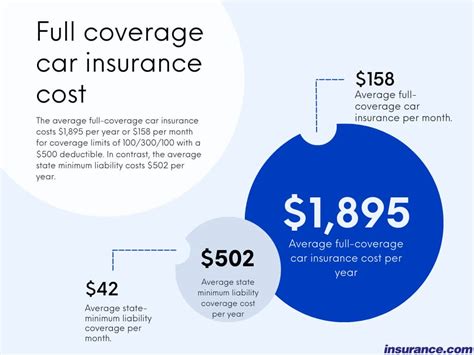

Factors Influencing Car Insurance Costs

The cost of car insurance can vary significantly depending on a multitude of factors. Understanding these variables can help you predict and potentially mitigate the expenses associated with coverage.

- Vehicle Type: The make, model, and age of your car play a role in insurance costs. Generally, newer and more expensive vehicles will command higher premiums.

- Location: Where you live and park your car can impact insurance rates. Urban areas with higher traffic volumes and crime rates often result in higher premiums.

- Driver Profile: Your age, gender, driving record, and years of driving experience all factor into insurance costs. Younger drivers, especially males, often pay higher premiums due to statistical risk factors.

- Coverage and Deductibles: The level of coverage you choose and the associated deductibles will directly influence your insurance costs. Higher coverage and lower deductibles typically result in higher premiums.

- Claims History: A history of insurance claims can impact future premiums. While a single claim may not significantly affect your rates, multiple claims or large claims could lead to rate increases or policy cancellation.

Researching and Comparing Insurance Providers

With a myriad of insurance providers in the market, it's essential to conduct thorough research to find the best fit for your needs. Here's a guide to help you navigate this process:

Online Comparison Tools

Online comparison tools are a convenient way to quickly assess the market and get a sense of the available options. These tools allow you to input your details and receive quotes from multiple providers, making it easy to compare prices and coverage.

Reading Reviews and Ratings

Reviews and ratings from independent sources and current or past customers can provide valuable insights into an insurance provider's service quality, claims handling, and overall customer satisfaction. Pay attention to consistent themes in the reviews to get a holistic view.

Understanding Provider Reputation

The reputation of an insurance provider is a critical factor to consider. A reputable provider is more likely to offer fair and transparent policies, efficient claims processing, and reliable customer service. Research the provider's history, financial stability, and any complaints or legal actions against them.

Evaluating Coverage Options

Each insurance provider offers a unique set of coverage options and add-ons. Evaluate these closely to ensure you're getting the right level of protection for your needs. Some providers may offer specialized coverage for specific situations, such as rental car reimbursement or roadside assistance.

Understanding the Fine Print

Before committing to a policy, it's crucial to thoroughly read and understand the fine print. This includes the policy's exclusions, limitations, and any specific conditions or requirements. Pay close attention to any clauses that could potentially void your coverage.

Securing the Best Deal on Car Insurance

Once you've researched and compared your options, it's time to secure the best deal on car insurance. Here are some strategies to help you achieve this:

Bundling Policies

Many insurance providers offer discounts when you bundle multiple policies with them, such as combining your car insurance with home or renters insurance. This can be a cost-effective way to save on your premiums.

Negotiating Discounts

Don't be afraid to negotiate with your insurance provider. Many providers are willing to offer discounts for loyal customers or those who meet certain criteria, such as safe driving records or installing safety features in their vehicles.

Paying Annually or Bi-Annually

Paying your insurance premium annually or bi-annually instead of monthly can often result in savings. This is because providers sometimes charge a convenience fee for monthly payments, which can add up over time.

Improving Your Driving Record

A clean driving record can significantly impact your insurance rates. Avoid accidents and traffic violations, and consider taking a defensive driving course to improve your skills and potentially qualify for a discount.

Using Telematics Devices

Some insurance providers offer telematics devices or smartphone apps that track your driving behavior. If you maintain a safe driving record, these devices can lead to reduced premiums. However, it's essential to understand the privacy implications and any potential drawbacks before opting into such a program.

Common Pitfalls and How to Avoid Them

While buying car insurance is an essential process, it's not without potential pitfalls. Being aware of these pitfalls can help you navigate them successfully and ensure you get the coverage you need at a fair price.

Underestimating Coverage Needs

One of the most common mistakes is underestimating the level of coverage you need. It's essential to thoroughly assess your situation and choose a policy that provides adequate protection. Remember, the cheapest policy isn't always the best value.

Rushing the Process

Taking your time to research and compare options is crucial. Don't rush into a decision based on a single quote or a provider's marketing materials. Thoroughly evaluate your choices to ensure you're making an informed decision.

Neglecting to Read the Fine Print

Failing to thoroughly understand the policy's fine print can lead to unexpected surprises down the line. Always take the time to read and comprehend the policy's terms and conditions before signing.

Assuming All Policies Are the Same

While car insurance policies share some common features, they are not all created equal. Each provider offers unique coverage options, add-ons, and benefits. Always compare policies side by side to ensure you're getting the best value.

Frequently Asked Questions

How often should I review my car insurance policy?

+

It’s a good idea to review your policy annually, especially if your circumstances have changed. This could include a new vehicle, a change in location, or a significant life event. Regular reviews ensure your coverage remains adequate and you’re not overpaying for unnecessary features.

What factors can cause my insurance rates to increase?

+

Several factors can lead to an increase in insurance rates, including getting into an accident, receiving a traffic violation, moving to a higher-risk area, or adding a young or inexperienced driver to your policy. It’s important to keep your driving record clean and stay informed about changes that could impact your rates.

Can I switch insurance providers mid-policy term?

+

Yes, you can switch insurance providers at any time. However, if you cancel your current policy before its end date, you may incur a penalty or lose any remaining discounts. It’s generally best to let your current policy expire naturally before switching to a new provider.

What should I do if I’m involved in an accident?

+

If you’re involved in an accident, the first step is to ensure the safety of all involved parties. Exchange insurance information with the other driver(s) and contact the police to file a report. Notify your insurance provider as soon as possible, and provide all the details you can. Your provider will guide you through the claims process.

How can I get a copy of my car insurance policy?

+

You can typically access a digital copy of your policy through your insurance provider’s website or app. If you prefer a hard copy, you can request one from your provider. It’s a good idea to keep a copy of your policy readily available, especially when traveling or in situations where you might need to provide proof of insurance.