Car Insurance California

In the vast state of California, car insurance is a necessity, providing financial protection to millions of drivers and their vehicles. With a diverse landscape ranging from bustling cities like Los Angeles and San Francisco to picturesque coastal roads and mountainous regions, California's car insurance landscape is equally diverse, catering to the unique needs of its residents.

Understanding the intricacies of car insurance in California is essential for drivers, as it ensures compliance with state laws and provides peace of mind in the event of accidents or other unforeseen circumstances. In this comprehensive guide, we delve into the world of car insurance in the Golden State, exploring the key aspects, regulations, and best practices to help you make informed decisions about your coverage.

The Importance of Car Insurance in California

California, known for its vibrant culture, diverse population, and extensive highway systems, also boasts one of the most stringent car insurance laws in the nation. These regulations are designed to protect drivers, passengers, and pedestrians, ensuring that all parties involved in an accident have access to necessary financial support.

Car insurance is a legal requirement in California, and it serves several critical functions:

- Financial Protection: Car insurance provides coverage for a range of expenses, including medical bills, vehicle repairs, and liability claims, ensuring that policyholders are not financially devastated in the event of an accident.

- Compliance with Law: In California, having valid car insurance is not just a suggestion; it's the law. Driving without insurance can result in significant penalties, including fines, license suspension, and even imprisonment in severe cases.

- Peace of Mind: Knowing you have adequate car insurance coverage gives drivers the confidence to navigate California's roads, whether they're commuting to work, exploring the state's scenic routes, or simply running errands.

California’s Car Insurance Laws and Regulations

California’s car insurance regulations are governed by the California Department of Insurance (CDI), which sets the minimum coverage requirements and enforces compliance. Understanding these regulations is crucial for drivers to ensure they meet the state’s standards.

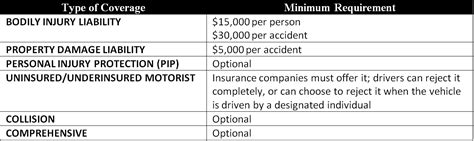

Minimum Liability Coverage

California requires all drivers to carry at least the following minimum liability coverage:

- Bodily Injury Liability: $15,000 per person and $30,000 per accident

- Property Damage Liability: $5,000 per accident

This coverage ensures that if you're at fault in an accident, your insurance will cover the other party's medical expenses and property damage up to the specified limits.

Uninsured and Underinsured Motorist Coverage

California also requires drivers to carry uninsured and underinsured motorist coverage. This coverage protects you if you’re involved in an accident with a driver who has no insurance or insufficient insurance to cover the damages.

Other Coverage Options

While the above coverages are mandatory, drivers can opt for additional coverage to enhance their protection, including:

- Collision Coverage: Covers damage to your vehicle in an accident, regardless of fault.

- Comprehensive Coverage: Provides protection against non-collision incidents, such as theft, vandalism, or natural disasters.

- Personal Injury Protection (PIP): Covers medical expenses and lost wages for you and your passengers, regardless of fault.

- Rental Car Coverage: Provides temporary rental car expenses if your vehicle is being repaired or is deemed a total loss.

Factors Influencing Car Insurance Rates in California

Car insurance rates in California can vary significantly based on several factors. Understanding these factors can help drivers make informed decisions about their coverage and potentially save money on their premiums.

Vehicle Type and Usage

The type of vehicle you drive and how you use it can impact your insurance rates. For instance, sports cars and luxury vehicles often carry higher premiums due to their performance capabilities and expensive repair costs. Additionally, if you use your vehicle for business purposes or frequently commute long distances, your rates may be higher.

Driving Record

Your driving history is a significant factor in determining your insurance rates. A clean driving record with no accidents or violations can lead to lower premiums. Conversely, a history of accidents, especially those deemed your fault, can result in higher rates.

Age and Gender

Insurance companies often consider age and gender when calculating rates. Young drivers, particularly those under 25, are often seen as high-risk and may face higher premiums. Similarly, gender can also play a role, with some insurance companies charging different rates for male and female drivers.

