Whole Life Insurance

Whole life insurance, also known as permanent life insurance, is a financial product that offers lifelong coverage and serves as a versatile tool for long-term financial planning. In an era where financial security is a top priority, understanding the intricacies of whole life insurance becomes essential. This comprehensive guide delves into the world of whole life insurance, exploring its features, benefits, and how it can be a crucial component of your financial strategy.

Understanding Whole Life Insurance

Whole life insurance is a type of policy that provides coverage for the entirety of an individual’s life, as long as premiums are paid. Unlike term life insurance, which offers coverage for a specified period, whole life insurance offers a death benefit that remains constant throughout the policyholder’s life, ensuring financial protection for their loved ones.

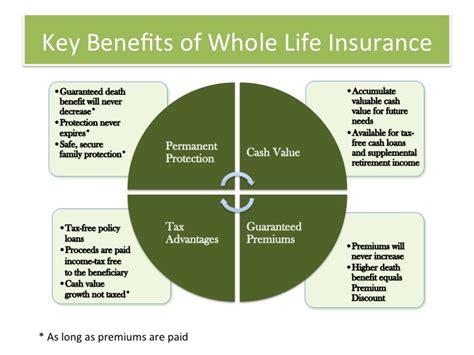

The key characteristic of whole life insurance is its dual nature: it combines a death benefit with a cash value component. The cash value is a savings element that grows over time, offering policyholders the opportunity to build a substantial financial asset. This unique feature makes whole life insurance an attractive option for those seeking both protection and a long-term savings plan.

Key Features of Whole Life Insurance

Guaranteed Death Benefit

One of the most significant advantages of whole life insurance is the guaranteed death benefit. Unlike other forms of insurance, where the coverage amount may decrease over time or be subject to specific conditions, whole life insurance provides a set amount that remains unchanged. This ensures that your loved ones receive a predetermined sum upon your passing, providing them with the financial support they need.

Cash Value Accumulation

The cash value component of whole life insurance is a significant differentiator. Over time, a portion of the premiums paid is allocated to this savings element, which earns interest and grows tax-deferred. Policyholders can borrow against this cash value or use it to pay premiums, providing a flexible financial resource. Additionally, the cash value can be withdrawn tax-free, offering a substantial benefit for retirement planning.

Flexible Premium Payments

Whole life insurance policies often offer flexible premium payment options. Policyholders can choose to pay premiums annually, semi-annually, quarterly, or even monthly, providing convenience and adaptability. Some policies also allow for the option to pay premiums for a limited number of years or even for life, depending on the policy terms and the individual’s financial situation.

| Premium Payment Frequency | Flexibility Benefits |

|---|---|

| Annual | Lower overall cost and potential for higher cash value growth. |

| Semi-Annual | Balanced between cost and convenience. |

| Quarterly | More frequent payments, ideal for those with fluctuating income. |

| Monthly | Highest convenience, suitable for budget planning. |

Benefits of Whole Life Insurance

Long-Term Financial Security

Whole life insurance provides a vital safety net for your loved ones. In the event of your passing, the death benefit ensures they receive a substantial sum, helping to cover expenses such as funeral costs, outstanding debts, and everyday living expenses. This financial security can be a crucial buffer during a challenging time.

Savings and Investment Potential

The cash value component of whole life insurance acts as a savings and investment vehicle. Over time, this savings element can grow significantly, offering policyholders a substantial financial asset. This accumulated cash value can be used for various purposes, such as funding retirement, paying for a child’s education, or even starting a business.

Tax Advantages

Whole life insurance policies offer tax benefits that can be a significant advantage. The cash value grows tax-deferred, meaning that any interest earned is not taxed until it is withdrawn. Additionally, policyholders can take out loans against the cash value, with the interest on these loans being tax-deductible in certain circumstances. These tax advantages can significantly boost the overall value of the policy.

Policy Loan Options

Policyholders have the option to borrow against the cash value of their whole life insurance policy. This provides a unique advantage, as the loan is secured by the policy itself, offering a low-interest rate and potential tax benefits. The borrowed funds can be used for various purposes, providing a flexible financial tool.

Estate Planning

Whole life insurance can be an essential component of estate planning. The death benefit can be used to pay estate taxes, ensuring that your assets pass to your heirs with minimal disruption. Additionally, the policy can be structured to provide income to your loved ones, helping to maintain their financial stability.

