Low Full Coverage Insurance

Full coverage insurance is a comprehensive policy that provides an extensive level of protection for vehicle owners. It typically includes both liability and collision coverage, along with additional benefits like comprehensive coverage, rental car reimbursement, and more. This type of insurance is designed to offer financial protection in a wide range of scenarios, ensuring that policyholders can recover from unexpected events that could lead to costly repairs or even total losses.

Understanding the Components of Full Coverage Insurance

Full coverage insurance is an umbrella term that encompasses several types of coverage. Let’s delve into each component to understand its significance and how it contributes to the overall protection offered by this insurance type.

Liability Coverage

Liability coverage is a fundamental part of any car insurance policy, including full coverage. It provides protection in the event that you cause an accident that results in property damage or bodily injury to others. This coverage is essential, as it safeguards you from potentially devastating financial consequences that could arise from such incidents.

| Liability Coverage Type | Description |

|---|---|

| Bodily Injury Liability | Covers medical expenses and lost wages for individuals injured in an accident you cause. |

| Property Damage Liability | Pays for repairs or replacement of other people's property damaged in an accident you cause. |

Collision Coverage

Collision coverage is another critical component of full coverage insurance. It comes into play when your vehicle collides with another vehicle or object, regardless of fault. This coverage ensures that your vehicle is repaired or replaced if it sustains damage in such an incident.

For instance, imagine you're driving and accidentally collide with a tree. Collision coverage would be instrumental in covering the costs of repairing or replacing your vehicle, ensuring you're not left with a significant financial burden.

Comprehensive Coverage

Comprehensive coverage is an optional component of full coverage insurance, but it's highly recommended for comprehensive protection. It provides coverage for damages to your vehicle caused by incidents other than collisions, such as theft, vandalism, natural disasters, or damage from falling objects.

For example, if your vehicle is damaged due to a hailstorm, comprehensive coverage would cover the costs of repairs. Similarly, if your car is stolen or vandalized, comprehensive coverage would be crucial in helping you recover financially.

Additional Benefits

Full coverage insurance often includes additional benefits that enhance your protection and peace of mind. These may include:

- Rental Car Reimbursement: Provides coverage for rental car expenses if your vehicle is in the shop for repairs.

- Glass Coverage: Covers the cost of repairing or replacing your vehicle's glass, including windshields.

- Towing and Labor: Offers assistance with towing your vehicle to a repair shop and covers labor costs for certain services.

- Roadside Assistance: Provides emergency services like battery jumps, flat tire changes, and fuel delivery.

Why Choose Low Full Coverage Insurance?

Low full coverage insurance offers an attractive option for vehicle owners seeking comprehensive protection without breaking the bank. While full coverage insurance is typically more expensive than liability-only coverage due to the broader range of protection it provides, there are strategies to minimize costs without sacrificing essential coverage.

Strategies for Affordable Full Coverage

Here are some strategies to consider when seeking low full coverage insurance:

- Shop Around: Compare quotes from multiple insurance providers to find the best rates for your specific needs.

- Increase Your Deductible: Opting for a higher deductible can lower your monthly premiums, but it's important to ensure you can afford the deductible in the event of a claim.

- Bundle Policies: Combining your auto insurance with other policies, such as homeowners or renters insurance, can often result in significant discounts.

- Maintain a Clean Driving Record: Insurance companies reward safe drivers with lower premiums. Avoid traffic violations and accidents to keep your rates as low as possible.

- Consider Usage-Based Insurance: Some insurers offer usage-based insurance programs that track your driving habits and reward safe driving with discounts.

Potential Drawbacks and Considerations

While low full coverage insurance can be an attractive option, it's important to carefully consider your needs and circumstances. Here are some factors to keep in mind:

- Cost-Benefit Analysis: Weigh the potential costs of repairs or replacement against the savings you'll achieve with lower premiums. Ensure that you're not sacrificing too much protection for cost savings.

- Vehicle Value: If you own an older vehicle with a low market value, you may consider reducing your coverage to save on premiums. However, keep in mind that this could leave you financially vulnerable in the event of an accident.

- Personal Financial Situation: Assess your ability to pay for repairs or replacement out of pocket. If you have sufficient savings or access to other financial resources, you may be able to opt for lower coverage limits.

