Ca Dept Insurance

The California Department of Insurance (CDI) is a crucial state agency responsible for regulating the insurance industry in the largest state in the US by population. With a vast and diverse insurance market, CDI plays a pivotal role in protecting consumers, ensuring fair practices, and maintaining the stability of the insurance sector in California.

CDI: A Pillar of Insurance Regulation in California

The California Department of Insurance, established in 1868, has a rich history of safeguarding the interests of policyholders and promoting a robust insurance market. Headquartered in Sacramento, CDI operates through a network of regional offices, allowing it to effectively serve the diverse needs of Californians across the state.

CDI's mission is multi-faceted, encompassing consumer protection, industry oversight, and the facilitation of a competitive insurance marketplace. It achieves these goals through a comprehensive set of regulatory activities, including licensing, enforcement, education, and advocacy.

Licensing and Compliance

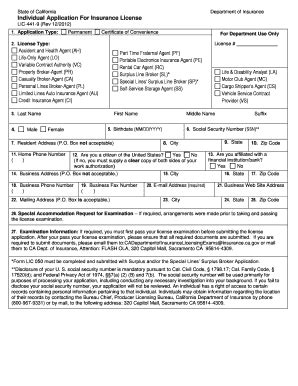

At the heart of CDI’s work is the licensing and regulation of insurance companies, agents, and brokers. It ensures that all entities operating within the state are properly licensed and adhere to stringent standards of conduct. CDI’s rigorous licensing process involves background checks, financial examinations, and ongoing compliance monitoring to maintain the integrity of the insurance industry.

| Type of Licensee | Number of Licenses |

|---|---|

| Insurance Companies | Over 1,800 |

| Insurance Agents/Brokers | Approximately 300,000 |

CDI's compliance efforts extend beyond initial licensing. It actively investigates consumer complaints, conducts market conduct exams, and takes swift action against entities engaging in fraudulent or unfair practices. By imposing fines, revoking licenses, and referring cases to law enforcement when necessary, CDI ensures that insurance providers maintain ethical standards.

Consumer Protection and Education

Consumer protection is a cornerstone of CDI’s mission. The department empowers Californians to make informed insurance decisions through a range of educational initiatives. It offers comprehensive guides, workshops, and online resources covering various insurance topics, from auto and homeowners’ insurance to life and health coverage.

CDI's proactive approach to consumer education extends to its fraud prevention efforts. It raises awareness about common insurance scams and provides tips for identifying and avoiding fraudulent activities. By educating consumers, CDI strengthens the insurance market's integrity and reduces the risk of financial losses for policyholders.

Market Oversight and Rate Regulation

CDI plays a vital role in overseeing the insurance market to ensure it remains competitive and accessible. It reviews and approves insurance rates to prevent excessive pricing and ensure affordability for consumers. This process involves analyzing financial data, market trends, and actuarial calculations to assess the fairness and reasonableness of proposed rates.

In addition to rate regulation, CDI monitors the overall health of the insurance industry. It conducts regular financial examinations of insurance companies to assess their solvency, investment practices, and ability to meet policyholder obligations. This proactive approach helps identify potential risks and ensures the stability of the insurance market, benefiting both consumers and businesses.

Key Initiatives and Achievements

The California Department of Insurance has a strong track record of successful initiatives and achievements that have shaped the insurance landscape in the state.

The California Fair Access to Insurance Requirements (FAIR) Plan

One of CDI’s most notable accomplishments is the establishment and administration of the California FAIR Plan. This innovative program provides access to property insurance for homeowners and businesses in high-risk areas, such as those prone to wildfires or coastal erosion. By ensuring coverage for those who might otherwise be uninsured, the FAIR Plan enhances community resilience and economic stability.

Consumer Outreach and Advocacy

CDI actively engages with communities across California to raise awareness about insurance issues and promote consumer rights. It hosts town hall meetings, participates in community events, and leverages digital platforms to reach a broader audience. Through these efforts, CDI ensures that all Californians have access to the information and resources they need to navigate the insurance market confidently.

Fighting Insurance Fraud

Insurance fraud is a significant concern, and CDI has taken a leading role in combating this issue. Its dedicated Fraud Division investigates and prosecutes cases of fraud, working closely with law enforcement agencies and insurance companies. By cracking down on fraudulent activities, CDI protects consumers, preserves the integrity of the insurance market, and ensures that policyholders receive the benefits they deserve.

Looking Ahead: Future Priorities and Challenges

As the insurance landscape continues to evolve, the California Department of Insurance remains committed to adapting its strategies and approaches to meet emerging challenges and opportunities.

Climate Change and Natural Disaster Preparedness

With California facing increasing risks from wildfires, droughts, and other climate-related events, CDI is focused on enhancing disaster preparedness and resilience. It works closely with insurance companies to encourage the adoption of sustainable practices and the development of innovative coverage options for policyholders in high-risk areas. By fostering a more resilient insurance market, CDI aims to protect both consumers and the environment.

Emerging Technologies and Insurtech

The rise of insurtech and digital transformation presents both opportunities and challenges for the insurance industry. CDI recognizes the potential of these technologies to enhance efficiency, accessibility, and consumer experiences. At the same time, it remains vigilant in ensuring that new technologies are deployed responsibly and that consumer data is protected. By striking a balance between innovation and regulation, CDI aims to position California’s insurance market as a leader in the digital age.

Consumer Empowerment and Financial Inclusion

CDI is dedicated to ensuring that all Californians, regardless of their background or financial situation, have access to affordable and adequate insurance coverage. It continues to explore initiatives that promote financial inclusion, such as simplified insurance products and targeted outreach to underserved communities. By empowering consumers with knowledge and resources, CDI aims to reduce insurance disparities and build a more equitable insurance market.

FAQ

How can I contact the California Department of Insurance for assistance or to file a complaint?

+

You can reach out to CDI through their official website, where you’ll find contact information for various departments and services. For general inquiries, you can call their Consumer Hotline at 1-800-927-HELP (4357). To file a complaint, you can use the online complaint form or mail your complaint to the Consumer Services Bureau. CDI aims to respond to all complaints promptly and provide guidance or take appropriate action.

What should I do if I suspect insurance fraud or witness suspicious activities?

+

If you have reason to believe that insurance fraud is taking place, it’s important to report it to the authorities. You can contact CDI’s Fraud Division directly by calling 1-800-927-4357 or using their online fraud reporting form. Your report can help investigate and prevent fraudulent activities, protecting both consumers and the insurance market.

How does CDI ensure that insurance rates are fair and affordable for consumers?

+

CDI employs a rigorous rate review process to evaluate insurance companies’ proposed rates. This process involves analyzing financial data, assessing market conditions, and considering the impact on consumers. CDI may approve, modify, or reject rate filings based on its findings. By actively monitoring rates, CDI aims to prevent excessive pricing and promote affordability for Californians.