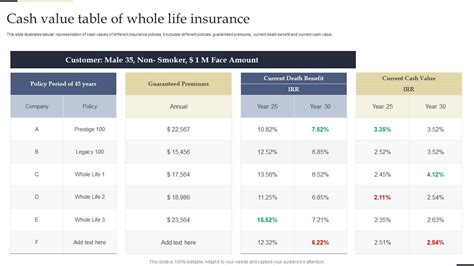

Performance Analysis and Real-World Examples

To illustrate the potential of whole life insurance, let’s examine a case study. John, a 35-year-old professional, purchases a whole life insurance policy with a 500,000 death benefit. He pays annual premiums of 5,000 for 20 years. Over this period, his cash value grows to $120,000, earning an average of 5% interest annually. This accumulated cash value can now be used to pay off a significant portion of the premiums, reducing his financial burden.

Furthermore, John can utilize the cash value to take out a policy loan to fund his child's education or start a business. The flexibility of whole life insurance allows him to adapt his financial strategy as his needs change. This example showcases how whole life insurance can provide both financial protection and significant savings opportunities.

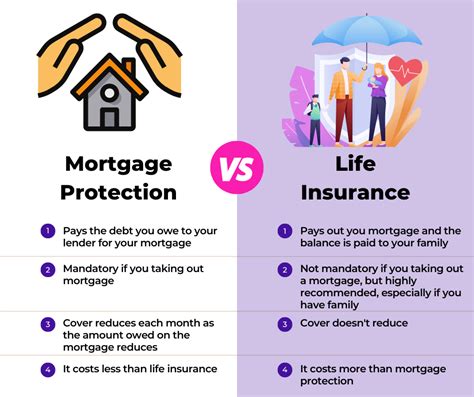

Comparative Analysis

When considering whole life insurance, it’s essential to compare it with other types of insurance policies. Term life insurance, for instance, offers coverage for a specified period, typically 10-30 years. While it may be more affordable in the short term, it does not provide the long-term savings and investment potential of whole life insurance. Additionally, term life insurance does not offer a guaranteed death benefit, making it less suitable for those seeking lifelong protection.

Universal life insurance is another alternative, offering flexible premium payments and a death benefit. However, it may not provide the same level of cash value growth as whole life insurance, as the policy's focus is primarily on the death benefit. Variable universal life insurance, on the other hand, offers investment options, but it carries more risk and may not be suitable for those seeking a guaranteed return.

Industry Insights and Expert Tips

Whole life insurance is a popular choice among financial advisors for its versatility and long-term benefits. Here are some expert insights to consider:

- Whole life insurance is an excellent option for those seeking lifelong financial protection. It ensures that your loved ones are provided for, regardless of when you pass away.

- The cash value component can be a significant financial asset, offering a substantial savings and investment opportunity.

- Policyholders should carefully consider their premium payment options to ensure they align with their financial goals and budget.

- Working with a financial advisor can help tailor a whole life insurance policy to your specific needs, maximizing the benefits.

Future Implications and Industry Trends

The whole life insurance industry is continually evolving, with new products and features being introduced to meet the changing needs of policyholders. Here are some trends to watch:

- Increasing focus on customization: Insurance providers are offering more personalized policies, allowing policyholders to tailor coverage and premium payments to their specific needs.

- Enhanced digital capabilities: Insurance companies are investing in digital platforms to provide policyholders with better access to their policies and more efficient management tools.

- Integration of technology: The use of technology, such as artificial intelligence and machine learning, is improving the accuracy and efficiency of insurance processes, from underwriting to claims management.

As the industry adapts to these trends, whole life insurance policies are becoming more accessible and flexible, ensuring they remain a vital component of long-term financial planning.

Conclusion

Whole life insurance is a powerful financial tool that offers lifelong protection and substantial savings potential. Its unique features, such as the guaranteed death benefit and cash value accumulation, make it an attractive option for those seeking long-term financial security. By understanding the benefits and opportunities provided by whole life insurance, individuals can make informed decisions to protect their loved ones and build a solid financial foundation.

How much does whole life insurance cost?

+The cost of whole life insurance can vary significantly depending on factors such as age, health, and the amount of coverage desired. Generally, premiums are higher for whole life insurance compared to term life insurance, but they remain fixed throughout the policyholder’s life. It’s recommended to consult with an insurance provider or financial advisor to obtain a personalized quote.

Can I withdraw the cash value from my whole life insurance policy?

+Yes, policyholders can withdraw the cash value from their whole life insurance policy. However, it’s important to note that any withdrawn funds will reduce the policy’s death benefit and may also have tax implications. It’s advisable to consult with a financial advisor to understand the potential consequences before making any withdrawals.

Is whole life insurance suitable for retirement planning?

+Whole life insurance can be an effective tool for retirement planning due to its cash value accumulation. The tax-deferred growth of the cash value can provide a substantial financial asset over time. Additionally, the policy’s death benefit can offer a legacy for your loved ones. However, it’s essential to carefully consider your financial goals and consult with a professional to ensure whole life insurance aligns with your retirement strategy.