Location

The area where you live and drive your vehicle can significantly impact your insurance rates. Urban areas, especially those with high traffic and crime rates, often have higher premiums. Conversely, rural areas may offer more affordable rates due to lower accident risks.

Credit Score

In California, insurance companies are allowed to consider your credit score when determining your insurance rates. A higher credit score may lead to lower premiums, while a lower score could result in higher rates.

| Factor | Impact on Rates |

|---|---|

| Vehicle Type and Usage | High-performance and luxury vehicles, business use, and long commutes can increase rates. |

| Driving Record | Clean records lead to lower rates; accidents and violations increase premiums. |

| Age and Gender | Young drivers and certain genders may face higher rates. |

| Location | Urban areas with high traffic and crime rates often have higher premiums. |

| Credit Score | Higher credit scores may result in lower premiums. |

Tips for Choosing the Right Car Insurance in California

With so many options and variables, selecting the right car insurance policy in California can be a daunting task. Here are some tips to help you make an informed decision:

Understand Your Coverage Needs

Before shopping for car insurance, assess your specific needs. Consider the value of your vehicle, your driving habits, and the risks you want to protect against. Determine whether you need basic liability coverage or if additional coverage options like collision and comprehensive are essential for your peace of mind.

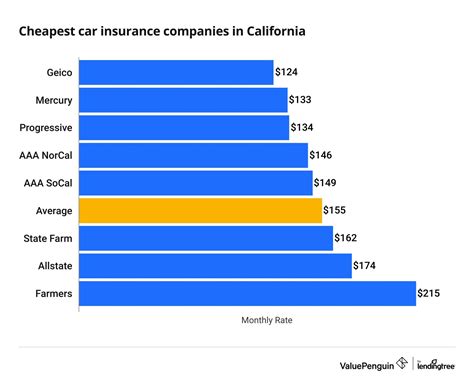

Compare Multiple Quotes

Car insurance rates can vary significantly between providers. Obtain quotes from multiple insurance companies to compare coverage and prices. Online quote tools can be a convenient way to get a snapshot of various options quickly.

Consider Discounts

Insurance companies often offer discounts to attract and retain customers. These discounts can include safe driver discounts, multi-policy discounts (for bundling car insurance with other types of insurance), and loyalty discounts for long-term customers. Ask about available discounts and ensure you’re taking advantage of any that apply to you.

Read the Fine Print

When comparing policies, pay close attention to the fine print. Understand the specific terms and conditions, including any exclusions or limitations. Ensure that the policy provides the coverage you need and that you’re comfortable with the conditions.

Choose a Reputable Insurer

Selecting a reputable insurance company is crucial. Look for companies with a solid financial standing and a history of paying claims promptly. Check online reviews and ratings to get an idea of the insurer’s customer service and claim handling processes.

Consider Bundle Options

If you have multiple insurance needs, such as home, renters, or life insurance, consider bundling your policies with the same insurer. Bundle discounts can save you money and simplify your insurance management.

Common Car Insurance Claims in California

California’s diverse road network and large population make it a state with a high volume of car insurance claims. Understanding the most common types of claims can help drivers prepare and potentially avoid certain situations.

Accidents and Collisions

Accidents, ranging from minor fender benders to severe collisions, are the most common type of car insurance claim in California. These incidents can occur due to various factors, including distracted driving, speeding, adverse weather conditions, or mechanical failures.

Theft and Vandalism

California’s urban areas often experience a high rate of vehicle theft and vandalism. Comprehensive insurance coverage is essential to protect against these risks, as it covers damages or losses resulting from non-collision incidents.

Natural Disasters

California is prone to natural disasters like earthquakes, wildfires, and floods. These events can cause extensive damage to vehicles, and comprehensive coverage is vital to ensure you’re financially protected in such situations.

Hit-and-Run Accidents

Hit-and-run accidents are unfortunately common in California. In such cases, uninsured motorist coverage becomes crucial, as it provides protection when the other driver involved in the accident is unidentified or uninsured.