Case Study: Balancing Cost and Coverage

To illustrate the importance of finding the right balance between cost and coverage, let’s consider a hypothetical case study.

The Smith Family's Dilemma

The Smith family recently purchased a new vehicle and is now seeking affordable insurance coverage. They have a limited budget for insurance premiums but want to ensure they have adequate protection.

After researching their options, they found that full coverage insurance would cost them approximately $200 per month. This is a significant expense for their budget, but they understand the importance of comprehensive protection.

Strategic Decision-Making

To strike a balance between cost and coverage, the Smith family decided to explore their options. They began by shopping around and comparing quotes from multiple insurance providers. This process helped them identify an insurer offering full coverage insurance for $175 per month, a significant savings compared to their initial quote.

Next, they considered increasing their deductible. By raising their deductible from $500 to $1,000, they were able to further reduce their monthly premiums to $150. This decision was made carefully, ensuring that they had the financial means to cover the higher deductible if needed.

Additionally, the Smith family took advantage of a usage-based insurance program offered by their insurer. By enrolling in this program and demonstrating safe driving habits, they were eligible for additional discounts, bringing their monthly premiums down to a manageable $130.

Outcome and Reflection

Through strategic decision-making and careful consideration of their needs and budget, the Smith family was able to secure full coverage insurance at a cost they could afford. This comprehensive protection gives them peace of mind, knowing that they are financially prepared for a wide range of potential incidents.

This case study highlights the importance of tailoring insurance coverage to individual circumstances. By balancing cost and coverage, the Smith family achieved the protection they needed without straining their finances.

Conclusion

Full coverage insurance is a valuable asset for vehicle owners, offering comprehensive protection in a wide range of scenarios. While it can be more expensive than liability-only coverage, there are strategies to minimize costs without sacrificing essential protection. By understanding the components of full coverage insurance, shopping around, and considering personal circumstances, individuals can make informed decisions to find the right balance between cost and coverage.

How much does full coverage insurance typically cost?

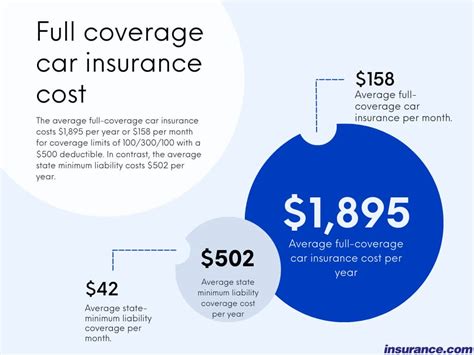

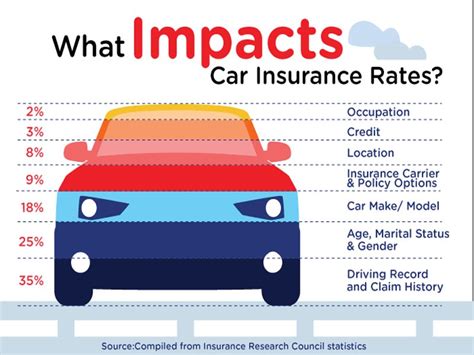

+The cost of full coverage insurance can vary significantly based on factors such as your location, driving record, and the make and model of your vehicle. On average, full coverage insurance can range from 100 to 250 per month, but it’s essential to obtain personalized quotes to determine the exact cost for your specific circumstances.

Is full coverage insurance mandatory in all states?

+No, full coverage insurance is not mandatory in all states. While every state requires a minimum level of liability insurance, the specific requirements vary. Some states may require collision and comprehensive coverage, while others leave these as optional choices. It’s crucial to understand your state’s specific regulations and consider your personal needs when choosing your insurance coverage.

What should I do if I can’t afford full coverage insurance?

+If you’re unable to afford full coverage insurance, it’s essential to carefully evaluate your options. Consider your vehicle’s age, value, and your personal financial situation. You may decide to opt for liability-only coverage, which is typically more affordable. However, it’s crucial to understand the potential risks and costs associated with this choice. Ensure you have an emergency fund to cover potential repair expenses, and always prioritize safety on the road.