Humana Insurance

Welcome to an in-depth exploration of Humana Insurance, a prominent player in the healthcare industry. With a rich history spanning decades, Humana has established itself as a trusted provider of health insurance and related services across the United States. In this comprehensive article, we will delve into the key aspects of Humana Insurance, including its evolution, product offerings, impact on healthcare accessibility, and future prospects.

The Evolution of Humana Insurance: A Journey of Healthcare Innovation

Humana Insurance, with its headquarters in Louisville, Kentucky, has a legacy that dates back to 1961. It was founded with a vision to revolutionize the healthcare landscape by making quality healthcare services more accessible and affordable for Americans. Over the years, Humana has consistently adapted to the changing dynamics of the healthcare industry, emerging as a leading force in health insurance.

The company's journey is marked by significant milestones. In the early years, Humana focused on providing Medicare supplement plans, offering an essential safety net for seniors. As the healthcare system evolved, Humana expanded its offerings, introducing innovative products such as Medicare Advantage plans and prescription drug coverage, catering to the diverse needs of its customers.

One of the key strengths of Humana lies in its ability to anticipate and respond to market demands. For instance, with the rise of digital health, Humana has embraced technology, implementing digital tools and platforms to enhance customer experience and streamline administrative processes. This digital transformation has not only improved efficiency but has also made Humana's services more accessible to a broader range of individuals.

Furthermore, Humana's commitment to community well-being is evident through its various initiatives. The company actively engages in promoting preventive healthcare and wellness programs, educating communities about the importance of early detection and healthy lifestyle choices. Through partnerships with local organizations and healthcare providers, Humana strives to create a positive impact on public health.

Product Offerings: Empowering Individuals with Comprehensive Healthcare Solutions

Humana Insurance offers a diverse range of products designed to meet the unique needs of its customers. Here’s an overview of their key offerings:

Medicare Plans

Humana is a well-known name in the Medicare space, providing a comprehensive suite of plans tailored for seniors. These include:

- Medicare Advantage Plans (MA Plans): Offering an alternative to Original Medicare, MA Plans provide additional benefits such as prescription drug coverage, dental, and vision care. Humana’s MA Plans are known for their flexibility and customization options, allowing seniors to choose the coverage that suits their specific needs.

- Medicare Part D Plans: These plans focus solely on prescription drug coverage, helping individuals manage the cost of their medications. Humana’s Part D plans are highly regarded for their competitive pricing and extensive drug formularies.

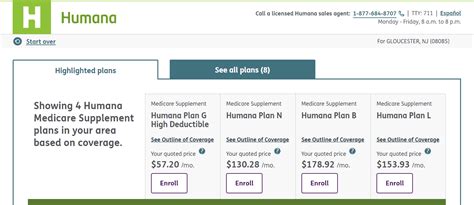

- Medicare Supplement Plans (Medigap): Designed to fill the gaps in Original Medicare coverage, Medigap plans from Humana offer financial protection for seniors by covering expenses such as copayments and deductibles.

Individual and Family Health Insurance

Humana also caters to individuals and families with a range of health insurance plans, including:

- Short-Term Medical Plans: Ideal for temporary coverage needs, these plans provide cost-effective solutions for individuals between jobs or waiting for other insurance coverage to begin.

- Health Maintenance Organization (HMO) Plans: HMO plans from Humana offer comprehensive coverage with a focus on preventive care. Members typically have a primary care physician who coordinates their healthcare needs.

- Preferred Provider Organization (PPO) Plans: PPO plans provide more flexibility in choosing healthcare providers, both in and out of network. These plans often include a broader range of benefits and coverages.

Dental and Vision Insurance

Humana recognizes the importance of oral and eye health, offering standalone dental and vision insurance plans. These plans provide coverage for a wide range of dental procedures and eye care services, helping individuals maintain optimal health.

Impact on Healthcare Accessibility: Bridging Gaps and Empowering Communities

Humana Insurance’s presence and initiatives have had a profound impact on healthcare accessibility across the United States. By offering a wide array of affordable insurance plans, Humana has made quality healthcare more attainable for individuals and families.

For seniors, Humana's Medicare plans have been a lifeline, providing essential coverage for medical expenses and prescription drugs. The company's commitment to Medicare education and support has empowered seniors to navigate the complex world of healthcare with confidence.

Furthermore, Humana's focus on community health initiatives has led to tangible improvements in public health. Through partnerships with local organizations, Humana has brought healthcare resources and education to underserved communities, promoting early intervention and disease prevention. This holistic approach to healthcare has not only improved individual health outcomes but has also contributed to the overall well-being of communities.

Performance Analysis: A Trusted Partner in Healthcare

Humana Insurance’s performance and financial stability have consistently ranked among the best in the industry. With a strong focus on member satisfaction and innovative product development, Humana has maintained a solid reputation for delivering reliable and comprehensive healthcare solutions.

According to industry reports, Humana's customer satisfaction scores consistently place it among the top health insurance providers. The company's commitment to member experience is evident in its user-friendly digital platforms, efficient claims processing, and dedicated customer support teams. These factors contribute to a positive overall experience for policyholders.

In terms of financial strength, Humana maintains a robust balance sheet. The company's strong financial position allows it to invest in research and development, ensuring that its products remain competitive and aligned with the evolving needs of the healthcare landscape. This financial stability is a testament to Humana's ability to weather market fluctuations and provide long-term security for its members.

| Financial Metric | 2022 Data |

|---|---|

| Total Revenue | $77.7 Billion |

| Net Income | $3.1 Billion |

| Membership | 15.5 Million |

Additionally, Humana's strategic partnerships with healthcare providers have resulted in improved access to quality care. Through these partnerships, Humana has been able to negotiate favorable terms for its members, ensuring a wider network of healthcare facilities and specialists. This network expansion has been particularly beneficial for members residing in rural areas, where healthcare resources may be limited.

Future Implications: Shaping the Healthcare Landscape

As the healthcare industry continues to evolve, Humana Insurance is poised to play a pivotal role in shaping the future of healthcare. With a focus on innovation and member-centric approaches, Humana is well-positioned to address emerging challenges and opportunities.

One of the key areas of focus for Humana is the integration of technology into healthcare. The company is actively exploring digital health solutions, such as telemedicine and remote patient monitoring, to enhance accessibility and convenience for its members. By leveraging technology, Humana aims to provide more personalized and efficient healthcare experiences.

Furthermore, Humana's commitment to preventive care and wellness is expected to drive positive outcomes in the long term. By investing in education and early intervention, Humana is helping individuals take control of their health, leading to reduced healthcare costs and improved quality of life. This approach aligns with the industry's shift towards value-based care, where the focus is on preventing illness rather than solely treating symptoms.

As the population ages and healthcare needs become more complex, Humana's Medicare expertise will continue to be a vital asset. The company's dedication to understanding the unique needs of seniors and developing tailored solutions will ensure that Medicare beneficiaries receive the care and support they deserve.

Frequently Asked Questions

What is Humana Insurance known for?

+Humana Insurance is renowned for its comprehensive Medicare plans, offering a wide range of options to seniors. Additionally, Humana’s focus on community health initiatives and its commitment to member satisfaction have made it a trusted name in the industry.

How does Humana ensure member satisfaction?

+Humana prioritizes member satisfaction through user-friendly digital platforms, efficient claims processing, and dedicated customer support. The company’s focus on innovation and member-centric approaches ensures a positive experience for its policyholders.

What are some of Humana’s key contributions to community health?

+Humana actively promotes preventive healthcare and wellness through community partnerships. These initiatives focus on education, early intervention, and disease prevention, ultimately improving public health and well-being.