Filing a Car Insurance Claim in California

In the event of an accident or other insured incident, knowing how to file a car insurance claim efficiently and effectively is essential. Here’s a step-by-step guide to help you through the process:

Step 1: Stay Calm and Assess the Situation

After an accident, it’s natural to feel shaken. Take a moment to calm yourself and assess the situation. Check for injuries, both for yourself and any passengers or bystanders. If anyone is injured, call for medical assistance immediately.

Step 2: Gather Information

If the accident involves another vehicle, gather as much information as possible. This includes the other driver’s name, contact details, insurance information, and vehicle details. Also, note the location and time of the accident, as well as any witness contact information.

Step 3: Take Photos

Document the accident scene by taking photos of the vehicles involved, the damage sustained, and the surrounding area. These photos can be crucial evidence when filing your claim.

Step 4: Contact Your Insurance Company

Reach out to your insurance company as soon as possible to report the accident. Provide them with all the information you’ve gathered, including photos and witness statements. Your insurance provider will guide you through the next steps, which may involve filing a police report or scheduling an inspection.

Step 5: Cooperate with the Claims Adjuster

A claims adjuster from your insurance company will be assigned to your case. Cooperate fully with them by providing any additional information or documentation they request. Be honest and transparent throughout the claims process to ensure a smooth resolution.

Step 6: Understand Your Coverage and Deductible

Familiarize yourself with your policy’s coverage and deductible. The deductible is the amount you must pay out of pocket before your insurance coverage kicks in. Knowing your deductible will help you understand your financial responsibility in the claims process.

Step 7: Repair or Replace Your Vehicle

Once your claim is approved, you can proceed with repairing or replacing your vehicle. Work with reputable repair shops or dealerships to ensure quality work and proper repairs. Keep all receipts and documentation related to the repairs for your records.

The Future of Car Insurance in California

The car insurance landscape in California is evolving, driven by technological advancements and changing consumer preferences. Here’s a glimpse into the future of car insurance in the Golden State:

Telematics and Usage-Based Insurance

Telematics devices and usage-based insurance are gaining traction in California. These technologies track driving behavior, such as speed, acceleration, and mileage, and use this data to offer customized insurance rates. Drivers with safe driving habits may benefit from lower premiums under these programs.

Autonomous Vehicles and Insurance

As autonomous vehicles become more prevalent, the insurance industry will need to adapt. Liability for accidents involving self-driving cars is a complex issue that insurance companies are actively addressing. New coverage options and regulations are likely to emerge to accommodate this emerging technology.

Digital Transformation

The insurance industry is increasingly embracing digital technologies to enhance customer experiences. From online quote tools to mobile apps for policy management and claims filing, digital transformation is making car insurance more accessible and convenient for California drivers.

Environmental Initiatives

California is at the forefront of environmental initiatives, and the insurance industry is no exception. Insurers are exploring ways to encourage eco-friendly driving practices and reduce carbon footprints. Incentives for electric and hybrid vehicles, as well as discounts for eco-conscious driving habits, may become more common.

What happens if I’m involved in an accident with an uninsured driver in California?

+

If you’re involved in an accident with an uninsured driver, your uninsured motorist coverage will come into play. This coverage will protect you by providing compensation for your injuries and damages, ensuring you’re not left financially burdened due to the other driver’s lack of insurance.

Can I choose my own repair shop for vehicle repairs after an accident?

+

Yes, you generally have the right to choose your preferred repair shop for vehicle repairs after an accident. However, it’s essential to review your insurance policy to understand any specific requirements or limitations regarding repair shops. Some insurance companies may have a network of preferred providers, while others may offer more flexibility.

How often should I review and update my car insurance policy?

+

It’s a good practice to review your car insurance policy annually or whenever your life circumstances change significantly. This includes changes in your vehicle, driving habits, marital status, or the addition of a young driver to your household. Regular reviews ensure your coverage remains adequate and that you’re not paying for unnecessary features.